Table Of Contents

What Are Debt Securities?

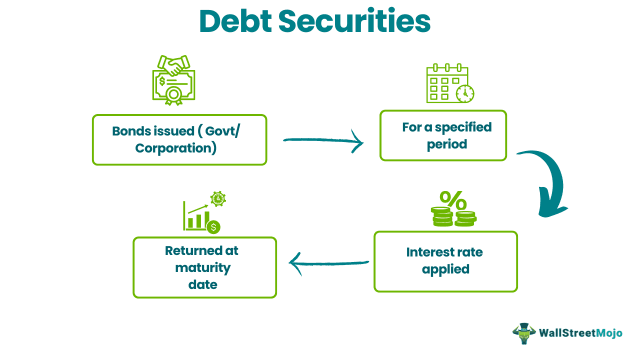

Debt securities are issued by governments and corporations and sold to investors as fixed-income debt assets. Every security has an associated coupon rate; It refers to the interest received by the investor. Interests are paid in the form of monthly premiums.

Securities have a fixed maturity date; investors receive the entire principal amount upon maturity. As a result, investors opt for this investment for long-term yields. Debt securities are the go-to investment option for those seeking a fixed-income stream. It caters to retirement planning as well.

Key Takeaways

- Debt securities are debt assets traded between two parties before their maturity date.

- Governments and corporations issue them. Securities are treated as financial assets that pay a regular income stream and are therefore referred to as fixed-income securities.

- Government bonds, US treasury bills, and corporate bonds are the most common examples of securities in the US.

- Government bonds are considered the safest form of securities (compared to corporate debt securities or corporate bonds) because a stable government backs them. It is doubtful for a powerful government to default on its payments.

Debt Securities Explained

Debt securities are assets issued by governments and corporations. Governments use these financial instruments to raise capital. Capital is further utilized to fund business operations and to build infrastructure.

Simply put, it is a reverse loan—investors provide funds to governments instead of interest payments. As a result, interest payments become a steady income stream for investors.

As the name suggests, debt securities meaning revolves around the issuance of bonds. Investors purchase these financial instruments for short-term and long-term periods because they consider them safe.

In the US, treasury bonds are considered the safest form of securities (compared to corporate debt securities or corporate bonds) because the United States government backs them. As a result, it is doubtful for a powerful government to default on its payments.

Government bonds are classified based on the issue date. Investors purchase these bonds at a special coupon rate. When a bond matures, the company or government repays the principal amount to the investor. An investor may choose to keep the bond till the maturity date or sell it in the secondary market.

Those who lack knowledge of stock markets and financial products prefer debt securities investments (low risk and assured returns).

Types

It is subdivided into the following types.

#1 - Government Bonds

They are also called treasury bonds, considered the safest investment as the United States government backs them. The raised funds are used for infrastructure construction, military contracts, and public healthcare. Primarily, the bonds are issued for twenty to thirty years with a fixed six-month interest rate.

#2 - Commercial Paper

Firms use it to support their payroll, inventories, and short-term liabilities. These investments are considered unsecured securities. The maturity date varies from one to 270 days. Investors receive a discount on its face value. The minimum denomination limit is $100,000—with a fluctuating interest rate.

#3 - Corporate Bonds

Large corporations also issue bonds. However, instead of the investments, the companies pay an interest rate to the investors. Corporate debt securities are similar to government bonds but differ from equity securities. That is, corporate bonds do not offer any ownership or stock-holding rights to investors.

#4 - Treasury Bills

Treasury bills are a part of the US treasury securities. They are further classified into three subtypes—T-bills, T-notes, and T-bonds. Typically, treasury bills are short-term securities with zero coupons (also known as cash management bills). These are issued for four weeks, 13 weeks, 26, or 52 weeks. They are sold at a discount (less than par value). Upon maturity, investors receive the face value of the T-bill.

#5 - Municipal Bonds

These are similar to government bonds. The only difference is that income generated from municipal bond interest is not subject to federal income tax. Municipal bonds are issued by states, cities, counties, and government offices. The raised funds are used for building roads, schools, hospitals, etc.

Features

The features of debt securities are as follows:

- Every security comes with an Issue price and issue date. The term issue date refers to the date on which the bond was first issued. They are primarily issued at face value and then traded at market value. The market value fluctuates—it could rise above the face value or plummet.

- The term coupon rate refers to the interest rate received by investors. This is paid in the form of monthly payments. The coupon rate can remain constant or fluctuate—depending on inflation and market conditions.

- On the maturity date, investors receive the entire principal amount from the corporation or the government. Maturity dates are either short-term or long-term.

- Yield to maturity (YTM) refers to the expected returns an investor anticipates after keeping the bond intact till the maturity date. Simply put, it is a bond’s returns scheduled after making all the payments throughout the life of a bond.

Examples

Let us look at some examples to understand securities better.

Example #1

Let us assume that a corporation issued bonds as corporate debt securities on 9th September 2009. Peter bought the bonds for $90000. The bond's maturity date was 9th September 2021—a tenure of twelve years. The bond came with a coupon rate of 4% (the interest paid by the corporation to Peter). Peter received interest in the form of monthly premiums.

So, from Peters's point of view, he receives 4% of 90000—$3600 every month for twelve years. Peter gets this amount regularly from the issue date (9th September 2009) to the maturity date (9th September 2021).

Upon maturity, Peter will also receive the principal amount. In the meantime, Peter is allowed to sell the security in the secondary market (to another company). Corporate debt securities are re-packaged and sold in the secondary market as debt assets.

Example #2

Let us look at another example.

Credit Suisse Group AG is a global investment bank headquartered in Zurich, Switzerland. It offers to buy back securities worth $3 billion in cash. In addition, the institution announced the results of a strategic review on October 2022 (about asset sales and market exit units).

Meanwhile, the Swizz government plans to implement a new law offering public liquidity backstop for systemically relevant banks.

Currently, Credit Suisse recorded a 13.5% CET1 capital ratio in June, which is sufficiently ahead of the international regulatory minimum of 8% and 10% requirement of Swiss regulations.

Tier 1 Capital Ratio is the ratio of capital available for banks on a going concern basis. It is expressed as a proportion of the bank’s risk-weighted assets. Tier 1 capital includes the bank’s retained earnings, shareholder's equity, other accumulated income, and debt instruments.

The bank is also trying to separate tender offers concerning $12 senior debt securities with an aggregate consideration of around $2 billion.

Debt Securities vs Equity Securities vs Loans

Debt securities, equity securities, and loans are similar. Let us look at their salient features to distinguish between them.

| Basis | Debt Security | Equity Security | Loans |

|---|---|---|---|

Meaning | Governments and corporations issue bonds and treasury bills to raise capital. | These are shares of a company listed on the stock exchange. | These are treated as liabilities. |

| Significance | It is a loan to the issuer. | It signifies ownership in the company. | It is a debt agreement between a lender and a borrower. |

| Maturity | It usually comes with a maturity date. | No maturity date is applicable. | Typically comes with a fixed loan tenure. |

| Return | It yields a fixed return with a fixed rate of interest. | Returns vary depending on market conditions, stock performance, and dividends. | It comes with either a fixed interest rate or a floating interest rate. |

| Rights | Securities do not offer voting rights. | Voting rights are present are available for equity securities. | The lender has the right to seize the collateral in case of default payments. |

| Example | US treasury bills, bonds, T-notes, and commercial papers. | Stock holdings and company ownership. | Personal loans, car loans, home loans, education loans, etc. |