A deal sheet and a term sheet serve varying purposes in the context of business deals or transactions. Here are the differences between them.

Table of Contents

What Is A Deal Sheet?

A Deal Sheet is a document that records all the successful projects headed or collaborated on by an employee or entrepreneur. It is the snapshot of an individual's contribution to a previous project, investment, or business deal. In finance, it highlights contributions across corporate finance, asset management, financial consulting, and risk management, among others.

It is a to-the-point summary that is crucial when an employee or entrepreneur wishes to prove their professional merit. Candidates can prove their experience and expertise in business and finance to hiring managers by presenting this piece of paper. It broadly contains a company's brief, deal date, transaction rationale, individual contribution, and role in bagging and fulfilling the deal.

Key Takeaways

- A deal sheet is a document that contains brief information about an individual's noteworthy contributions to significant recent deals or projects.

- Such sheets are commonly used to outline past successes, including projects, investments, or other business deals.

- A sample deal sheet includes the company's overview, deal rationale, transaction date, individual contribution or role, and significant issues faced and how they were resolved.

- It adds value to an individual's professional profile and helps them secure deals in investment banking, real estate finance, asset management, etc., by presenting their expertise.

- Hiring managers can gauge a potential candidate's caliber, skills, and expertise in specific areas through such sheets.

- It is entirely different from a term sheet, which is a preliminary document outlining the potential terms of a prospective deal or contract.

Deal Sheet Explained

A deal sheet is a document comprising a concise summary of the major projects handled by an individual in the past. In the financial industry, deal sheets are frequently employed to showcase an individual's or a team's professional track record. They highlight deals and transactions, thereby demonstrating expertise and competence.

It includes crucial details such as the business overview, deal terms, individual's role or contribution, significant dates, and other pertinent information. It is important to note that deals that were initiated but did not go through can also be included in such deal sheets, particularly if they show how one gained knowledge and experience and grew as a professional.

In various industries like investment, private equity, venture capital, real estate finance, commercial banking, insurance, risk management, asset management, hedge funds, etc., deal sheets effectively communicate to relevant parties an individual’s contributions to recent projects undertaken and accomplished.

In some instances, deal sheets are used for marketing and networking endeavors. They can be shared with potential clients or partners to underscore past achievements and capabilities. For instance, they may be used to show expertise in portfolio management or real estate project management. Further, deal sheet formats can be tailored to reveal only necessary information, preserving the confidentiality of sensitive deal specifics.

Typically, deal sheets are brief, so they may not provide the depth of detail required for comprehensive analysis or due diligence. If the projects or endeavors undertaken but not closed are not highlighted in these sheets, they can be misleading. Hence, these sheets can be overly optimistic, or they may have information presented selectively in certain instances, potentially leading to a misrepresentation.

Deal sheets are critical to potential candidates as such sheets can enhance their profiles and influence decisions if written effectively; otherwise, it is just another piece of paper.

Examples

Let us now understand how to write a deal sheet with some examples.

Example #1

Jenny, a sustainable investing job aspirant, wrote the following deal sheet.

I recently had the opportunity to work on a groundbreaking project in the renewable energy sector. I represented a consortium of investors in securing a $300 million project finance deal for a state-of-the-art solar energy farm in the southwestern United States. This project required intricate financial structuring to optimize tax benefits and ensure compliance with local regulations.

I drafted and negotiated the financing agreements, coordinated due diligence on the land and permitting, and advised on renewable energy credits and incentives. It was a complex yet rewarding venture that will contribute significantly to the region's sustainable energy future.

Through this, Jenny offered her potential employer enough information to exhibit her skills but did not divulge any confidential information that could potentially land her in a soup—legal or contractual.

Example #2

Let us consider another sample deal sheet whereby Stacy, a finance consultant, exhibited her skills. She submitted the following deal sheet to a prospective client, highlighting her role in handling high-value business deals, computing relevant cost figures, and achieving cost reductions.

| Deal Sheet | |||||||

|---|---|---|---|---|---|---|---|

| Particulars | Company Overview | Deal Size | Deal Closed on | My Role or Contribution | Profit to the Company | Major Issues Resolved | Any Other Information or Remarks |

| Acquisition deal between ABC Ltd. and XYZ Corp. | ABC Ltd. is a leading automobile company | $500 billion | August 12, 2023 | Leading the team responsible for closing the deal | The deal increased the net worth of ABC Ltd. by $700 billion; share prices touched a new high at $37 per share. | Laying off the high-level executives of XYZ Corp. due to role overlapping after paying them fair compensation for their loss | It was a challenging acquisition deal since the companies were competitors of each other, and there were differences in the values and culture of both businesses. |

| Debt Refinancing at ABC Ltd. | ABC Ltd. is a leading automobile company | $250 Billion | March 31, 2023 | Financial Advisor to the Company | I reduced the debt cost of the company by 2.7% p.a., which was approx. $6.75 billion savings on loan. | I worked out the expenses on existing loans of the company and found that the bank was charging high interest on loans amounting to $250 billion; the biggest challenge was to find cheaper sources of finance and negotiate with the bank to close the loan at minimal early closure charges. | I found that issuing preference shares was a more feasible financing source for the company and, thus, raised $250 million from preference shareholders to pay the bank, which charged 0.56% as early closure charges. |

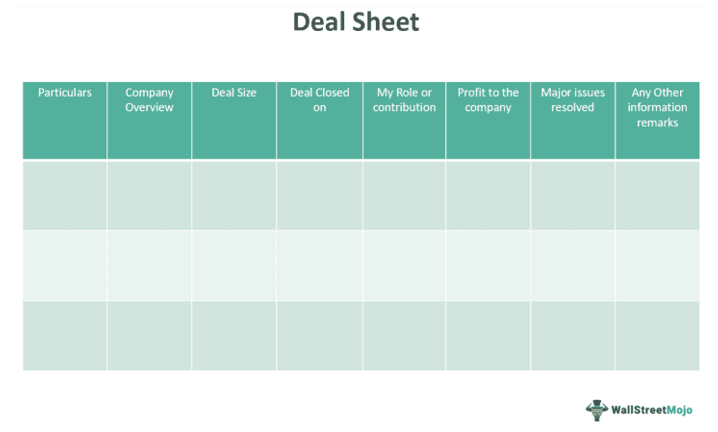

Template

Deal sheets typically follow a standardized format, simplifying the interpretation and comparison of different candidates' profiles, strengths, and weaknesses by relevant entities like hiring managers or prospective clients. However, they can be customized if needed. Here is a simple template of a deal sheet.

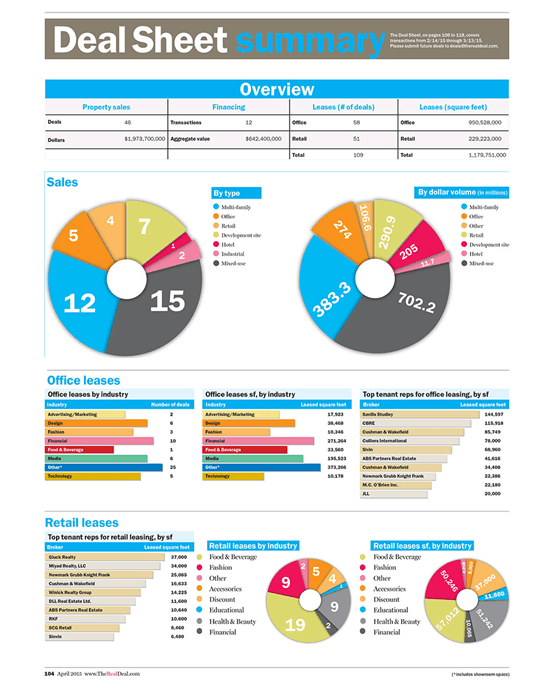

Following is an image of a sample deal sheet format that professionals in real estate can use to showcase their experience and expertise in a visual format (with numbers, graphs, and figures).

Data Sheet Vs. Term Sheet

| Basis | Data Sheet | Term Sheet |

|---|---|---|

| 1. Definition | A deal sheet is a piece of paper that summarizes completed transactions or deals, providing an idea of an individual's contribution to past successful transactions. | A term sheet is an initial, non-binding document outlining the essential terms and conditions of a proposed business transaction or investment. |

| 2. Use | It is used by finance, investment banking, or real estate companies to track, verify, and glance at the previous accomplishments of a professional or job aspirant. | It serves as a starting point for subsequent discussions and helps avoid potential misunderstandings between parties engaged in business investments or transaction deals. |

| 3. Includes | It includes the company overview, deal size, completion date, and the specific role played by the person or entity presenting the deal sheet. | Business information, type of security, valuation, amount of investment, voting rights, percentage stake, liquidation preference, etc., are included in a term sheet. |

| 4. Types of Deals | Successfully closed deals or projects are typically highlighted in this sheet. | Potential deals or contacts are outlined in this sheet. |

| 5. Presented by | Job seekers, professionals, investment bankers, brokers, financial advisors, etc., use this sheet. It can be tailored to the requirements, field, and function of whoever is presenting the sheet. | Entrepreneurs and companies seeking investments use this sheet to present their ideas or proposals. |

| 6. Presented to | Hiring managers or headhunters at investment banks, real estate firms, and tech companies, among others, find such sheets useful. | Investors and venture capitalists find such sheets informative and useful for decision-making. |