Table Of Contents

What Is A Defensive Stock?

A Defensive Stock is a stock that provides steady growth and earnings to the investors in the form of dividends irrespective of the state of the economy as it has a low correlation with the overall stock market/economy and is therefore insulated from changing business cycles. Examples of Defensive sector stocks include utilities, consumer durables, pharmaceuticals, and real estate.

Although the return on investment may be low during a bullish market for defensive stocks, they provide a necessary hedge against a slide in returns in bearish markets as the demand for companies' stocks providing defensive goods and services remains relatively stable in any given market condition. Moreover, it provides a steady income stream and a conservative portfolio of stocks with diversified risks and returns.

Defensive Stock Explained

Defensive stock refers to the shares of a company that show very little volatility irrespective of the movement of the market. In other words, they remain stable regardless of the economic state. These stocks do not get affected by economic cycles; therefore, they are also referred to as non-cyclical stocks.

Despite these stocks barely outperforming the index of the market, investors tend to invest in defensive stock companies as they come in handy even during turbulent times in the market such as a recession. These stocks show little to no effect for both extremities and therefore, investors tend to hedge their risks with stocks of this nature.

Fast-Moving Consumer Goods (FMCG) companies, pharmaceuticals, utilities, and household products are a few industries that have been historically proven to be non-cyclical stocks, and investors have found suitable stocks to invest in accordance with their portfolios.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

List

These stocks are hedged from the uncertainty factors in the business cycles of the market and economy. The following is the list of consumer defensive stock.

#1 - Domestic Utilities

Power, Gas, and Water are generic examples of defensive stocks. It is a basic necessity for people of any economic class or background as the people require them during any phase of an economic cycle. For example, utility companies gain from slower business cycles as borrowing rates or capital costs tend to be lower during an economic slowdown.

#2 - Consumer Durables

A business involved in the manufacture or distribution of fast-moving consumer durables like food and drinks, clothing, health products that consumers purchase out of necessity irrespective of the economic cycle. These companies generate stable revenues during both robust and slow economic cycles.

#3 - Pharmaceutical or Medical Stocks

Shares of pharmaceutical or life science companies perform well in any economic cycle as there will be sick people requiring these drugs or medicines to fight life-threatening diseases. But new companies entering the Drug and medicine manufacturing market and the absence of drug price control bodies means they may no longer be as defensive as before.

#4 - Real Estate or Property Market

The companies involved in building houses and apartments for retail consumption show an ever-increasing demand as people require shelter as a basic necessity irrespective of the economic cycle. Besides, real estate companies need to pay a minimum amount of money as Dividends to their shareholders out of their taxable profits as a statutory requirement. At the same time, seeking these stocks that keep aside companies dealing in high-end flats, office buildings, or technology parks may see non-payment of Leases when the economy or business is low.

Examples

Let us understand why investors invest in defensive stock etf and shares despite their performance being rather flat through the examples below.

Example #1

A stock with a Beta of 0.6. If the market is expected to drop 20% and the risk-free rate is 5%, the drop in the defensive stock will be = 15%. On the other side, if the market is expected to rise by 10% with a risk-free rate of 5%, a defensive stock will increase by = 3%. Investors generally invest in low beta stocks when they expect the market to fall, whereas when expected to be high, investors seek high beta stocks to maximize their returns.

Example #2

In January 2023, Goldman Sachs introduced their Defensive Equity ETF (GDEF) at a time when the economy began bracing for the impact of a major recession. Their defensive stock etf had an expense ratio of 0.55% and was listed on the New York Stock Exchange (NYSE).

This stock was introduced to provide hedging of risk during turbulent times despite the fact that these stocks might not perform especially well during a bull run in the market.

However, to provide diversification of funds and investment for investors, these types of stocks and ETFs would prove beneficial.

Advantages & Disadvantages

Defensive stock companies have their own set of advantages and disadvantages. Depending on investing style and risk appetite, investor would or would not want to invest in these stocks. Let us understand the crux of this concept with the help of the discussion below.

Advantages

- The greatest advantage an investor gains through defensive stocks is a balanced portfolio of low beta stocks coupled with some non-defensive high beta stocks to give him steady and safe returns over some time as these stocks balance the risk of a portfolio of stocks consisting of high and low beta stocks making a conservative portfolio.

- The portfolio with defensive stocks provides steady returns, even in a slow-growing economy. The returns from these stocks will remain stable even during recessionary economic conditions as the demand for the goods or services of these companies will remain inelastic regardless of the economic conditions. Even when the economy is bearish or sluggish, there will be a steady market demand for products manufactured or services provided by defensive stocks companies. The ideal time to buy such stocks will be during an economic downturn. The worst time to buy would be during an economic boom or a bull market, as the beta factor for these stocks tends to be less than one giving below-average returns when the market is high.

Disadvantages

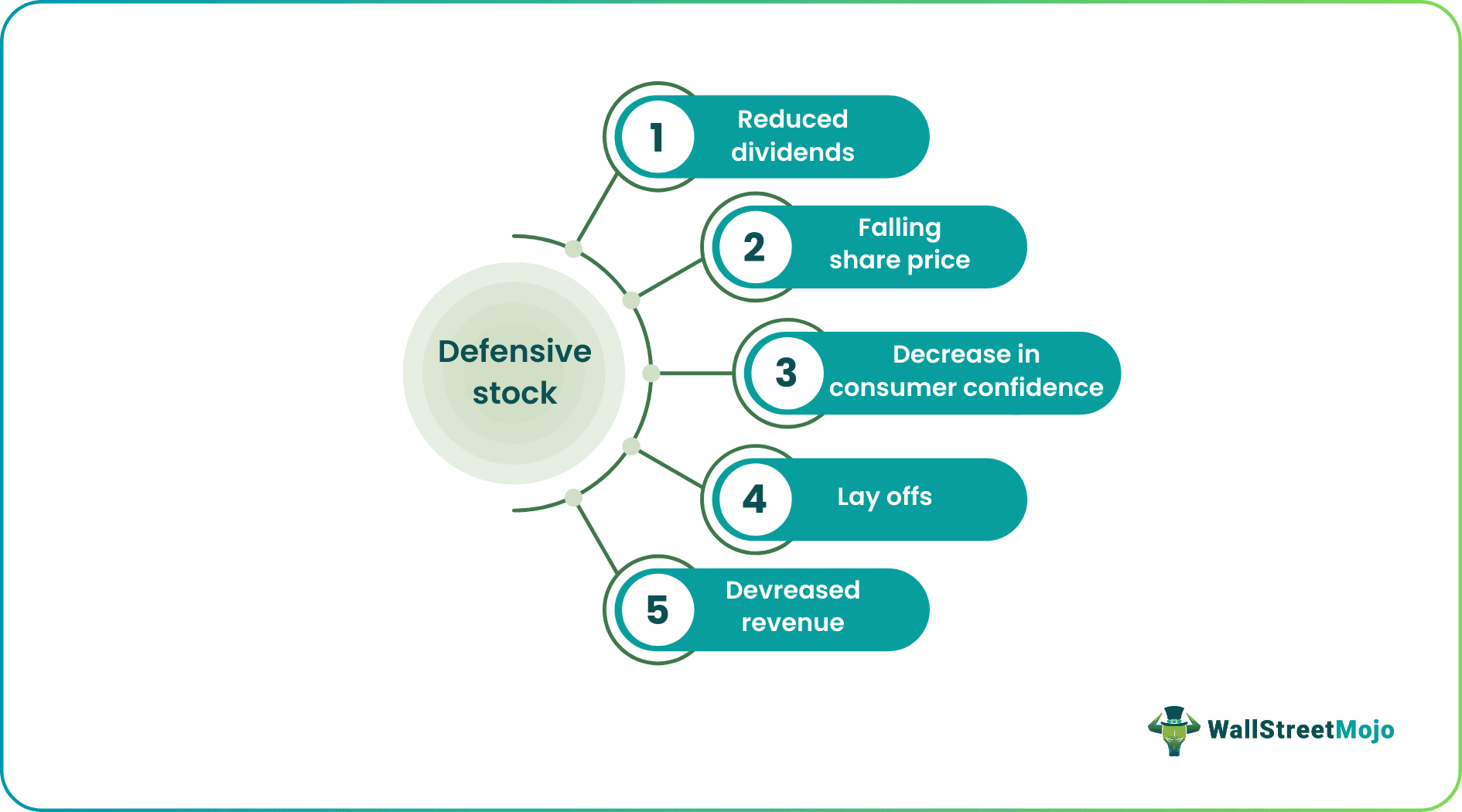

- #1 - Defensive Stocks can Slide Low - They can slide up or down like any other stocks. The reasons behind their slide are geopolitical, economic, or industry factors. Interestingly, these stocks are not hit hard in a declining market as a steady dividend flow in such times acts as a support to defensive stocks. Therefore, as compared to other stocks, defensive stocks are less affected by economic slowdowns.

- #2 - Interest Rate Factor - Defensive Stocks may be sensitive to rising interest rates. When interest rates rise, other securities like corporate bonds, Treasury securities, Bank deposits are more profitable. When defensive stocks yield 4%, and the interest rate rises to 6% or 7%, one may consider selling defensive stocks. As more investors start selling their stocks, their prices start falling. Rising interest rates may deplete the company's resources and affect its earnings. It pays more interest and may pay lesser dividends as profit after interest and taxes take a fall.

- #3 - The Inflation Factor - Even if the companies raise their dividend rates, although many don't, the rise may be small. If income is of prime concern, the investor needs to be aware. Rising inflation causes a concern when the investor receives the same level of dividend year on year. Rising inflation reduces the value of dividends received as the nominal returns on investments start falling.

Interestingly, dividends perform better than fixed income-bearing bonds and investments. Moreover, defensive stocks companies provide a greater return on investment (ROI) than the inflation rate as demand for the goods and services of defensive stock companies always remain stable.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.