Table Of Contents

What Is The Depreciation Rate?

The depreciation rate is the percentage rate at which an asset is depreciated across the estimated productive life of the asset. It may also be defined as the percentage of a long-term investment done in an asset by a company that the company claims as a tax-deductible expense across the asset's useful life. It is different for each class of assets.

Table of Contents

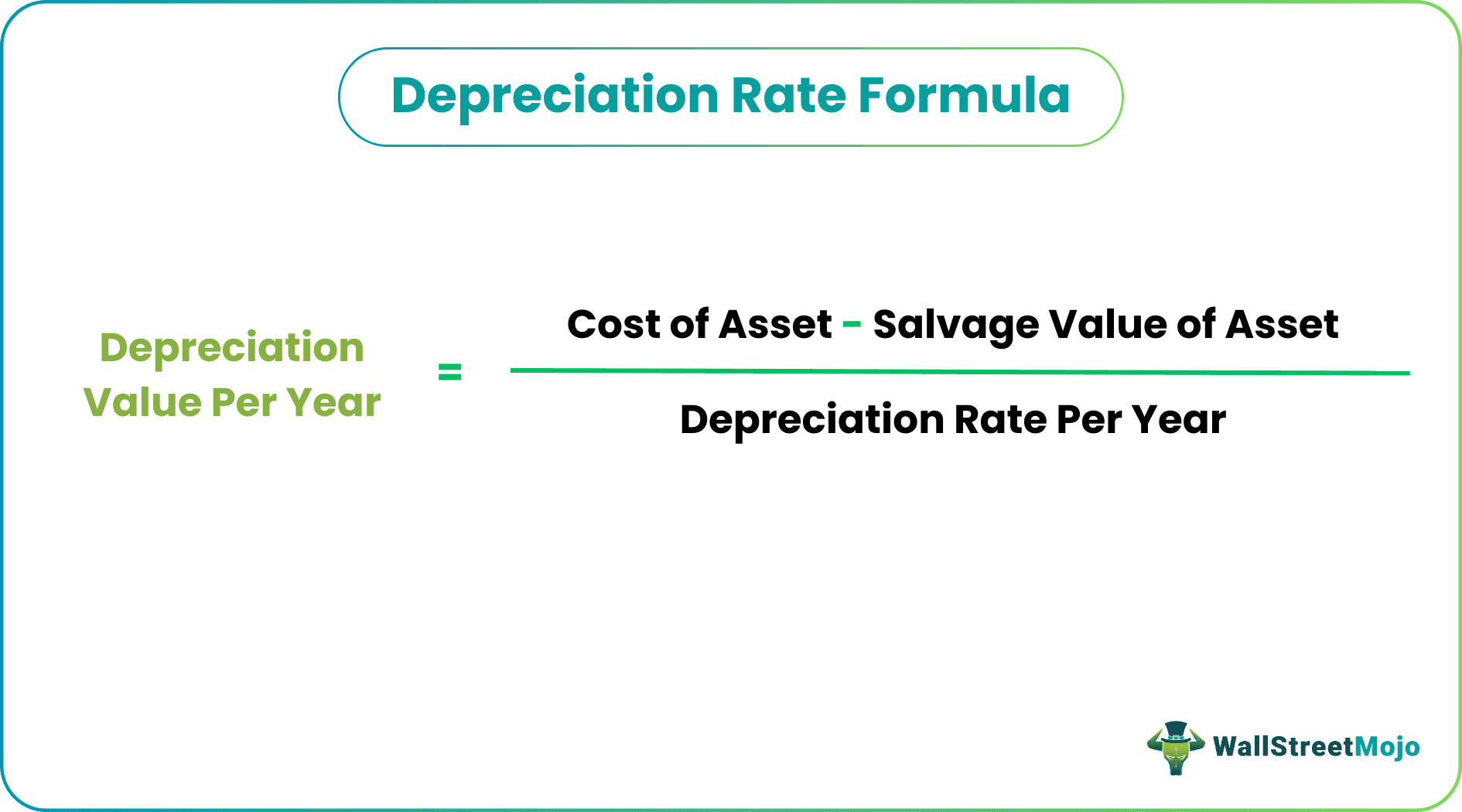

Depreciation Rate Formula

The most widely used method of depreciation is the straight-line method. This rate is calculated as per the following formula:

Depreciation Rate per year: 1/useful life of the asset

Depreciation Value per year = (Cost of Asset – Salvage value of Asset)/ Depreciation Rate per Year

- Cost of asset: It is the initial book value of the asset. It includes taxes paid or shipping charges paid for the asset if any.

- The useful life of the asset: Useful life of the asset is the period for which an asset can function properly. Beyond the useful life, the asset is deemed to be cost-ineffective or not fit for operation/usage. The respective revenue authority defines the useful life of a few assets like computers, real estate, etc. For example, computers are depreciated over five years, while vehicles are depreciated over eight years.

- Salvage Value: Value of asset after the useful life of the property at which the company may sell the asset. It is also known as scrap value.

Depreciation Rate - Explained in Video

Examples

Below are some of the examples to understand this concept better.

Example #1

- Cost of a Vehicle: $5,00,000/-

- Scrap Value of Machine: $50,000

- The useful life of asset: 5 years

Depreciation rate formula: 1/5 = 20%

- Depreciation value per year: (500000-50000)/5 = 90,000

- Thus depreciation rate during the useful life of vehicles would be 20% per year.

Example #2

A company purchases 40 units of storage tanks worth $1,00,000/- per unit. The company uses a Double declining method of depreciation method to calculate the tank's depreciation expense. Tanks have a useful life of 10 years and a scrap value of $11000/-.

Thus,

- The formula as per the straight-line method: 1/useful life of asset = 10%

- Depreciation period Double Decline Method: Rate as per straight-line method * 2 = 10% * 2 = 20%

Depreciation for subsequent years (considering storage tanks are bought at the start of FY19) is as follows:

*Depreciation expense for the Year 2028 is kept at 2422 to maintain the salvage value at the end of 10 Years.

For 40 units, the depreciation table will be as follows:

*Book value is for 40 unit

# Depreciation expense for the Year 2028 is kept at $96,871 to maintain the residual value at the end of 10 Years.

Advantages

- It helps to spread the cost of an investment in fixed assets across the asset's useful life. This way, the company does not have to account for the cost in the first year; else, the company will have to suffer losses in the year of purchase.

- It helps provide the correct market value of assets, thereby reflecting the wear and tear the asset might have had on the basis of the number of years it has been used for.

- It helps to generate tax savings for the company.

Limitations

- It is usually considered constant for the particular class of asset and hence reflects the estimated depreciation value every year. The useful life of an asset and hence depreciation depends on many other factors like how an asset is handled, the number of hours it is operated for, the quality of parts of assets, etc., which are not reflected in the depreciation rate usually.

- For assets like IT assets, which are upgraded from time to time, it is difficult to ascertain the actual depreciation rate since the value of assets varies in the middle of the useful life of assets, subsequently changing the useful life of an asset. This further complicates the calculation.

Conclusion

The depreciation rate is used by the company for the calculation of depreciation on the assets owned by them and depends on the rates issued by the Income-tax department. Poor calculation methods may distort both the Profit and Loss statement and Balance sheet of the company. Hence a fair understanding of the same is very important.

Recommended Articles

This has been a guide to Depreciation Rate and its definition. Here we discuss its Depreciation Rate formula, its calculations, and practical examples. You may learn more about accounting from the following articles –