Table Of Contents

What is Deferred Tax?

Deferred tax (DT) refers to the difference between tax amount arrived at from the book profits recorded by a company and the taxable income. The effect arises when taxes are either not paid or overpaid. Companies calculate book profits using a particular accounting method; tax authorities charge taxes based on tax laws, and the two often differ.

The difference is seen as a deferred tax asset (DTA) or a deferred tax liability (DTL). When the reported income tax exceeds income tax payable, the difference is an asset. When the income tax payable exceeds reported income tax, it becomes a liability for the company.

Key Takeaways

- Deferred tax is the gap between income tax determined by the company's accounting methods and the tax payable determined by tax authorities.

- Deferred tax arises when there is a difference in the treatment of income, expenses, assets, and liabilities under the company's accounting procedure and the tax provision.

- It is the difference between income tax paid and income tax accrued. The difference results in a surplus or deficit.

Deferred Tax Explained

Deferred tax is the gap between income tax payable and income tax recorded. Sometimes, these differences are temporary—they can be adjusted with subsequent periods. For example, current period business losses can be claimed in the next period—for tax exemption. But some differences are permanent and cannot be adjusted—penalties charged by tax authorities.

When reported tax exceeds tax payable, it is an asset for the firm. On the other hand, when tax payable exceeds reported tax, it becomes a liability for the business—to be paid off in the future.

The gap between reported tax and tax payable is often caused by the method of charging depreciation. Often, the percentage of depreciation charged on the income statement differs from tax statement depreciation values.

Gaps can be brought out by unrealized revenues and unpaid expenses, as well. A company cannot be taxed till it receives revenue. Similarly, an expense cannot be deducted from the tax assessment (current year) till the company actually pays for the expense.

Types

Deferred tax can be broadly categorized into the following two types:

#1 - Deferred Tax Asset (DTA)

Deferred Tax Asset (DTA) comes into effect when a company either pays excess tax or pays tax in advance.

DTAs account for the timing difference between book profit and taxable profit. Tax regulations allow the deduction of some items from the taxable profits and disallow others. When a company’s book profit exceed taxable profit, it ends up paying more taxes. On the balance sheet, DTA is recorded on the asset side. This way, it can be used to reduce taxable income in the future.

Following are the various DTA scenarios:

- When revenue received in advance is taxed before the revenue is recognized, DTA comes into effect.

- When accounting procedures and tax provisions treat expenses differently, DTA comes into effect.

#2 - Deferred Tax Liability (DTL)

Deferred tax liability (DTL) comes into effect when the tax payable for the current period has not been paid fully.

When a company's book profits exceed taxable profits, the tax paid is lower than the reported tax. This becomes a liability for the company. Therefore, DTL is the pending tax amount to be paid in the future.

Different DTL scenarios are as follows:

- When tax authorities consider unpaid expenses for a deduction, DTL comes into effect.

- When a company represents current profits as future earnings, it avoids taxes in the current period. But the same amount becomes a liability for the future.

- If dual accounting for depreciation and other expenses is undertaken, DTL comes into effect.

Calculation of Deferred Tax

Deferred tax is the difference between tax payable determined by income tax laws and the tax reported by the company's accounting method.

Formula

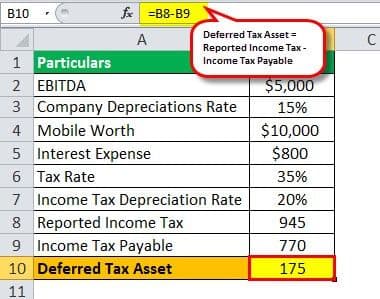

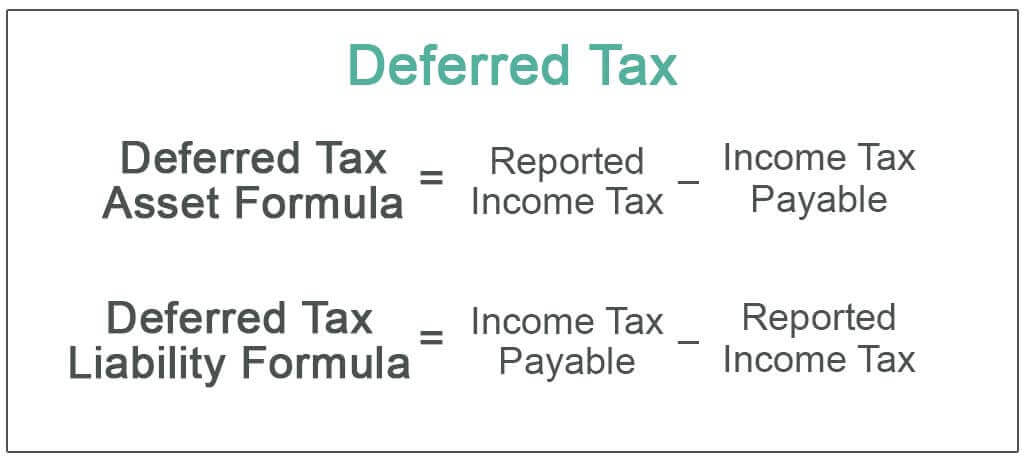

To calculate DTA, we use the following formula:

To calculate DTL, we use the following formula:

In income statements, reported tax is a percentage of gross profit after depreciation. Whereas, for tax statements, tax payable refers to the amount charged on gross profit after depreciation.

To evaluate the taxable income based on income and tax statements, we apply the following formula:

Examples

Let us understand the practical application of the concept using examples.

Example #1

Let us assume that a company purchases a new mobile worth $10,000—it has a useful life of 10 years. The company uses the straight-line method for both income statements and tax statements. However, the company depreciates the asset at 15%, and the income tax department prescribes a 20% depreciation rate.

Determine the DTA created because of the difference in rate. The given company reported an EBITDA of $5,000, an interest expense of $800, and an effective tax rate of 35%.

Solution:

DTA = ($5,000 – 15% * $10,000 – $800) * 35% – ($5,000 – 20% * $10,000 – $800) * 35% = $175

Therefore, the reported DTA at the end of the first year is $175.

Example #2

A company owns equipment with a useful life of four years. The equipment is worth $2,000. The company uses the straight-line method for depreciation and uses the double-declining method for tax reporting purposes.

Determine the cumulative DTL reported in the balance at the end of year 1, year 2, year 3, and year 4. For the given company, reported EBITDA and interest expenses are $2,500 and $200, respectively. Also, the applicable tax rate for each year is 35%.

Solution:

Let us draw a table to capture the effect of deferred tax expenses for each year, along with calculations:

For year one, a DTL is created—book profits exceed taxable profits. However, in year 2, the reported tax is equal to the tax payable.

From year three onwards, reported tax is lower than the tax payable—DTL starts depleting. The reported cumulative tax liabilities stood at $175, $175, $88, and $0 at the end of years 1, 2, 3, and 4, respectively.