Table Of Contents

Key Takeaways

- The dividend payout ratio is the portion of the earnings that the company decided to distribute as dividends to the shareholders.

- The formula for calculating the dividend payout ratio is Dividends/Net Ratio, where the net ratio is calculated as (Net Profit / Net Sales) x 100.

- This ratio can help investors determine the company's profitability, financial health, and intention to protect shareholders' interests.

Explanation

For a company, sharing the profit is an after-thought. First, they decide how much they will reinvest into the company to grow bigger, and the business can multiply the shareholders' money instead of just sharing it. That's why this formula is important.

It tells us how much a company pays dividends to the shareholders. And also how much the company is reinvesting into itself, which we call "retained earnings."

Sometimes, a company doesn't pay anything to the shareholders because they feel the need to reinvest its profits so that the company can grow faster.

Since the net profits of the company are only used for two purposes, we can conclude that –

Net Income = Retained Earnings + Dividend Payments

If anyone of the above is nil (among retained earnings and dividend payments), the entire profit is distributed or invested in the other.

As we note above, Colgate Dividend Ratio was 61.78% in 2016-17. However, Amazon, Google, and Berkshire Hathway haven't paid a penny to the shareholders via Dividends.

If an investor looks at the company's income statement, she would be able to find the net income for the year. And in the balance sheet, retained earnings would be found. So if you need to know how the company has calculated the retained earnings and dividends, you can check the footnotes under the financial statements.

Dividend Payout Ratio Video Tutorial

Example

Let’s look at a practical example of dividend ratio calculation.

Danny Inc. has been in the business for the last few years. Recently it started paying its shareholders dividends. It has paid dividends of $140,000 to the shareholders. The net income of Danny Inc. was $420,000 in the last year. Therefore, Danny Inc. decided to keep retained earnings as 66.67%. Using two methods, find out the dividend ratio of Danny Inc. in the last year. As mentioned in the example, we will use two methods to calculate this ratio.

As mentioned in the example, we will use two methods to calculate this ratio.

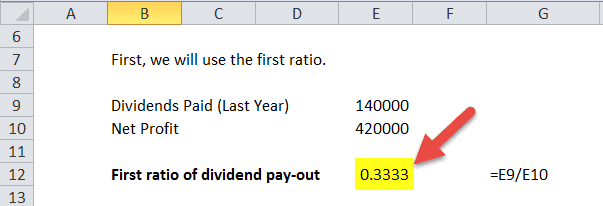

First, we will use the first ratio.

- We know that the dividends paid in the last year were $140,000. And the net profit was $420,000.

- Using the first ratio of the dividend payout formula, we get –

- Dividend ratio = Dividends / Net Income = $140,000 / $420,000 = 1/3 = 33.33%.

Now, we will use the second ratio.

We know that 66.67% was kept as retained earnings.

- That means the retention ratio is 66.67%. Then, using the second method, we get –

- Dividend payout ratio = 1 – Retention Ratio = 1 – 66.67% = 1 – 2/3 = 1/3 = 33.33%.

Apply Dividend Payout Ratio Calculation

Let’s look at a practical example to understand the dividend ratio better –

source: ycharts

| Items | 2012 | 2013 | 2014 | 2015 | 2016 |

| Dividends ($ bn) | 2.49 | 10.56 | 11.13 | 11.56 | 12.15 |

| Net Income ($bn) | 41.73 | 37.04 | 39.51 | 53.39 | 45.69 |

| Dividends Payout Ratio | 5.97% | 28.51% | 28.17% | 21.65% | 26.59% |

Till 2011, Apple didn't pay any dividends to its investors. Because they believed that if they reinvested the earnings, they would be able to generate better returns for the investors, which they eventually did.

Uses

Understanding the equation between retained earnings and dividend payments will help an investor comprehend a company's short-term and long-term goals.

Since many companies also pay a 100% dividend, we can also use an alternative formula for calculating the dividend payout ratio.

Here’s the alternative formula –

The retention ratio is the percentage of profits the company keeps for reinvestment.

Looking at the last dividend payout ratio formula, the investors get ensured about how much they may receive in the near future.

Calculate Dividend Payout Ratio in Excel (with excel template)

Let us now do the same example above in Excel.

This is very simple. You need to provide the two inputs of Dividends and Net Income.

You can easily calculate the ratio in the template provided.

First, we will use the first ratio.

Now, we will use the second ratio.