Table Of Contents

What is the Dividend Formula?

When an organization or a firm earns a profit at the end of the accounting year, they may take a resolution in the Board meeting or through shareholder's approval in certain cases to share a portion of their earned profits with their stockholders, which are called dividends. Using the formula below, we can determine the percentage of dividends paid to the stockholders from the net profit earned for that accounting year.

Dividend Ratio Formula = Total Dividends/ Net Income

Key Takeaways

- The dividend formula utilizes net profit to determine the percentage of dividends paid to stockholders. Dividends can be distributed in a Board meeting or with shareholder approval.

- Analyzing a company's dividend payments and retained earnings provides insights into its objectives. The retention ratio, calculated by subtracting the dividend payout ratio from 1, can further explain the company's investment strategies.

- Investors need to consider multiple dividend ratios, including consolidated dividend ratios, to assess a company's confidence.

Explanation of Dividend Formula

Sharing the profit earned is an afterthought for an organization or the firm. But, first, the management will decide how much they can reinvest into the firm so that its business can grow huge, and the company can multiply the stockholders' hard-earned money instead of just sharing it with them. That is the reason the dividend is crucial.

Furthermore, it tells one about how much the firm or the organization is rewarding or, in order words, paying the dividend to its stockholders. Further again, how much the firm or the organization is reinvesting into itself can be called retained earnings.

Sometimes, the firm or the organization doesn't desire to pay anything to their stockholders as the management would feel the need to reinvest the profits earned by the company as that can aid the firm to grow bigger and faster.

Calculation Examples

Let us see some simple to advanced examples to understand them better.

Example #1

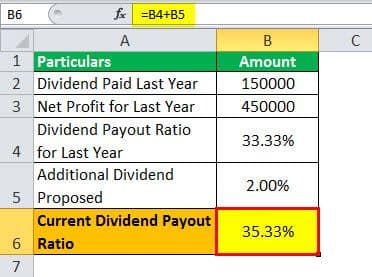

Patel Ltd. last paid a dividend of $150,000 when it made a net profit of $450,000. This year, the company is also looking to pay a dividend as they have done spectacular business, and shareholders are pleased about it. The company has decided to increase its dividend by 2%. Compute the dividend payout ratio for this year.

Solution:

Last year’s dividend and net profits were $150,000 and $450,000. Therefore, we can use the formula below to calculate dividends and generate a dividend payout.

Therefore, the calculation of the dividend payout ratio is as follows: -

Dividend Formula =Total Dividends / Net Income

= 150,000/ 450,000 *100

Dividend Payout will be: -

- Dividend Payout = 33.33%

Now, the company proposes to pay an additional dividend of 2% from last year. Hence this year, the dividend would be 33.33% + 2.00%, which is 35.33%.

Current Dividend Payout = 35.33%.

Current Dividend Payout = 35.33%.

Example #2

Mr. Lesnar is a wealthy investor and is now considering the Indian stock market to invest in. However, he is skeptical and wants to be risk-averse as he is new to the market. Mr. Lesnar has heard the name BSE since that is also a market-recognized exchange. He will only invest if the company has a more than 30% dividend payout ratio for the last two years. He has extracted the income statement of BSE Ltd., and the following are the details. Now, you must ascertain whether Mr. Lesnar would invest in this company.

Solution:

We are given the last two year's dividends and net profit as $150.64 million, $191.70 million, and $220.57 million, $711.28 million, respectively.

Therefore, the calculation of the dividend payout ratio for 2017 will be as follows: -

Dividend Ratio 2017= Total Dividends /Net Income

= 150.64 /220.57 x 100

Dividend Payout for 2017 will be: -

- Dividend Ratio 2017 = 68.30%

Therefore, the calculation of the dividend ratio for 2018 will be as follows: -

Dividend Formula 2018 = Total Dividends/Net Income

= 191.70 / 711.28 x 100

Dividend Payout for 2018 will be: -

- Dividend Payout 2018 = 26.95%

Since the dividend payout ratio for 2018 is less than 30%, Mr. Lesnar may not choose to invest in BSE Ltd.

Example #3

Swastik Ltd., a small company in the Valsad district, registered itself as a private limited company. The directors are in the finalization stage of financial statements and want to pay dividends for $353,000. Still, they are unsure what percentage of profits they give as dividends. Therefore, you must ascertain the dividend payout ratio based on the below extracts from financial statements.

Solution:

First, we need to ascertain the company's net profit for the report date, March 2017.

Therefore, the calculation of the dividend payout for 2017 will be as follows: -

Dividend Payout 2017 = Total Dividends /Net Income

= 353,000 / 460,000 x 100

Dividend Payout Ratio for 2017 will be:-

Dividend Payout 2017 = 76.74%

Relevance and Uses

Understanding the mathematics between dividend payments and retained earnings will aid an investor or the shareholder comprehend the short-term and long-term goals and objectives of the firm or the company. One can also use this dividend to determine the company's retention ratio. When you subtract the dividend payout ratio from 1, you will get the retention ratio, which depicts how much the company is confident for its future and how much they want to invest.

The stock analyst mostly uses this ratio for investors to ascertain the company's confidence. However, other dividend ratios should be looked at, at the consolidated level and not judged on a single ratio like dividend per share, dividend yield, etc.