Table Of Contents

What is the Depreciation of Building?

Depreciation of Building refers to the process of reducing the recorded cost of a building in an organized way till the time when the value of the building either becomes zero or reaches its salvage value. It allows us to map the revenue (say in the form of lease rental) generated during a period to the corresponding expenses.

The rate of depreciation for different types of building are categorized into the following three rate buckets, as shown below:

- 5% Depreciation Rate: The buildings that fall under the category of residential premises are depreciated at the rate of 5% under the income tax act. Buildings used for residential purposes except for boarding houses and hotels fall in this category. A building is considered to be used for residential purposes only if more than 66.66% of the built-up floor area is used for residential purposes.

- 10% Depreciation Rate: All other types that don't fall under the category of residential premises are depreciated at the rate of 10% under the income tax act.

- 100% Depreciation Rate: Buildings mainly used for installing machinery and plants that form part of the water treatment system and water supply project fall under this special category. Further, wooden structures and tin sheds also fall under this category as they are purely temporary erections. These are depreciated at a special rate of 100%.

How to Calculate it?

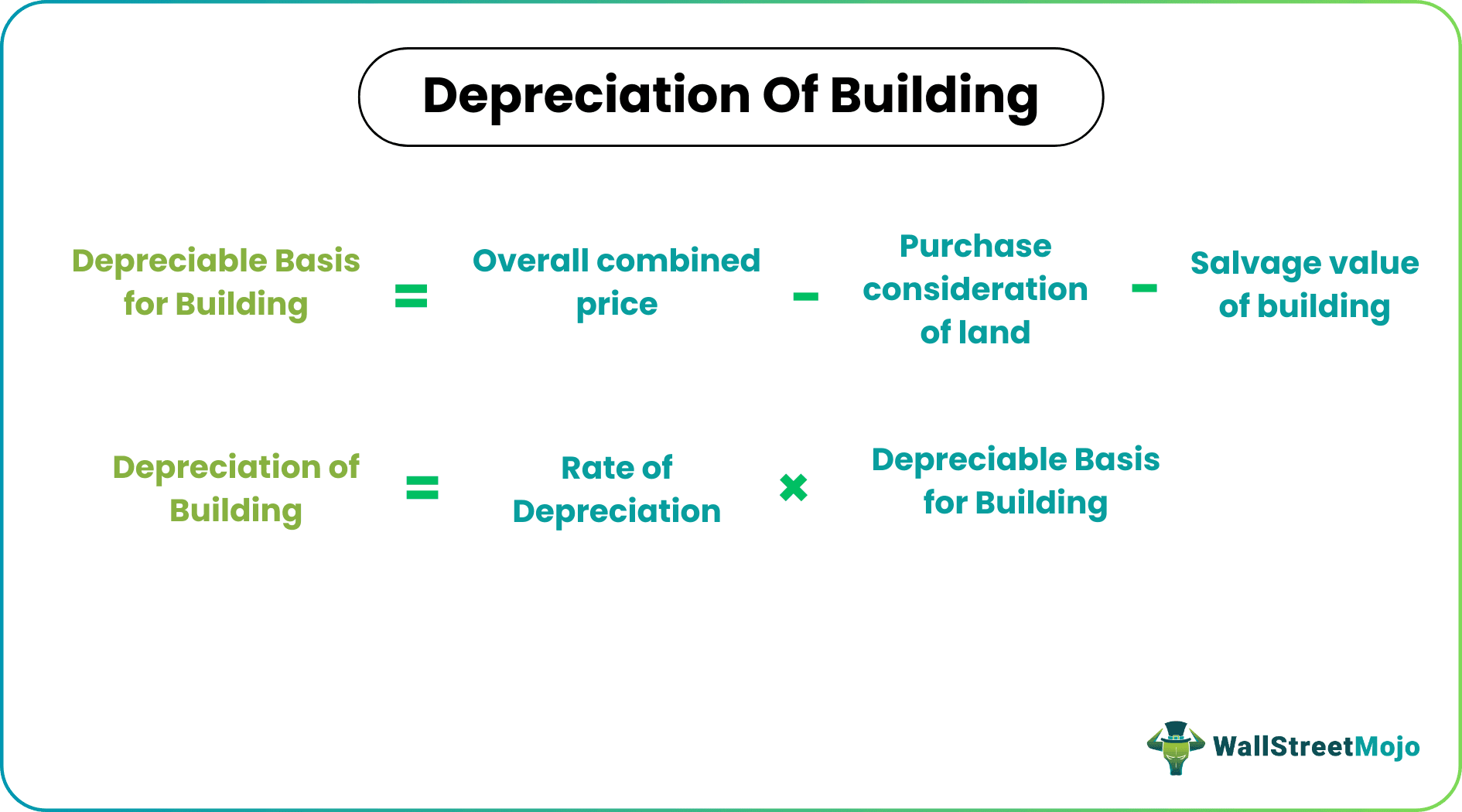

Step 1: Firstly, determine the depreciable basis for the building under consideration. (Take the help of a qualified accountant or an external appraiser to ascertain the depreciable basis for the building.) If the property price is a combination of both buildings and land, then it can be derived by deducting the purchase consideration of the land from the overall amount paid, as shown below. Also, you can deduct the building's salvage value (if available) for a precise valuation.

The Depreciable Basis for Building = Overall Combined Price – Purchase Consideration of Land – Salvage Value of Building

Step 2: Next, determine the depreciation rate category based on the property's nature. It would be either 5%, 10%, or 100%, which would be used to calculate the annual depreciation of the building. The depreciation rate can also be calculated as the reciprocal of the useful life of the asset.

Rate of Depreciation = 1 / Useful Life

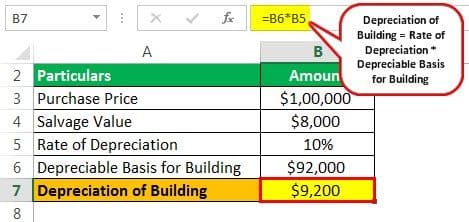

Step 3: Next, multiply the rate of depreciation and the depreciable basis for the building to derive the annual depreciation of the building, as shown below.

Depreciation of Building = Rate of Depreciation * Depreciable Basis for Building

Step 4: Finally, capture the annual depreciation in the income statement to calculate EBIT (earnings before interest and tax). It is very important information for tax filing.

Examples

Let's discuss the following examples for better understanding.

Example #1

Let us take the simple example of a building bought for $100,000 and is estimated to have a salvage value of $8,000. Determine the annual depreciation of the building if the applicable rate of depreciation is 10%.

Solution:

Given,

- Purchase price = $100,000

- Salvage value = $8,000

- Rate of depreciation = 5%

Now, the depreciable basis of the building can be calculated as,

Depreciable Basis = $100,000 - $8,000 = $92,000

Now, the calculation will be -

= $92,000 * 10% = $9,200

Example #2

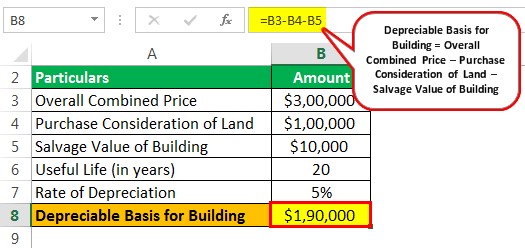

Let us take the example of a building bought by XDE Inc. to illustrate the concept of depreciation. The property was bought for $300,000, including the purchase price of the land, which is $100,000. The building is estimated to have a useful life of 20 years, and at the end of the 20 years, the building is expected to have a salvage value of $10,000. Determine the annual depreciation of the building based on the given information.

Solution:

Given,

- Overall combined price = $300,000

- Purchase consideration of land = $100,000

- Salvage value of building = $10,000

- Useful life = 20 years

Now, the rate of depreciation can be calculated as,

Rate of depreciation = 1 / 20 = 5%

Now, the depreciable basis of the building can be calculated as,

The depreciable = $300,000 - $100,000 - $10,000 = $190,000

Now, calculation will be -

=$190,000 * 5% = $9,500

Effects on the Financial Statements

- Debit to depreciation expense results in a reduction of the net income, which eventually results in lower retained earnings and shareholder equity.

- Credit to accumulated depreciation results in a reduction in the carrying value of building and the number of total assets on the balance sheet.

- Depreciation also helps in reducing taxable income, which means lower tax liability.

Conclusion

So, it is an important part of the accounting method that facilitates the maintenance of true profitability in the income statement through systematically converting capitalized assets into expenses.