Table of Contents

What Is Delivery Trading?

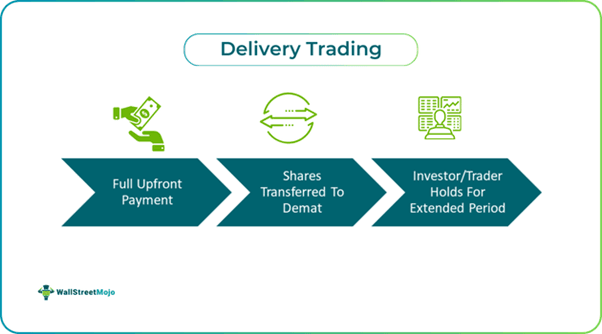

Delivery trading occurs when a trader or investor purchases stocks with the intention of holding them for an extended period, usually until the price increases to the extent that the trader deems sufficient to sell. It is considered the exact opposite of intraday trading, in which the trader purchases and sells the stock within the same day.

The delivery trading strategy is most suited for long-term investing, where there is no set deadline or settlement date before which it must be sold. Since the shares are transferred to the demat account, the payment for the stocks must be made upfront. These strategies provide investors with a higher probability of making significant returns at lower risk levels.

Key Takeaways

- Delivery trading is a form of stock market trading in which the investor or trader pays the total amount upfront, and the shares are transferred to their demat.

- These shares have no specific expiry date and can be held for months or years.

- Since they are held long-term, short-term fluctuations and downturns can be negated, giving investors a higher probability of making long-term gains.

- Transfer of ownership happens right when the stock is credited to the investor's demat. As a result, they are also eligible for bonus issues, dividends, and other such benefits.

Delivery Trading Explained

Delivery trading is when a stock purchase is transferred to the investor or trader’s demat account without a specific expiry date. The investor or trader can choose to sell the stock after a significant period, usually after the stock has experienced significant price gains.

Since the shares are transferred or “delivered” to the investor's demat account, they are required to make the payment upfront. However, once the shares are credited to their account, it is up to them to sell them after a week, month, or even multiple years. They enjoy complete control and ownership of these shares.

Since these stocks are generally held for an extended period, the investor has the advantage of staying vested. Even if the stock has underperformed in the short term, the company might recover and provide massive gains in the long run.

The exact delivery trading charges for executing these purchases depend on the investor’s broker. However, a few charges that the investor inevitably incurs are brokerage, exchange transaction charges, turnover fees, and securities transaction tax.

However, some traders find that delivery trading attracts comparatively higher taxes and charges than intraday trading. Moreover, the fact that the entire amount has to be settled upfront may affect the investor's overall cash flow. Nevertheless, investors must weigh the pros and cons and decide what type fits their investment goals and risk appetite.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How To Start?

According to delivery trading rules, an investor needs only a demat, trading account, and sufficient balance to purchase the set of stocks. Below is a step-by-step explanation of the process.

- Investors can start by visiting a brokerage firm’s website or downloading their application and opening their account.

- Opening the account shall require details such as name, email ID, phone number, and address.

- Investors must also provide bank details of the account that they wish to link with the demat.

- Many brokerages offer different subscription plans. Investors must choose the one that best suits their investment goals.

- Subsequently, the brokerage conducts either an in-person or virtual verification as per the jurisdiction's regulatory requirement.

- Once the verification is successful, the investor is intimated through email.

- Investors can now transfer a desired amount from their bank account to their demat and initiate the purchase.

Examples

Now that the theory of delivery trading strategy is established, it is time to address the concept's practical applicability through the examples below.

Example #1

Henry has been executing intraday trades for the past decade. However, in the past few months, he noticed that the volatility index has been up significantly. To avoid losing money in intraday trades, he decided to slow down and take long-term positions.

He decides to start purchasing stocks when they fall due to extreme fluctuations and holds them for at least a year before deciding to sell them or hold them further. He realizes that staying vested for a longer duration not only increases his long-term gains but also involves significantly less risk.

Example #2

Intraday trades in the United States markets have touched over $30 billion per day, involving 10,000 stocks, ETPs, and ADRs. In fact, the average period of these trades is a mere fifteen-minute window.

However, given the market's volatility, the volume has gone down, and investors are turning to slightly safer options such as swing trades and, more so, delivery trading.

Charges And Minimum Margin

The various delivery trading charges involved in executing these trades heavily depend on which part of the world it is being executed from. However, there are a few charges that are prevalent in most parts of the world. A few of the most common ones are:

Margin Rate: Margin rates are charged based on the debit balance in the account. Different brokerages have different charges. However, an average or most common set of rates are:

- Debit balances below $10,000 = 13.7%

- Debit balances between $10,000-$24,999.99 = 13.45%

- Debit balances between $25,000-$49,999.99 = 13.20%

- Debit balances between $50,000-$99,999.99 = 12.70%

Brokerage: Stockbrokers may charge a specific amount for every order executed through their exchange.

Delivery Margin: This refers to the margin of funds that investors or traders are required to hold in their accounts to purchase the stocks of their preference.

Exchange Transaction Charges: An additional amount charged by the exchange that records the purchase and sale of stocks.

Advantages & Disadvantages

The advantages and disadvantages of adopting a delivery trading strategy are:

Advantages

- It allows investors to hold stocks for as long as they deem fit, gaining the benefit of being invested in the stock for an extended period. It is most compatible with investors who are looking to build their wealth.

- Investors are eligible to receive dividends, bonus share allotments, and other such benefits.

- Daily market volatility does not affect the stock's action or execution. This is especially beneficial for investors with a low-risk appetite.

- Since there is no fixed execution or expiry date, investors can take their time to conduct their due diligence and execute when they feel the time is right.

Disadvantages

- Since the entire amount is required to be paid upfront, the need to arrange for capital is higher than in intraday trades.

- These shares are held for months or years. Therefore, investors may feel like their capital has been tied or locked into these stocks.

- Even after holding it for such long periods, if the market crashes or the company underperforms, the stock might plummet, resulting in significant losses.

- Transaction fees and brokerage are generally higher for such transactions. These costs can add up over time and eat into the long-term gains.

Delivery Trading Vs Intraday Vs Swing Trading

The distinctions between delivery trading rules, intraday, and swing trading are:

| Basis | Delivery Trading | Intraday Trading | Swing Trading |

|---|---|---|---|

| Definition | Transfer of shares purchased to the demat account by paying the whole amount upfront. These shares may be held for months or years before being sold. | Shares are purchased and sold within the same day, sometimes within minutes. | Shares are purchased and held for a short time and sold once they reach or breach a certain price threshold. |

| Objective | Capital appreciation. | Quick profits. | Profits from price swings in the market. |

| Ownership | Shares are transferred to the buyer’s demat, hence, making them the owner. | Since the stocks are purchased and sold within the same day, there is no transfer of ownership. | For the short or medium term, the investor holds the stock. They are the owners. |

| Capital | Full payment must be made upfront for the shares to be delivered to demat. | Typically, margin accounts are used to execute these trades, so only a tiny portion of the total value is used. | Even here, a full payment is required. However, it can be less than delivery trading. |

| Risk Level | Low risk. | High risk. | Medium risk. |

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.