Table Of Contents

Delisting Meaning

Delisting is a voluntary or forceful removal of a company's shares from the stock exchange. Companies get delisted due to non-fulfilment of listing requirements, acquisitions, mergers, business shutdowns, and insolvency. When a publicly listed company is delisted from the stock exchange, it becomes a private entity. As a result, shares cannot be traded in the open market.

However, if a firm is unlisted on one stock exchange, shares might still be available on other stock markets. Otherwise, shareholders might have to sell through over-the-counter means outside any stock exchange. If the company can resolve the issues for which it was delisted, it can reapply to be listed on the exchange. However, such a scenario is extremely rare.

Key Takeaways

- Delisting of stocks is the voluntary or involuntary removal of a company's security from the respective stock exchange. It thus leads to the privatization of a public company.

- Private firms cannot raise funds from the public. However, existing shareholders retain their stake in the business.

- Withdrawal from the stock market can lead to devaluation of stocks, tarnished reputation, and loss of market share.

- These firms are not required to publish annual reports—directors gain control over decision-making. These firms are less prone to hostile takeovers.

Delisting Explained

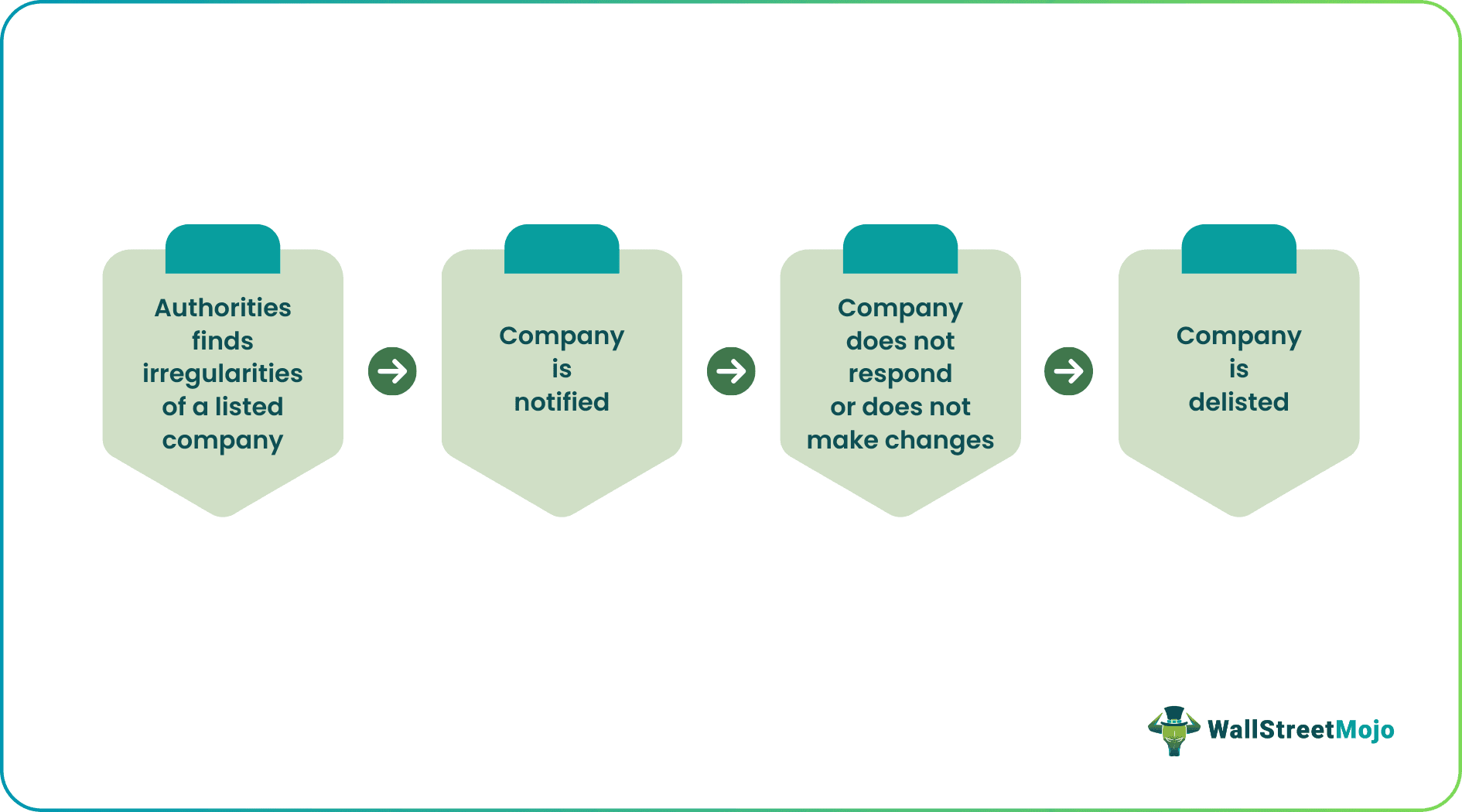

Delisting is the process of removing a listed company from the stock exchange due to their inability or ignorance towards fixing issues. Usually, regulatory authorities find irregularities in their documentation, accounting, or compliances and notify them about the same.

If they do not respond or make the necessary changes after a couple of attempts to establish communication, they are delisted from the exchange and their shares cannot be publicly traded due to their inability to follow delisting rules.

After delisting, the company's shares cannot be traded on the stock exchange. This is usually caused by mergers, bankruptcy, or when a company voluntarily goes private. Alternatively, companies are removed from the stock market for not meeting mandatory conditions.

Let us take a closer look at the process. NASDAQ mandates compliance with certain requirements. When a company’s share trades below $1.00 for 30 consecutive days, the shares get delisted from the stock exchange. On the 31st day, the stock exchange sends a non-compliance notice to the company. The notice instructs the company to delist its shares.

If the stock trades below the stated amount 180 days post notification, the exchange will delist the issue. The exchange suspends trading, notifies the issuer, notifies the Securities and Exchange Commission (SEC) in writing, and formulates a press release.

Types

Let us understand the different types of delisting stock process through the discussion below.

#1 – Voluntary Delisting

The company's directors willingly take off the shares from the stock exchange listing, this is referred to as ‘voluntary.’ Companies often wish to go private. It is also brought out by mergers, acquisitions, and liquidation.

Sometimes, companies that go private struggle with business operations. Such an action could trigger speculations—the company does not want to disclose its financial statements anymore.

source: startribune.com

#2 – Involuntary Delisting

Involuntary delisting is done forcefully—caused by adverse circumstances. It is a scenario where the company does not want to go private, but laws and regulations require it to do so.

This happens when a company fails to meet minimum financial standards—incurring losses for three straight years. Not meeting minimum share price, financial ratios, or sales can also get a company delisted.

List of Delisted Stocks

Let us look at some examples to understand the practical application of the delisting stock concept.

On March 8, 2022, the New York Stock Exchange (NYSE) announced the delisting of SCVX Corp's Class A ordinary shares—due to non-fulfillment of listing standards. SCVX Corp. failed to maintain a minimum market cap of $40 million—over a period of 30 consecutive days.

Similarly, on March 11, 2022, shares worth $1.1 trillion were delisted by SEC. These shares belonged to Chinese corporations—Yum China, ACM Research, HutchMed, Zai Lab, and BeiGene. The companies could not furnish detailed audit reports that certified their financial statements. Therefore, based on the Holding Foreign Companies Accountable Act, the shares were removed.

Delisting Video Explanation

Advantages & Disadvantages

Let us understand the advantages and disadvantages of delisting rules through the discussion below.

Advantages

- Delisted firms do not have to publish its annual reports or shareholding patterns anymore.

- Private companies are not subject to a minimum listing limit anymore.

- Business cut expenses—listing fee and annual trading costs.

- Private firms are less prone to hostile takeovers.

- Private firms are exempt from market speculation.

- Directors retain decision-making ability.

Disadvantages

- A private company cannot raise funds from public markets.

- When a company delists, it can lose public trust—market share can shrink.

- It can also negatively affect the book value of the company.

- Delisted stocks undergo considerable devaluation. Shareholders end up losing investment value.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Relisting a delisted firm on stock markets is possible. However, there must be at least three years between delisting and relisting, according to the Securities and Exchange Board of India (SEBI).

A stock that has been delisted may still be traded over the counter. However, trading costs and bid-ask spreads are likely greater on over-the-counter markets because they lack the major exchanges' liquidity.

According to China's securities regulator, undervaluation was a major factor in Chinese ADRs delisting and becoming private, according to the China Securities Regulatory Commission. Compared to their ADR peers in the U.S. market and their peers in the Chinese market, Chinese ADRs elect to delist and go private after being undervalued there.

A delisting has no immediate impact on the rights or claims of shareholders against the delisted firm. Even if thousands of securities trade over the counter, it will frequently cause the share price to decline and make holdings more difficult to sell.