Table Of Contents

Debt Default Meaning

A debt default is when the borrower fails to repay the loans taken, affecting the borrower’s reputation. However, before the debt is declared as a default, a notice is sent to the borrower stating the debt's position and the lender's intention to claim it as default in case of non-repayment of the debt.

These non-repayments or defaults on debt obligations are not just limited to individuals and organizations. In fact, the federal government has also defaulted on the repayment of loans. This is often referred to as national debt default. In such scenarios, an economy can easily slip into recession and the Feds might have to increase the borrowing limit.

Table of contents

- Debt Default Meaning

- A debt default occurs when a borrower cannot repay the loans they have taken, and it can harm the borrower's reputation.

- Before declaring a debt default, the lender must send a notice to the borrower stating the debt's status and the lender's intention to consider it a default if the debt is not repaid.

- The types of debt that can default include secured loans, unsecured loans, debentures, and bonds.

- The effects of a debt default can include an increase in the cost of borrowing, inflation, regulatory restrictions, and market volatility.

Debt Default Explained

Debt Default is the situation where a borrower has defaulted in paying the debt given by the lender. The default may be because of various reasons. The lender will try to secure the debt to minimize the risk of loss by taking insurance, guarantors’ consent, and asking for collateral.

In the case of secured loans, one can recover the loan by selling the collateral attached to it. But in the case of an unsecured loan, legal action is the only option left with the lender. The borrower can prevent themselves from defaulting by accepting and entering into the settlement or asking for help from family and friends.

In debt default, the borrower fails to repay the debt at the scheduled time, i.e., on maturity. For each organization, the default period is different. For example, for some lenders like individual lenders, non-repayment of single installments amounts to default. In contrast, non-repayment of three installments is considered the default for banks, and financial institutions.

Before the debt is declared default by the lender, the borrower has been allowed to repay the debt or enter into a debt settlement, depending on the borrower’s choice. The default status negatively affects the borrowers’ reputation and market standings. There are many default types of debt, including secured loans, unsecured loans, deposits, debentures or bonds, etc.

Even a sovereign entity or a country can become unsuccessful in their attempts to repay their debt obligations and interest to their lenders on time. This is usually referred to as sovereign debt default. This can occur due to political instability, poor economic conditions, overleverage, or several other reasons.

Consequences

Let us understand the consequences of an individual or a national debt default. The repercussions of default on payment not only affects the image of the defaulting party but also adversely affects securing loans in the future. Let us discuss other consequences through the discussion below.

- When the lender declares the debt default, they must revalue the borrower’s assets.

- The goodwill of borrowers is affected negatively.

- The ratings of borrowers fall considerably.

- The faith of the investors starts decreasing.

- The investment by the investors decreases in debt, becoming the default.

- Their borrower gets the problem of obtaining other loans.

- There might be an increase in cost due to default as the lender may file the case, and the borrower increases the lawyer's fees.

- There are also legal regulations and issues to arrive at the debt default.

Effects

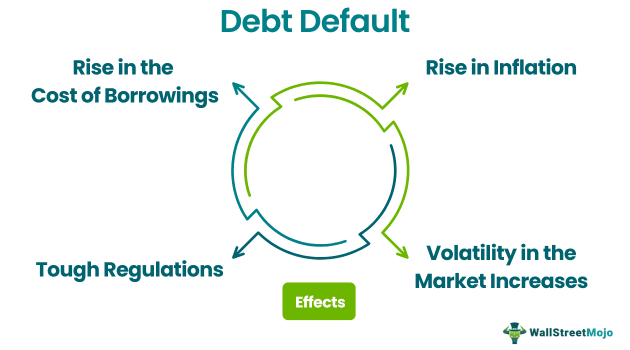

On a larger scheme of things, consumers also see the effect of a sovereign debt default through the following occurrences. Let us understand the concept in further detail through the explanation below.

- Rise in the Cost of Borrowings: The lender will collect the default loss from other borrowers. Hence, the cost of borrowing might increase.

- Rise in Inflation: The rise in the cost of borrowing leads to inflation as the borrower will also try to collect the price from its customers, which ultimately increases the prices.

- Tough Regulations: The economy may face strong regulations due to default debt, as the lender will ensure a minimum loss.

- Volatility in the Market Increases: If the debt is defaulted by the organization listed on the stock exchange, then the stocks of that organization start decreasing, which highly affects the volatility in the market and increases the price fluctuations in the start decreasing, which highly affects the volatility in the market and increases the price fluctuations in the stock market.

Secured and Unsecured Loans

Loans are of two major types, secures, for which collateral or security is provided to the lender, and unsecured, which is free of any collateral.

Depending on the type of loan default would mean a different course of action. Let us understand the intricate details depending on the type of loan on the sovereign debt default in question.

- If the default is on the secured loan, the lender may try to recover the debt from the borrower by selling the security attached to the loan with prior notice to the borrower. The loss to the lender in debt default of secured loans is considerably less as the collateral against the loan is usually more than the loan value.

- In case of a default on unsecured loans! The loss to the lender is heavy. Hence, unsecured loans carry a high-interest rate. The lender will give notice to the borrower in case of default of unsecured loans and his intention to file a legal lawsuit against the borrower in case of failure to repay within the stipulated time. The lender and borrower may come into arrangement or settlement in case of default of unsecured loans.

Threat

Before providing a loan that might turn into a national debt default, a few factors might indicate that well in advance such as political instability or overleverage. The same goes for an individual as well where they have unclear sources of income or spending beyond their capacity. Let us understand the different forms of threat in such situations through the points below.

- Take the security against the loan to recover the loan from the safety in case of default.

- Take the details of the guarantors, evaluate their income, and obtain a declaration from the guarantors that the guarantors are liable to repay the loan in case of default.

- The lender may take loan insurance to prevent loss and minimize risk.

- To secure the loan repayment guarantee, check all the borrower's details, including income, financial status, credit standing, and the borrower's reputation in the market.

How to Avoid?

It is important for both the lender and the borrower to ensure that a sovereign debt default or an individual default of such nature is avoided as it not only affects the image of the borrower, and bad cash flow for the lender but also creates bigger problems. Let us understand how to avoid such situations.

- Agree to Sale of Collateral Security for Collection of Debt: In case the borrower cannot repay the debt, the borrower may communicate his consent to selling the collateral security attached to the debt to recover the loan.

- Borrow the Time Limit for Repayment: The borrower may ask the lender to allow the time limit to repay the debt and the reimbursement assurance.

- Draft the Debt Schedule: The borrower may draft the debt schedule to keep track of the borrowings and manage the cash flows accordingly.

- Ask the Help: The borrower may ask for help from family and friends to repay the loan. It prevents the borrower from becoming the default.

Frequently Asked Questions (FAQs)

Sovereign debt default refers to a situation where a government cannot honor its debt obligations to its creditors. This can occur due to factors such as economic recession, political instability, or a lack of foreign reserves.

The Johnson Debt Default Act is a U.S. federal law enacted in 1934 during the Great Depression. The act prohibited foreign governments that had defaulted on their debts to the United States from borrowing money from American banks. The law was designed to protect American taxpayers from losses resulting from foreign debt defaults and to discourage foreign governments from defaulting on their obligations to the United States.

The Russian debt default of 1998 refers to the financial crisis in Russia in August 1998, when the government defaulted on its domestic and foreign debt obligations. The crisis was triggered by a combination of factors, including the collapse of oil prices, the Asian financial crisis, and a lack of confidence in the Russian government's economic policies.

Recommended Articles

This article is a guide to Debt Default and its meaning. Here, we explain its consequences, threats to the economy, and how to avoid such defaults. You can learn more about it from the following articles: -