The Future Of Digital Banking: Why Customization Matters

Table of Contents

Introduction

Back in the day, individuals used to visit banks to deposit or withdraw funds, open new accounts, and avail of other services. They even had to wait in long queues in front of counters to get their queries addressed, which took a significant amount of time. This would be the same scenario today if digital banking hadn't been introduced in the banking and financial system.

Digital banking allows us to perform all banking-related tasks online through the bank's official website or mobile application. We don't think about this enough, but having the ability to send money to someone who lives in a different town, state, or country without having to get up from our couch has made our lives so much easier.

Today, there is a whole fintech industry in which digital banking is a crucial part. This doesn't stop here; looking at the bright future and considering the growing demand for digital banking solutions, there are many companies that are working to create banking software that helps financial institutions provide customized solutions. For instance, software by CISIN offers not only customized solutions for customer banking software but also mobile applications, enterprise banking services, and so on. In this article, we are going to discuss the future of digital banking and shed light on the importance of customization along with other aspects.

The Rise Of Digital Banking

The rise of digital banking is not limited to banks offering mobile applications assistance and online banking solutions to their customers but is also the rise of digital banks. Yes, you read that right. Digital banks, in particular, do not have any physical address, branches, or tangibility but operate predominantly online. Proper authorities license these banks, which remain under the supervision and surveillance of government agencies and regulatory bodies.

From Brick-and-Mortar To Digital-First

Now, this simply refers to the transformation that has occurred in the banking sector. Earlier, there were physical or brick-and-mortar banks. That said, now there’s a shift toward digital-first business. For those who don't know what a digital-first company is, it basically refers to an organization that offers its services via digital channels. In banking, it represents a banking company or institution that primarily operates online and offers solutions digitally. According to McKinsey, digital-first companies have increased customer satisfaction by 30% and improved employee satisfaction by 20%.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

The Power Of Personalization

Here is how the power of personalization has revolutionized the digital banking landscape:

#1 - Understanding Customer Expectations

Digital banking through online and mobile applications offers customized and personalized solutions to their customers and clients, which is next to impossible with conventional banking entities. By understanding the customers' expectations and offering personalized solutions, digital banking goes deeper into understanding customers’ financial needs, habits, spending behavior, and risk appetite. Digital banks collect substantial data and process it with advanced analytics to provide tailored solutions that the enhance custom banking experience, loyalty, and revenue.

#2 - Benefits Of Customized Banking Solutions

There are literally endless benefits of customized banking solutions when compared to traditional banking services. Typically, customized solutions are available completely online, and there is little to no paperwork. All verifications take place online, and technology is well integrated into the application of the company.

Some more benefits include proactive customer support, improved user experience, and significant cost and time savings. In addition, customers can also get access to their account statements easily and obtain personal financial insights. It goes without saying that it has completely changed the way people look at banks.

Revolutionizing Personalized Banking with Unmatched Precision and Sophistication

Predictive Analytics For Customer Insights

Predictive analytics uses data to predict future trends and events. The same is used to understand customers. The information utilized for that includes historical behavioral data, and, based on that, banks can create and offer tailor-made solutions like payment reminders and quick transaction keys. They can also skip a few steps in the process, which minimizes the time because the analytics strongly know how the customer is going to act online or on the mobile application for digital banking operations. In a nutshell, historical data is used to make future assumptions.

Chatbots And Virtual Assistants

With the innovation of artificial intelligence and machine learning, banking applications and platforms now use chatbots and virtual assistants that offer prompt replies and helpful information. Users can chat and type in their queries, and they will offer the best possible solutions without the users having to navigate through the whole process or platform. It saves time and effort and offers an enhanced user experience and improved customer satisfaction.

The Human Touch In Digital Banking

Digital banks do have a workforce, and they help customers with various concerns. The two main areas where human touch in digital banking is required are as follows:

Balancing Automation And Human Interaction

Although digital banking has just started to work on it, they have cracked the balance between automation and human interaction. It means the banks have figured out a way to balance the tasks that are meant to be done manually along with tasks that get done via automation. By finding the right balance between these, digital banking restricts human interaction to a certain extent.

It makes almost all tasks and functions automated with no requirement for human interaction. This not only reduces time and effort for the users but offers them a swift custom banking experience where everything happens pretty much automatically, and they do not have to interact with a human unless it is extremely necessary.

Training Staff For The Digital Age

Digital banking services are provided online and through mobile applications. This does not mean that the finance companies do not have a workforce or office staff. Most of their staff work at the back end and are present to offer customer support and solve user problems. With innovations, technology, and digital banking trends, digital banking requires staff to have relevant training with respect to the digital age.

Moreover, companies ensure that the staff know how to handle client and user queries and provide them with the best possible solution. It involves creating a continuous learning culture, integrating technology in training, focusing on future skills, and even offering personalized learning paths.

The New Face of Banking: Traditional Hybrids vs. Digital-Only Disruptors

Yes, some banks offer online banking services and have launched mobile applications to let customers control their account activities through websites or just via a smartphone app. However, there is still a vast difference between traditional hybrid banking and digital-only banks.

Disrupting Traditional Banking Models

As we discussed earlier, the new digital banking models have totally disrupted the traditional banking models. With online and digital solutions on smartphones, tablets, and PCs, people do not have to visit bank branches manually, fill up forms, wait in line, and waste their precious time performing the simplest of banking tasks such as deposits, withdrawals, bank transfers, and so on.

Lessons For Traditional Banks

For a long period, people only believed in traditional banks and their operational processes. However, with the establishment of digital banking, people are switching to digital banks and are transitioning from their traditional bank accounts to personalized banking solutions. For a reasonable amount of time, some traditional banks have been reluctant to improve because there were no competitors and alternatives, but with digital banking on the rise, it is time for traditional banks to pull up their socks and start offering better customer support and solutions.

Regulatory Challenges In Digital Banking

The more services digital banking chooses to deliver, the more regulatory compliance challenges they have to face. Digital banks and fintech companies typically go through compliance and protocols associated with cross-border regulations, data security, and privacy; they have to bear the cost of compliance. Moreover, they can only onboard users when they meet the regulatory requirements to reduce the risk of fraud,

For onboarding, these companies need to complete customer verification and conduct due diligence. These are important measures and fall strictly under regulatory compliance guidelines. The purpose of these measures is to make sure the customer data is safe and the services are not used for money laundering and cyberattack practices.

Adapting To New Technologies

The fintech industry is experiencing an era of innovation. There are rapid technological advancements made, and as the technology evolves, new services, functionalities, features, and online assistance are coming into existence. Digital banks must be flexible in adapting to new technologies and constantly improve to set unique digital banking trends, new processes, and systems.

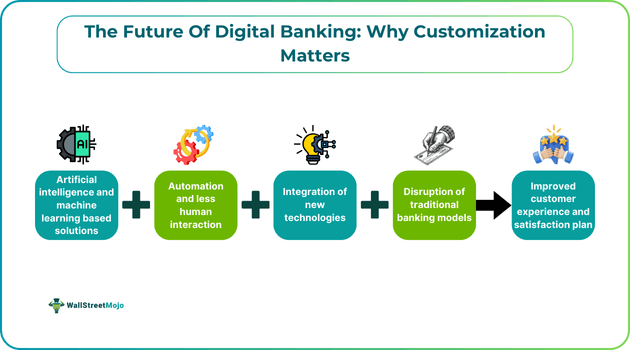

The Future Of Digital Banking

The digital banking platform market size was in the vicinity of $30.74 billion in 2023 and is expected to grow to $72.48 billion by 2032 at a CAGR of 10%. Indeed, the future of digital banking looks bright and growing. They have already incorporated AI and machine learning into their services to offer the best customer experience, but this is just the beginning.

In the future, we can expect fewer cross-border transaction barriers and lower or no fees for most services. At the same time, digital banking is constantly evolving to create better protection and security layers to offer better data protection and privacy to prevent financial scams, fraud, cyberattacks, and other online malicious activities that can lead to financial loss. Digital banking is already in the race to offer the best custom services to customers, and it remains to be seen in what ways it can enhance customer experience and convenience further.

Conclusion

At last, we can safely conclude that there is still a long way to go with regard to the future of digital banking; it has just set foot in the fintech industry. People are switching from traditional banking to digital banking solutions, and the digital-first entities are gaining popularity because of the tailor-made solutions provided to their customers, like personal financial insights. Not to forget, the number one benefit of digital banking is that you can avail banking services from anywhere without having to visit any office or branch. Digital banking has changed the face of banking services with personalized banking solutions, and we are all set to see and experience its magic in the coming future.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.