The distinctions between digital financial service providers & fintech are:

Table Of Contents

What Is Digital Financial Services (DFS)?

Digital financial services refer to the use of technology to modernize the orthodox way of banking. They include a wide array of financial services provided through digital means, including payments, remittances, insurance, savings, & credit, as well as mobile banking. These services allow customers to widen their geographic boundaries & provide the convenience of transacting from anywhere.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

Digital financial services companies have significantly evolved. As a result, customers experience higher levels of efficiency and security. Moreover, finding insights and conducting analysis of their finances has become easier than ever. However, there are also areas of concern, such as integration difficulties, regulatory compliance, cultural resistance, and data management challenges.

Key Takeaways

- Digital financial services refer to financial services and products delivered through digital means, such as smartphones, computers, and other electronic devices. The main aim is to provide customers globally with accessibility and convenience.

- The ARR analyzes the differences between two risks and helps determine the number needed to treat (NNT). It is otherwise known as the risk difference.

- It helps reflect the risk reduction related to the treatment and the underlying risk associated with access to the treatment. ARR is used to evaluate risk reduction along with relative risk reduction.

Digital Financial Services Explained

Digital financial services, or DFS, are technological advancements in the financial sector that use electronic devices such as computers, smartphones, & tablets. These services include digital payments, mobile banking, investment platforms, online lending, & insurance services—all through technological means.

Thanks to digital financial service providers, the financial world has expanded rapidly and made the movement of funds and other such services much easier than it has ever been. Today, all an individual needs is a smartphone and a stable internet connection to send or receive money from or to any part of the world.

The noticeable advantage of DFS is the efficiency it brings to the table by encouraging digital transactions. As a result, paper-based transactions have been reduced significantly, as have their complexity & erroneous nature.

A significant development as a result of DFS is the rise in global investments. Investment platforms must meet strict regulatory requirements to provide their customers with platforms that facilitate investments in international markets & through one of the latest facets of FinTech, blockchain-driven cryptocurrencies.

Furthermore, the incorporation of AI and data analytics has massively helped businesses worldwide with risk management and data-driven decision-making. However, despite providing efficiency, accessibility, and security, there are considerable challenges as well.

Most of these challenges pertain to cybersecurity, integration, & data prevention. Therefore, service providers constantly work to ensure that all transactions protect consumer data to maintain a level of trust.

Types

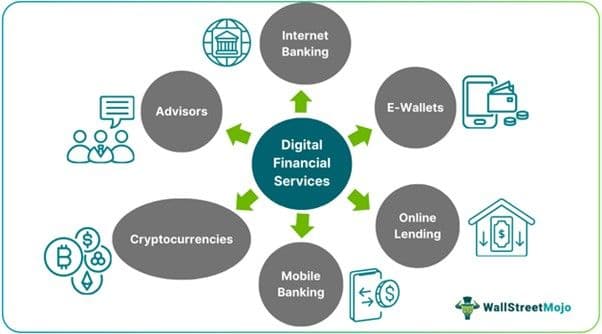

Different types of DFS that are not only taking the financial world by storm but also generating multiple digital financial services jobs include:

- Online & Mobile Banking: Digitization of banking services allows customers to access all their financial needs in one place. As a result, customers can transfer funds, check balances, pay bills, & so much more remotely.

- Mobile Wallets: Customers can store & pay through e-wallets instead of carrying their debit or credit cards. Near-field communication (NFC) technology has made contactless payments possible, which came in handy during the pandemic. Apple Pay, PayPal, Google Pay, & Samsung Pay are gaining more prominence with each passing day.

- Online Lending: The rise of digital businesses has also led to lending & financing going online. The lending industry has revolutionized by providing a platform for businesses & individuals to secure loans straightforwardly.

- Cryptocurrencies: Cryptocurrencies are blockchain-backed digital currencies that can be used as a means of payment for online transactions. They are a decentralized version of general currencies & limit the control of intermediaries & central authorities in the verification process.

- Robo-advisors are algorithm-driven automated services that provide investors with customized investment-related decisions based on their risk appetite & financial goals. These services help investors rely on non-biased & cost-efficient information regarding their investments.

Examples

Now that the concept's theoretical aspects are well-established, the examples below will illuminate the practical applicability of the products developed by digital financial services companies.

Example #1

Mr. Joe called his grandson Donald to help him send money to a friend in Alaska. He said he would write a check that could be presented at the bank to facilitate the transfer. Donald came over and installed the official mobile banking app of his grandfather's bank.

He then explained online transfers & their ease to Mr. Joe. Upon trying it for the first time, Joe was not convinced that the money had gone through. In fact, he felt like he was a victim of a scam.

However, when his friend got on the call & thanked him for the money, he was elated at the ease & security of the transfers.

Example #2

Based on a statement released after the G20 summit states that the use of technological means to address financial opportunities leads to a significant decline in costs, an incline in the scale of work, & a widening of work's reach. In fact, the statement also says that the low-cost, high-tech developments in the DFS space have led to the most accessible financial market in the history of the United States of America.

Given that lack of financial literacy cost Americans a mind-boggling $388 billion in 2023, the development of such tools helps with financial literacy. It saves individuals a lot of money, & as a result, the economy flourishes.

Applications

Digital financial service providers' applications cater to a variety of facets. A few of the most prominent ones include:

- Mobile Banking: The days of going to the bank in person to send or receive money are over, as most people transact from the comfort of wherever they are with just a few taps on their smartphones.

- Online Lending: Conventional ways of securing a loan require a tremendous amount of paperwork & long waiting times. However, due to the development of DFS products, individuals & businesses can access loans significantly faster.

- Digital Payments: The transition from carrying cash to cards was a revolution in the financial world. An even better revolution is the current transition from cards to digital wallets. Customers can pay using their smartphones without having to carry cards everywhere.

- Insurance: The ability to buy insurance & raise claim-related queries online has made the ever-complicated insurance industry more understandable & hassle-free.

- Investment Platforms: Online platforms make investing in different asset classes, like stocks, cryptocurrencies, bonds, & other investment vehicles, easier. These platforms provide these services at a significantly lower cost & better accessibility.

Advantages & Disadvantages

There are various advantages of DFS. However, there are factors from the other end of the spectrum concerning digital financial services companies. They are:

Advantages

- The rise in DFS services has opened up space for financial inclusion worldwide. Customers can access their funds from anywhere in the world.

- The need to go to banks for the smallest of tasks is now a matter of the past, as most things can be addressed remotely.

- Before it could be processed, the transfer of funds was subject to clearance from multiple parties. Now, the transfer happens within seconds due to the advanced security that takes care of the verification.

- Using these payment methods has made it easier to shop online, & therefore, the flourishing of these businesses has benefitted a large section of the economy.

Disadvantages

- Despite constant attempts to strengthen security, there are a significant number of data breaches. In fact, 86% of all data breaches have financial motivation, resulting in losses of about $5.9 million.

- Regulatory oversight is stricter for these companies than usual. Therefore, they must be up-to-date with changing regulations.

- The high volume of data that is generated can be a challenge to store, analyze, & protect.

- Integrating newer technology with existing systems can be a challenge that is too complicated for some businesses, especially smaller ones.

Digital Financial Services Vs FinTech

| Basis | Digital Financial Services | FinTech |

|---|---|---|

| 1. Definition | DFS refers to financial services provided to customers through digital platforms. | FinTech refers to the technology-driven financial services that give birth to innovative business models & products. |

| 2. Focus | It emphasizes convenience & accessibility. Moreover, it seeks to simplify traditional financial services. | It focuses significantly on technological advancement to boost the possibility of offering innovative & ideally disruptive solutions. |

| 3. Users | They are fundamentally used by individuals looking to have access to financial services through their electronic devices. | They are primarily used by start-ups, financial institutions, & tech companies to develop new financial services or tools. |

| 4. Objectives | It boosts the accessibility & delivery of existing financial services. | Its main objective is to transform the financial sector by introducing tech-driven solutions. |