Table Of Contents

What is Debt Relief?

Debt relief is a process through which the debts acquired by individuals and entities can be readjusted so that the borrowers get partial or complete relief from paying off the creditors. In addition, it helps reorganize and consolidate the scattered loan payment and settle them at an amount that is fit for both the indebted entity and the creditor.

Commonly referred to as debt settlement, the process is considered one of the cheapest ways of reorganizing debts per the convenience of both parties involved. They mutually agree to settle the outstanding dues at a fixed amount. However, this debt handling system becomes risky, given the frauds taking advantage of the debtors.

Table of contents

- What is Debt Relief?

- Debt relief is a program introduced to help debtors make repayment while they struggle financially and creditors who are at risk of debt mitigation.

- Creditors include certain relaxation in the programs since the debtors cannot repay the total or partial debt.

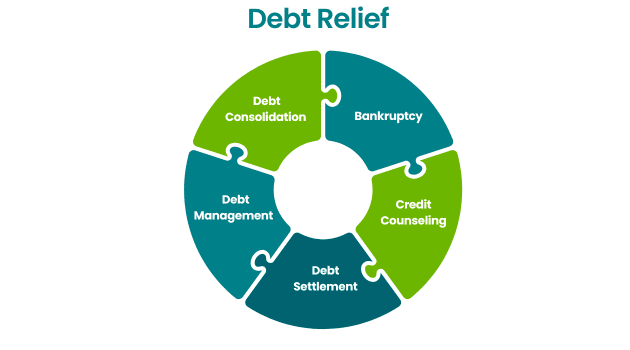

- The debt management plan, credit counseling, debt settlement, bankruptcy, debt consolidation, etc., are some of the best relief programs for debtors.

- These debt-relieving plans could be risky as debtors' involvement in reducing or settling loans directly and negatively impacts the credit score.

How Does Debt Relief Work?

Debt relief serves to be an effective measure to avoid debt mitigation. While it pleases debtors to see creditors offering debt settlement measures, the latter opt for such reorganization of debts only when they suspect defaults. Thus, the creditors and lending institutions find it safe to choose these programs. The debt settlement amount normally ranges between 10-50% of what debtors owe.

When lenders offer loans to borrowers, the latter has to pay back the amount plus the applicable interest charge. In such a scenario, many fail to make the repayments. The moment the creditors suspect defaults, they opt for debt adjustment programs to ensure they get at least a part of what the other party owes to them. In short, adopting and implementing debt relief solutions minimizes the debtors' financial burden and assures creditors of getting back their loans.

There are multiple ways in which debt relief programs work. One of the most common is the reduction of the interest rates on loans. The creditors, in addition, might decide to make changes to the repayment terms or reduce the principal amount. Refinancing and consolidation of debts also help in accumulating scattered amounts in one place. Here, borrowers have to repay to a single source rather than multiple financiers.

People and entities choose the debt relief options due to their inability to repay unsecured loans within the specified period. Considering these alternatives becomes a must as soon as the borrowers start struggling to repay the lenders and they seem to have tried everything on their own to manage the debt, but nothing worked. Last but not least, when businesses are likely to file bankruptcy, a debt adjustment option turns savior.

Debt Relief Strategies

The debt relief methods are many, and creditors and debtors have the liberty to decide and agree upon the one that best suits their requirements.

#1 - Credit Counseling

Credit counseling is one of the basic options that debtors can opt for. In the process, they consult a credit counselor to discuss their affordability and debt payment issues. Then, the counselor goes through the details they share and personalizes a debt management plan to help debtors and creditors.

#2 - Debt Management Plan

The debt management plan consists of all available debt handling options. The debtors, then, need to enroll in the scheme that seems convenient to them. The indebted individuals or organizations must make a single payment for each plan they opt for every month. The received payment then reaches the lenders awaiting repayments with respect to the terms and conditions of the respective plans.

#3 - Debt Consolidation

The next effective debt adjustment option is debt consolidation. When one has multiple loans scattered around different sources, this option allows them to bring all the debts together. Therefore, the individuals or entities become liable to pay only one single source.

#4 - Bankruptcy

Filing for bankruptcy is what most businesses opt for to pay off their creditors. Corporate loans are huge in volume. Hence, the owners have only one option left, i.e., filing bankruptcy. This option involves the liquidation of the non-exempted assets of the debtors. As a result, the debtors can use the funds to pay back the creditors. In addition, the organizations get a chance to start afresh with a new identity.

#5 - Debt Settlement

Though bankruptcy is normally the last resort to debt handling, individuals and entities can opt for debt settlement. This is the process in which debtors consult the creditors and discuss the problems relating to the repayment. If the latter agrees, they reduce the loan amount to a feasible limit for you to pay. Unfortunately, while this option seems to be most effective, it affects the debtors' credit score to a great extent. This makes it difficult for them to obtain any finance from any lender in the market in the future.

Examples

Let us consider the following examples and check what initiatives make the debt relief activity as effective as possible.

Example #1

Association of Family and Conciliation Courts presented data to show how cheap the debt settlement option is for the debtors. US's renowned debt negotiator, Freedom Debt Relief, compiled the data. Based on it, the negotiator confirmed that the credit scores can be recovered soon despite being adversely affected by the debtors' decision of opting for debt settlement plans.

Example #2

The World Bank collaborated with the International Monetary Fund (IMF) to reduce the citizens' debt burdens. They offered the best national debt relief options to citizens struggling with poverty. The program's main objective was to achieve the Sustainable Development Goals (2015-2030).

Accordingly, the scheme divided the plan into two categories. While the Multilateral and Bilateral Debt involves debt accumulation, Commercial Debt provides debt relief grants to eligible governments, allowing the latter to buy back at huge discounts.

Risks

Lots of risks associated with opting for such schemes. The most significant is the direct impact of the debt settlement or adjustment on the credit score. Though debts are adjusted and settled, the late payments of the written-off amount are recorded at the credit rating agency, and the credit score is reduced accordingly.

Moreover, if the amount settled or forgiven is more than $600, debt relief taxes are applicable for debtors. Plus, this program comes with many hidden charges to be paid to the debt relief companies, which may be higher. Above all, there is no guarantee that creditors will agree to the settlement offers. In fact, they might file a lawsuit against the debtors if they suspect defaults.

Frequently Asked Questions (FAQs)

DRO is considered a cost-effective alternative to bankruptcy, which helps deal with the debts when one cannot afford to pay back the creditor. In the process, debtors can skip paying the installments for a specific time. Post that period, the amount for that time range is written off. It is, however, applicable only where the debt is low.

Anyone struggling to pay back their loan is eligible for the benefits of these programs. However, it is not for those who want to continue adding debt balances or are unwilling to go for long-term engagement to repay debts.

Yes, these programs are legitimate schemes introduced by national authorities to help citizens partially or fully repay their debts when they struggle with paying back their lenders. The creditors and debtors mutually agree to an amount to settle the loan.

Recommended Articles

This article is a guide to what is Debt Relief and its meaning. Here we explain the strategies/options available and the risks involved with examples. You can learn more about it from the following articles: -