Table Of Contents

What Is Debt Market?

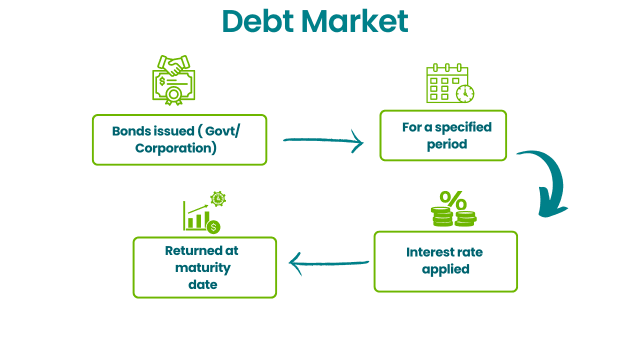

The debt market is a marketplace for debt securities. Investors buy debt securities issued by companies and federal authorities. The issuers sell securities to raise capital and use it to fund business operations, infrastructure development, and military projects. It plays an important role in facilitating economic growth and stability by connecting borrowers and lenders, enabling the flow of capital, and promoting investment.

Here, treasury bills, government bonds, and corporate bonds are traded. In return, investors receive coupon payments—periodic interest payments. Thus, debt security investors get a steady income stream, considered among the safest investments. Debt security investors do not attain any ownership or equity.

Key Takeaways

- The debt market facilitates the sale and purchase of government bonds, corporate bonds, treasury bills, and notes.

- In this marketplace, other financial instruments or equity cannot be traded.

- The loan market is further classified into the primary and secondary markets. In the primary market, investors purchase bonds directly from the issuer.

- Investors can buy and sell securities over the counter (OTC) in the secondary market.

- Debt securities are considered one of the safest investment vehicles. On the flip side, debt securities offer very low returns compared to other investment options. Thus, the opportunity costs are high.

Debt Market Explained

A debt market is a marketplace for debt instruments and securities. This market deals in debt instruments only—equity and other financial instruments cannot be traded here.

There is a fundamental difference between equity and debt markets; equity offers ownership, and debt securities do not. Debt securities are loans—investors offer loans to a corporation or government. In return, the borrower pays a coupon rate to the investor (till maturity).

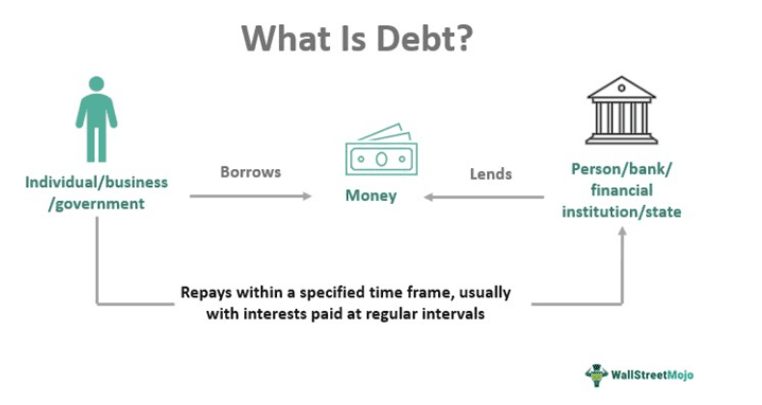

Before venturing further, let us quickly define debt. Debt is the practice of borrowing a tangible item, primarily money. The borrower could be an individual, business, government, financial institution, or state. The lender is often referred to as a creditor. The loan could involve cash, a mortgage, bonds, or a credit card.

Individuals, corporations, and governments borrow funds to purchase products, properties, assets, and services or meet a need that would otherwise be unmet. The borrower agrees to return the amount within a specified time frame. In most cases, this involves periodic interest payments. The debt is classified into secured, unsecured, or guaranteed, depending on the collateral.

Debt markets are considered safer than equity markets. In equity markets, investors need to know about the company they are investing in. But not all investors have the time or access to conduct thorough research. As a result, a stock market crash can disrupt an equity investment for a long period. Fortunately, this is not the case with the debt market.

The debt market of India is one of the largest in the Asian continent. Also, US treasury bills are considered the safest form of investment. It is highly unlikely that the US government will default; thus, investors receive safe long-term returns. The debt market offers a steady income for ten or twenty years. Usually, investors receive a coupon in a semiannual system (once every six months).

This marketplace also benefits corporations; they can sell bonds to investors with adequate knowledge of the capital markets. But unfortunately, the private debt market is highly leveraged and mostly unrated.

Types

Let us look at debt market types.

#1 - Primary

It is the marketplace for creating, issuing, and trading new securities; governments and corporations initiate debt financing. They raise capital to fund business operations and infrastructure development.

The issuers sell shares, bonds, bills, and notes. Investors purchase debt securities directly from the issuers. The Securities and Exchange Commission (SEC) enforces strict rules in the primary markets. Once all the debt securities offered in the initial offering are sold, the market is closed.

#2 - Secondary

Trading in the secondary debt market begins after closing the primary market. Here, investors sell securities. However, there is a fundamental difference between both markets. In the primary market, the money goes directly to the issuer. In contrast, the secondary market dictates the price and yield of each bond.

All the bonds are traded over the counter (OTC) in the secondary market. That is, these debt securities are not listed on the stock exchange. Rather, the investor approaches a broker to arrange a sale or purchase.

Examples

Let us look at debt market examples to understand debt securities better.

Example #1

Daniel has just started investing; he doesn't know much about the equity market. However, he has a low risk appetite. As a result, he comes across debt securities during initial research. Further, he narrows down on US bonds.

If he buys a US bond from the primary market—he will receive regular coupon payments. Since the United States government backs it, default risks are minimal.

Now, Daniel may keep the bond till its maturity and receive periodic payments or sell it in the secondary market.

Example #2

The Bank of Japan intends to underpin the loan market. It conducted an emergency bond purchase, but the yields kept rising. So the bank bought government bonds worth 250 billion yen ($1.67 billion). The bonds had a maturity period of five to 25. Nonetheless, the impact was minimal. The bond prices soared to their highest peak since 2015.

Debt market vs Equity Market vs Money Market

Now let us look at debt market vs equity market vs money market comparisons to distinguish between them.

- Debt securities are bought and sold in the debt market. In the equity market, shares belonging to publicly listed companies are traded. On the other hand, the money market is the wholesale trading of debt investments.

- In comparison, debt markets are considered the safest of the three. Likewise, the money market is considered safer than the equity market.

- Bonds, treasury bills, and notes are traded in the loan market. In the equity market, company shares are traded. On the other hand, commercial papers and certificates of deposit trade in the money market.

- The loan market offers coupon payments to investors. The equity market offers dividends, ownership, and voting rights to shareholders. On the other hand, the money market offers higher interest (compared to a savings account) but limited withdrawals.

- In the loan market, transaction costs are not standardized. That is not the case with equity markets.