Table Of Contents

Disintermediation Meaning

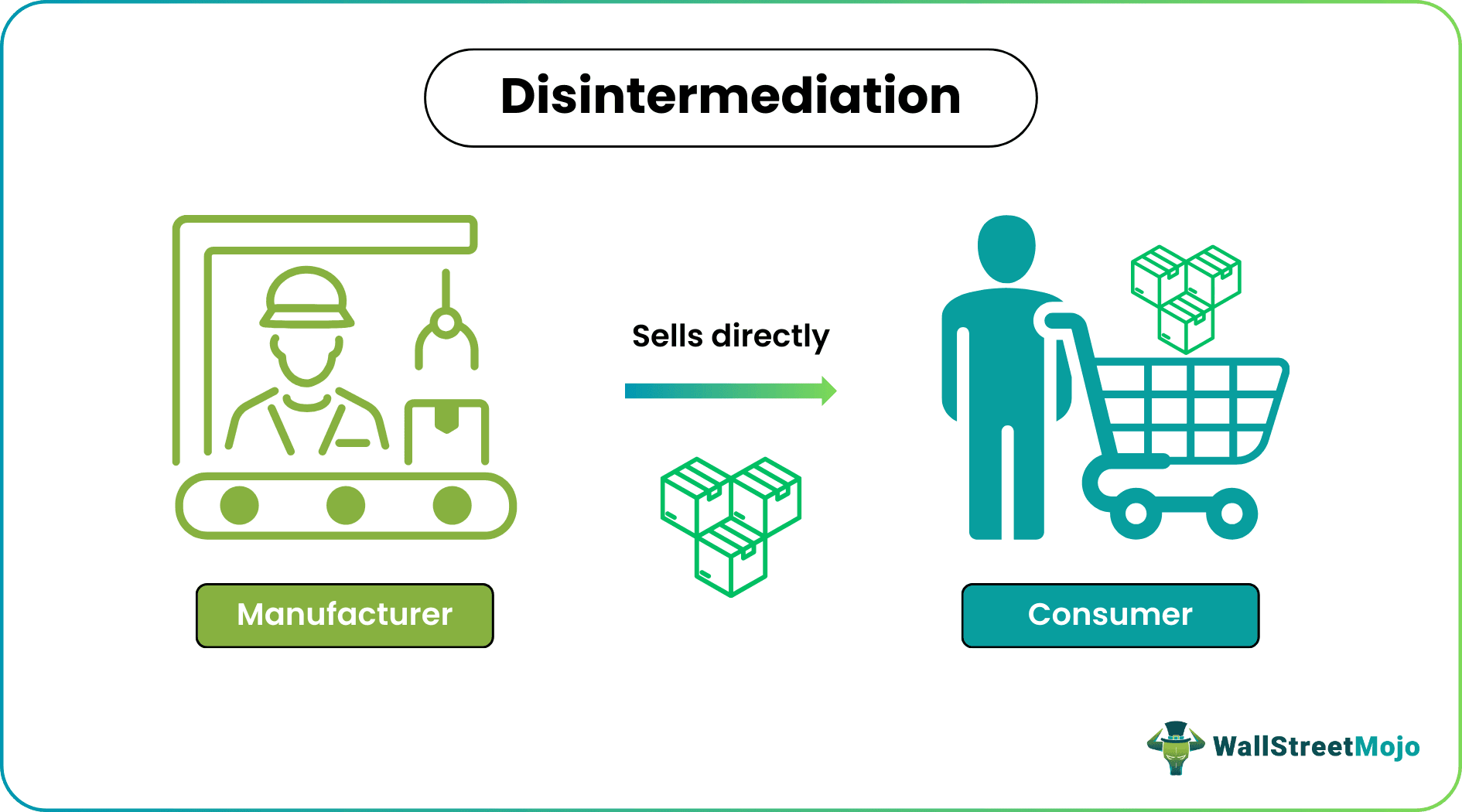

Disintermediation means cutting out the middlemen from the distribution channel to sell directly to the customers. For example, if brokers are eliminated as an intermediary so that a firm can deal and offer its shares directly to its potential buyers, it would be a case of disintermediation.

Often, this process will occur for a company or individual to save on costs or cut down on time to sell a product or service.

Key Takeaways

- Disintermediation involves cutting out some aspects of the distribution chain, including eliminating a retailer, wholesaler, brokers, insurance firms or anyone else acting as an intermediary.

- Technology is fueling disintermediation, making processes significantly quicker and more efficient.

- Companies can use this process to eliminate unnecessary steps in the supply chain, leading to increased profit margins and lesser time consumption to get the product to the consumer.

- Although it is often implemented as a cost-cutting measure, it does come with risks, like having to absorb additional costs in some cases.

How Does Disintermediation Work?

To better understand the meaning of disintermediation, it’s first essential to understand what it means to “intermediate.” An intermediary bridges the gap between two separate parties and help them achieve specific goals. For example, a retail giant like Walmart acts as an intermediary for brands showcased on its shelves as it is giving the buyers a platform to purchase their products.

Similarly, some banks act as intermediaries between investors and low-risk financial instrument providers when they offer a platform to invest in government bonds. To disintermediate will lead to eliminating the representatives like Walmart or banks so that the brands communicate and sell directly to their customers.

Intermediaries in finance have always provided a crucial role in the financial industry by acting as the middleman between entities and allowing a smooth transition from user to product or service. Some would even say that this system has contributed to the rise of globalism and has allowed businesses to scale their operations.

A few examples of intermediaries in finance include Insurance agents, stockbrokers, and bankers. In many cases, without intermediaries, individuals wouldn’t have access to certain goods or services. The same could be said for some businesses. Without the middleman, they wouldn’t have the labor and resources necessary to get the job done.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Disintermediation Examples

- Let’s say, for example, you build technology such as computers, smartphones, and laptops. You sell your products to big-box retail stores such as Best Buy, Walmart, and Target, which sell them to the consumer. However, you begin to realize your products are in high demand, and buyers seem to prefer to purchase them online.

- In this instance, you may want to consider disintermediation. To put this process into effect, you would stop selling to the big-box retailers, and instead, you would sell to the consumers directly. You could set up a website and begin attracting customers to it, skipping the middleman altogether.

- When talking about disintermediation examples, tech giant, Dell needs a special mention. Dell achieved an edge over its competitors like Compaq & IBM in the 90s. One of the chief reasons for Dell's success was that it had adopted a direct selling model. With a direct selling model, Dell was selling products directly to its customers without intermediaries, which helped its buyers avail services like customization. Resultantly, Dell grew from $6 million in 1994 to an astonishing over $25 billion in 1999. In 1999, Dell also overtook the Compaq Computer Corporation 1999 as the largest PCs selling brand in the United States.

Technology's role in disintermediation

New technology is being developed every day, making people’s lives easier and giving them access to opportunities they wouldn’t be eligible for otherwise. This is becoming a problem for many intermediaries as technology is replacing their processes, making them more comfortable and efficient. If businesses don’t have to cover the overhead costs associated with brick and mortar stores, they can pass those savings along to the consumer.

The internet is a significant driver of disintermediation, allowing people to become closer than ever and interact with one another. The internet also allows businesses and other entities to communicate with potential consumers directly. If a company decides they want to begin selling directly to the consumer, they can skip the retailer and directly establish a relationship. Examples of such brands include Lulus and Kylie Cosmetics that ship to different countries as well.

Cryptocurrencies such as Bitcoin and Ethereum are getting all the attention this year as both digital currencies have experienced unprecedented price growth, recently hitting all-time high prices. Many people are interested in the speculative prices of currencies. However, it’s the technology behind these digital currencies that’s the intriguing part.

Fiat money or paper currency is controlled by a centralized figure, like a central bank. On the other hand, Cryptocurrencies will utilize Blockchain technology, which is decentralized and not controlled by a central figure. Instead, the transactions are entered into a database and stored on a massive network or servers. The data can be observed by everyone on the network live as it’s updated.

Risks in Disintermediation

Although companies that practice disintermediation can receive certain benefits like increased profit margins and less transit time, there are known risks associated with the practice.

These risks can include:

- Absorbing additional costs - If you were to cut the retailer out, you may end up spending more money on shipping your product to the consumer directly than it would to send them all to the store and have the consumer pick them up there.

- More management responsibilities - Since you are eliminating a portion of the supply chain, there has to be another factor added, or you will risk disrupting the whole process. For example, if your computer company were to eliminate the retailers and didn’t have another channel capable of the same production, you would risk an oversupply with reduced demand. This will lead to an increase in the requirement of labor owning to a disrupted supply chain.

- Reduced brand awareness - Disintermediation can also risk your brands’ awareness. If your brand isn’t competitive enough and eliminates the retailer stores, the brand will not receive nearly as much attention, jeopardizing its future.

- Smaller market potential - In many instances, people will go to the big-box retailers looking for specific products. If they don’t see your particular brand, they will go with the competition. You can avoid this situation if your brand has already created a community of followers, as they will be more loyal to the brand.

- Futile - In some cases, disintermediation makes sense to implement, but not in every scenario. Sometimes it will make more sense for a company to ship its products to a retail location. Doing so will give a centralized location for customers to have the ability to shop for and pick up their products.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.