Table Of Contents

What Is Dividend Distribution Tax?

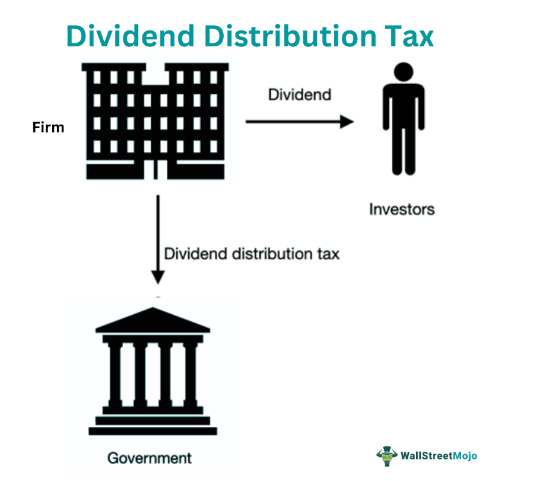

The dividend distribution tax (DDT) is imposed on companies when they distribute dividends. The Indian government imposes this tax. Firms are required to pay the tax within 14 days of distribution. It is intended to tax a company's payout of dividends to its shareholders as income.

If a company failed to pay DDT, an additional 1% (of DDT) interest was imposed. As a result, DDT constituted 15% of the gross dividend. However, on April 2020, the Finance Act of 2020 was passed; DDT was abolished. Since then, taxation has been imposed on investors. This way, the burden on companies is reduced. DDT aims to increase tax collection and act as a source of funding for government spending.

Key Takeaways

- Dividend distribution tax is a company liability; they must pay taxes on the dividends distributed among investors.

- Dividends are a portion of companies’ profits shared with investors. However, even without DDT, companies have to pay other taxes on profits (e.g., income tax).

- After abolishing DDT, the Indian government imposes a 10% tax on investors receiving company dividends. But this tax is not applicable if the investor receives less than Rs. 5000 from a dividend.

Dividend Distribution Tax Explained

Dividend distribution tax was introduced in India via the Finance Act of 1997 under Section 115-O of the Income Tax Act of 1961. Dividends paid by companies are taxed according to these regulations. The declared dividends are a share of profits paid to shareholders.

Before venturing further, let us quickly define a dividend. A company pays dividends to investors as gratitude for investing in the company’s equity. Dividends are a portion of business earnings. They are issued in the form of cash or additional shares. The board of directors decides the exact nature of repayment.

It is important to note that not all stocks offer dividends. Dividends are a significant expense for a firm—it brings down retained earnings. Dividends reflect a company’s earning capabilities. Companies encountering losses cannot afford dividends. Reinvestment of retained earnings is crucial for business growth. But most Investors prefer dividend-bearing stocks nonetheless. Dividends provide a steady income to investors.

DDT was imposed in addition to income tax payments. Thus, these companies had to bear multiple liabilities on profits. However, Finance Act 2020 abolished the tax. Since then, companies are not obligated to pay tax on distributed dividends. Instead, the tax is imposed on the investors who receive the dividends. This tax amendment was applied from April 2020 onwards.

The dividend income tax is mandatory for all investors who receive a dividend of ₹5,000 or more. A 10% taxation is levied. If the dividend income exceeds ₹1,000,000, an additional 10% will be imposed on the investor. Further, since the dividend income is taxable, the investor’s income tax also rises.

DDT Abolished

The Indian government abolished the dividend distribution tax to attract foreign investment. Earlier, companies were liable to pay the tax, and it reduced business profits. As a result, the infusion of foreign direct investment into India stagnated.

Therefore, companies have greatly benefited from the abolition of DDT. But the merits of DDT abolition cannot be restricted to foreign companies alone. Investors who receive less than ₹5,000 receive tax-free dividends. There are some drawbacks, too; investors with different tax slabs pay different amounts of tax for the same dividends.

For example, let us assume that investors A and B invest in a certain company and receive a dividend of ₹10,000 as dividends. Now, a flat 10% is deducted at the source (TDS), and they get ₹9,000.

However, investor A pays a 15% tax on total income (other than dividends), whereas investor B pays a 10% tax on taxable income. Thus, A will pay a tax of ₹1,350 for the dividends, whereas B will only pay ₹900 for the same.

Dividend Distribution Tax Rate

Let us look at the dividend distribution tax rate.

Before abolishing DDT, a 15% taxation was imposed on companies that distributed dividends. The tax is calculated on the gross dividends. Thus, the levied taxation becomes 17.65% of the distributed dividend. The calculation is as follows:

- 15% Tax Rate on Gross Dividend =

- 15% Tax Rate on Gross Dividend = 1.1765 of Dividend

The respective rates for mutual fund dividend tax are different. For instance, DDT imposed on debt-oriented mutual funds is 25%. At the same time, DDT for equity-oriented funds is 10%.

How To Calculate?

Now, let us discuss how to calculate dividend distribution tax.

- Step 1: Determine 17.65% of the total declared dividend. Let’s call this value V1.

- Step 2: Add V1 to the total declared dividend (net rate should be 117.65%). This value is the gross dividend, V2.

- Step 3: Now, calculate 15% of V2 to arrive at the value of V3. This is the net DDT.

Example

Company X declared its 2018-2019 dividend as ₹100,000. Based on the given values, determine the DDT paid to the government.

- Gross Dividend = (100,000 x 17.65%) + 100,000

- Gross Dividend = ₹117,650

Now, we apply the gross dividend value to calculate DDT:

- DDT = 117,650 x 15%

- DDT = ₹17,647.5