Table Of Contents

What Is Debtor In Possession (DIP)?

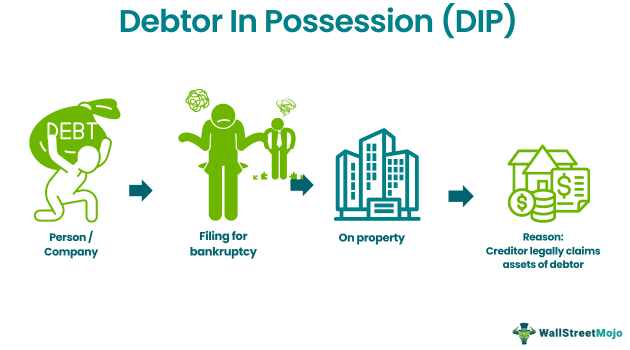

The Debtor In Possession, or DIP, refers to a person, business, or any entity that has sought Chapter 11 bankruptcy protection and is still in possession of property secured by a lien or other security interest on which creditors have a legal claim. The main purpose of DIP is to avoid a default on the creditors by operating a business during the liquidation.

It acts as an essential factor during bankruptcy. It helps the company to continue to operate its business. Also, it provides relief to the creditors as the assets are secured. In addition, it provides better negotiations with creditors about settlements. However, the process involved can be lengthy, time-consuming, and expensive.

Table of contents

- What Is Debtor In Possession (DIP) ?

- The debtor in possession (DIP) is an insolvent person or a corporation where creditors have the right over their assets and property. Debtors need to file Chapter 11 under the Bankruptcy Code.

- In 1800, Congress enacted the first Bankruptcy Code for the interest of debtors and creditors. It includes Chapters 7, 11, and 13.

- Chapter 11 instructs the DIP to avoid disposing of the existing assets and possession unless all claims are settled.

- A creditor in the control committee includes the largest (20) creditors who did not receive their claims from the debtors. Thus, they hold the right to takappropriateul action against them.

How Does Debtor In Possession Financing Work?

The debtor in possession is a title designated (given) to a debtor in bankruptcy where creditors have a claim over the debtor's assets. A debtor turns DIP when they file for bankruptcy. The debtor in possession account appears in Chapter 11 of Bankruptcy of the United States Penal Code. However, it comes with specific strict rules and regulations.

In a typical debtor in possession (DIP) scenario, the debtor makes an effort to recover some value from their assets after filing for bankruptcy. Therefore, A DIP may carry on operating with those assets. However, the court must approve any actions outside the thordinaryal course of business.

Additionally, the DIP must insure any property, maintain accurate financial records, and submit accurate tax filings. The ability to continue operating a firm while having the authority and responsibility to do so in the best interest of any creditors is the main benefit of having DIP status.

The debtor in possession loan provides funding to bankrupt companies. However, before accessing the DIP facility, the debtors must file Chapter 11 of Bankruptcy with the U.S. Court of Justice. Besides, they need to fulfill many other formalities, like the following:

- Debtor in possession financing cannot sell or dispose of any company asset without the court's permission.

- Debtors can conduct the ordinary course of business during this phase.

- They are given a whole 120 days after filing to reconstruct their business plan.

- Use the time to negotiate with the creditors and other shareholders.

History

The debtor in possession history relates to its legislation in 1978. During the 19th century, the rate of bankruptcies in European countries and America increased. Throughout the 1700s, there were 41 to 86 defaults in these nations. Thus, the administrators put these default entities and individuals into the debtor's prison. As a result, a system that regulated bankruptcy became necessary. However, although bankruptcy rules existed, the debtors and creditors still suffered.

Thus, in 1800, Congress proposed the U.S. Bankruptcy Act. It included Chapter 7, Chapter 11, and Chapter 13. Each of them had certain rights and liabilities for debtors and creditors. Chapter 11 specially governed the debtor in possession financing in the possession credit facility. The main reason was to protect the interest of creditors and allow debtors to operate their businesses alongside. Also, the debtors can come out of financial distress through DIP financing.

Rules And Guidelines

Let us look at the prescribed rules and guidelines by the Federal Court of Justice on the debtor in possession check:

- The debtors need to follow the Bankruptcy Code in all aspects.

- Pay all the post-petition debts and obligations if due. These include general business expenses, wages, payroll, property, and sales taxes.

- File all the due state, local, and Federal taxes.

- No pre-petition and professional employment fees, even though they arise from post-petition. Until the court does not approve it, they are forbidden to do so.

- Disposal of any possession or property cannot occur unless the creditor claims are settled.

- Debtors cannot use any cash collateral in the phase of bankruptcy without a court order. Also, they cannot obtain any secured or unsecured credit and debt.

- Maintain all insurance payments thereon if any are due. Upon the filing of Chapter 11, the court's debtor in possession check forces them to present the insurance proof along with a "Certificate of Holder."

- The post-filing orders the debtors to close any existing bank accounts immediately. Thus, open a new debtor in possession account and a new payroll account.

- Funds held during the bankruptcy phase should be deposited in this new account, complying with the United States Trustee. However, it should be within the approved limits.

- Mention the 20 largest creditors with a significant interest claim on the debtor's assets.

- Present all the required documents at the Debtors and creditors conference.

- According to the DIP check, the debtors must pay quarterly fees. The minimum DIP fee is $325 if there are no default payments.

If DIP fulfils all the mentioned compliances, the court might allow their operations. As a result, the debtor in possession lenders might also help them to fund their businesses.

Account Requirements

Let us understand the debtor in possession account requirements for the process.

- It is necessary to close all the existing bank accounts that existed before the entity getting converted into debtor in possession.

- Then new accounts related to the debtor in possession loan should be opened, as many as required.

- Every account should clearly state the purpose of opening them.

- They should have the case number taken from Chapter 11 and mention it in the account. It is important that this number should be mentioned in the checks in printed form clearly.

- The depository’s name, the name and number of bank account and the amount that will be treated as an initial deposit will be mentioned in the Declaration Regarding Compliance.

- As long as the case continues, it is essential to maintain the cash from the estate in the respective accounts through a depository who are approved to handle them. This is a responsibility of the debtor.

- If the debtor happens to close any account or open any new account, then they should inform the same to the U.S Trustee in a written form.

Thus, the above are some important requirements that the debtor should follow in such cases.

Example

Let us look at the debtor in possession bankruptcy example to comprehend the concept better.

In October 2022, LATAM Airlines Group finally exited the Bankruptcy case after securing the required financing. According to the Santiago-based airlines, they received funding of $5.4 billion from the debtor in possession lenders. Besides, during this bankruptcy process, they reduced the debt by up to 35%Furthermore, another e-cigarette-making firm, Juul Labs Inc signed for DIP financing in a similar month.

Debtor In Possession Vs Creditor In Control

Although DIP and creditors in control are a part of Chapter 11, they differ slightly. While the former involves the debtor, the latter includes the creditors waiting for their default claim. In addition, the DIP allows insolvent debtors to maintain assets in bankruptcy.

However, if these debtors fail to make respective payments to the creditors, the latter can keep a committee on this. Per the creditor in control committee, if the debtor does not pay within 10 days, they can lawfully get a claim under insolvency.

| Basis | DIP | Creditor In Control |

|---|---|---|

| Meaning | A person or company filing for bankruptcy with possession of assets. | A creditor’s committee is formed in case of default of claims from debtors. |

| Purpose | It provides a claim of interest to creditors | To help to regain the amount from debtors. |

| Person involved | Either individuals or corporate that went into bankruptcy. | Majorly includes creditors |

| No of days | 120 days | 10 days |

Frequently Asked Questions (FAQs)

When banks dissolve or fall into bankruptcy, the court declares them DIP. In such cases, they must follow the Bankruptcy code for the same and freeze the existing bank account.

In a bankruptcy case, both debtor and creditor have equal benefits. While the debtor gets to continue their existing business, the creditor gets assurance about the claims and liens from the debtors.

While DIP is the insolvent person or company, the court of Justice appoints the trustee to overlook the bankruptcy case. The trustee supervises whether the debtor fulfills the requirements under the DIP case.

Fobankrupt businesses, there is a unique type of financing called debtor-in-possession (DIP) financing. DIP funding is only available to businesses that have submitted a Chapter 11 bankruptcy, petitiontypicallyce at the beginning of a filing.

Recommended Articles

This article has been a guide to what is Debtor In Possession. We explain its differences with creditors in control, account requirements, history, rules & guidelines. You can learn more about it from the following articles -