Table Of Contents

What Is A Declaration Of Trust?

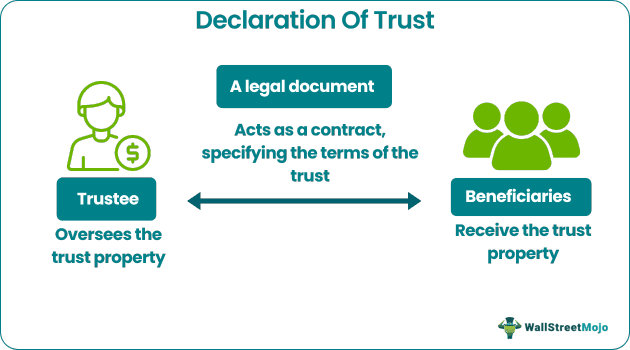

A declaration of trust refers to a legal document that appoints a trustee to manage the assets held for one or more persons’ benefits. It identifies certain funds or property held in the trust and mentions how the trustee will distribute them among the beneficiaries.

The document states the restrictions, if any, on how the beneficiaries can utilize the assets held in the trust and outlines the trust’s purpose. Moreover, one may utilize such a document to adjust an existing trust’s specific aspects. Some crucial elements included in this document are the terms of the trust, beneficiary, revocability, and duration of the trust.

Table of contents

- What Is A Declaration Of Trust?

- The declaration of trust refers to a legally enforceable document that states how the trustee should control and distribute all assets held in the trust. This document specifies the interests, rights, and responsibilities of the beneficiaries and the trustee.

- Some components of this document are revocability, names of the beneficiaries, trust duration, terms of the trust, and the trustee’s name. The cost of declaration of trust depends on multiple factors, like the terms of the trust and the experience of the service provider.

- A disadvantage of this document is that it can become burdensome for the trustee.

How Does Declaration Of Trust Work?

The declaration of trust refers to a legal document utilized to establish a new trust or confirm an existing trust’s terms. It serves as a legally binding agreement between the trust’s beneficiaries and the trustee.

Although the trustees oversee the assets held in the trust, the funds and properties belong to the beneficiaries named in the document. A few examples of trustees are trust companies, individuals, or banks. Under trust agreements, the assets a trustee usually manages assets like securities, cash, or real estate. Such a document also mentions who will take the place of the trustee in the case of death, illness, incapacitation, or any other event.

After the execution of this contract, the issuance of subsequent declarations is possible to make changes to the existing agreement or confirm the current terms.

Individuals must note that state laws govern how this document applies to everyone involved in the trust’s operations, including trustees, grantors, and beneficiaries. Generally, the cost of a declaration of trust depends on who is drafting the document, that person’s experience, and the complexity of the trust’s terms.

Components

The components of the declaration of trust documents are as follows:

#1 - The Trust’s Terms

The terms refer to the instructions provided by the settlor about the trust’s management and the distribution of the assets among beneficiaries. For example, per the settlor’s instructions, the beneficiary must get earnings from a trust asset after reaching a specific age.

#2 - Settlor

Also referred to as trustor or grantor, a settlor is a person who establishes the trust via the transfer of their property. A grantor is responsible for choosing the beneficiaries and trustee and deciding the trust’s terms. Note that sometimes, a trustor can also be a beneficiary or trustee.

#3 - Beneficiary

A beneficiary is an entity or individual who will receive the trust’s benefits. The levels of rights can be different for a trust’s beneficiaries. For example, a few beneficiaries could be entitled to the earnings that the trust generates during their lifetime, and the other beneficiaries might have entitlement to the remaining trust assets once the rights of the other beneficiaries are over.

#4 - Revocability

A trust can be irrevocable or revocable. While the grantor can terminate or change the latter at their convenience during their lifetime, they typically cannot terminate or change an irrevocable trust, except under certain circumstances. Moreover, the grantor may require the court or beneficiaries’ permission to make changes or terminate an irrevocable trust.

#5 - The Duration Of The Trust

This refers to the period for which a trust is going to last. The duration could be a specific number of years, until the occurrence of a certain event or until the death of a beneficiary or the grantor.

#6 - Trust Asset Or Property

Trust property refers to the assets the grantor placed in the trust. It may include an extensive range of assets, such as real estate, securities, cash, life insurance policies, and more.

#7 - The Trust’s Terms

The terms are the instructions a trustor gives about how the trustee must manage the trust property and distribute the assets among the beneficiaries.

Examples

Let us look at a few declarations of trust examples to understand the concept better:

Example #1

Suppose David was the grantor of a trust who appointed Company XYZ as the trustee. At the time of the trust’s establishment, David clearly mentioned that his two sons were the beneficiaries. Moreover, the terms of the trust stated that following the death of David, both of his sons would get 50% of the total trust assets each. So, once David was deceased, Company XYZ distributed the trust assets equally between the two sons.

Example #2

Suppose Jason has various assets, including real estate, stocks, cash, etc. To protect the assets and make sure that his wife does not have any financial trouble in the event of his sudden demise, he establishes a trust. Jason drafts a declaration of trust to ensure there is no confusion or discrepancy regarding the asset distribution. Moreover, the document clearly mentioned all the assets his wife would get in the event of his untimely death. Through the document, he appointed ABC Bank as the trustee.

Advantages And Disadvantages

The benefits and limitations of drafting a declaration of trust document are as follows:

Advantages

- Offers Clarity: This legal document safeguards everyone’s interest in the assets held in a trust by specifying the trustee’s duties and outlining how the assets should be distributed among all beneficiaries. It minimizes disputes or confusion concerning the control and ownership of the assets.

- Ensures Privacy: Contrary to wills, such documents do not become public records. Hence, the trustee can distribute the assets discreetly.

- Provides Control: The grantor can specify the trust’s terms in detail. For example, a trustor may mention that a beneficiary can only receive certain assets after reaching a certain age.

Disadvantages

- Time-Consuming: Trustees usually have to handle daily tasks, such as asset management, communication with beneficiaries, and asset distribution. So, the commitment can become burdensome, especially if trustees have personal or professional responsibilities.

- Lack Of Flexibility: Once a grantor establishes a trust using this document, changing the terms can be challenging, especially in the case of an irrevocable trust.

Declaration Of Trust vs Trust Agreement vs Trust Deed

The concepts of trust agreement, declaration of trust, and trust deed can be confusing. Individuals can fully comprehend their meaning and purpose and steer clear of potential confusion if they know the distinct characteristics of each of these documents. So, let us find out how they differ.

| Declaration Of Trust | Trust Agreement | Trust Deed |

|---|---|---|

| This is a document that a person utilizes to appoint a trustee who will oversee the trust assets for the benefit of an individual or persons. | A trust agreement is a legal document enabling grantors to transfer their asset’s ownership to the trustee who holds it for the beneficiaries. | This refers to an agreement between a borrower and a loan provider to give the property title to any neutral third party, for example, an escrow company, that holds the assets until the debt repayment is complete. |

| It outlines the description of the trust assets and details concerning asset distribution and control. | This agreement enables trustees to avoid probate. | It secures real estate transactions. |

| The components of this legal document are generally revocability, trust duration, and more. | Its components typically include the value of all trust assets, addresses of properties, etc. | The elements of this document include the identities of the trustee, borrower, and lender, besides a complete description of the property and the restrictions on the property’s usage. |

Frequently Asked Questions (FAQs)

This legal document can be valid for as long as it remains active. That said, one must remember that it may include a ‘Variations and Revocation clause.’ This clause allows one to revoke or make changes to the document in the future.

One can follow these steps to prepare such a document:

- Define the purpose.

- Identify all the assets.

- Select the beneficiaries.

- Choose the trustee.

- Decide the terms of the trust.

- Draft the agreement and sign it.

This legal document must be signed by all relevant parties and witnessed. Typically, a witness must not be a party involved in the agreement, unconnected with the involved parties, over the age of 18. In addition, the person must be of sound mind. That said, the requirements may vary slightly across different states or countries.

No, a will cannot override the document.

Recommended Articles

This article has been a guide to what is a Declaration Of Trust. We explain its examples, comparison with trust agreement & trust deed, components, and advantages. You may also find some useful articles here -