Table Of Contents

Depository Participant Meaning

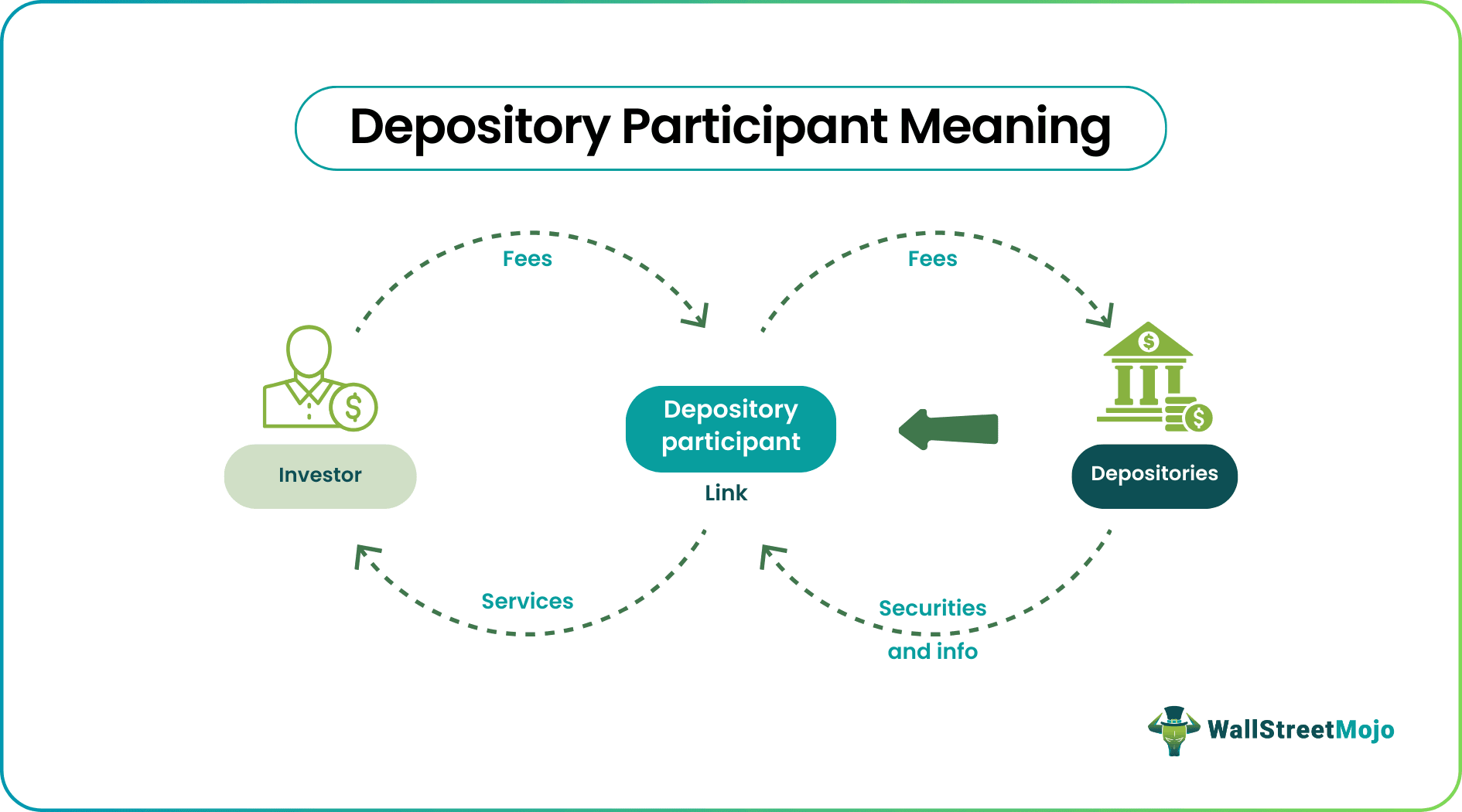

A depository participant in India refers to a stockbroker or agent registered with a depository. They should fulfill the minimum net worth criteria as instructed by the Securities and Exchange Board of India (SEBI) and the respective depositories. They act as an intermediary between the depository and investors.

Depository participants (DPs) are established under sub-section 1A of Section 12 of the SEBI Act, 1992. DPs must obtain a certificate of registration from SEBI to function as DP and offer services to investors. Further, the Depositories Act 1996 governs their relationship with the depositories.

Key Takeaways

- Depository participants or agents of a depository are agents who connect investors to the depositories in India.

- They play a significant role in facilitating the trading process.

- DPs can be registered with NSDL, CDSL (the two depositories in India), and sometimes both. They must fulfill the eligibility and minimum net worth criteria specified by each depository.

- Occasionally, the SEBI, NSDL, and CDSL publish the depository participant list that mentions the details – name, address, and contact details – of all the entities registered with them.

Depository Participant Explained

Depository participants in India are an important link in the investing process. They connect the government depositories to the investors, thus playing a crucial role. For this, they charge the investors a minimum fee of Rs. 5 and a maximum of Rs. 25, depending upon the transaction. Then, these DPs pay the buying and selling fees to the respective depositories. Along with this, DPs manage settlement, transfer of ownership, etc.

SEBI and the respective depositories – NSDL and CDSL – publish the depository participant list containing all the DPs registered. As of December 2022, 289 DPs are registered with NSDL, 637 with CDSL, and there are 17 designated DPs. Designated depository participants refer to custodians of securities who have registered with SEBI. Prominent banks such as Axis Bank, HDFC Bank, JP Morgan Chase Bank, etc., are designated DPs.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Role And Functions

The primary role of DPs is to act as a link between investors and depositories. Other roles are based on the following functions:

- Help investors in opening accounts with the registered depository.

- Facilitate transfer of securities.

- Settle trades are done on the exchange connected to the depository.

- Dematerialization of securities

- Rematerialization of securities

- Pledge and un-pledge securities for a loan.

And other related services.

Types

Depository participants can be classified based on the depository they are registered with. In India, there are two depositories – National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL).

#1 – NSDL

NSDL was set up by the National Stock Exchange in 1996 and headquartered in Mumbai. Its promoters include the Unit Trust of India and the Industrial Development Bank of India. DPs registered with NSDL are called business partners and should have a minimum net worth of Rs.3 crores. Share transfer agents and clearing corporations of stock exchanges are also business partners of NSDL. Investors must first open a depository account with the registered DPs to avail of services. Examples include Aditya Birla Money Limited, Bajaj Capital Limited, etc.

#2 – CSDL

CSDL was set up by the Bombay Stock Exchange in 1999 and headquartered in Mumbai. Some promoters are the State Bank of India and the Bank of India. DPs should first register with CSDL to become eligible to provide services to investors. Investors can connect with DPs to know their account information, balance, etc. The minimum net worth criteria apply here too, but it is ₹2 crore. Examples – 5paisa Capital Limited, Andhra Bank, etc.

Apart from this, there are DPs registered with both NSDL and CSDL. DPs should comply with each depository's minimum net worth criteria.

Examples

Consider the examples given.

Example #1

Stock-XYZ is a stock broker having thousands of customers. They have been in the stock-broking business for ten years. As part of their tenth anniversary, they registered with NSDL as a DP. They fill out the application and submit the requisite documents. As a result, stock-XYZ gets approved by the NSDL and SEBI. After expanding their services, they were able to provide versatile services to their customers and further add 200 new investors to their company.

Example #2

SEBI has recently revised the framework for changes in control of market intermediaries such as depository participants, stock brokers, investment advisers, research entities, share transfer agents, etc. The revision aims to streamline the approval process to propose changes in the control of entities. Though the announcement was made on November 28, 2022, it will be effective from December 01, 2022. Some new changes include ensuring strict compliance with the 'fit and proper person criteria, approaching SEBI before applying for specific approvals from National Company Law Tribunal (NCLT), etc.

Depository Participant vs Stock Broker

- A depository participant functions as the link between an investor and the depository, whereas the stock broker is the link between the investor and the stock exchange.

- Therefore, a stock broker should be registered with SEBI and the respective stock exchange. On the other hand, a DP should also be registered with SEBI and the respective depository.

- Regarding functions of the stockbroker, their services include bringing together buyers and sellers, advising on which investment to buy, and providing information regarding other investments, the stock market, etc. In addition, DPs help investors open Demat or Remat accounts, transfer securities, settlement of trade, etc.

- DPs and stock brokers are two separate entities. However, nowadays, there are stock brokers who are also DPs. Such entities offer specialized and all-around services at one stop.

Despite the differences, both parties are important components in the investing process. However, they charge a fee for their services.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A DP is an entity that plays the role of an agent of a depository and links investors to them. It can be an individual or a company registered with the respective depository. All depository participants are registered with NSDL or CDSL. In addition, the stock broker can give information regarding the depository.

Both depository participants and stock brokers are participants in the trading market. A DP has to register with a depository. Often stock brokers have registered DP membership.

Investors might want to change their DPs for various reasons – no satisfaction with the service provided, delays, disputes, etc. To change DPs, the investor should fill up the delivery instruction slips (DIS) stating the reason. Once the DP receives the DIS, they should process the transfer and the investor's assets.

A depository is a financial institution where securities are held and handled. It provides services to investors, issuing companies, etc. A DP connects investors to these depositories and acts as their agents.