Table Of Contents

What Is A Direct Stock Purchase Plan (DSPP)?

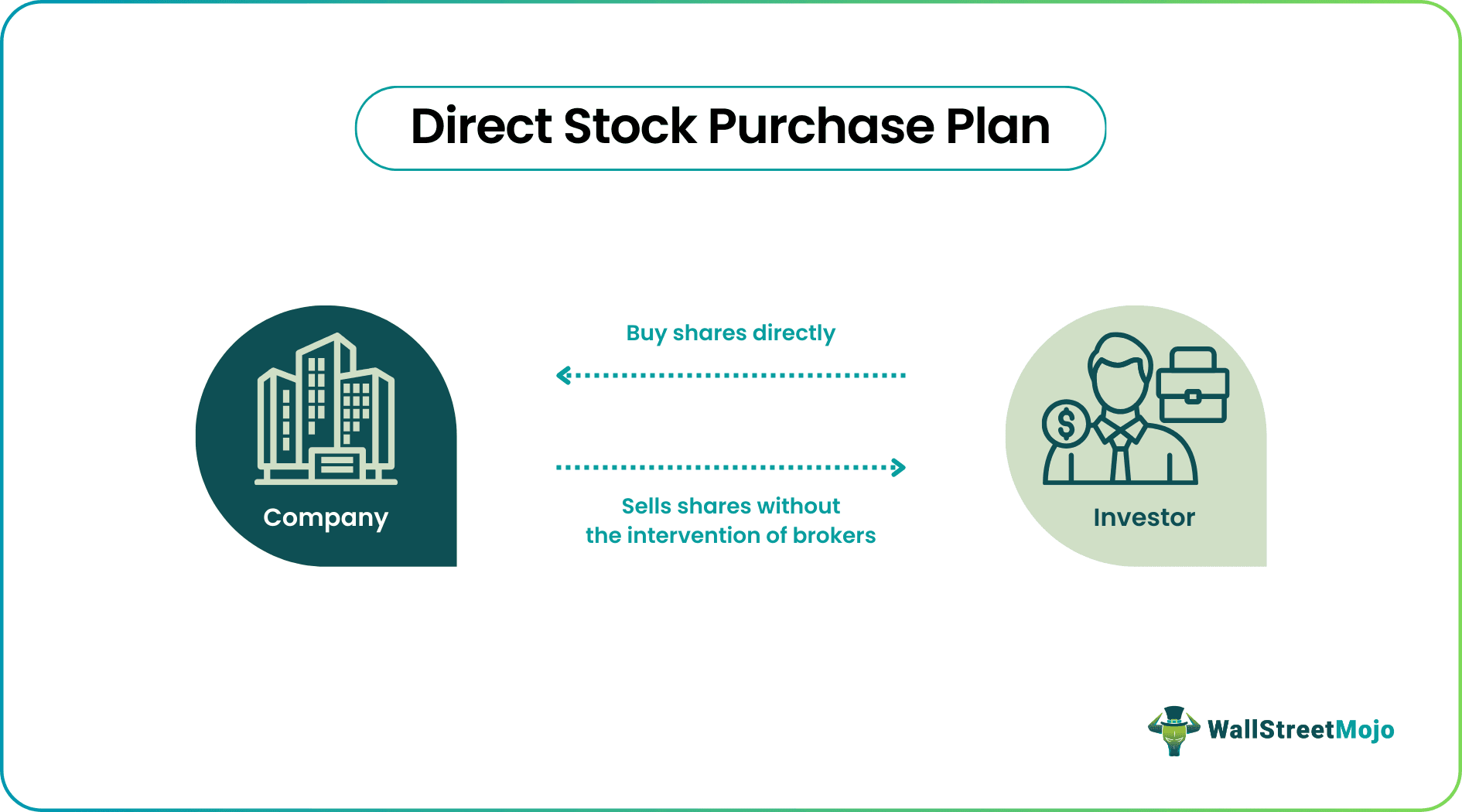

A direct stock purchase plan (DSPP) is a type of investment program that enables investors to purchase shares of stock directly from a company without the assistance of a broker. It increases the value of the company's shares, making it simple for employees to purchase shares.

Investors use it to buy shares at discounted rates and build their wealth. Companies use it to increase their stock prices for a long time. It helps a business align its interests with the interests of its employees. Moreover, through a DSPP, individual investors can become direct shareholders of the company and participate in its growth and performance.

Key Takeaways

- A direct stock purchase plan (DSPP) is an investing program offered by publicly listed companies to investors, allowing them to buy shares directly at discounted rates without any broker.

- Its advantages include allowing investors to buy company shares directly without any broker. While the disadvantage is that employees get a limited option to invest in only their employer company's stocks.

- Moreover, it offers convenient entry to stock ownership, cost-effective investing, regular savings, dividend reinvestment, reduced stock purchases, and active ownership.

- Hence, its features are a direct and easy mode of stock purchase, affordable investment, automatic dividend reinvesting, shareholder benefits, and shareholder accessibility to various services.

How Does A Direct Stock Purchase Plan Work?

The Direct Stock Purchase Plan (DSPP) is a strategy that eliminates the requirement for a standard brokerage account and permits individual investors to buy shares of a company's stock directly from the latter. Here, employees get a window to a regular investment at fixed periods with retirement options and free account management. Moreover, the Securities Exchange Commission laid regulations to ensure compliance with securities and trading laws, investor interest protections, and market transparency. However, determining the best direct stock purchase plan (DSPP) can vary depending on individual preferences, investment goals, and risk tolerance.

How It Works?

It starts when a publicly listed company offers its shares to investors and employees at a discounted rate with a lock-up period. Afterward, investors and employees apply to buy the company shares at a discounted rate. Then the company deducts the total cost of the share purchased from the employee's salary and purchases the stakes for them. Upon enrollment, investors can make an initial purchase of the company's stock, and some DSPPs also allow for regular contributions to build their investment over time.

The pooled funds then get used by employees and investors to purchase shares regularly. Moreover, for all share purchases, certificates are issued containing all details of the share to the buyer. The buyers can sell at any time after the lock-up period is over. While DSPPs may have fees associated with enrollment and transactions.

Hence, these often provide a cost-effective and accessible way for individual investors to participate in the stock market and build long-term wealth directly with the company they invest in. Therefore, the direct stock purchase plan companies handle all administrative tasks, including issuing stock certificates or book-entry statements as proof of ownership and managing dividend payments.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Features

DSPPs have certain features beneficial to investors, shareholders, and the company itself, as discussed below:

- Direct and easy mode of stock purchase: One can buy shares directly from the company.

- Affordable investment: Employees buy stocks at discounted prices, saving their money.

- Automatic dividend reinvesting: Most DSPPs allow reinvesting dividends involuntarily to buy extra shares at fixed intervals.

- No broker and brokerage charges: There are no brokers and hence no brokerage fees.

- Shareholders benefit: Companies extend certain special perks to investors, like invitations to events, offers, and important information.

- Shareholder accessibility to various services: Services like free de-materialized accounts for share trading, zero processing charges, account management, investment statements, and transaction statements are provided by the company to investors.

- Dividend payments in accounts: Employees get the dividend payout in their accounts.

- Individual Retirement Account (IRA) options: A few DSPPs also offer IRA options to be used as retirement savings vehicles.

- Investment flexibility: Employees get the flexibility to enhance or reduce their investment amount or even opt out of the DSPP as per company policies

- Lock-up period: Many companies enforce a lock-up period to sustain a significant increase in share price after DSPP. It means employee cannot sell their shares for a certain period as notified in the terms of the DSPP.

- Employee match: Few firms conduct employee matches to contribute to their DSPP, boosting the overall wealth and investment value.

- A dividend payment in cash: Some companies offer DSPPs to withhold a particular portion of employee dividend payout to pay them in cash.

How Are DSPPs Used?

Publicly traded companies offer DSPs to acquire new shareholders from existing or new investors. Hence, they get used in multiple manners, as depicted below:

- Convenient Entry to Stock Ownership: It offers a way to bypass brokers and brokerage to buy & own the shares of a company directly.

- Cost-Effective Investing: It makes for a cost-effective investing method for investors to become shareholders by investing small amounts regularly due to the low cost and lower fees involved here.

- Regular Saving and Investment: It has the feature of setting up purchases on an automatic recurring basis resulting in consistent yet regular contributions to investments for the investors. As a result, it helps one to build an extensive investment portfolio over time.

- Automatic Reinvestment of Dividends: The investor's shareholdings experience accelerated growth due to the option of dividend reinvestment. The dividends generated from the company's stocks are reinvested automatically to purchase new shares.

- Stock Purchase at a Reduced Price: Investors and employees get an opportunity to buy high-priced shares of companies at a discount rate. Hence, they could buy more shares with less investment from the company directly.

- Active Participation in Ownership: It makes employees develop a sense of ownership of the company where they work. Consequently, it encourages employees to perform efficiently and commit to the company's best interests.

- Emphasis on Long-Term Investing: Most DSPPs are issued with a long-term company perspective. Since employees don't have the option of trading the shares frequently, it aligns perfectly with the company's goals and perspective.

- Short-selling prevention: The stocks bought by the employee under the scheme cannot be traded immediately, thus helping in short-selling prevention.

Examples

Let us understand the concept with the help of an example.

Example #1

Suppose Daniel is working in a biotech company and wants to invest in his favorite technology company, Broadcom Tech Inc. Instead of using a traditional brokerage account, he enrolls in Broadcom's Tech Inc.'s DSPP. With an initial investment of $200, he becomes a direct shareholder and receives four firm shares. Moreover, Daniel set up automatic monthly contributions of $50 to grow his investment.

The DSPP also offers a dividend reinvestment option, allowing her to buy additional shares with his dividends. As the technology firm continues to innovate and grow, Daniel's investment flourishes through the simplicity and accessibility of the DSPP.

Example #2

Suppose Berkshire Hathaway, a company in a well-established US insurance company, offers a convenient DSPP for individual investors interested in becoming shareholders. Through their DSPP, investors can buy the company's shares directly from it, bypassing traditional brokerage firms. To participate, investors must enroll in the program by completing the necessary forms and making an initial minimum investment of $500.

Once registered, they can contribute funds regularly and purchase more shares over time. Moreover, the DSPP allows investors to benefit from dollar-cost averaging and avoid brokerage fees. If the firm pays dividends, it can also be reinvested in the DSPP to acquire more shares and grow the investment. Therefore, the DSPP offers an accessible and straightforward way for individuals to become long-term shareholders of the company Berkshire Hathway and participate in its growth and success.

Advantages And Disadvantages

Let us use the table below to understand the advantages and disadvantages of the DSPP:

| Advantages | Disadvantages |

|---|---|

| It allows employees to buy company shares directly without any broker. | Employees get a limited option to invest in only their employer company's stocks. |

| Unlike conventional brokerage accounts, employees do not have to spend higher charges as fees and expenses DSPP. | Moreover, employees get discounts on stock purchases, increasing their cost-efficiency |

| It inculcates regular saving habits in small values constantly. | The company provides no research tools, educational resources, or professional help regarding investment decisions. |

| Here, the stockholders get a golden avenue to participate in the company's growth and get regular dividends payout. | Investors need an opportunity to diversify their portfolio investment. |

| Here, the stockholders get a golden avenue to participate in the company's growth and get regular dividend payout. | These investors may face the risk of a decline in stock prices or the company losing their precious investment. |

| The contributions towards DSPP remain the same and automatic. | Furthermore, the terms and conditions of DSPP may change. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Many publicly traded companies offer DSPPs or similar programs, but the availability of these plans can change over time. Some well-known companies that have historically provided DSPPs include:

1. The Coca-Cola Company

2. The Walt Disney Company

3. Procter & Gamble Company

4. Johnson & Johnson

5. Intel Corporation

6. IBM (International Business Machines Corporation)

7. Walmart Inc.

8. Microsoft Corporation

9. Exxon Mobil Corporation

10. PepsiCo, Inc.

Yes, you can participate in a DSPP even if you own company shares through a brokerage account. DSPPs offer an additional method of purchasing shares directly from the company.

Yes, you can sell the shares purchased through a DSPP. However, selling the shares might involve additional steps and may require you to use a brokerage firm or transfer agent.