Table Of Contents

What Is Depreciation On Furniture?

Depreciation on Furniture is defined as the fall or reduction in the value of furniture due to its continuous use over time and the wear and tear caused throughout its useful life. These furniture items are any movable asset used to make any room, office, factory a convenient workplace with desired working conditions.

Depreciation on furniture is a part of furniture cost price, charged as an expense in an accounting period. This is because with every passing year, the value of the furniture items depreciates and its resale value decreases. Hence, it’s usefulness is affected negatively. This concept of depreciation, however, is normally applicable for the furniture pieces used for commercial purposes.

Depreciation On Furniture Explained

Depreciation On Furniture occurs due to the gradual deterioration in the condition of the furniture items that a commercial premises use for having a convenient workplace for it people. According to the rules listed by the Internal Revenue Service (IRS), the furniture bought for commercial purposes start depreciating in seven years.

With the passage of time and consumption or use, every asset undergoes a reduction in its value. This depreciation is defined as reducing the asset's value and simultaneously charging the equivalent amount in the profit and loss statement (P&L) for that period. Every organization needs to purchase different types of furniture to ensure the smooth running of management and operations. Generally, different furniture assets purchased have a different useful life and accordingly help in the generation of future economic benefits for more than one accounting period.

However, there is some furniture that helps in the generation of future economic benefits for no longer than a single accounting period. These types of assets are entirely written off in Profit and Loss (P&L) statements and do not need depreciation over multiple accounting periods. An organization has to abide by all the applicable laws and regulations.

Moreover, there are factors that play an important role in calculating this depreciation. Some of these are – type of furniture, the purchase price, and the years of utilization. With online calculators available, these details help conveniently calculate an approximate depreciation on furniture.

How To Calculate?

Determining the depreciation method for furniture is an accounting policy that the entire organization must uniformly adopt over different accounting periods. However, the policy may be changed if the situation demands or due to a change in regulations. Calculating depreciation on furniture is the same as calculating depreciation on any other asset like machinery or vehicle. The only difference is the depreciation rate of the asset and the useful life of the asset.

The main methods of calculating the depreciation include – Straight-Line Method (SLM) and Written Down Value (WDL) method.

Straight Line Method (SLM)

This is the most convenient method applied by businesses to calculate the depreciation applicable for furniture items in the commercial spaces. In this process, the amount deducted as depreciation remains the same every year of the furniture’s useful life. As a result, when the value of the furniture item is plotted on a graph, it is represented as a straight line, beginning from its initial cost to its salvage value. Hence, this method is so named.

Written Down Value (WDV)

Though the SLM method is simple, most commercial entities apply written down method to calculate the depreciation on furniture. The WDV works on the basis of depreciation on furniture rate. This fixed percentage is charged and EDV method is applied to figure out the depreciation amount with respect to the current rate. It starts from applying the rate on the initial cost and then it continues to be applied to the consecutive years of the useful life of the furniture item.

Some other methods also include the Declining Balance method, and the Production-based method, etc. So far as the journal entry of depreciation on furniture is concerned, the amount of depreciation determined will be charged as depreciation in the Statement of Profit & Loss for that period. Also, the same will be reduced from the asset balance.

Examples

For better understanding, let us take the help of numerical examples.

Example #1 - Straight Line Method

On 01/01/2019Mark Inc. purchased office furniture like tables and chairs worth $10,000. The rate of depreciation is 10% straight-line method. Calculate yearly depreciation to be booked by Mark Inc.

Solution:

- Yearly depreciation to be booked under Statement of Profit & Loss will be ($10,000 x 10%) = $1,000 annum.

Example #2 - Written Down Value Method

On 01/01/2019Mark Inc. purchased office furniture like tables and chairs worth $10,000. The rate of depreciation is 10% Written Down Value Method. Calculate yearly depreciation to be booked by Mark Inc on 31/12/2019 and 31/12/2020.

Solution:

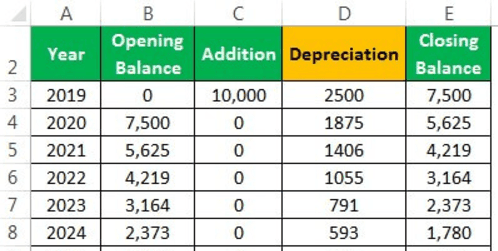

The calculation of yearly depreciation under WDVM for 2019 and 2020 is as follows:

As on 31/12/2019:

- 10% of WDV i.e. $10,000 x 10% = $1,000

As on 31/12/2020:

- 10% of WDV i.e. $10,000 - $1,000 (2019 depreciation) = $9,000

- Depreciation as on 31/12/2020 = $9,000 x 10% = $900

Example #3

On 01/01/2018, Henry Trading Inc., a cloth manufacturer, purchased furniture worth $10,000 for office maintenance. The rate of depreciation is 25% D.B. You are required to calculate yearly depreciation and determine the year in which the asset's value will be Nil or negligible.

Solution:

Depreciation on the furniture will be calculated as follows:

Note: Please refer above given excel template for a detailed calculation of depreciation.

Accordingly, 2032 will be the year furniture value will be NIL or negligible. Sometimes, assets may be sold at the end of their useful life and generate some monetary benefits. Such an amount must be reduced from the asset's total value before calculating depreciation. For Example, consider a straight-line method of depreciation; Furniture purchased for $11,000 has a useful life of 10 years and can be sold at the end of its useful life for $1,000. Here, for calculating depreciation, we need to determine depreciable value by reducing scrap sale value, i.e., $11,000 – $1,000, which is $10,000, and this amount will be split between 10 years equally. Therefore, annual depreciation will be $1,000 ($10,000 / 10).

Depreciation Rates

Different prevailing laws prescribe different rates for furniture depreciation. Generally, under the US Prevailing laws, furniture, fixtures, and related equipment life are assumed to be seven years in case furniture is used in office locations. However, the furniture life is reduced by two years and assumed as five years in case the asset is used in areas other than office premises. Generally, the method of tax depreciation is 200% Declining Balance (D.B.)