Table Of Contents

What is Debt Consolidation?

Debt consolidation is the process through which a borrower refinances and combines several loans into a single one to receive the benefit of a lower interest rate or a reduced periodic payment, or maybe both. In addition, it leads to a reduction in their liability and eases the management of the loans.

We need to understand that the consolidation process does not reduce the loan obligation. However, it reduces the interest on a loan or shortens the period, leading to quicker repayment. Debt consolidation programs also allow less clutter for the borrower as there is one transaction settling all loans instead of multiple EMI payments.

Key Takeaways

- Debt consolidation involves combining multiple loans into a single one with a lower interest rate, resulting in reduced payments and easier loan management.

- Popular debt consolidation companies include LendingTree, Lightstream, Discover Debt Consolidation, Marcus by Goldman Sachs, and Wells Fargo.

- Benefits of debt consolidation include favorable terms, tax deductibility, ease of management, and lower collection costs.

- Limitations of debt consolidation include the inability to provide debt relief, the difficulty with unsecured loans, strict terms and conditions, and a requirement for high creditworthiness.

Debt Consolidation Explained

Debt consolidation refers to the act of securing a single loan to settle two or more loans. This clubbing of multiple loans into one loan allows more flexibility to the borrower as the interest rates are generally lower and their repayment schedule is also adjusted in their favor.

It is the process of combining multiple debts to take advantage of lower interest rates and convert multiple payment streams into a single one leading to an easier repayment structure.

Generally, debt consolidation is most popular for credit card loans and student loans. However, it may also apply to government debt or corporate debt. At times, such loans require collateral, and one of the most popular collateral is home equity.

However, the borrower must assess the appropriateness before trying to consolidate his debt because defaulting on even a single payment can cost him dearly, unlike in the case of unconsolidated loans because the risk becomes non-diversified.

It allows the borrower to gain more clarity in their personal books of accounts as a singular transaction can pay for their debts instead of multiple monthly payments. Also, if they consolidate the loans at a lower interest but a longer repayment schedule, they might end up paying more than they initially might have with their existing structure of multiple loans.

However, it is vital to understand that their credit scores might take a hit due to debt consolidation loan. Therefore, if they decide to take up a loan in the future, this act might reflect on their credit history and might affect their chances of securing those loans.

How To Get?

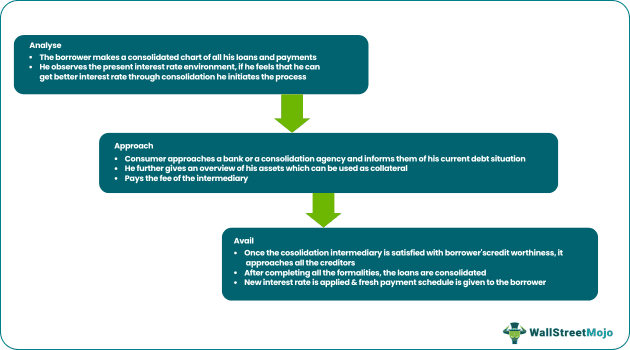

Let us understand the process of securing a debt consolidation program through the explanation below. If someone is looking to club all their existing loans into a singular loan that fulfils all their debt requirement, these are the steps to follow to get such a loan:

- Loan consolidation can be self-created such as balance transfer options of credit cards, or can be achieved by seeking the help of a financial institution.

- As shown in the below flow diagram, the intermediary financially approaches all the lenders on behalf of the borrower and informs them of the consolidation and new terms and conditions once it is satisfied with the ability of the borrower to pay off the loan. As a result, secured loans have a better chance of getting consolidated, while unsecured loans are more difficult.

- After consolidation, the borrower makes payments to the consolidation intermediary, paying the lenders.

A few institutions that provide debt consolidation facilities are the following:

- Lendingtree

- Lightstream

- Discover Debt Consolidation

- Marcus by Goldman Sachs

- Wells Fargo

Examples

There can be two situations that can lead to a reduced liability through debt consolidation: -

- Interest rates and periodic payments reduce, while the loan term remains constant.

- The periodic payment remains constant while the loan term and interest rate are reduced.

Let us understand the concept of debt consolidation loans with the help of a couple of examples. These examples will give us a practical view point of the concept and its related factors.

Example #1

Suppose we have four loans of $250,000.00 each with an average interest rate of 20% p.a. We find out that we can consolidate it into one loan at 15% p.a. Therefore, if we are given the information 1-4 as shown below, we calculate the 5th, i.e., PMT: -

A periodic payment is calculated by solving the following equation: -

PV = PMT* (1-(1+r/frequency)-n*frequency) / (r/frequency)

We calculate the PMT under both scenarios below, followed by their respective amortization schedules, and then draw a comparison between the two to understand the impact of debt consolidation.

Before Consolidation: -

- = PVBefore Consolidation = PMT *(1+(1+20%/12)^(-2*12))/(20%/12)

- = 1,000,000 = PMT * (1+(1+20%/12)^(-2*12))/(20%/12)

- PMT = 1,000,000/196480

- PMT = $50,895.80

Amortization Schedule Before Consolidation: -

Amortization Schedule After Consolidation

- PVAfter Consolidation = PMT *(1+(1+15%/12)^(-2*12))/(15%/12)

- 1,000,000 = PMT * (1+(1+15%/12)^(-2*12))/(15%/12)

- PMT = 1,000,000/20.6242

- PMT = $48,486.65

Points for understanding the above calculations: -

- Opening balance = previous year's closing balance.

- Closing balance = Opening balance + Loan- Principal repayment

- PMT is calculated as per the above formula

- Interest = 0.20/12 x opening balance in before consolidation scenario and 0.15/12 x opening balance in after consolidation scenario

- Principal repayment = PMT – Interest

Comparing the two scenarios, we observe: -

- This example is of the first type mentioned above, wherein the interest rate and periodic payments both get reduced due to a fall in the interest rate from 20% to 15%.

- Total interest paid before consolidation over the two years was $221,499.26, while that after the consolidation is $163,679.55; therefore, this leads to a saving of $57,819.71.

- The monthly payment before consolidation was $50895.80, while that after the consolidation was $48486.65, which leads to a saving of $2,409.15 per month.

- To pay off a loan of $1,000,000, before consolidation, we pay a total amount of $50,895.80 x 24 = $1,221,499.26 while after consolidation we pay off the same loan by paying only $48,486.65 x 24 = $1,163,679.55, which is a saving of $57,819.71, same as the difference between the total interest mentioned in the first bullet point.

Example #2

Now let us look at an example where the periodic payment remains constant while the interest rate and the term of the loan reduce: -

Point to be noted:

Before, the consolidation scenario was the same as in the previous example, and the PMT calculation was also the same. However, we keep the PMT the same as before consolidation after the consolidation scenario, but the interest rate falls. Therefore, the time taken for the loan to repay has been shortened to 23 months instead of the full two years, and the last payment will be less than $50,895.80 so that it is sufficient to pay off the loan.

Therefore, all the calculations for the before consolidation scenario remain the same while those for after consolidation are as follows: -

- PVAfter Consolidation = PMT *(1+(1+15%/12) ^(-n*12))/ (15%/12)

- 1,000,000 = 50895.80* (1+(1+15%/12) ^(-n*12))/ (15%/12)

- n = 1.89 years.

Amortization Schedule After Consolidation: -

We can even view the same graphically in the below chart of interest and principal payment.

Comparing the two scenarios, we observe: -

- This example is of the second type mentioned above.

- Total interest paid before consolidation over the two years was $221,499.26, while that after the consolidation is $154,751.62; therefore, this leads to a saving of $66,747.64.

- The time is taken to pay off before consolidation was 24 months, while that after the consolidation is 22 months when the PMT = $50,895.80 and the 23rd month of liquidating payment of $35,043.96.

Pros and Cons

Let us understand the pros and cons of taking up a debt consolidation program. As these facilities might be both a boon or a bane based on the terms under which multiple loans are being clubbed into one.

Pros

- Favorable terms: If the Central Bank so desires, it reduces the policy rate, and therefore the borrowing costs for commercial banks fall, which is transmitted in their lending rates. It leads to similar loans being available at a lower interest rate. In such an interest rate environment, refinancing or consolidating debt is rational, reducing borrowers' interest obligations.

- Tax deductibility: This is country-specific; however, under certain circumstances, the debt backed by collateral is allowed tax deductions by the IRS in the US.

- Ease of management: Consolidation leads to only a single payment instead of several payments, reducing omission errors.

- Lower collection cost: From the lender's point of view, the collection costs reduce as instead of incurring the same for several loans, they have incurred the same for only one loan.

Cons

- Does not provide debt relief: Consolidation only reduces the interest payments and not the initial obligation. Therefore, it may mitigate periodic payments to a more affordable level, but the initial loan amount ultimately remains the same.

- Difficult for unsecured loans: Consolidation is easier for loans that do not offer collateral. Therefore, not all borrowers can benefit from the lower interest rate environment.

- Strict terms and conditions: Loans backed by a home as collateral may become risky if the borrower cannot make periodic payments. That could lead to the lender claiming the collateral itself.

- Creditworthiness: A very high creditworthiness is required for a financial institution to refinance the borrower's loan. It may be based on several conditions such as past payment history, collateral, or innovative terms such as expected future career trajectory. Without such creditworthiness, debt consolidation may not be possible.

Debt Consolidation Vs Personal Loan

There is a common confusion between debt consolidation and personal loans. While both of them provide debt to fulfill a specific area of need, there are differences in their fundamentals, repayment schedules, and interest rates. Let us understand the difference between debt consolidation loans and personal loans through the comparison below.

Debt Consolidation:

- A debt consolidation loan is designed to club two or more loans to streamline monthly installments and interest rates.

- It allows the borrower to get better terms of repayment and interest rates through this deal.

- It allows the borrower to get the same amount as a new loan for all their other outstanding loans, for a lower interest rate.

- Therefore, they can pay one single payment towards their new loan, which shall have its own repayment schedule and interest rates.

- Overall, it helps borrowers to pay lower interest rates in the loan’s lifetime as compared to different loans with different interest rates and repayment schedules.

- However, it is critical to consider the fact that it might affect the borrower’s credit score temporarily.

Personal Loan

- A personal loan refers to an installment loan that can be secured from anything from home repairs to weddings.

- The loan amount is credited to the borrower’s account as a lump-sum and the borrower can repay the loan in installments until the loan amount with interest is repaid.

- Most of these loans are unsecured, which means, the interest rates are majorly dependent on the borrower’s credit history and score.

- The range of repayment options are wide and since it does not require any collateral, it is easier to secure such a loan.

- However, for a borrower with an average or low credit score, the interest rate might be exceedingly high.