Table Of Contents

What Is The Disposition Effect?

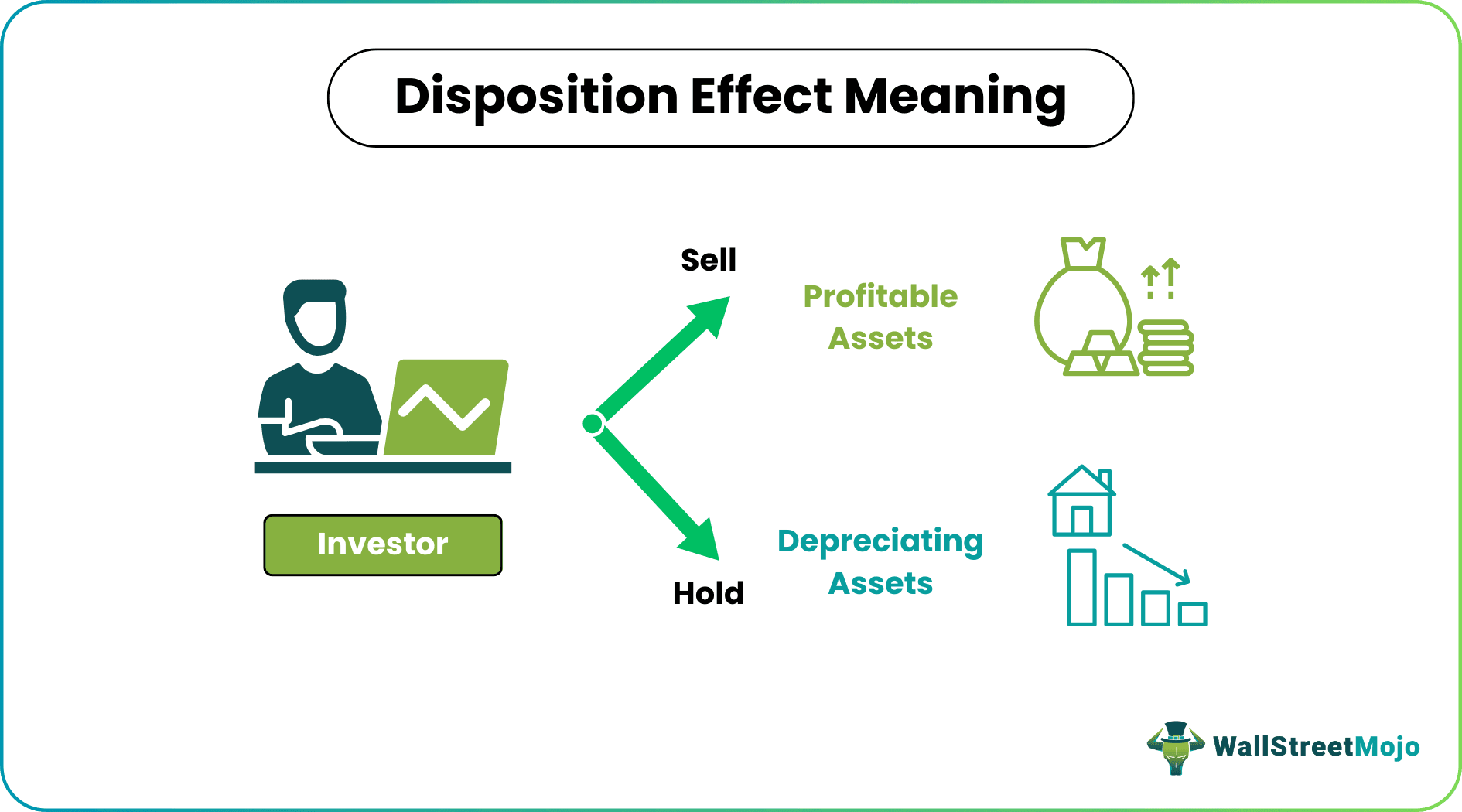

The Disposition effect in behavioral finance refers to a psychological bias that makes individual investors sell the assets that have made gains while holding on to those securities that have lost value. Ultimately, the purpose of understanding this effect is to improve decision-making in investing and promote more rational and optimal investment strategies.

These factors contribute to the investor selling their profitable investments to ensure a profit and hoping their low-performing assets will yield gains eventually. Some causes for this bias include prospect theory, mental accounting, and regret avoidance. Moreover, overcoming the disposition effect requires self-awareness and disciplined decision-making. Furthermore, financial professionals can consider this effect when designing investment products and strategies.

Key Takeaways

- The disposition effect in behavioral finance is a cognitive tendency where traders in the stock market sell profitable securities and hold on to loss-incurring assets.

- They sell the 'winning' assets, eager to make profits while keeping the 'losing' assets hoping that they would increase in value and make up for the losses incurred.

- A psychological bias reduces the investors' profits by exposing them to losses.

- Investors have to change how they look at profits and losses by cultivating logical thinking abilities.

Disposition Effect Explained

The disposition effect in behavioral finance refers to a psychological condition seen in investors. It describes the pattern of individuals being more inclined to sell winning investments too quickly and hold onto losing assets for too long.

Economists Hersh Shefrin and Meir Statman introduced the term in their 1985 paper. The problem with this bias is that it reduces investors' returns. Trading is all about knowing when to buy and sell securities. Therefore, disposition effect bias blinds investors and hampers them from executing this decision appropriately.

These cognitive biases can lead to suboptimal investment decisions. Selling winning investments slowly can mean missing out on potential gains if the investment continues to perform well. Conversely, holding onto losing investments for too long can lead to additional losses. Since investors may be reluctant to cut their losses and reallocate their resources to more promising opportunities.

Thus, investors can mitigate the impact of the disposition effect bias by maintaining a long-term investment strategy, diversifying their portfolio, and regularly reviewing and adjusting their investments based on sound analysis. Here is how the disposition effect manifests in investors:

- Reluctance to realize losses

- Quick profit taking

- Inconsistent investment strategy

- Reinforcement of biases

Furthermore, it is a deviation from the rational behavior assumed in traditional finance theories, which suggests that investors should make decisions based on expected future returns and risk considerations. Thus, investors can make more rational and objective investment decisions by understanding and managing these biases.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Refer to the following examples to understand the disposition effect better.

Example #1

Let's assume Tom is an amateur investor. He holds the stocks of companies Cisco Systems and Intuit Inc. Over time, the stock price of Cisco Systems climbed three times its value in 4 months, while Intuit Inc. stocks plunged to 80% of their value when Tom bought them. Eager to realize the profits from the Cisco system, Tom sold these stocks while their value was still increasing.

However, he wouldn't sell Intuit Inc. stocks, hoping they would appreciate and bring him profits. Finally, he incurred a 40% loss when he sold Intuit Inc. stocks. Therefore, in this hypothetical example, the disposition effect influences the investor's decision to hold onto the losing investment for an extended period.

Example #2

When navigating complex markets, investors must know many biases influencing their judgments and allocations. According to Blackrock, an American multinational investment company, these issues deserve careful consideration before making portfolio modifications. We're avoiding their pitfalls because we believe the new regime necessitates a portfolio overhaul," said Emily Haisley, behavioral finance, Blackrock Risk & Quantitative Analysis.

The disposition effects are a source of worry for Blackrock. According to Haisley, this is an impulse to hold losing stocks for too long and sell winning ones too quickly. Thus, based on findings, many people experience the pain of loss twice as intensely as they experience the pleasure of an equivalent gain. She further added that stocks and bonds have experienced falls not seen since the 1970s.

How To Avoid?

The investors' disposition effect can be cured through a few techniques that focus on changing how traders view their investments, especially regarding profits and losses.

- Establish a Clear Investment Plan: Develop a well-defined investment plan that outlines the financial goals, risk tolerance, and criteria for buying and selling investments. A predetermined program can help you make objective decisions based on the investment strategy rather than succumbing to emotional biases.

- Set Realistic Expectations: Maintain realistic expectations about investment outcomes. Hence, recognize that investment values can fluctuate, and it's vital to assess investments based on their underlying fundamentals and long-term potential rather than short-term price movements.

- Stick to the Investment Plan: Once a person has decided on an investment strategy, they should stick to it. Short-term market swings should not be used to make hasty or emotionally driven judgments. Rather than reacting to momentary market changes, examine and rebalance the portfolio regularly based on the principles of the plan.

- Set Clear Buying and Selling Criteria: Define clear criteria for when to buy and sell investments. This could include predetermined price targets, valuation metrics, or specific milestones. Setting objective criteria beforehand allows you to avoid rash decisions based on short-term swings or emotions.

Disposition Effect vs Loss Aversion

Disposition effect and loss aversion are psychological biases investors face while trading. Let’s define loss aversion before comparing the two concepts.

| Basis | Disposition effect | Loss Aversion |

|---|---|---|

| Definition | Refers to the tendency of investors to hold onto losing investments too long and sell winning investments too quickly. | Loss aversion refers to feel the pain of losses more strongly than the pleasure of gains. |

| Focus | Primarily related to investment decision-making and behavior. | It is a cognitive bias that affects various domains, including investment decisions. |

| Selling Behavior | Investors tend to sell winning investments quickly to lock in gains. | Here, investors may delay selling currently profitable investments due to the fear of missing out on future gains. |

| Impact on Decisions | Influences the timing of buying and selling decisions based on past performance. | Determines the willingness to take risks and accept losses in investment decisions. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Yes. Prospect theory is the leading cause of the disposition effect. According to this theory, investors feel the pain of making losses more severely than the pleasure of making similar gains. Therefore, when stocks fall, investors hold on to them, hoping that the stock value will rise, so they do not make any losses.

Mental accounting is a cognitive bias where people value the same investment differently, given different factors and circumstances. Hence, this is an extension of the prospect theory, as it explains how people view gains and losses of the same amount differently. Here's how mental accounting is related to this effect:

- Segregating investments

- Evaluating gains and losses in isolation

- Quick profit taking

The disposition effect influences investment decisions by distorting risk assessments and creating buying and selling behavior biases. It can lead to suboptimal portfolio management, imbalanced risk-reward profiles, and missed opportunities for gains or losses.