Table Of Contents

What Is The Death Tax?

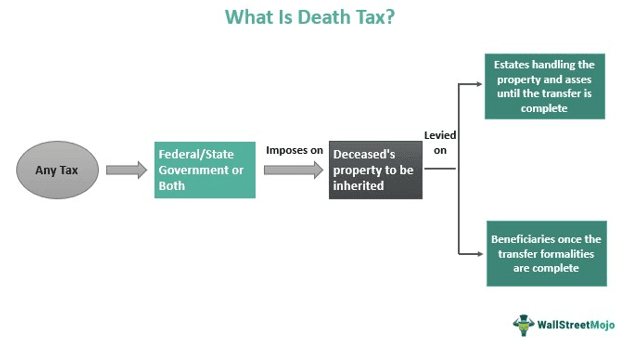

Death tax refers to the taxes imposed on a property upon the owner's death and which are levied on either the beneficiary who inherits it or the estate taking care of it until the transfer is complete. These can be part of federal taxes or state taxes, or both but do not apply to all.

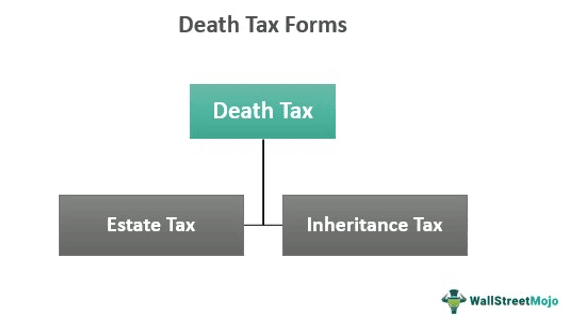

Inheritance and estate taxes are two such tax forms imposed on a deceased's property. The death tax quotes are determined based on the value of the asset in question at the time of the owner's death.

Key Takeaways

- The death tax is any tax imposed on a property to be transferred to the legal heir after the owner's death.

- Inheritance (imposed by states) and estate (imposed by federal administration and/or states) taxes are the two forms in which these taxes apply.

- It applies to those whose gross value of assets and property is higher than the threshold of $12.6 million in 2022.

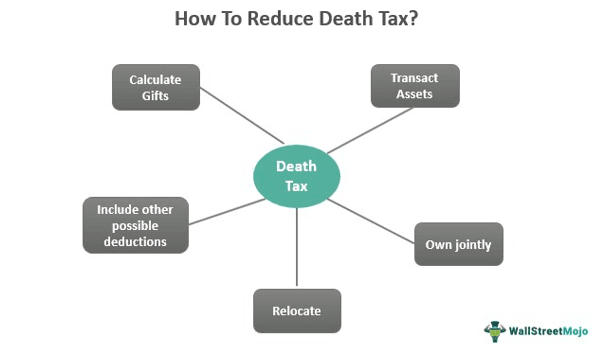

- Spending assets, calculating gift amounts, owning property jointly, and other deductions help reduce death tax payments.

How Does Death Tax Work?

A death tax is imposed on any property to be inherited. It is not a single tax but refers to a set of taxes imposable on the property of a deceased while it gets transferred to the legal heir. These taxes can be levied on the estate handling the property and assets before they are handed over to the successor or the beneficiary who inherits the same.

These taxes are widely classified as estate tax, where the estate has to pay the tax imposed on the property until it is transferred to the one inheriting it, and inheritance tax, where the beneficiary has to pay the tax as soon as they become the owner. While the former can be levied on the estates by federal administration and some state governments, the latter is only imposed by the states and never by the federal authorities.

The states that levy estate or federal death tax include Connecticut, Illinois, Hawaii, Vermont, Washington, Rode Island, Minnesota, Maine, Maryland, Oregon, District of Columbia, Vermont, New York, Massachusetts, etc. However, the states where paying inheritance tax is a must are Kentucky, Nebraska, Iowa, Maryland, Pennsylvania, New Jersey, etc.

California, however, has no such taxes to be imposed on citizens. So, people over there do not have any death tax in California to bear.

Who Qualifies For It?

The authorities levy inheritance tax on the beneficiary, anyone from parents or children to grandparents. The only person who is not liable to pay the tax while inheriting the property and assets is the deceased's spouse. However, the death taxes do not apply to everyone around. The property's value needs to reach the threshold to become taxable.

The estate taxes, which the federal administration imposes, are payable to those whose value of assets and property exceeds a particular limit. In 2022, the Internal Revenue Service (IRS) has made filing these taxes mandatory for the estates with the gross property value exceeding $12.6 million. If one has a gross value less than that threshold, they are not liable to pay any taxes.

Though most of the American population remains exempted from estate taxes, they are still liable to pay their inheritance tax.

Reducing Death Tax Liability

This tax is imposed on the property to be transferred to its legal heir. Hence, whoever is in charge has to pay it. As the value of the property and assets is quite high, the taxes to be paid are also high. In such a scenario, the taxpayers look for ways to minimize the tax payable. There are a few ways in which one can reduce their tax liability.

Calculate Gifts

The most suitable way of reducing these taxes is by calculating the gifts as major deductions. The taxable amount decreases if the owner has gifted any portion of the asset or property to someone before death. In fact, if the gross value of the asset after deducting the gifted proportions decreases to a limit, making the property value ineligible for the taxes to be imposed, the estate or beneficiary does not have to pay the tax in that case.

Transact Assets

The next one is the asset transaction. The assets include stocks, bonds, and bank accounts, which can be spent, transacted, or used to increase the returns on the estate tax. This is like a cashback on the payment and hence, could be thought of.

Own Jointly

Owning the asset or property jointly as a couple is great in minimizing the tax. When a person owns a property with their spouse, the share is 50-50. Thus, the gross value of the asset reduces by half. Hence, the person's property might not qualify for the estate tax after death. However, if the inheritance tax is applicable, it would no longer be a financial burden for the beneficiary after the reduction.

Relocate

As stated above, the estate and inheritance taxes apply in a few states. If an owner wants to get rid of paying these taxes, they can settle in a state or country where the death tax is not applicable.

Other Deductions

Besides the above ways of minimizing or avoiding death tax payment, marrying a US citizen can help as it allows unlimited deductions to the owners, given the spouse's inheritance rights. In addition, one can deduct the legal and tax fees along with any contribution to the charitable deeds. Moreover, if one has a Family Limited Liability Company, it also enables tax reductions to a great extent.

Examples

Let us consider the following examples to understand the concept well:

Example 1

Greg had property and assets worth $13 million. He and his wife, Mary, decided to gift a part of the assets worth $2 million to their daughter. When the owner died, Mary inherited the property, the value of which was $11 million after deducting the gift amount. Hence, his spouse did not have to pay anything as tax, given the gross value of the property being less than the threshold.

Example 2

Many states have opted for death tax repeal. The most recent one is Iowa, which, from August 2021, is no more on the list of the states imposing inheritance or estate taxes on beneficiaries or estates handling the property before transfer. The decision came following the expected changes in the federal tax structure, which were also likely to affect the taxpayers with much lower wealth.

Pros & Cons

The death taxes have their own sets of advantages and disadvantages. Let us have a quick look at them:

| Pros | Cons |

|---|---|

| A higher threshold makes only a portion of the population eligible to pay these taxes. | Considered unfair as it is meant for wealthier ones only |

| Helps governments generate high revenue, boosting the economy | Double taxation in some cases where the state and the federal governments both impose them |

| Not applicable to those with assets and property of lower value |