Table Of Contents

What Is A Disclosure Statement?

Disclosure Statement is an official document forming part of the list of documents issued by the person, an organization, or the government, containing various key and relevant information in a non-technical language to communicate terms of contracts to other parties or contractee, generally an average person.

A disclosure statement contains essential and critical information about the terms and conditions, terminologies used, and the main agreement between the parties in clear and straightforward language. It forms the part of legal documents and could be referred back in litigation.

Key Takeaways

- A Disclosure Statement is an official document forming part of the list of documents issued by the person, an organization, or the government, containing vital and relevant information.

- The purpose of a Disclosure Statement is to create transparency in the communication of subject matter for a corporation to the public. It ensures that the information communicated is understandable by an individual/entity unrelated to the company.

- It includes vital terminologies, analytical tables and charts, relevant individuals/entities, etc.

- It can create transparency in the information provided and develop a better understanding, but it can lead to misinterpretation and misuse.

Disclosure Statement Explained

A disclosure statement is an official record or document that one party provides to another that gives them information or facts and figures which should be revealed regarding or during the course of a transaction or contract. The main objective of such a statement is to ensure that bot the parties are aware of the terms and conditions of the transaction which is very important for decision making.

In simple terms, a product disclosure statement indicates explaining or making information public to others. So, the disclosure statement could be a written or a verbal statement delineating various information required or supposed to be expressed. But, in general, parlance refers to a document issued by an organization stating different facts and terms. For instance, if a financial transaction takes place with an organization and people at large, there are many terms and conditions mentioned in the paper that a layperson could not understand. These are essential terms concerning the contract entered between both parties.

Thus, this statement or document is widely used in different situations. It can be related to the purchase or sale of real estate, any private investment or financial transaction, government policies, selling consumer products, etc. But depending on its usage and which industry a product disclosure statement is related to, the type, format, and information revealed may vary. It legally protects the interests of investors, consumers, or any other party involved. If the document does not provide a complete and accurate disclosure.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Purpose

The very purpose of the disclosure statement is to transfer the knowledge of crucial terminologies, terms, and conditions, exclusions and inclusions of the contract, etc., in a language comprehensible by even an amateur person. It compiles all the information and assures the customer about the legality and security of the investment, insurance, mortgage, or various other transactions involved. The disclosure statement makes sure that everything is communicated to the customers as the organization perceives it, and there is no miscommunication or misinterpretation. It outlines all the provisions regarding the contract and the duties and responsibilities of the customers.

Examples

Let us understand the concept of corporate disclosure statement with the help of some suitable examples.

Example #1

A typical loan statement such as a loan for students, mortgage, home loan, vehicle loan, property loan, etc., does include a disclosure statement. For example, it includes the name of the organization, the party of the loans, approval, date, and place at which the document was signed, key terms such as tenure of the loan, interest charged, annual percentage rate, total processing fees, loan statement, prepayment terms, and various other information including the terms regarding defaults in payment and so on.

Example #2

Another example could be an insurance contract between the insurer and the insured. Nowadays, the public is quite aware of insurance, and the government markets it well. A financial disclosure statement of the insurance includes the insurance title along with various riders such as accidental insurance, health insurance, and so on. Also, it explains certain situations in which the insurance cover would not be in force. The conditions stated by the insurance company, such as genetic information, the exclusion clause, and nomination-related details, are also a few important areas of the statement.

In case of investments in various securities or IRAs, the statement contains terms defining the entire contract, Rules, and regulations of investing, penalties, the regularity of funds, deposits, withdrawals, and so forth. Generally, it allows the person a noticeable time to read and refer the agreement to revert to the organization issuing it.

What Is Included?

A disclosure statement could consist of multiple topics, but vary from contract to contract and types of agreement. However, despite the dissimilarity, it mentions some terms which are quite familiar to almost all such statements. These are mentioned here.

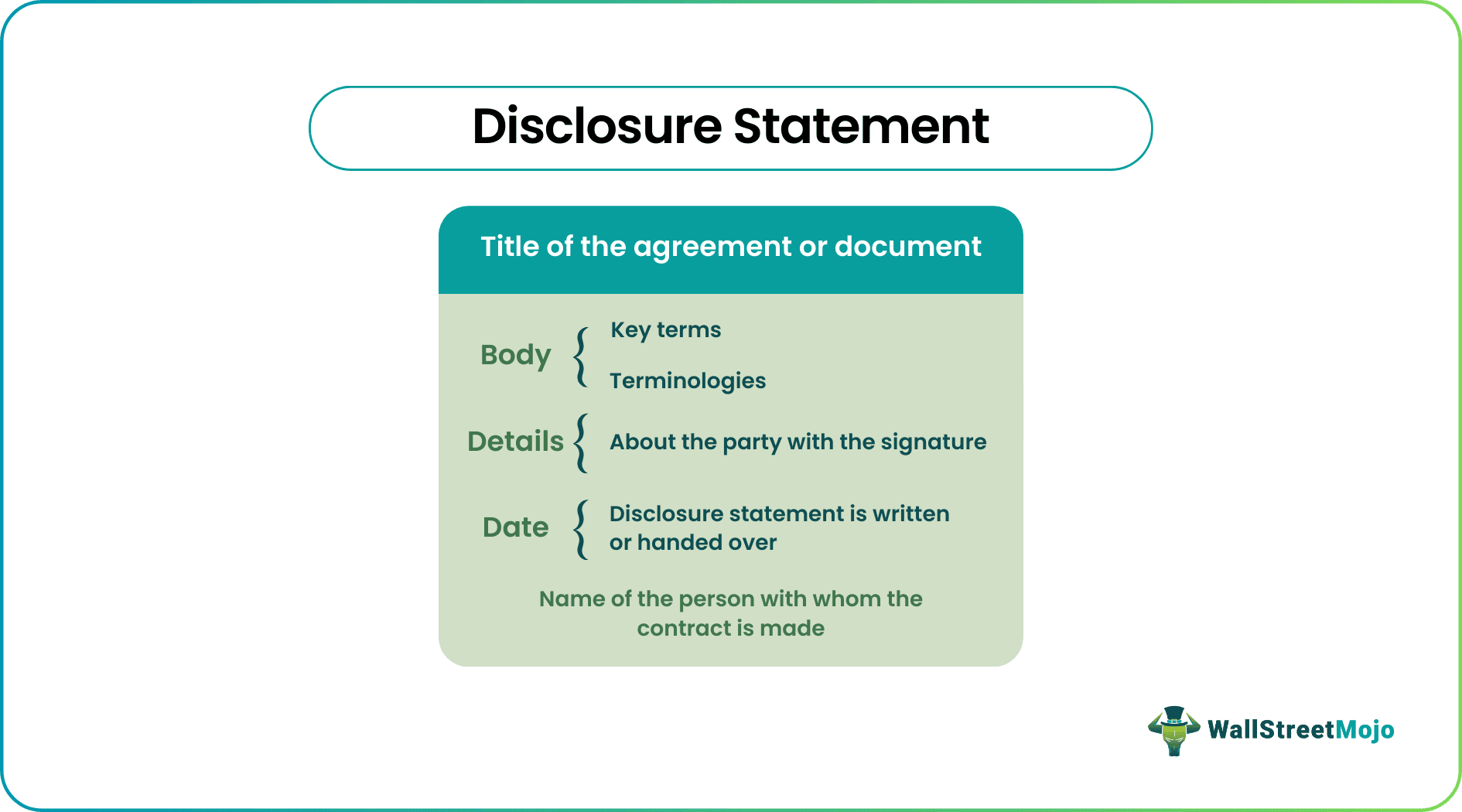

- Firstly, the disclosure statement template indicates the agreement's title or document, and generally, it is written in bold and capital letters. A few examples of claims could be the Loan Agreement, Personal Disclosure Statement, etc.

- The body contains the key terms and terminologies an organization intends to communicate to another party. It is filled with information in simple language and sometimes includes tables and charts.

- It also contains the details of the party responsible for its preparation and the signature of the person who approved it from the organization's point of view.

- The date on which this is written or handed over is also an essential tenet of the contract. Generally, it is the point after which both parties come under the legal scanner.

- The disclosure statement template includes the person's name with whom the contract is made, along with the relevant details such as the address, etc., are also included in this document.

All critical agreement, along with the brief purpose of the statement to be fulfilled, also finds a place here.

Uses

A disclosure statement is used in many ways, and generally, people are not even aware of it.

- It could indicate the product's condition when the sale has been made, uses, or abuses covered in case of guarantee or warranty provided by an entity, ways or method in which service could be provided, etc.

- The government could also issue it for the general public for abiding by specific laws and regulations required to be followed in case of public safety or government resources. The standard procedures followed by society and organizations to bring harmony should also be indicated via such a statement.

- It is very frequently used in the financial market, where the lender has to give such a financial disclosure statement to the borrower which will contain all details of the loan related terms and conditions, the interest rates, the repayment schedule and the fees to be paid. In this case, the document acts as a guide to the borrower to plan their loan associated procedure after getting a clear idea about the cost and obligations.

- Similar to the above, it is also used in the real estate sector, where the seller gives information about the property to the buyer related to its condition, the age of property, any defects and problems, etc. Such details affect the buyer’s decision to a great extent.

- All manufacturers and producers of goods and services are strictly required to make the disclosure statement a part of their labels attached to the product so that the consumers can have correct information about it regarding its ingredients, manufacturing date, expiry date, instructions for usage and ingredient leading to allergic reactions, or any other warnings related to safety issues, etc.

- Corporates that issue securities in the form of bonds or stocks should also give disclosure statements to its investors so that all related and important details regarding the securities are given in them for the information of the investors.

Thus, the following are some important uses of the document in different sectors and situations, whose main purpose is t maintain transparency and accuracy.

Advantages

Let us look at some advantages and disadvantages of this concept of corporate disclosure statement.

- First of all, it provides critical information to the user or the parties involved. It is expressed in the non-technical language so that the unfamiliarity of technical terms does not hinder the comprehension of the non-expert person. It is also considered a part of the legal document and could be presented as evidence if there is a legal tussle.

- It is especially useful in case of consumable products, which may contain ingredient not suitable for everyone. Legal steps can be taken in case either the consumer or producer has any issues.

- It acts as a guide for maintaining transparency and accuracy of information in the contracts. Thus, both the parties to the contract are equally aware of the terms and their own rights and duties.

- It helps in mitigating risk of loss of funds in case of financial transactions. The investors or lenders can assess their risk much before entering into the transactions.

- It makes the issuer of the document accountable for the disclosures made in it. Whatever is mentioned in it is assumed to be true and authentic by the party who accepts it. Thus, if there are any discrepancies later on, the issuer is accountable for it.

Disadvantages

Some disadvantages are as follows.

- Even though it contains all the relevant details, key terms, important clauses affecting the contract, and other such information, sometimes, due to the volume of the details and the way it is written, people tend to overlook it or generally don't go through it in detail. By doing so, various essential points are missed, and it loses the very purpose of its issuance in the first place.

- If the details are too complex and full of difficult words, it may hinder the objective of taking important decisions based on it.

- Sometimes companies of the parties issuing the statement may not disclose all information. This makes the document based and misleading.

- There is a cost of preparing the statement which may go higher in case of large business operations, thus increasing the expense for the business.

- In certain cases, the terms of the document may not be enforced properly even in case of complaints or issues. This will fail to protect the interest of the investors or consumers.

- Sometimes the parties may not have the necessary knowledge to properly understand and interpret the information given in the document. Due to this there may not be proper transparency and fairness in the transaction.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The primary purpose of a Disclosure Statement is to create transparency in terms of relevant information provided to individuals and entities and to make it understandable to all.

In general, this statement is not usually a legally binding agreement. Instead, it is a document that provides information and discloses relevant facts, risks, or terms related to a particular transaction, contract, or legal matter. However, while the statement may not create a direct legal obligation, its information can have legal implications.

If a Disclosure Statement does not exist for an organization, it may create future troubles as the financial accountability of the corporation can be challenged, and the company’s legal status might be affected due to the absence of the Disclosure Statement.