Table of Contents

What Is A Deed Of Reconveyance?

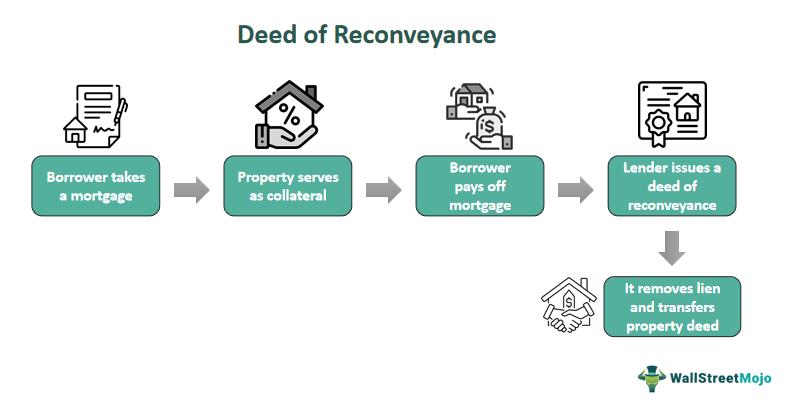

The deed of reconveyance is a legal document that symbolizes property transfer and ownership entitlement papers. The document is readily used between a borrower and lender, issued by the borrower once the lender has fully paid off the mortgage.

The deed can be used as proof of ownership and evidence that the borrower has paid the loan, fulfilled all the liabilities, and is free from any obligations. Simultaneously, it confirms that the lender has no interest in the property. The borrower receives the deed within three to four weeks after the final payment.

Key Takeaways

- A deed of reconveyance refers to the legal document that transfers the property’s ownership title once the borrower has satisfactorily paid off the mortgage debt.

- The document is registered with the local courthouse and serves as proof of evidence for the borrower. Therefore, they must collect it.

- It typically takes three to four weeks after the final payment for the lending authority to issue and share the document with the borrower.

Deed Of Reconveyance Explained

A deed of reconveyance refers to the official letter that a borrower receives from the lender after paying off the debt and satisfying all the conditions. It is a significant document that must be collected from the lender as it clarifies that they do not have any interest in the property mortgaged or submitted as collateral.

The deed’s significance lies in the fact that in any loan arrangement, the borrower requires proof from the lender that they have paid off the debt and, therefore, are free from any obligations. Since most loans are secured loans, there is a collateral that is submitted from the borrower which is to protect the lender in case the debtor defaults on payment.

The document is mainly observed and filed in home loans or in scenarios where real estate, land, or properties are mortgaged for a loan through banks, individual creditors, and other financial institutions. The document serves multiple aspects; even if the borrower later wants to sell the property, they would require the document as proof that the property is under no interest of any lending authority and they are the true owner. If not received, the borrower can file a lawsuit against the lender in court, asking for a deed of reconveyance. In contrast, if the loan is not repaid, the bank has full authority to seize the property and take legal action against the borrower.

The document is primarily associated with home loans or situations where real estate, land, or properties are used as collateral for loans from banks, individual creditors, or other financial institutions. Its importance spans various aspects; for instance, if the borrower intends to sell the property later, they would need the document as proof that no lending authority has an interest in the property and that they are the rightful owner. Failure to receive the document may prompt the borrower to take legal action against the lender in court to obtain the document. Conversely, if the loan remains unpaid, the bank retains the authority to seize the property and pursue legal action against the borrower.

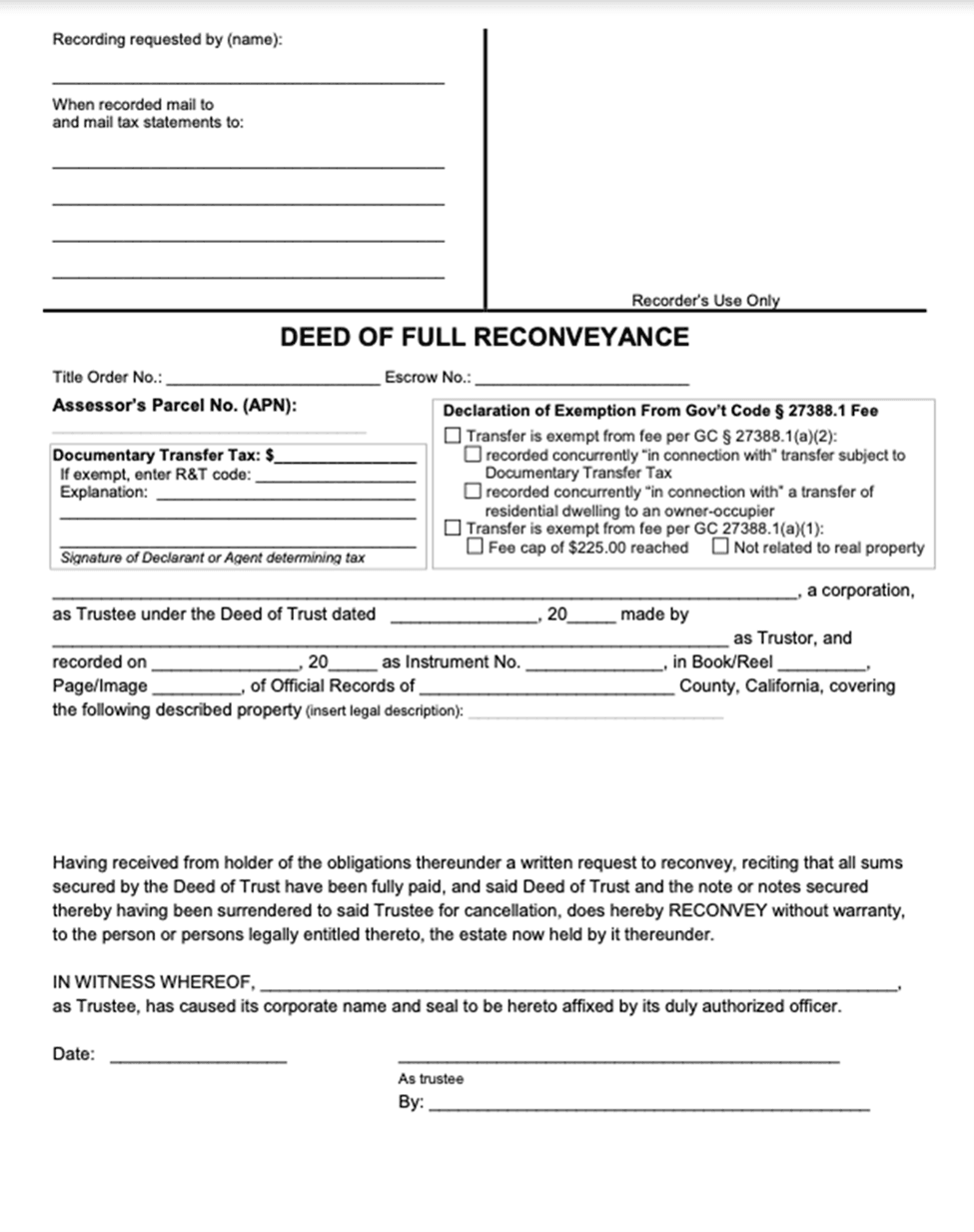

Sample

Given below is a sample deed showingthe legal documentation involved in transferring property ownership rights from a lender to a borrower.

The deed of reconveyance format consists of important sections and mention of borrower, lender, and statement of lien removal and transfer of ownership title.

Examples

Below are some examples to help you understand the concept better:

Example #1

Suppose Emily lives in California and runs a small handbag business. She wants to expand her business and apply for a business loan. Emily visits the local bank and gets a business loan of $90000, but the manager asks for collateral. She decides to keep her home as collateral According to the California deed of reconveyance, the bank has the right to seize and sell the property to balance the loan money if Emily defaults on the loan.

Emily gets a four-year business loan with a certain interest rate and monthly installments. Emily uses the funds to expand her business while diligently paying the monthly installments. After four years, when Emily makes the final payment, the bank issues the document, which signifies that the bank no longer has an interest in Emily’s property. The ownership title is transferred to Emily.

Example #2

In a 2011 mortgage debt case, an individual paid off the loan and received a loan satisfaction letter from the finance company. The man complained that he had not received the reconveyance deed for the next three months and had not been registered with the county.

It's plausible that the document may be in transit or undergoing processing, perhaps sent directly to the recorder’s office or another legal entity. Additionally, if the finance company has offered a letter of satisfaction, the man needs to claim his entitlement. A mortgage borrower needs to understand that even after taking the loan, the ownership remains the same. Still, the lender has a lien on the property, and further actions will only be taken after the borrower defaults.

Substitution Of Trustee And Deed Of Reconveyance

Both these documents are closely linked, typically filed when there is a change in the position and requirement of the trustee. The lender appoints a trustee to take charge and arrange the sale proceedings in the event of foreclosure. In some cases, they are appointed to take care of the property.

There are scenarios where a secondary trustee is mentioned in the document, who assumes responsibility if the primary trustee is unable or unwilling to perform the tasks. The document is filled and submitted to the region’s recorder, with which the original documents are filed. A substitution of trustee and deed of reconveyance form helps the lending party appoint a new individual for the trustee’s position and allows them to release the lien.

Various lending institutions may use different terms for the document, but it holds equal significance for the lender to provide it to the borrower upon full repayment of the debt.