Table Of Contents

Formula to Calculate Disposable Income

Disposable income is the amount of money available after accounting for income taxes, either spending or saving.

Disposable Income formula = PI - PIT

where PI is personal income and PIT is the personal income tax.

The disposable income equation is quite simple to use and calculate. First, we must determine the individual's gross income before any expenses and then deduct the same gross income by the applicable tax rate. As the taxes cannot be avoided subsequently, it's a must to deduct the income taxes to arrive at disposable income figures. Disposable income can be used for paying expenses, bills, and leisure activities.

- Disposable income is the money left over for either saving or spending after deducting income taxes.

- It differs from personal disposable income, the entire amount an individual earns from investments, salaries, dividends, bonuses, pensions, social benefits, and other endeavors over a specific period.

- The following is how the formula for disposable income is represented mathematically: Personal income less personal income taxes equals disposable income. Based on the existing revenue, spending decisions are made.

Disposable Income Formula = Personal Income – Personal Income Taxes.

Key Takeaways

- Disposable income is the money left over for either saving or spending after deducting income taxes.

- It differs from personal disposable income, the entire amount an individual earns from investments, salaries, dividends, bonuses, pensions, social benefits, and other endeavors over a specific period.

- The following is how the formula for disposable income is represented mathematically: Personal income less personal income taxes equals disposable income.

- Based on the existing revenue, spending decisions are made. Disposable Income Formula = Personal Income – Personal Income Taxes.

Disposable Income Calculations

Example #1

Wilson and Wilson's family earn around $60,000 monthly, and they pay $5,000 as monthly federal tax. Therefore, you must calculate the Disposable Personal Income for the entire year based on the above information.

Solution

Use below given data for the calculation of disposable income

- Gross Salary: $60,000

- Federal Taxes: $5,000

First, we need to calculate the yearly gross salary and federal taxes.

Therefore, the calculation of disposable income will be as follows,

= 720,000 - 60,000

Disposable Income will be -

- Disposable Income= 660,000

Hence, the disposable income of Wilson and the Wilson family is $660,000.

Disposable Income (DPI) Explained in Video

Example #2

Anjali is working full-time with Morgan Chase Inc. as a senior analyst in a supporting role. She recently learned about disposable income concepts in a seminar, and she was curious to calculate her disposable income from an engineering background. So she opened up her salary slip, and below are the details:

She is paying 35% federal taxes after eligible deductions. Further, she is eligible for three times a year shift allowance. Her provident fund and professional taxes are deducted monthly. Therefore, you are required to calculate the yearly disposable income for Anjali.

Solution

In this example, we will first calculate the gross income after deducting the provident fund and professional taxes and finally deducting federal income taxes.

Now gross salary before fed taxes will be 106,900 less 10,800, which equals 96,100.

Now gross salary before fed taxes will be 106,900 less 10,800, which equals 96,100.

She is in the bracket of 35%, and the income tax on the same will be 96,100 x 35%, which is 33,635.

Therefore, the calculation of disposable income will be as follows,

= 96,100 – 33,635

Personal Disposable Income will be -

- Disposable Income = 62,465

Hence, the disposable income for Anjali would be 62,465.

Example #3

Mr. X was working in an MNC where he was earning a gross salary of $2,000,000 per annum, and he was in a tax bracket for 30% on income above $1,000,000 and 10% on income below $1,000,000. He was recently asked to move to the US as part of the job, and there he was eligible for a $27,000 per annum basis. He was supposed to return in 5 years back to his home country.

However, he was given a decision whether to opt for this opportunity or not. He learned that he would be paying taxes in the US flat 27% without any deductions. Moreover, the exchange rate prevailing was 1 USD = 70 units of home currency. Therefore, you are required to assess whether he should opt for the US or let it go based on the disposable income concept.

Solution

In this example, we need to compare the disposable income of the home country with the US.

- Gross salary per annum of the home country: 2,000,000.00

- Income tax rate up to 10 lacs: 10%

- Income tax rate above ten lacs:30%

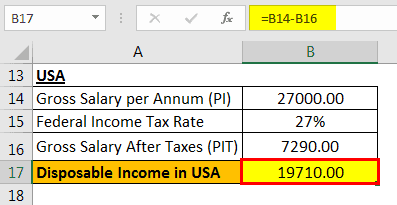

- Gross salary per annum of USA: 27,000.00

- Federal income tax rate: 27%

Calculation of disposable income of the home country

=2000000.00-400000.00

Disposable Income of Home Country will be -

=1600000.00

Calculation of Personal Disposable Income in the USA

=27000.00-7290.00

Disposable Income in USA will be -

=19710.00

Therefore, using the exchange rate given in the problem, 70, the disposable amount in-home units will be 19,710 x 70 equals 1,379,700.

Since this is less than their current home country's disposable income, he can consider not opting for the USA job.

Relevance and Uses

Disposable income can be used in deriving several economic indicators and statistical measures. For example, economists can use disposable income as a beginning point to calculate metrics like personal savings rates, marginal propensity to save (MPS), discretionary income, and MPC formula. Disposable income is the income left after taxes.