The usance and deferred letters of credit are both financial instruments that promote secured international trade; however, there are a few differences between them, as discussed below:

Table of Contents

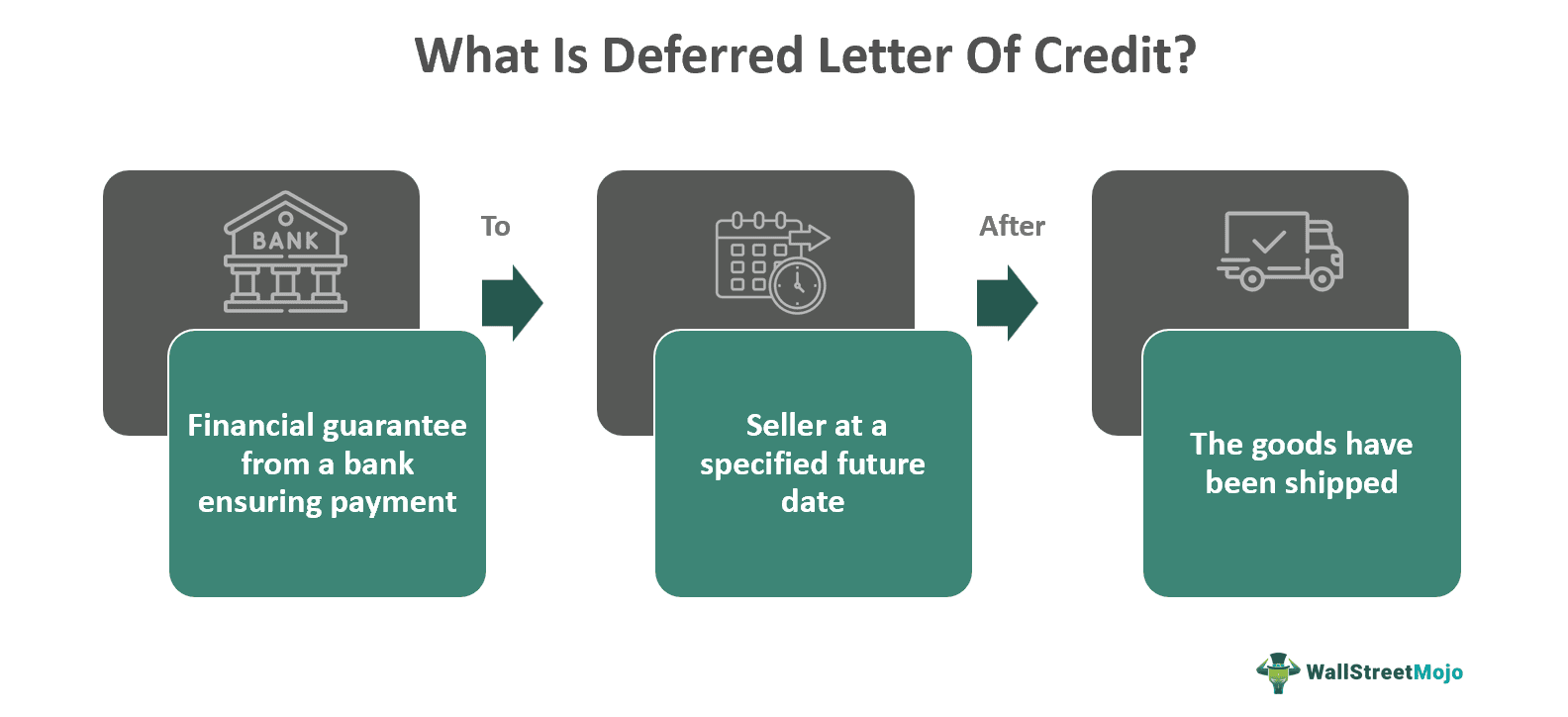

What Is Deferred Letter Of Credit?

Deferred letter of credit (LC) refers to a financial instrument usually issued during the trade finance between the seller and the buyer. It enables the buyer to delay the payment to the seller up to a future date until the fulfillment of a specific condition, like receipt of goods or services.

The primary purpose of a deferred LC is to offer an extended payment period to the buyer in trade or commerce, especially in cross-border sales of goods or services, thus allowing flexibility in their cash flow management. Moreover, it secures international trade and commercial transactions by ensuring assured payment to the seller on credit cross-border sales of goods or services.

Key Takeaways

- A deferred letter of credit is a conditional payment contract between an exporter and importer whereby the buyer can make the payment after a certain period to fulfill a specific condition, like receiving the consignment of goods.

- Such an arrangement makes international trade secure for both the exporter and the importer.

- Here, the issuing bank assures payment to the seller after a specific period, usually for a certain number of days from the date of shipment, contingent upon the fulfillment of the buyer's specified condition.

Deferred Letter Of Credit Explained

A deferred letter of credit (LC) allows the buyer to extend the payment period for a specified number of days from the date of receiving the bill of lading or other shipping document while importing goods or services from another nation. Generally, in a regular LC, the buyer needs to make the payment as soon as the seller ships the consignment and the former receives the relevant shipping documents. A deferred LC involves five parties, i.e., the seller, buyer, seller's bank, buyer's bank, and the carrier.

However, after the shipment, the exporter needs to make sure that the deferred payment clock begins ticking. For this purpose, the seller or exporter first needs to furnish all the essential documents confirming the shipment of the consignment with goods to their bank. The seller's bank would then inform the buyer's bank (the issuer of the deferred letter of credit) of the same to begin the deferral period. The letter of credit bank would then inform the importer or buyer about the onset of the deferral period.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Examples

A deferred letter of credit facilitates international trade by securing the transactions between the exporters and importers. Some of the examples signifying the use of a deferred payment LC are as follows:

Example #1

Suppose AZ Co. Ltd. is an exporter of watches in France and XYZ Ltd. is an importer in the USA. On January 30, 2024, XYZ Ltd. Ordered a consignment of watches worth $5000 with AZ Co. Ltd. The transaction was commenced through a deferred letter of credit issued by PR Bank (buyer's bank) that assures the payment to AZ Co. Ltd. After receiving the goods. As the exporter shipped the consignment on February 05, 2024, it presented the bill of lading to the CD Bank (seller's bank), who further informed the start of the deferred payment period to the PR Bank. The PR Bank then intimated its client XYZ Ltd. of the same, who confirmed the receipt of the Bill of Lading's copy. Thus, the deferred payment period begins on February 05, 2024, making XYZ Ltd. Liable to pay in full on March 21, 2024, I.e., the date of receiving the consignment in the USA.

Example #2

The ongoing dollar crisis has led banks to increasingly issue deferred letters of credit, reaching a record $1 billion in July 2023. Importers opting for deferred payments face additional costs, including around 9% interest and a 20% tax on the interest amount. It contributed to inflation as suppliers charged interest and passed it on to consumers, with food inflation reaching 12.54%. During the pandemic, deferred payments surged to $955 million in 2021, temporarily boosting reserves to $48 billion but eroded to $23 billion in August 2022 when payments began.

Despite a 15.76% decline in imports in FY23, reserves continued to decline due to previous payment obligations. Importers preferred deferred LCs for 3-4 months to ease immediate payment pressure but faced increased costs, impacting inflation. Moreover, rebuilding reserves became challenging without improved dollar inflow due to stagnant remittance inflow and insufficient export orders. The global interest rates were expected to reduce in the next six months, which could alleviate some import costs. Also, failure to address the dollar crisis led to a situation similar to the rapid reserve depletion experienced during the pandemic. Simultaneously, the inflation remained high, with a 23 basis points increase to 9.92% in August 2023, driven by high import costs and food inflation at 12.54%.

Advantages and Disadvantages

A deferred payment letter of credit denotes an arrangement that helps the buyer avoid making immediate payment for a shipped consignment while importing goods from another country. It has various pros and cons, as discussed below:

| Advantages | Disadvantages |

|---|---|

| A deferred payment LC allows the buyer an extended credit period. | However, such an arrangement increases the credit period of the exporters, thus hindering their profitability. |

| It thus ensures the importer's flexible and efficient cash flow management. | The seller may consider the time value of money, thus elevating the price of goods or services under a deferred LC contract, which will ultimately raise the cost of purchase for the buyer. |

| Such an LC builds healthy international trade relations between the buyers and sellers of different countries by providing a secured transaction mechanism. | It makes the international trade process more complex by making the parties enter into a separate contract with different terms and conditions. |

| It further guarantees the payment to the seller since the transaction is backed by the exporter's and importer's banks. | It involves the risk of future non-payment or partial payment by the buyer in case of bankruptcy or a situation of financial distress. |

| A deferred LC saves the buyer from blocking their working capital or elevating the financial cost of importing goods or services from another country. | It fails to account for the fulfillment of other trade terms, including the product quality, quantity, features, or condition, before accepting the consignment and clearing the bill. |

| It is a conditional payment contract. Thus, the buyer is eligible to pay only if a specific condition is fulfilled. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Difference Between Usance And Deferred Letter Of Credit

| Basis | Usane Letter of Credit | Deferred Letter Of Credit |

|---|---|---|

| 1. Definition | An usane letter of credit is a financial instrument that enables the buyer to make the payment for the procurement of goods or services to the seller on a future date (I.e., 30 to 180 days later from the date of furnishing the relevant documents). | A deferred letter of credit is a conditional payment contract whereby the buyer ensures the payment to the seller on the fulfillment of a specific condition at a future date. |

| 2. Payment Period | After 30 to 180 days from the date of presenting the required documents | At a later date, when the specified condition is fulfilled |

| 3. Payment Terms | Compulsory payment after the completion of the specified period. | Payment is made when the stated condition is met, such as the goods are received. |

| 4. Risk Management | Manages non-payment risk while making the payment on a specific date | Mitigates non-payment risk by meeting the desired condition for payment |

| 5. Flexibility | Limited flexibility to buyer since the payment tenure is fixed | Greater flexibility to buyer, making the payment conditional |