Table Of Contents

What Is A Direct Quote?

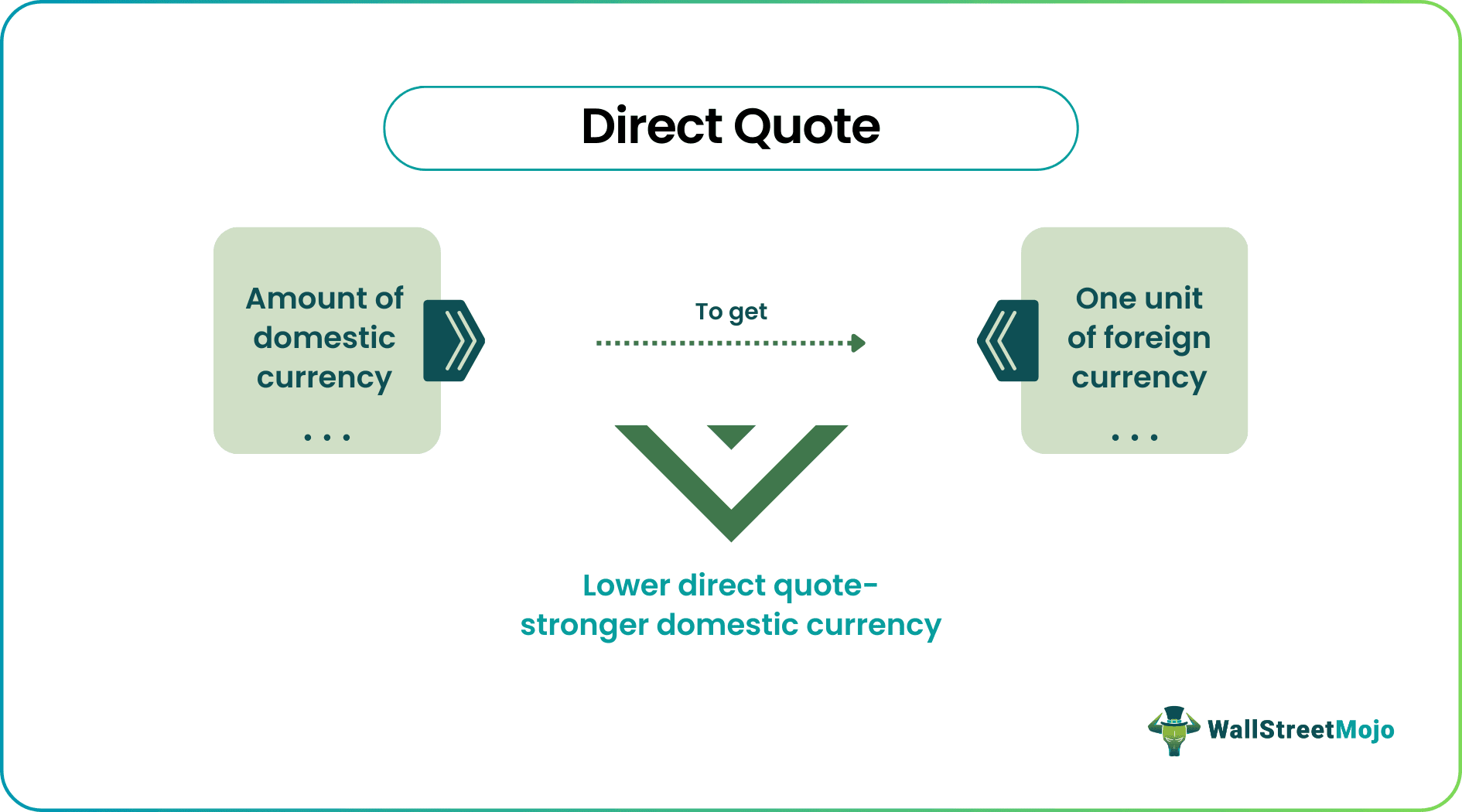

Direct Quote is one of the two methods used to define or express the foreign currency conversion rate with the domestic currency. It explains how many domestic currencies are needed to buy a single unit of foreign currency.

It describes the number of units of domestic currency required to get a certain amount of foreign currency. It is used in the foreign exchange market to show the ratio of one currency in relation to another. If the direct quote has a lower exchange rate, it means the domestic currency is stronger.

Key Takeaways

- Direct Quote is one of the two methods used to define or express the foreign currency conversion rate with the domestic currency. It quotes the foreign exchange rate in fixed units of the foreign currency concerning the variable units of the domestic currency.

- The formula for Direct Quote is the Amount of Domestic Currency divided by the amount of Foreign Currency.

- A low exchange rate through Direct quotes signifies that the domestic currency is getting more robust in terms of the foreign currency and vice versa.

- The Direct Quote method has numerous benefits over the Indirect Quote method, wherein ease of calculation, tracking, and evaluation are the significant factors.

Direct Quote Explained

The direct quote method provides the base currency per quoted currency (i.e., foreign currency). This provides the cost of the local currency to purchase 1 unit of the foreign currency. The nature of the direct quote currency depends upon the location of the transaction concerned and the person concerned.

Foreign currency conversion rates could be expressed and presented in two ways, either by direct or indirect quotations. Indirect quotation method, the Foreign currency amount is fixed, and the domestic currency is variable depending upon the geographical location of where the transaction takes place.

The direct quote currency is usually simple and easy for the consumer to understand as it provides the amount of local money needed for the conversion into the required foreign currency. So in case the rate of conversion is lower, then it means that the value of the domestic currency is increasing in the market. In contrast, if the conversion rate is higher, the value of a domestic currency decreases in the market.

Formula

The formula to be used for a direct quote could be shown as follows:

The result will be the amount of domestic currency needed to convert into 1 unit of foreign currency. For example, in case the indirect quote is available, the following formula could be applied:

Direct Quote = 1/ Indirect Quote

Where indirect quote will be given as the amount of foreign currency required for the 1 unit of the domestic currency.

Examples

Let us look at some examples of citing a direct quote.

An Indian Company ABC Ltd. needed USD 1200 & it was provided that it will require to convert its INR 84000 for such purpose. Comment on the Direct quote for the company.

As ABC Ltd. is an Indian Company and its place of residence is in India, the direct quote will be in the form of "Domestic Currency (i.e., INR) needed for conversion of 1 unit of Foreign Currency (i.e., USD).

So, as per the formula, the quote would be;

- = Domestic Currency (INR) / Foreign Currency (USD)

- = 84000 / 1200

- = 70

So, this would be; INR 70 per USD at the time of conversion.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Uses

- Direct quote referencing are often the majorly used way to communicate or present the rate of foreign currency change. But the most frequent usage of this method is when the base currency has more value than the counter currency in the market.

- To understand this point, let's take an example of citing a direct quote. At a point in time, the Indian currency (INR) needed 72 units to purchase 1 unit of USD.

- In this case, the statement will be treated as a direct quote as foreign currency (USD) is of the fixed unit with the variable domestic currency (INR). In this scenario, the base currency is USD, which carries more value in the market than the counter currency, INR.

Benefits

- The direct quotation method provides a simple cost of how much will be the domestic currency needed to buy one unit of foreign currency. This statement is easily understandable for the public in general.

- A direct quotation helps in easily evaluating the value of the domestic currency for the public in comparison to the other foreign currencies.

- The direct quote referencing also helps the general public understand which country's currency has more value in the market than their domestic currency.

- The decrease in rate mentioned in the direct quote provides that the domestic currency market is performing better, and its value is increasing in comparison to the other foreign currencies, which shows the growth in the economy of the domestic country.

Direct Quote Vs Indirect Quote

The quotation of the currency conversion rate can be presented in two methods. One is the direct quote exchange rate, and the other is the indirect method. Although the purpose of both methods is the same, the conceptuality behind them is different:

- The rate of conversion of foreign currency is considered direct when the value or price of one unit of foreign currency is presented in the value or price of the domestic currency. However, the quote will be considered indirect when the value or price of one unit of domestic currency is presented in the value or price of the foreign currency.

- The quotation of the currency exchange rate depends on the geographical area or location of the person concerned or the location of the transaction concerned. In the case of a direct quote, how many domestic currencies are needed to buy 1 unit of any other foreign currency is expressed. However, in the case of indirect quotations, how many foreign currencies are needed to exchange 1 unit of domestic currency is expressed.

- In the case of direct quote exchange rate, if the rate declines, that means that the domestic currency's value increases. Whereas, in the case of indirect quotation, if the rate decreases, then that means that the value of the domestic currency decreases.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Direct Quote is the Amount of Domestic Currency divided by the amount of Foreign Currency. Therefore, a low exchange rate through Direct quotes signifies that the domestic currency is getting more potent in terms of the foreign currency and vice versa.

Direct quotes are used in currency trading. Traders and investors analyze direct quotes to determine the value of one currency relative to another. Therefore changes in these quotes can indicate shifts in currency valuations and are crucial for making informed trading decisions.

Direct quotes for currency exchange rates can be obtained from financial institutions, online currency converters, financial news websites, and trading platforms. These sources provide real-time or delayed direct quotes for various currency pairs.

This article has been a guide to direct quotes & their definition. Here we discuss the formula to calculate direct quote examples and their use and benefits. You can learn more about from the following articles –