Table Of Contents

Formula to Calculate Discounted Values

Discounting refers to adjusting the future cash flows to calculate the present value of cash flows and adjusted for compounding where the discounting formula is one plus discount rate divided by a number of year’s whole raise to the power number of compounding periods of the discounting rate per year into a number of years.

Discounting Formula primarily converts the future cash flows to present value by using the discounting factor. Discounting is a vital concept as it helps in comparing various projects and alternatives that conflict while making decisions since the timeline for those projects could be different. Discounting them back to the present will ease comparison. Further, discounting is also used in making investment decisions. Discounting is nothing but a compounding concept in a reverse way, and it will decrease as the time increases.

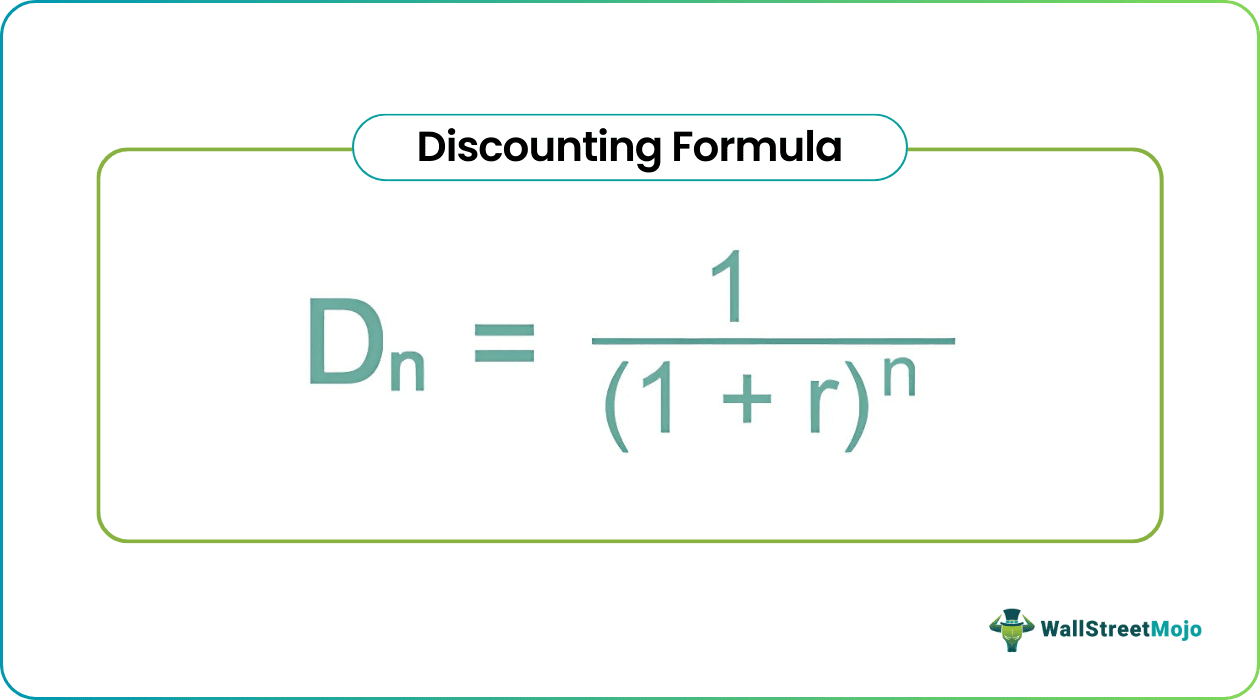

The equation for Discounting is:

Dn = 1 / (1+r)n

Where,

- Dn is the Discounting factor

- r is the Discounting rate

- n is the number of periods in discounting

Key Takeaways

- The discounting formula is a financial calculation used to determine the present value of future cash flows.

- The discounting formula considers two main factors: the future cash flow and the discount rate.

- By applying the discounting formula, future cash flows are reduced to their present value, enabling meaningful comparisons and evaluation of cash flows occurring at different points in time.

- The discounting formula is widely used in various financial analyses, including discounted cash flow (DCF) analysis, valuation of investments, and determining the fair value of assets or liabilities.

Steps to Calculate Discounted Values

To calculate discounted values, we need to follow the below steps.

- Calculate the cash flows for the asset and timeline that is in which year they will follow.

- Calculate the discount factors for the respective years using the formula.

- Multiply the result obtained in step 1 by step 2. This will give us the present value of the cash flow.

Examples

Example #1

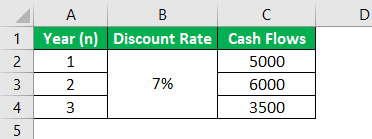

Veronica is expecting the following cash flows in the future from her recurring deposit. Her son, however, needs funds today, and she is considering taking out those cash flows today, and she wants to know what the present value for those is if she withdraws today.

You are required to calculate the present values of those cash flows at 7% and calculate the total of those discounting cash flows.

Solution:

We are given the cash flows as well as the discount factor. All we need to do is discount them back to present value by using the above discounting equation.

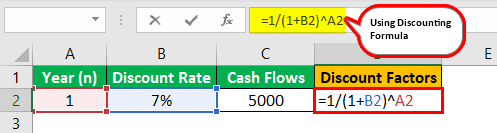

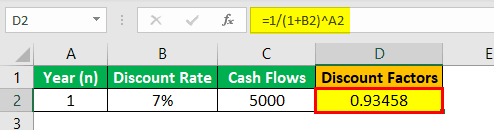

First, we need to calculate discount factors which would be

Discount Factor for Year 1 = 1/(1+(7%)^1

The discount factor for Year 1 will be -

Discount Factor for Year 1 = 0.93458

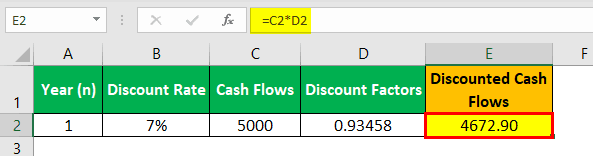

Calculation of Discounted Cash Flow will be -

Lastly, we need to multiply each year’s cash flow with the discount factor Calculating above.

For example, for year one, it would 5,000 * 0.93458, which will be 4,672.90, and similarly, we can calculate for the rest of the years.

Discounted Cash Flow for Year 1 = 4672.90

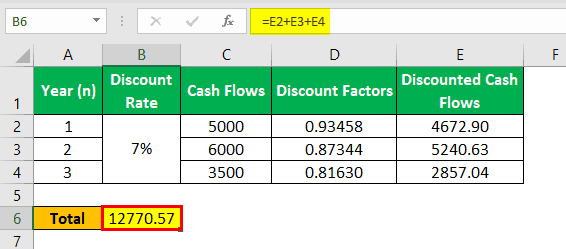

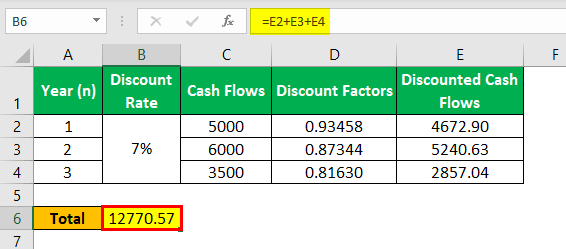

Below is a summary of the calculations of discount factors and discounted cash flow that Veronica will receive in today's term.

Total = 12770.57

Example #2

Mr. V is employed in an MNC company for around 20 years, and the company has been investing in a retirement fund, and Mr. V can withdraw the same when he reaches the retirement age, which is 60. The company has deposited till now $50,000 in his account as full and final. The company, however, allows only 60% premature withdrawal, which shall also be taxable and such withdrawal is allowed only in specific cases.

Mr. V, who is currently 43 years old, came up with an urgent requirement of funds for medical expenses, and this condition is met for premature withdrawal. And he also has FD, which is maturing at a similar period and is amounting to $60,000. He is thinking of breaking his FD as another option. However, the Bank allows only 75% premature withdrawal, and this would also be liable for the tax.

The tax rate for Mr. V is 30% flat for FD and 10% flat for the retirement fund. You are required to advise Mr. V as to what should be done? Use 5% as a discount rate.

Solution:

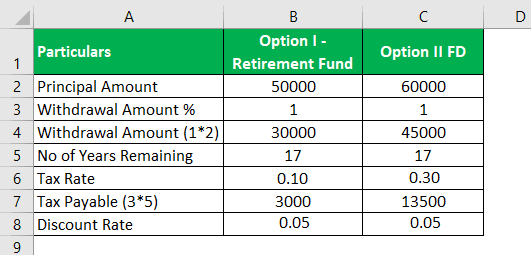

First, we will calculate cash flows, which would be the related percentage as per given in the problem, and will deduct the tax amount, and that final amounted will be discounted for years remaining, which is 17 years (60 – 43).

Use the following data for the calculation of the discount factors.

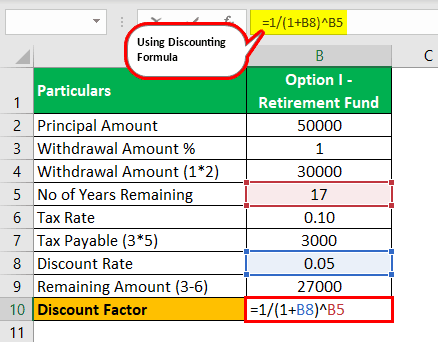

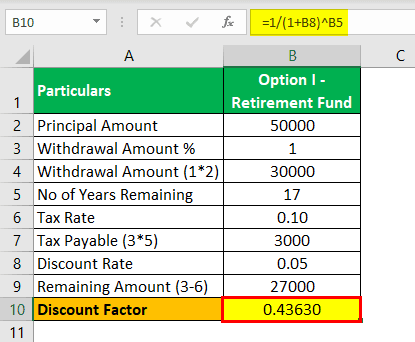

Calculation of the Discount Factor for retirement fund can be done as follows:

Discount Factor for Retirement Fund= 1/(1+0.05)^17

The discount Factor will be-

Discount Factor for Retirement Fund = 0.43630

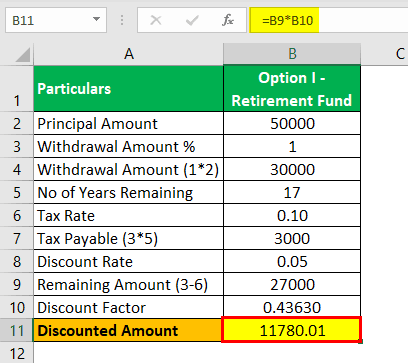

Calculation of Discounted Amount for Retirement fund will be -

Discounted Amount for Retirement Fund = 11780.01

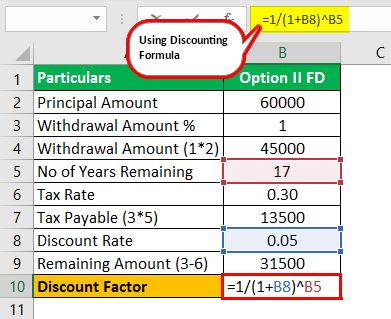

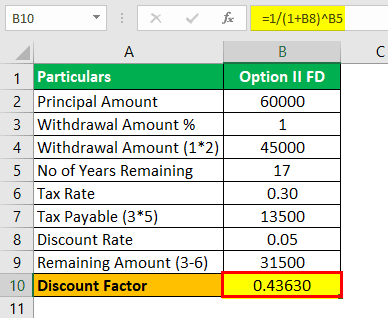

Calculation of the Discount Factor for FD can be done as follows:

Discount Factor for FD = 1/(1+0.05)^17

The discount Factor for FD will be -

Discount Factor for FD = 0.43630

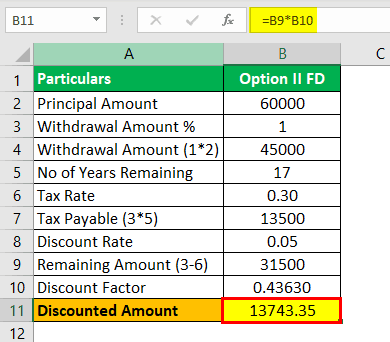

Calculation of Discounted Amount for FD Will be -

Discounted Amount for FD = 13743.35

Hence, he can opt to withdraw from the FD fund as it maxes the present value amount in hand.

Example #3

ABC Incorporation wants to invest in on-the-run treasury bonds. However, they are skeptical about investing in the same as they believe they first want to do valuation of the treasury bond since the investment amount they are looking for is approx—$ 50 million.

The research department has provided them with security details of the bond.

- Life of the bond=3 years

- Coupon frequency= semi-annually

- 1st Settlement date=1st Jan 2019

- Coupon Rate=8.00%

- Par Value=$1,000

The Spot rate in the market is 8.25%, and Bond is currently trading at $879.78.

You are required to advise whether ABC Inc should invest in this bond or not?

Solution:

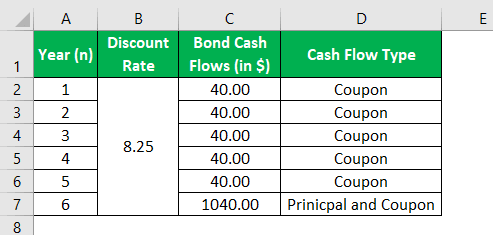

The question here is asking us to calculate the intrinsic value of the Bond, which can be done by discounting the cash flows of the bond that are to be received.

First, we will calculate the cash flows that are expected in the investment: Also, note that the bond pays semi-annually, and hence the coupon would be paid on its behalf, which would be 8/2 % on par value $1,000, which is $40.

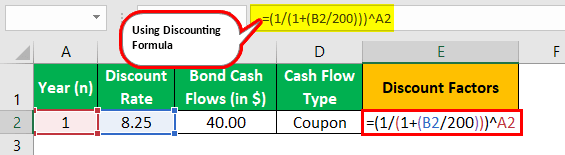

Now, as a second step, we will calculate the discount factors in excel for each of the periods using 8.25%. Since we are competing for a half year period and the life of the bond is 3 years; therefore, 3 * 2 which is 6 and hence we need 6 discount factors.

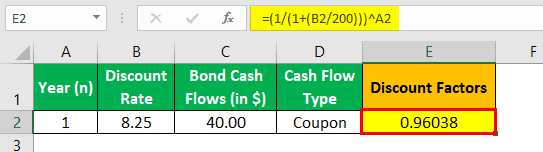

Calculation of discount factor in excel for Year 1 can be done as follows.

The discount factor in excel for Year 1 will be -

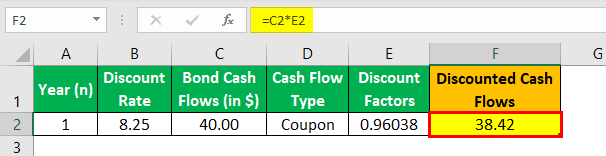

Calculation of Discounted Cash Flow will be -

Lastly, we need to multiply each period cash flow with the discount factor Calculating above.

For example, for period 1, it would 40 * 0.96038, which will be 38.42, and similarly, we can calculate for the rest of the periods.

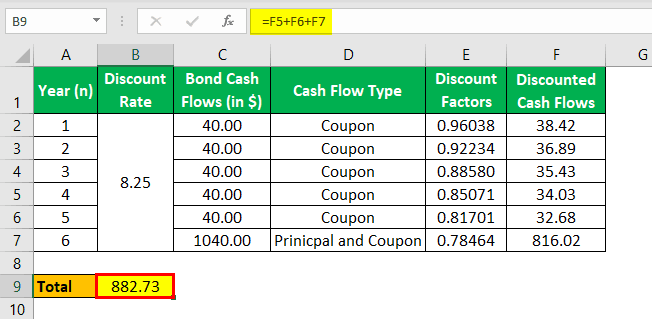

Below is the summary of our calculations and total discounted cash flow.

Since the current market price of the bond, $879.78 is less than the intrinsic value of the bond Calculated above, which states its undervalued, the company can make an investment in the bond.