Table Of Contents

Deferred Income Tax Definition

Deferred income tax is a balance sheet item that can either be a liability or an asset as it is a difference resulting from the recognition of income between the accounting records of the company and the tax law because of which the income tax payable by the company is not equal to the total expense of tax reported.

Deferred Income tax affects the tax outgo to the authorities for the financial year. It simply refers to the tax that is overpaid or owed by the Company to the tax authorities. If there is a deferred tax asset, the Company will have to pay less tax in the particular year, whereas, if there is a deferred tax liability, it will have to pay more tax.

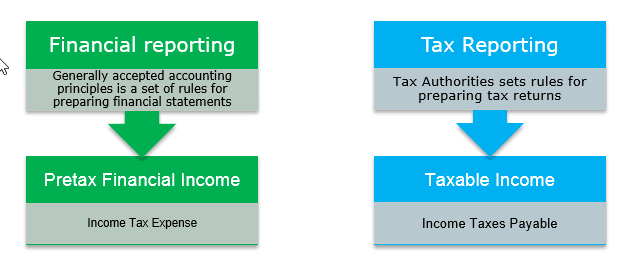

Causes of Deferred Income Tax Expense

Deferred tax is created due to the difference in the timing of book profit and the taxable profit. Timing differences are of two types: some items are deducted from the taxable profits, and others are not.

- Permanent Difference: The differences which cannot be reversed in the subsequent periods and may take a long time are permanent.

- Temporary Difference: The difference which can be reversed in the subsequent period and is generally created because the items are charged and taxed in different periods is the temporary difference.

Let us discuss the two types of Deferred Income Tax expenses in detail.

Revenue vs Income Explained in Video

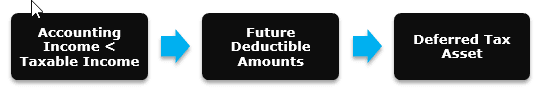

1) Deferred Income Tax Asset

A deferred tax asset is created when the Company has already paid the tax. The benefit of deferred tax assets is that the Company will have less tax outgo in subsequent years.

Example

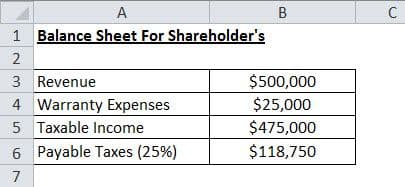

Consider an Electronics Company XYZ Inc., which gives a warranty on the goods and assumes that the warranty repairs cost will go around 5% of the total revenue. If the revenue for the period is $ 500,000, then the balance sheet of the Company to the shareholders and the tax department will be:

Balance Sheet for Shareholders

Balance Sheet for Tax Authorities

The Company has already paid a tax difference of $ 6,250 but is not visible on the balance sheet. Thus, it will record a deferred tax asset of $ 6,250 for the period.

2) Deferred Income Tax Liability

Deferred tax liability is created when the Company underpays the tax, which it will have to pay shortly. The liability is created not due to Company defaulting on its tax liabilities but due to timing mismatch or accounting provisions, which causes less tax outgo than required by the Company.

Example

An Oil Company, ABC Inc, produces 10,000 barrels of oil at the cost of $ 15 per barrel 1st year. But in the next year, the labor cost increased, and it produced the same amount of oil but at the cost of $ 20. The Company sold the oil at the end of year two but used different accounting treatments for financial and tax purposes. It recorded the cost as $ 150,000 FIFO inventory for the financial balance sheet, where it recorded the cost as $ 200,000 for tax purposes LIFO inventory. It created a temporary difference of $ 50,000, and if the tax rate is 30% would create a tax liability of $ 15,000.

Important Notes - Deferred Income Tax

- Deferred tax impacts the future cash flows for the Company – while deferred tax assets lower the cash outflow, deferred tax liability increases the cash outflow for the Company in the future.

- Change in deferred tax balances should be analyzed to understand the future course – if the difference will rise or if there will be a reversal in the trend of the deferred taxes.

- Deferred taxes are prone to the type of business the Company is in. If it's a capital-intensive business and the Company purchases new assets, it will have an increasing deferred tax liability because of accelerated depreciation of the assets.

- Analysts should look for changes in deferred taxes by reading the footnotes to the financial statements, including information about the warranty, bad debts, write-downs, policy on capitalizing or depreciating assets, policy on amortizing financial assets, revenue recognition policy, etc.

Conclusion

Deferred tax is a balance sheet line item recorded because the Company owes or pays more tax to the authorities. The deferred tax represents the company's negative or positive amounts of tax owed. Deferred income taxes impact the company's future cash flow, i.e., if it's an asset, the cash outflow will be less, and if it’s a liability, the future cash outflow will be more.