Table Of Contents

What Is Debt Management?

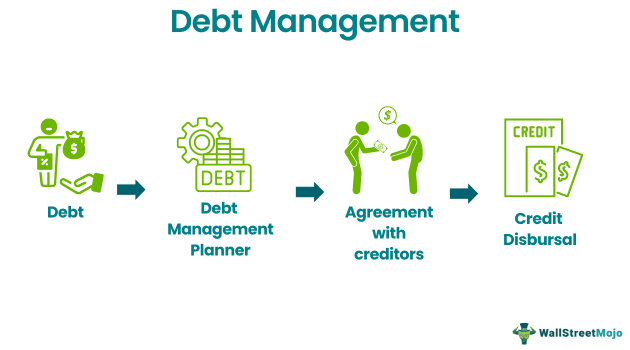

Debt management is the planning of controlling debt in a business by securing unsecured debts. It helps minimize the company's outstanding and unsecured obligations and regain control of the finances. An agreement between the creditor and debtor addresses the terms of the credit, stating the interest rates.

It aims to lower debt by reducing interest rates and lowering monthly payments. It is primarily for unsecured debts. A credit counseling agency helps the debtor in agreeing to lower interest rates. An insolvency practitioner, in turn, will help you manage your money by reducing expenses and creating a budget. Simplification and regularization of payments improve the credit score of the debtor.

Key Takeaways

- Debt management enables a debtor to pay down all the unsecured debts via a single monthly payment system. A consultancy agency helps by consulting the creditors on behalf of the debtor.

- It simplifies the repayment process and removes the burden of the debtor. However, it may take a longer time to settle such loans. Such programs are primarily for non-priority loans like credit cards.

- Since it is an informal agreement, debtors can terminate whenever possible.

How Does Debt Management Work?

Debt management is a comprehensive plan for lowering the debt burden within a stipulated period. Typically, a third-party provider, such as a management firm or a credit counseling agency, sets up and administers a program. The debt planner will work to create a budget before setting up the project. This illustrates payment plan debts after meeting living expenditures and priority payments.

After covering living expenses, the remaining funds are equitably distributed among creditors. A monthly fee goes to the debt management companies for their services, which manage the terms of the agreement between debtor and creditor and help send the appropriate amounts to your creditors.

However, since it is not a contract, a debtor is not obligated to abide by it and can end it whenever they choose. It's an informal agreement, and debt settlement takes place through monthly payments. Such contracts are for non-priority debts like credit cards and loans.

Strategies

Debt planning includes reworking on budget by prioritizing debts, reviewing loan terms, increasing cash flows, and increasing sales at the end. Some of the classic and popular strategies are as follows.

#1 - Debt Avalanche Method

The debt avalanche approach makes the minimum payments on unpaid bills, then pays off the highest interest rate loan with any money still designated for debts. In the avalanche strategy, interest rates reduce to a more significant extent.

#2 - Debt Snowfall method

The debt snowball process entails paying off the smaller debts first to clear the way for larger ones before continuing. First, list each outstanding debt in descending order of size. Then, putting as much additional money into each payment, aim to pay off the first one first. On the others, only pay the minimum. The extra cost is applied to the next-smallest one when the initial debt is paid off.

#3 - Debt Snowflake Method

The debt snowflake approach focuses on making modest financial contributions through regular spending reductions or side income. Then, these tiny sums are combined at the end of each month to pay down additional debt and the required minimum payment.

Examples

Let us understand it through the following examples.

Example #1

Suppose Daniel had a list of debts in the following manner:

1) Student Loan: 5,00,000 at 14.25%;

2) Car Loan: 1,50,000 at 10.5%;

3) Credit Card# 1: 45,000 at 36%;

4) Credit Card# 2: 1,50,000 at 38%

5) Credit card number three: Rs. 25,000 at 30%

The debt avalanche technique prioritizes paying off Debt four, then debt three, debt fifth, debt first, and debt second, listed in the order of interest rate payouts. So, in addition to making the minimum payment on the remainder of the debt, any extra money from the financial budget is used to pay off the second Credit Card. In this case, loan amounts or sizes are not taken into account.

Example #2

Recently in November 2022, the Ministry of Finance rejected the Circular Debt Management Plan (CDMP) of OGDCL, PPL, and GHPL developed by the Petroleum Division on a non-cash settlement basis. As a result, outstanding receivables for these three firms have risen to an alarming Rs 1.6 trillion, consisting of Rs 1.124 trillion in principle and Rs 448 billion in interest and LPS.

Pros and Cons

Like many other alternatives, debt management services have benefits and drawbacks. They might be generally favored for their adaptability and capacity to consolidate debts in a single manageable monthly payment successfully. However, it doesn't ensure that interest rates would be frozen.

Pros

Some of the benefits are discussed below.

- End of the contract with creditors - As soon as you and your creditors agree on a repayment schedule, your creditors stop making money demands. The management company proposes on your behalf.

- Single monthly payments - Your debts should be much simpler to manage if you consolidate them into a single, manageable monthly payment. In addition, if creditors accept the arrangement, you won't have to worry about managing several payments to different organizations; you can focus on one.

- Save money - Savings throughout the plan might be significant when combined with the lower interest rate and the expedited repayment period.

Cons

The disadvantages of credit management plans can be understood in the following manner.

- Longer plan - Debt Management Program may be in effect for a very long time, depending on your circumstances and the magnitude of your repayments.

- No impact on interest rates - While creditors are not required to comply with your request, you can ask them to do so if you have a management plan. It depends on the prerogative of the creditors.

- No legal enforcement - A debt management plan is not enforceable in court. So although it provides you with additional options, it also means that the law doesn't protect the solution.

Debt Management vs Debt Settlement vs Debt Consolidation

Debt management is the strategy for reducing unsecured debts with the help of a credit counseling organization. In comparison, debt balances are negotiated with the creditors to lower the amount in debt settlement. At the same time, debt consolidation calls for combining the loans into a single loan with a single interest rate.

The crucial differences among them can be understood in the following ways.

| Basis | Debt management | Debt settlement | Debt consolidation |

|---|---|---|---|

| Objective | Rolls multiple debts into one single monthly payment. | Lower the total amount of debt via negotiation. | Reduce the number of creditors by combining them. |

| Impact On Credit score | Influences credits scores initially. | It affects the score significantly before the final payment. | Slightly. |

| Cost Involved | Consultancy agency charges are exorbitantly high. | Fees between 15%-25% go to debt settlement companies. | In addition, a new consolidated loan may involve a fee. |