Table Of Contents

What Is Debt Capital?

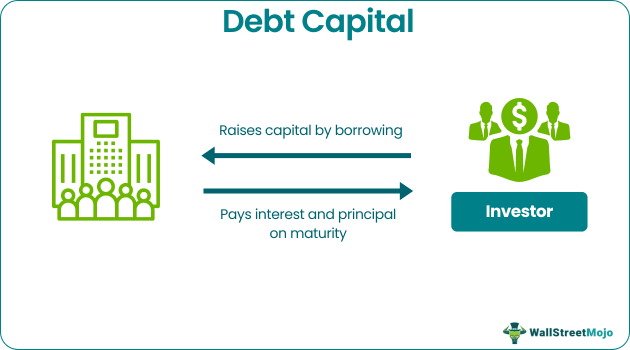

Debt capital is a fund that a company or organization raises by borrowing from lenders or investors that must be paid with interest. Debt capital is a valuable source of funding for businesses, and it can be used for various purposes, including expansion, acquisition, and working capital.

Debt financing is usually provided in the form of loans, bonds, or other types of debt securities. The investor determines the terms of the debt capital, such as the interest rate, repayment period, and collateral requirements. However, companies that take on too much debt can become over-leveraged and burdened if it fails to meet their debt obligations.

Key Takeaways

- Debt capital definition refers to the money borrowed from lenders or investors by a company or organization. Companies and organizations often use loans, bonds, and other debt securities to raise capital.

- In addition, debt financing comes with a predetermined repayment structure. In comparison, equity capital does not come with a repayment obligation.

- This form of financing aims to provide an organization with the funds to finance its operation. Furthermore, it offers tax benefits and financial leverage.

- Investors and analysts use the debt-capital ratio to evaluate a company's financial risk and leverage.

Debt Capital Explained

Debt capital, also known as debt financing, is a form of financing that allows a company to raise funds by borrowing money from creditors or investors. When utilizing this type of financing, borrowers must repay the borrowed amount along with interest over a specific period.

Furthermore, this form of funding can provide tax benefits for companies because the interest paid on the debt is tax-deductible. Determining a company's debt capital structure is based on several factors, including financial objectives, borrowing capacity, and willingness to take on debt.

Here's an overview of the debt financing procedure:

- First, the company approaches potential investors, such as banks, or financial institutions, to secure debt financing. Furthermore, the investor evaluates creditworthiness, financial stability, and loan repayment ability.

- If the investor agrees to provide the debt capital, the company enters into a loan agreement indenture outlining the loan terms.

- Therefore, the capital that a company receives through debt financing can be utilized for various purposes, including expansion, acquisition, or working capital.

- In addition, the company pays the common investor interest and repays the principal amount of the loan when it matures.

- The terms of the agreement entitle the investor to receive interest and principal payments.

Hence, by issuing debt securities, companies, and governments can access funds from a broad range of investors, including institutional investors and pension funds. Therefore, debt capital markets help investors with an opportunity to diversify their investment portfolios and earn returns through fixed-income securities.

Investors use the debt-capital ratio to analyze a company's financial risk and leverage. Moreover, the debt-capital ratio is calculated by dividing a company's total debt by its total capital, including debt and equity. Overall, using this form of financing can provide a company with greater flexibility and financial leverage.

Types

Generally, a company’s debt capital structure will comprise a mix of short-term and long-term debt. The following are types of debt financing:

- Bank Loans: Borrowing bank loans from financial institutions or banks is generally used for working capital or asset acquisition.

- Bonds: These are debt securities sold to investors that pay either a fixed or variable interest rate.

- Lines Of Credit: These facilities allow a business to borrow money up to a predetermined limit as needed.

- Equipment Financing: This type of debt financing wherein a company borrows money to purchase equipment, which serves as collateral for the loan.

- Commercial Paper: This is a short-term unsecured promissory note corporations issue to raise funds quickly.

- Small Business Administration (SBA) Loans: The US government provides small business loans, typically with lower interest rates and more extended repayment periods.

- Mezzanine Financing: This type of debt falls between secured debt and equity in the capital structure. Moreover, these are typically unsecured and have higher interest rates.

Examples

Let us understand the concept better with the help of an example.

Example #1

Let's assume a small startup specializing in mobile app development. The company wishes to expand its operations and develop new apps but requires additional funding. So the company decides to raise the needed capital through debt financing and issue a bond to raise the necessary funds.

The bond has a $1 million face value and a 6% annual interest rate. Investors who hold the bond will receive interest payments every six months, and the bond will mature in ten years. The company raised $950,000 by selling the bond to investors, and the funds will be utilized to finance its expansion plans.

By purchasing the bond, the bondholders have become the company's creditors. As a result, they are entitled to receive regular interest payments and the repayment of the principal amount when the bond matures. The company must repay the bond in full when it matures, but in the meantime, it will pay bondholders interest every six months until maturity.

Example #2

Dream Unlimited Corporation is a Canadian real estate development firm. The firm intends to provide ESG (Environmental, Social, and Governance) focused debt capital to US markets. As a result, Aviro Real Estate Credit was established in collaboration with PaulsCorp LLC. This new joint venture will give loans ranging from $25 million to $150 million for acquiring, refinancing, and recapitalizing commercial real estate assets.

Furthermore, Dream Unlimited Co. will restore the new entity's stability and ESG lens. Moreover, Paulscorp LLC. has a diverse background in development, asset management, property management, construction management, and underwriting.

Vicky Shriff would oversee the new entity Aviro as its CEO. Aviro is authorized to offer short-term, first-mortgage debt and various structured finance products for projects that comply with ESG guidelines.

Michael Cooper, the President, and Chief Relationship Officer of Dream Unlimited Co., stated that the newly formed entity, Aviro, will have its headquarters in Denver, Colorado, with additional offices in Toronto, Canada, New York, and Los Angeles, California. Schiff and Kyle Geoghegan would be in charge of this.

Advantages And Disadvantages

Advantages

- Predictable cash flows: Interest and principal debt payments are usually fixed and predictable, providing the borrower with a consistent cash flow stream.

- Tax efficiency: Debt interest payments are tax deductible, which can reduce the borrower's overall cost of borrowing.

- Unlimited funding: This financing can fund various activities, including expansion, acquisitions, and research and development.

- Leverage: Debt financing allows businesses to leverage their existing assets, potentially increasing return on equity.

Disadvantages

- Risk of default: If a borrower cannot make interest or principal payments on its debt, it may default on the loan, resulting in financial loss for the lender.

- Interest Payments: Although interest payments are tax-deductible, they still represent a high cost to the business. Therefore, the higher the interest rate, the more expensive the debt financing becomes.

- Debt service: Borrowers must devote a portion of their cash flow to debt servicing, which can limit their ability to invest in growth or respond to unexpected expenses.

- Negative impact on credit rating: A business with too much debt can negatively impact its credit rating, making it harder to obtain future financing at a favorable rate.

Debt Capital vs Equity Capital

Debt financing and equity capital are two types of financing those businesses can use to fund their operations.

- Debt capital refers to funds borrowed by a company or organization that must be repaid later, usually with interest. In contrast, Equity capital refers to funds invested in a company in exchange for a stake.

- Loans, bonds, and mortgages are all forms of debt capital. Stock offerings, venture capital, and crowdfunding are all examples of equity capital.

- When a company raises debt financing, it is legally obligated to repay the borrowed funds but does not relinquish ownership of the company. On the other hand, when a company raises equity capital, it gives up a portion of its possession in exchange for the funds.

- Debt interest payments are tax deductible. However, equity dividend payments are not.