Table Of Contents

Debt Service Reserve Account (DSRA) Meaning

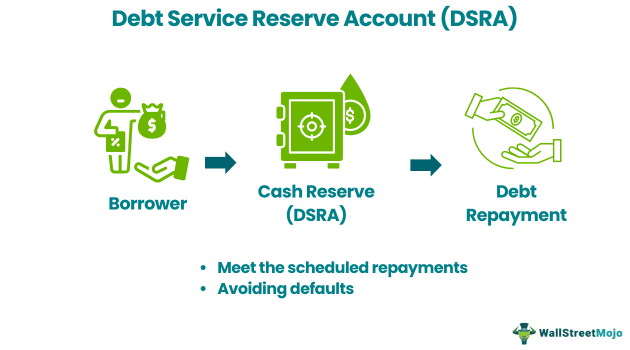

Debt Service Reserve Account (DSRA), is a reserve account created by the borrower to set aside some cash to pay the debt back to the lenders. The main purpose of this account is to avoid any form of cash disruption or default risk.

The DSRA has a phenomenal role to play in project finance. It reduces the risk factor of default payments to lenders. Plus, DSRA increases the credit score of the borrower. In addition, there are positive cash flows maintained. However, Debt Service Reserve Account requirements can be heavy.

Key Takeaways

- A Debt Service Reserve Account (DSRA) is a bank account opened by the borrower to keep aside an amount to avoid defaulter risk in the future.

- According to the SEC (Securities and Exchange Commission), the borrower must pay on the construction's last day or else should make partial payments to the lender.

- The borrower can fund the account once the project starts making positive cash flows. The two types include annuity and sculptured style DSRA.

- The only difference between DSRA and DSRF is that the former only provides a single bank account for reserves. But the latter is a contractual agreement.

How Does A Debt Service Reserve Account Work?

Debt Service Reserve Account acts as a secret reserve for a contingent liability arising from the outstanding debt of the borrower. Here, there is mitigation of default risk within the lenders and borrowers. In most cases, the latter tends to be business owners, and financial institutions like banks act as lenders.

At times, there is a constant risk of default by the borrower. As a result, the lender might advise the borrower to open a DSRA. It includes both principal and interest repayment. The holding period for the Debt Service Reserve Account requirement is 6 to 12 months. So, if a borrower has capital usage for four years, the lender will ask the former to keep some reserves aside for a year. It will ensure the borrower does not deny the payment. However, the funding phase has a detailed process.

The major application of the debt service account clause is in the construction contracts. As per the DSRA agreement, three funding (initials) methods are listed in the Debt Service Reserve Account agreement. They also include a target balance that includes both interest and principal payments. Let us look at them:

● Full funding on the last day of the construction

● Partial funding is on the last day, and the rest is recovered from the project's future cash flows.

● Funding is entirely from the project's cash flows.

Let us look at the two types of Debt Service Reserve Account clauses for a better understanding:

#1 - Annuity Style

In the annuity-style DSRA, the borrower must make monthly, quarterly or yearly payments. In short, the total payments will be evenly distributed to pay the interest amount first. Later, the lender provides a grace period after completion to pay the rest amount (interest and principal).

#2 - Sculptured Style

In a sculptured style DSRA, the debt payments increase with the DSRA reserves. The firms tend to force debt payments to generate higher returns. Therefore, the debt capacity is higher than the annuity style.

Although most project finance models include DSRA, the Debt Service Reserve Account accounting treatment differs. Since DSRA is a cash balance for the firm, it is treated as a current asset. For a lender, it acts like collateral that ensures timely debt payments.

Since businesses can also model it as a control account, it can be treated as a comprehensive account consisting of opening and closing balances, and cash inflows and outflows. Plus, there are columns representing the projects where repayment requires DSRA. So, if any month has a shortage of funds, the business can withdraw cash from the DSRA account.

Examples

Let us look at these examples to understand the concept better:

Example #1

Suppose ABC Ltd is a firm engaged in the production business. They planned to build a plant on 4-acre land. However, they did not have enough funds to execute this project. Therefore, they took a loan of $150,000 from Sit-in Bank, including a Debt Service Reserve Account clause.

As per the DSRA agreement, ABC Ltd will set aside the debt amount on the last day of the construction. Or else, they will make a partial reserve on the last day, and the rest will be recovered as the plant starts making revenues.

Example #2

Another example is associated with the Siti Networks, a company belonging to the Essel Group. Standard Chartered Bank had provided credit facilities to Siti Networks, and these facilities were secured, in part, by the Debt Service Reserve Account (DSRA) support and undertaking provided by Zee Entertainment.

Zee Entertainment Enterprises Ltd. has finalized a one-time settlement agreement with Standard Chartered Bank in connection with a loan that Siti Networks took. The settlement aims to address defaults on the loan taken by Siti Networks. The DSRA is the reserve account created to set aside cash to pay back the bank's debt and mitigate the default risk.

In essence, it played a role in securing the credit facilities provided by Standard Chartered Bank to Siti Networks. The details of the settlement and its terms are likely outlined in the agreement between Zee Entertainment and Standard Chartered Bank. The objective is to resolve any outstanding issues related to the loan and associated defaults.

Debt Service Reserve Account vs Debt Service Reserve Facility

Although DSRA and DSRF have similar applications, they have distinct characteristics. Let us look at their differences:

| Basis | Debt Service Reserve Account | Debt Service Reserve Facility |

|---|---|---|

| Meaning | It refers to the bank account opened by the borrower to create reserves for loans taken. | A debt service reserve facility (DSRF) is a service provided in a contractual agreement between the borrower and the lender. |

| Objective | To reduce the risk of default payment by the borrower. | It enables the borrower to get project capital to fulfill their financial needs. |

| Acceptance | DSRA is a narrow concept that only provides the bank account to create reserves. | DSRF is a wide concept that makes funds arrangements for borrowers. |

| Number of Account | There is a single account allocated to the borrower. | Here, DSRF might include multiple accounts. |