Table Of Contents

What Is Direct Listing?

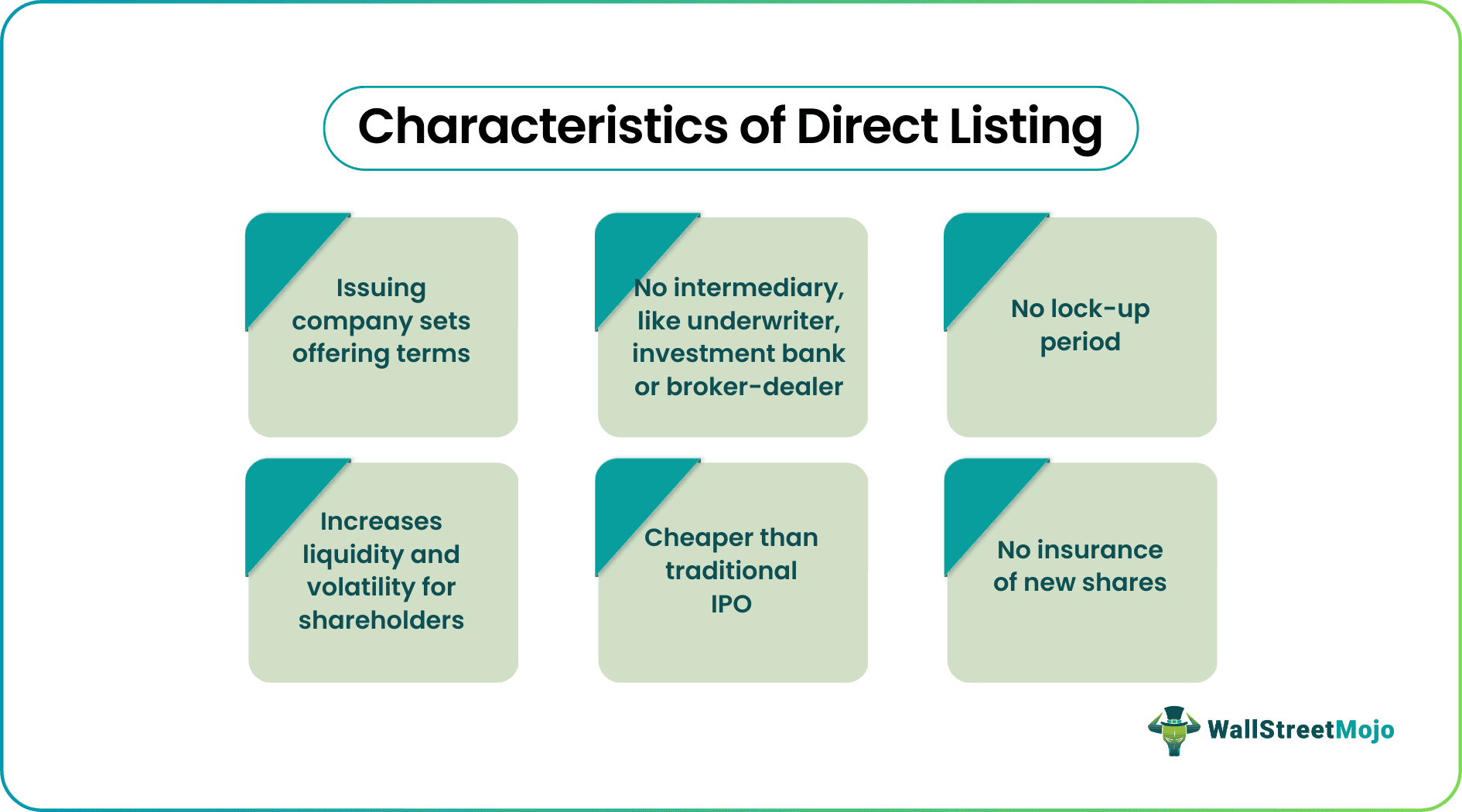

Direct listing refers to the process by which privately held firms go public by selling their outstanding and existing shares to retail and institutional investors. Companies that want to list on stock exchanges do not need an underwriter, investment bank, or broker-dealer to help them through the procedure, and there are no lock-up periods.

This strategy is often used as an alternative to an initial public offering (IPO) by companies with substantial brand value, goodwill, and goals other than raising capital. It means they will not have to issue new shares or pay any fees to raise funds, making it a more cost-effective way to go public than an IPO. Furthermore, it improves liquidity and volatility in the open market for existing shareholders (employees or investors).

Key Takeaways

- Direct listing meaning describes a method by which privately held companies go public by selling their existing shares to retail and institutional investors rather than issuing new ones.

- The process allows retail and institutional investors to purchase the company and employee-owned equities without a lock-up period.

- Companies that cannot afford to pay underwriters often choose this option. It improves shareholder liquidity and volatility in the open market and is less expensive than an IPO.

- The issuing company sets the parameters, such as the price and period of the offering, the minimum investment, the amount of shares an investor can buy, and the settlement date.

How Does Direct Listing Works?

The direct listing enables companies to go public by listing securities on stock exchanges and issuing them directly to the public. It is an alternative to IPO to raise capital and is mostly preferred by small and medium-sized businesses.

In general, a private firm following this approach has distinct business goals. It also looks for various benefits of becoming a public company, such as increased liquidity and volatility for existing shareholders. Moreover, the entire process eliminates any intermediary, so companies do not have to pay hefty charges to investment banks or underwriters. Instead, businesses must employ an investment bank as a financial advisor to handle regulatory filings, price discovery, securities law compliance, and investor communication before listing shares on stock exchanges.

Additionally, companies save themselves from the indirect cost of discount selling their stocks. Only the company shareholders (employees and initial investors) ensure the demand and availability of shares on the stock exchange. If they do not wish to sell their stocks after getting listed on stock exchanges, there will be no transactions.

On the contrary, a company willing to go public through direct public offering must understand and satisfy specific benchmarks. Since there are no underwriters, the firm must have reputation and brand value, an easy-to-understand business structure, and a sophisticated revenue model. It will make investors indulge in buying the direct listing stocks on the listing date.

Recently, NASDAQ has petitioned the United States Securities and Exchange Commission (SEC) to lift limits on raising capital through the direct public offering and the maximum price at which shares can be traded. It is also worth mentioning that SEC has given the New York Stock Exchange permission to list new shares alongside existing ones from companies seeking direct public offering.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Benefits of Direct Listing

- Allows firms to go public and directly raise capital from investors or shareholders rather than middlemen, like financial institutions, banks, venture capitals, etc.

- Removes costs associated with fundraising

- Issuers determine terms, including the offering price and period, the minimum investment, the number of shares an investor can purchase, and the settlement date

- Companies can offer common stocks and preferred stocks, real estate investment trusts, and debt securities

- Frees firms from bank restrictions

Video Explanation Of Direct Listing

Direct Listing Examples

Take a look at the following direct listing examples to see how businesses are using them:

Example #1

Slack and Spotify are two well-known companies to use the direct public offering strategy. Slack is a proprietary communication application developed by the American firm Slack Technologies. On the other hand, Spotify is a media streaming service application from the Swedish company Spotify Technology SA.

The slack stock opened at $38.50 per share, up 48% from the reference price of $26 per share on its public debut on the New York Stock Exchange (NYSE). On their first day of trading on the NYSE, Spotify shares opened at $165.90, up over 26% from the reference price of $132.

These companies have set an outstanding example, demonstrating that companies may collect significant cash even with the less common direct public offering option.

Example #2

Another example is data analytics firm Amplitude Inc., which has a market capitalization of almost $7 billion after going public through a direct public offering. The company witnessed a hike of 9.6% in its share price after opening at $50 against the reference price of $35 on NASDAQ and rising to $54.80.

Direct Listing vs IPO

Both methods of going public are becoming more common as new companies and start-ups emerge. At the same time, the debate over direct listing vs IPO is an important consideration. So let us look at those:

| Parameters | Direct Listing | IPO |

|---|---|---|

| Objectives | Enjoy other benefits of becoming a public company | Primarily to raise high capital |

| Shares | Companies list their outstanding and existing shares on stock exchanges and sell them to the public | Companies sell part of the business by issuing new shares |

| Intermediary | No underwriters, investment banks, or brokers-dealers | Companies pay underwriters and investment banks for new shares |

| Lockup period | No lockup period | A lockup period exists based on the size of the IPO |

| Affordability | Cheap and affordable way of going public | Companies pay hefty charges to underwriters and investment banks |

| Availability | The availability of shares depends on the company employees and investors | Generally, due to the issuance of new shares, they are readily available in the market |

| Buying process | Investors can only buy shares of direct listing companies after they are listed on the stock exchange | Investors can apply for it beforehand through an IPO and bid for lot size |

| Liquidity and volatility | A direct listing provides more liquidity and volatility for shareholders | Less liquidity compared to the direct public offering method due to issuance of new shares |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A direct listing method or direct public offering (DPO) or direct placement directly lists private companies on the stock exchange. The other process is an IPO, which is quite popular among investors. Still, recently, companies have shown that DPO is also a good way of raising capital and enjoying benefits without paying much to underwriters and banks.

Any stock exchange, like NASDAQ and NYSE, reports a reference price for the company's stock before listing it. This reference price gives investors an idea about the stock's price range. It is calculated based on various factors, such as the company's performance, market valuation, competitors, and financial reports.

Unlike IPO, there is no application process in the direct listing. There is no lot and bid that an investor can place. They can only buy stocks after they are listed on the stock exchange, not before that.