Table Of Contents

Dematerialization (DEMAT) Meaning

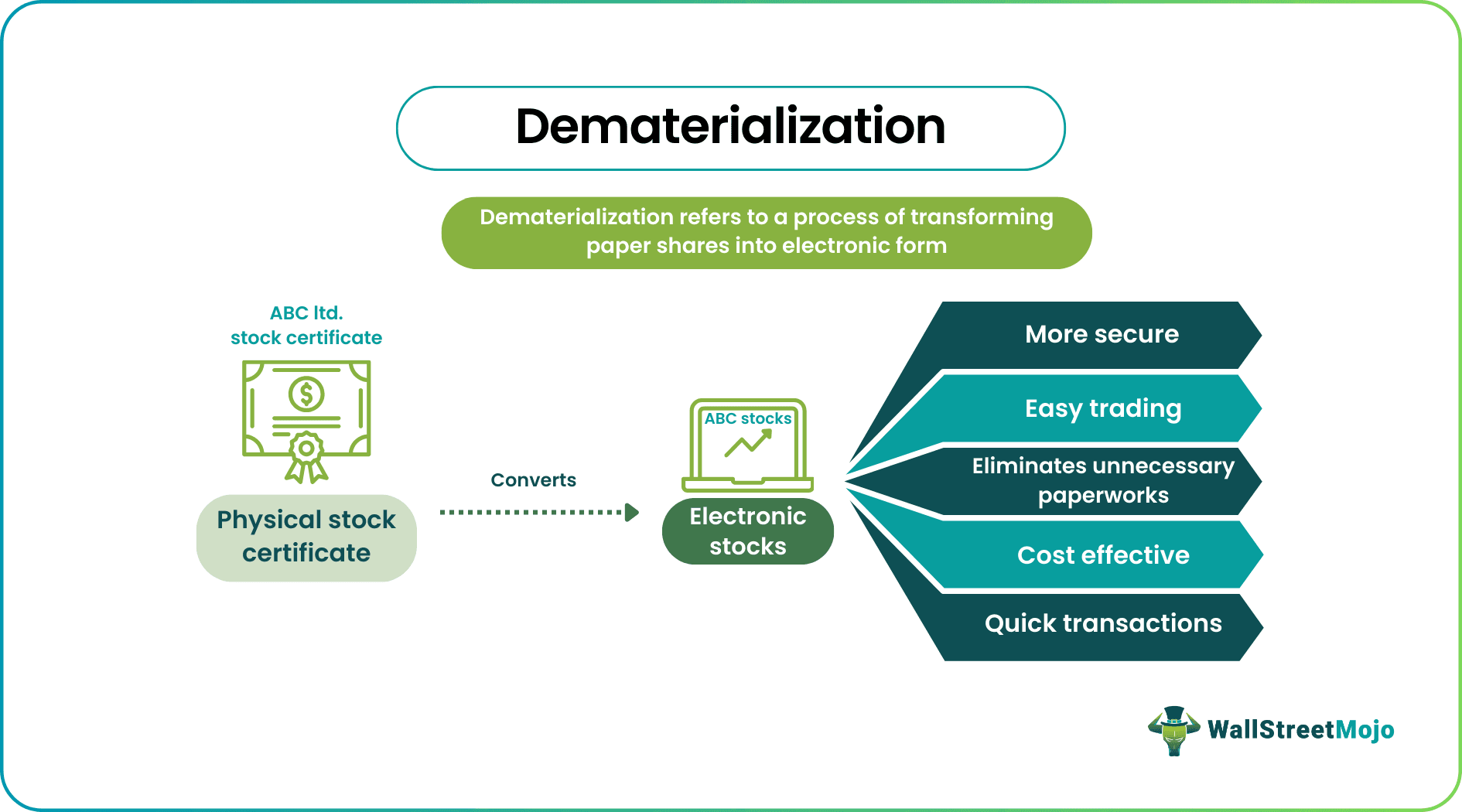

Dematerialization (DEMAT) is the process of converting physical financial instruments into digital or electronic format. It aims to ease the process of buying, selling, storing, and transferring securities. As a result, financial trades become more cost-effective, quick, and secure.

This indirect holding system substitutes the paper form of bookkeeping with trading institutions holding all assets and securities ownership details in electronic format. Once the details are electronically stored, the original physical forms of stock certificates are removed from the records. The trading institutions prefer this form of bookkeeping as it tends to be the most efficient and safe form of tracking, tracing, storing, and retrieving records.

Key Takeaways

- Dematerialization (DEMAT) refers to the process of transforming paper shares into electronic form.

- It addresses risks associated with holding paper securities like delays in transfers, forgeries, and loss of certificates.

- Digital securities are safer and more convenient to handle.

- The DEMAT account keeps track of all the shares held in digital format.

- For dematerialization of shares, investors must submit a DEMAT Request Form along with the physical stock certificates to a depository participant.

- The depository helps register the securities and transfer them electronically. Most brokers and banks are its participants.

Dematerialization Explained

In the context of finance and stocks, dematerialization refers to the movement from paper recordkeeping to electronic form for more secure, flexible, and convenient bookkeeping. It applies to stocks, mutual funds, bonds, and other investments. Thus, a DEMAT account holds all financial instruments converted into digital form.

Dematerialization came into being to keep track of securities issued in the form of physical certificates. Paper stocks carry certain inherent risks like getting lost or misplaced. Also, they cause delays in transactions due to the need to physically transfer security certificates. Therefore, trading institutions moved towards dematerialization. It addressed all these issues effectively.

Thus, the digitization of securities ensures that securities are free from forgeries and other risks associated with holding them in their physical forms. Besides, this switch to the digital holding of securities certificates enabled automatic and instant updates to DEMAT accounts. As a result, digital securities transformed the landscape of securities trading and made it safer and faster.

Investors must contact an intermediary or depository participant to initiate the process of digitization of their paper securities. The depository like Depository Trust Company (DTC), brokers, and transfer agents are responsible for conducting vault audits of the certificates, ensuring high levels of security. After verification, investors are electronically notified of the dematerialization of the shares. Then, the investor can officially start transacting in them.

Thus, DEMAT helps investors or traders hold their securities in electronic format without carrying the same in a certificate form. The computer systems and the DTC register the securities and transfer them electronically. The Direct Registration System (DRS) under DTC allows shareholders to make multiple transactions using online portals without any hassle.

Demat vs Trading Account (Video Explanation)

Process

Nowadays, companies rarely issue physical stock certificates. However, investors own certificates issued to them many years ago. So, as soon as these investors decide to digitalize their securities, they must follow a series of steps.

Step #1 - Open a DEMAT account

To open this trading account, investors need to select a depository participant offering the dematerialization services. Once a suitable service provider is found, they can open the DEMAT account.

Step #2 - Fill in the Request Form

To activate the DEMAT account, investors must fill out a Dematerialization Request Form (DRF). This form is available with the depository participant. The traders should fill in the form and deposit the same along with their physical certificates. The certificate must state “Surrendered for Dematerialization.”

Step #3 - Verification of Details and Certificates

Post-submission, the depository participant verifies the details in the application and the certificates. Finally, it forwards them to the company and transfer agents through the depository.

Step #4 - Application Approval

As soon as the request is approved, the paper or physical format is destroyed, and the electronic form is activated. An electric notification is sent regarding the same to the users immediately.

Step #5 - Final Confirmation & Activation

The depository confirms the depository participation of the dematerialization of shares. The shares of the traders are instantly transferred to their DEMAT account for further necessary actions.

Examples

Let us consider the following examples to understand what is dematerialization better:

Example 1

Robert decides to start trading shares publicly. However, during his research, he came to know that the first thing he would need to open a DEMAT account as the stock market doesn’t operate manually or on paper anymore. Hence, he connects with his broker and opens a DEMAT account to start trading shares on a public platform.

In this scenario, the DEMAT account becomes the platform for taking the physical process to an electronic format.

Example 2

In 2022, the Insurance Regulatory and Development Authority of India (IRDAI) announced the dematerialization of all new and old insurance policies. Hence, the insurance coverage seekers must have to adopt a Demat form of the process, which would no longer need policyholders to go through vast paperwork while renewing the policy. The process of adopting and continuing with the policy would be smoother and simpler.

Benefits

Like everything handled electronically, dematerialization also speeds up trading. Apart from quickening the storage and retrieval processes, there are other benefits too. Let’s discuss them.

#1 - Security

When securities are held in paper or physical format, there are chances of them being misplaced or lost. With the help of dematerialization (DEMAT), the details of the securities are held online and are ready for retrieval whenever required. Such digitized forms of trading information are safe and secure as there is no risk of forgeries at all.

#2 - Speed

For the paper forms of financial trades, be it mutual funds, bonds, or government securities, traders had to wait longer to process a transaction. On the other hand, dematerialization has made trading faster, allowing traders to buy, sell, and transfer assets just in a few clicks without any hassle or delay.

#3 - Cost

The cost of trading is reduced with the use of the electronic format of holding securities. The number of resources involved is less as all it needs is good technology rather than lots of papers for recordkeeping. Thus, when trading resources required are limited, the cost of order execution automatically diminishes. Plus, there is no processing fee involved in the process.

#4 - Smooth

When investors hold all securities electronically, handling data and updating the same from time to time is far swifter than the information stored in a physical format. The DEMAT account automatically updates all transaction-related data. Hence, the process is way better and smoother. Dematerialization saves a lot of time and effort.

Dematerialization vs Rematerialization

Dematerialization and rematerialization are opposite terms that hold huge significance when investors and other participants deal in securities. Let us check out some of the differences between the two:

| Parameters | Dematerialization | Rematerialization |

| Definition | Converts physical securities into electronic form | Brings electronic securities back to physical form |

| Purpose | Reduction of the need for physical storage and manual handling | Requires physical handling of securities and storage space for documentation |

| Benefit | Increases efficiency and paces up trading activities | Involves manual handling, thereby decreasing trading speed |

| Risks | Fraud cases and cyber threat increases | Decreases frauds and cyber threat chances |

Frequently Asked Questions (FAQs)

Dematerialization (DEMAT) is the process by which investors can convert physical share certificates into digital or electronic forms. This indirect holding system substitutes the paper form of bookkeeping with brokers or securities depositories holding all details of securities ownership in electronic format. This movement from paper shares to electronic form bookkeeping enhances security and eliminates delays in transactions.

The securities certificates held electronically are free from forgeries and other risks associated with those stored in their physical forms. With the dematerialization of securities, issues like the delays in certificate transfers and loss of certificates are effectively dealt with. Dematerialization makes securities transactions secure, safe, low cost, and convenient.

The steps of dematerialization include:

• Open a DEMAT account

• Fill in the Dematerialization Request Form

• Verification of the forms and stock certificates

• Application approval

• Final confirmation & activation