Table Of Contents

What is Discount Allowed and Discount Received?

Discount allowed is a reduction in the price of goods or services allowed by a seller to a buyer and is an expense for the seller. However, the discount received is the concession in the price received by the buyer of the goods and services from the seller and is an income for the buyer.

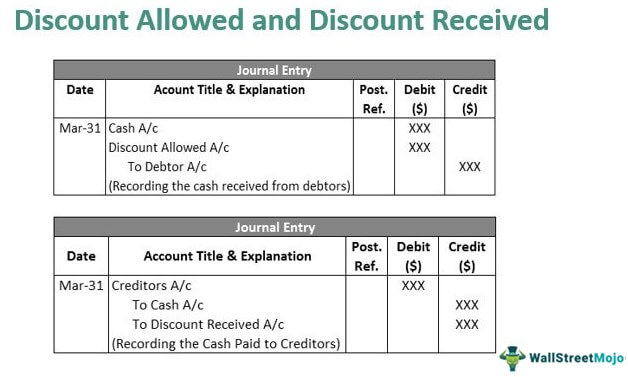

Journal Entries

There are two types of discounts allowed by the seller. First is a Trade discount and another is Cash discount.

Trade discount not recorded in the books of accounts. Instead, it is generally given at sales, like on bulk purchases. Hence, the Sales amount shows a net trade discount in the books.

A cash discount is given as an incentive for early payment. It is shown as an expense in the Profit and loss account. Initially, the sales are shown as the full amount. Then, the receivables are reduced with the amount of discount allowed.

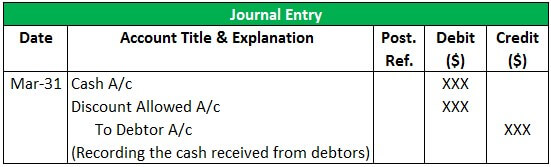

#1 - Discount Allowed

The discount allowed is accounted for as an expense of the seller. Hence, it is debited while making accounting entries in the books.

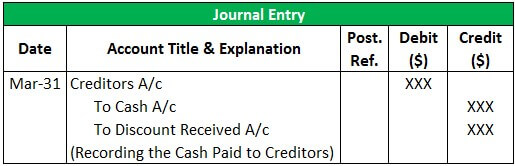

Journal entry performed -

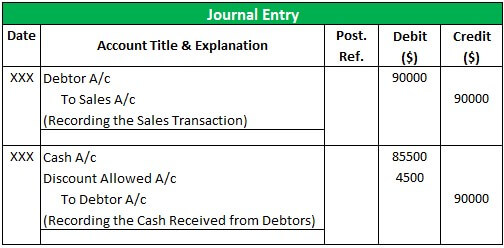

Example

Mr. Paul sells a water cooler for $50,000. Mr. Paul offers a 10% trade discount if the customer purchases two water coolers. If the customer makes an upfront cash payment, a further 5% discount is given on the total sales value.

Here, the seller offers two types of discounts, a 10% trade discount to increase the sales and a 5% cash discount as an incentive to make a quick payment.

Trade discount is not recorded in the books, and sales are shown as net of trade discount offered.

#2 - Discount Received

There are two types of discounts received by the buyer. First is a Trade discount, and another is a Cash discount.

Trade discounts are not recorded in the books of accounts. Instead, it is generally given at sales, like on bulk purchases. Hence, the Purchase amount is shown as a net trade discount in the books.

A cash discount is received as an incentive for early payment. It is shown as an income in the Profit and loss account. Initially, the Purchases are shown as the full amount. Then, the payable is reduced with the amount of discount received.

The discount received is accounted for as an income in the buyer's books. Hence, it is credited while making accounting entries in the books.

Journal entry performed -

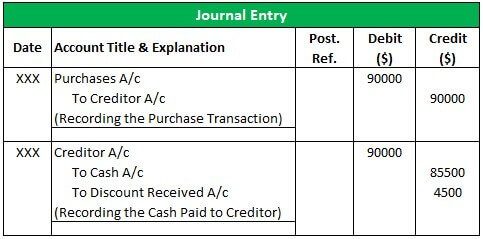

Example

Mr. Paul sells a water cooler for $50,000. Mr. Paul offers a 10% trade discount if the customer purchases two water coolers. If the customer makes an upfront cash payment, a further 5% discount is given on the total sales value.

Here, the seller offers two types of discounts, a 10% trade discount to increase the sales and a 5% cash discount as an incentive to make a quick payment.

Here we will make accounting entries in the books of the buyer.

Trade discount is not recorded in the books, and Purchases are shown as net of trade discount received.

Discount Allowed in Cash Book

A cash book is a financial statement to record cash transactions like cash sales, cash purchases, cash payments, etc. There are two sides to the cash book, i.e., the Debit side and the Credit side. Cash receipts are recorded on the debit side, and cash payments are recorded on the credit side.

The discount allowed by the seller is recorded on the debit side of the cash book.

Here is the format of the cash book -

Discount Received in Trial Balance

Trial Balance shows the ledger balances of all the accounts. The debit and credit sides of the trial balance should be equal.

The discount received is an income for the buyer. Hence, the balance of the discount received account is shown on the credit side.

Difference Between Discount Allowed and Discount Received

| Discount Allowed | Discount Received |

|---|---|

| Discount allowed is granted by the seller to the buyer. | The discount received is received by the buyer from the seller. |

| The discount allowed is the expense of the seller. | Discount Received is an income of the buyer. |

| Discount allowed is debited in the books of the seller. | Discount Received is credited in the books of the buyer. |

Advantages

- Increased Sales - Offering discounts helps increase sales and attract new customers. As paying lesser money is an incentive for the buyer.

- Saves Money - Discounts save money for the buyer since he has to pay lesser for the same amount of goods.

- Early & Quick Payments - Offering cash discounts helps get early payments. Many businesses use client invoicing software to automate discount applications, streamline invoicing, and ensure timely payments.

- Customer Loyalty - Customers will always like to buy goods from where they can get the best deal and concession

Conclusion

Discounts received, and discounts allowed are on different sides of the same coin. In any transaction involving a discount, one party allows a discount, and another receives the discount. For the buyer, the discount received is an income of the buyer, and the discount allowed is the seller's expense.