Table Of Contents

What Is Dividend Irrelevance Theory?

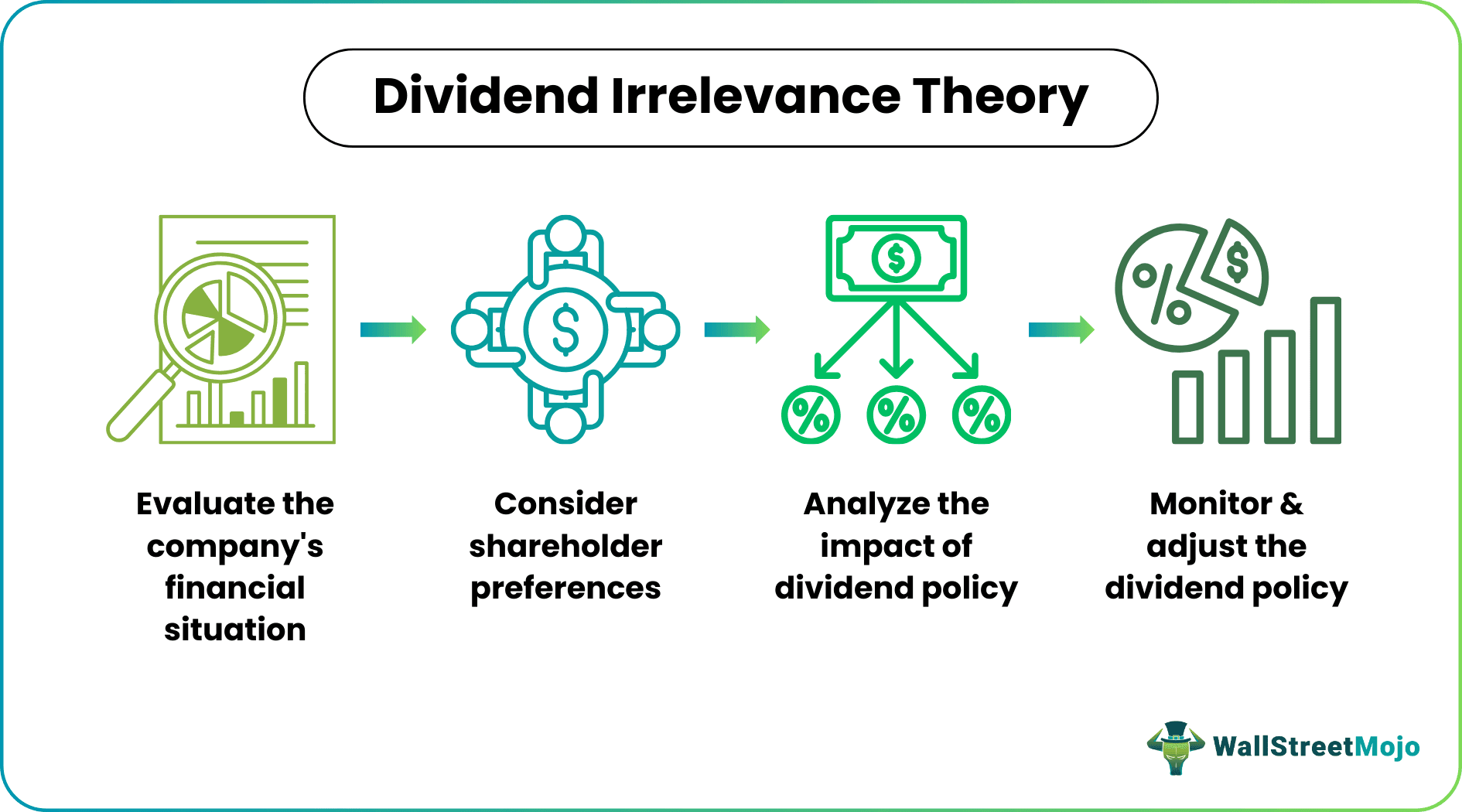

The dividend irrelevance theory is a financial theory that suggests that a company's dividend policy does not affect its stock price or overall value. It provides a framework for understanding the relationship between a company's dividend policy and overall value.

Companies can use this theory to determine their optimal dividend policy and balance the needs of their shareholders with the need to retain earnings for future growth. The theory assumes that investors are rational and have access to information about the company, which leads them to make sound investment decisions based on the company's future earnings potential and risk.

Key Takeaways

- The dividend irrelevance theory states that a company's dividend policy does not impact its overall value or stock price, assuming perfect market conditions. Instead, investors can create their desired income stream by buying or selling company shares as needed.

- A company's future earnings potential and risk are the main factors determining its overall value. As a result, companies have greater flexibility in deciding their dividend policy. This is based on their financial needs, growth prospects, and investor favorites.

- Investors can make informed investment decisions based on their desired income stream and potential for future growth. The theory explains the relationship between dividends and a company's overall value.

Dividend Irrelevance Theory Explained

The dividend irrelevance theory proposes that a company's dividend policy does not affect its overall value or stock price. It was introduced by Franco Modigliani and Merton Miller in 1961. It suggests that investors can create their desired income stream by buying or selling company shares as needed. This is regardless of whether the company pays dividends or retains its earnings.

The theory aims to understand the relationship between dividends and a company's value. By understanding this relationship, companies can make informed decisions about their dividend policy and how it impacts their ability to generate shareholder value.

In conclusion, while the theory provides a valuable framework for understanding the relationship between dividends and a company's overall value, it has limitations. It does not hold in all market conditions. Therefore, companies should carefully consider their dividend policy based on their unique circumstances and the needs of their shareholders.

Assumptions

The dividend irrelevance theory is based on assumptions necessary for the idea to hold. These assumptions include the following:

- Perfect market conditions: The theory assumes that investors can access the information, trade securities without transaction costs, and borrow and lend money at the same risk-free rate. This assumption is necessary to ensure that all investors make rational investment decisions based solely on the company's future earnings potential and risk.

- Rational investors: The theory assumes that all investors are reasonable and have access to information about the company. All investors will make investment decisions based solely on the company's future earnings potential and risk without considering its dividend policy.

- No taxes: The theory assumes no taxes on dividends or capital gains. This assumption is necessary to ensure that the tax treatment of dividends does not impact the company's market value.

- No signaling effect: The theory assumes that a company's dividend policy does not signal any information about the company's future earnings potential or risk. This means that investors do not view a change in the company's dividend policy as a signal of good or bad news about the company's future performance.

- No agency costs: The theory assumes no agency costs are associated with a company's dividend policy. This means that managers act in the best interests of shareholders and do not use the company's dividend policy to benefit themselves at the expense of shareholders.

Examples

Let us understand it better through the following examples.

Example #1

Suppose a company QPR Ltd. has two investment opportunities: it can pay its shareholders dividends or reinvest the earnings into the business for future growth. Under the dividend irrelevance theory, the company's market value would not be affected by its choice of dividend policy.

Investors who desire a higher income stream could sell some of their shares to generate the desired income. In contrast, those who want growth potential could hold onto their shares and benefit from the company's reinvestment in future growth opportunities. As long as the company's future earnings potential and risk remain the same, its dividend policy will not negatively impact its market value.

Example #2

Apple, Inc. announced in April 2020 that it would maintain its quarterly dividend payment to shareholders, despite the economic uncertainty caused by the pandemic. The company also announced that it would increase its share buyback program by $50 billion, indicating its intention to reinvest its earnings for future growth. Despite concerns about the pandemic's impact on the global economy, Apple's decision to maintain its dividend payment did not significantly impact its stock price. This is consistent with the dividend irrelevance theory, which suggests that a company's dividend policy does not affect its overall value or stock price, assuming perfect market conditions.

Advantages

The dividend irrelevance theory provides several advantages for companies and investors.

Firstly, the theory allows companies greater flexibility in determining their dividend policy. Companies can pay dividends or retain earnings based on financial needs, growth prospects, and investor favorites. This can help companies balance generating income for their shareholders and investing in future growth opportunities.

Secondly, the theory suggests that investors can create their desired income stream by buying or selling company shares as needed, regardless of whether the company pays dividends or retains its earnings. This gives investors greater control over their investment portfolio and allows them to customize their income stream based on their financial needs.

The theory explains the relationship between a company's dividend policy and overall value. As a result, companies can use this theory to make informed decisions about their dividend policy and how it impacts their ability to generate shareholder value.

Lastly, the theory can help investors evaluate the potential impact of a company's dividend policy on their investment portfolio. By understanding the relationship between dividends and a company's overall value, investors can make informed investment decisions and achieve better returns.

Criticisms

The dividend irrelevance theory has faced several criticisms since its proposal in 1961.

Firstly, the theory assumes perfect market conditions, which are often unrealistic and may not reflect the real-world needs of financial markets and the behavior of investors and companies. Information asymmetries, transaction costs, taxes, and agency costs can impact a company's dividend policy and overall value.

Secondly, the theory assumes that rational investors have access to information about the company. However, in reality, investors may only sometimes be reasonable and may have different access levels to information about the company. This can lead to biases in investment decision-making that may impact the company's market value.

Thirdly, the theory assumes that a company's dividend policy does not signal any information about the company's future earnings potential or risk. In reality, a company's dividend policy change may signal good or bad news about the company's future performance, which can impact investor sentiment and the company's market value.

Lastly, the theory assumes that a company's future earnings potential and risk remain constant regardless of its dividend policy. However, a company's dividend policy may impact its ability to generate future earnings or increase its risk profile. For example, a company that pays out too much in dividends may need more funds to invest in future growth opportunities.

Dividend Irrelevance Theory vs Bird-In-the-Hand Theory

The dividend irrelevance theory and the bird-in-the-hand theory are two different theories that provide different perspectives on the relationship between dividends and a company's overall value. Here are some of the critical differences:

#1 - Dividend Irrelevance Theory

- It suggests that a company's dividend policy does not impact its overall value or stock price, assuming perfect market conditions.

- It assumes that investors can create their desired income stream by buying or selling company shares as needed.

- It suggests that a company's future earnings potential and risk are the main factors determining its overall value.

#2 - Bird-In-The-Hand Theory

- It suggests that investors favor current dividends over future capital gains, which are more specific and provide immediate income.

- It assumes investors are risk-averse and favor current income over potential future growth.

- It suggests that a company's dividend policy can impact its overall value, as investors may place a premium on companies that pay consistent and reliable dividends.

Dividend Irrelevance Theory And Dividend Relevance Theory Differences

The dividend irrelevance theory and dividend relevance theory are two different theories that provide different perspectives on the relationship between dividends and a company's overall value. Some of the key differences between the two theories are:

#1 - Dividend Irrelevance Theory

- It suggests that a company's dividend policy does not impact its overall value or stock price, assuming perfect market conditions.

- It assumes that investors can create their desired income stream by buying or selling company shares as needed.

- It suggests that a company's future earnings potential and risk are the main factors determining its overall value.

#2 - Dividend Relevance Theory

- It suggests that a company's dividend policy can impact its overall value, as investors may place a premium on companies that pay consistent and reliable dividends.

- It assumes that investors favor current income over potential future growth.

- It suggests that a company's dividend policy can signal information about its future earnings potential and risk.

Frequently Asked Questions (FAQs)

Taxes on dividends may impact the theory's validity as they can create a tax disadvantage for companies that pay dividends, making them less attractive to investors than companies that retain earnings for growth.

Market conditions play a crucial role in the theory. The theory assumes perfect market conditions, where all investors can access the same information and trade securities without transaction costs. Market conditions can impact a company's dividend policy and overall value.

It applies to all companies and industries based on the assumption of perfect market conditions and rational investors. However, the idea may only hold in some market conditions, and companies should carefully consider their dividend policy based on their unique circumstances and the needs of their shareholders.