Table Of Contents

What is Discounted Cash Flow (DCF)?

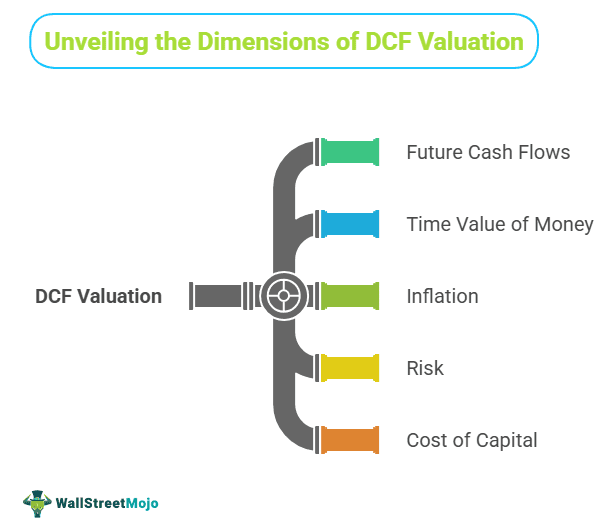

The Discounted Cash Flow (DCF) valuation model determines the company’s present value by adjusting future cash flows to the time value of money. This DCF analysis assesses the current fair value of assets or projects/companies by addressing inflation, risk, and cost of capital, analyzing the company’s future performance.

In other words, the DCF valuation model uses a company's forecasted free cash flows and discounts them back to arrive at the present value estimate, which forms the basis for the potential investment now.

Key Takeaways

- The Discounted Cash Flow (DCF) valuation model determines the present value of a company by adjusting future cash flows to account for the time value of money.

- It assesses the current fair value of assets or projects/companies by considering factors such as inflation, risk, and the cost of capital and predicts the company's future performance.

- The seven steps involved in DCF analysis include projecting financial statements, calculating free cash flow to the firm, determining the discount rate, calculating the terminal value, performing present value calculations.

Video Explanation Of Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) Valuation Analogy

Let us take a simple discounted cash flow example. Suppose you can choose between receiving $100 today and obtaining $100 in a year. Which one will you take?

Here the chances are more that you will consider taking the money now because you can invest that $100 today and earn more than $100 in the next twelve months. So, you thought about the money today because it is worth more than the money in the future due to its potential earning capacity (time value of money concept).

Now, apply the same calculation for all the cash you expect a company to be producing in the future and discount it to arrive at the net present value. You can have a good understanding of the company’s value.

- The thumb rule states that if the value reached through discounted cash flow analysis is higher than the current cost of the investment, the opportunity would be attractive.

- Please note that the DCF model entails thinking through factors that affect a firm, like future revenue growth and profit margins, cost of equity and debt, and a discount rate that largely depends on the risk-free rate. These factors drive the share value and thus enable the analysts to put a more realistic price tag on the company’s stock.

Assuming that you understood this simple DCF stock example, we will move to the practical discounted cash flow example of Alibaba IPO.

7 Steps of Discounted Cash Flow Valuation Model

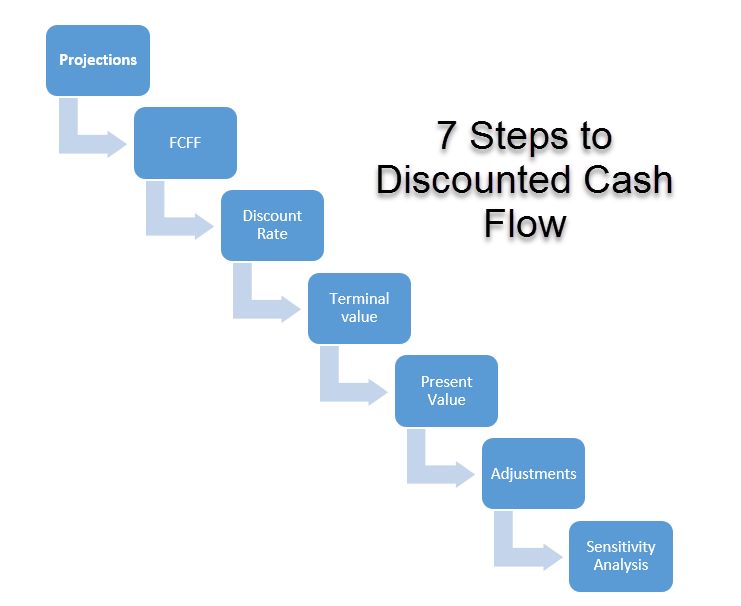

As a professional investment banker or an Equity Research Analyst. You are expected to perform DCF comprehensively. Below is a step-by-step approach to discounted cash flow analysis (as done by professionals).

Here are the seven steps to Discounted Cash Flow (DCF) Analysis -

- #1 - Projections of the Financial Statements

- #2 - Calculating the Free Cash Flow to Firms

- #3 - Calculating the Discount Rate

- #4 - Calculating the Terminal Value

- #5 - Present Value Calculations

- #6 - Adjustments

- #7 - Sensitivity Analysis

Step #1 - Projections of the Financial Statements

The first thing that needs your attention while applying discounted cash flow analysis is determining the forecasting period, as firms, unlike humans, have infinite lives. Therefore, analysts' have to decide how far they should project their cash flow in the future. The analysts' forecasting period depends on the company's stages, such as early to business, high growth rate, stable growth rate, and perpetuity growth rate.

IMPORTANT - Look at this step-by-step guide to Financial Modeling in Excel.

The forecasting period plays a critical role because small firms grow faster than more mature firms and thus carry a higher growth rate. So, the analysts do not expect the firms to have infinite lives because the small firms are more open to acquisition and bankruptcy than the larger ones. The thumb rule says that DCF analysis is widely used during a firm's estimated excess return period in the future. In other words, for a company that stops covering its costs through investments or fails to generate profits, you need not perform a DCF analysis for the next five years or so.

Image Source: Financial Modeling And Valuation Course Bundle

Forecasting is done professionally using Financial modeling. Here you prepare a three statement model and all the supporting schedules like the depreciation, working capital, intangibles, shareholder's equity schedule, other long term items schedule, debt schedule, etc.

Projecting the Income Statement

- Here, the analysts have to forecast the sales or revenue growth over the next five years, considering that the company will produce excess returns in the next five years. After that, the analysts calculate after-tax operating profits. At the same time, they estimate the expected CAPEX and an increase in networking capital over the forecasted period.

- Thus, the top-line growth or revenue growth becomes the most important assumption in the analysts' discounted cash flows about the company's future cash flows.

- Therefore, in forecasting top-line growth, we need to consider various aspects like the company's historical revenue growth, the industry's growth rate, and the economy's or GDP's development. Many analysts call it a top-to-bottom growth rate, wherein they first look at the economy's growth, then the industry, and finally, the company.

- However, another approach called the internal growth rate formula comprises return on equity and growth in retained earnings. Thus, we will use a combined growth rate to forecast future revenue, including the top-to-bottom and internal growth rates.

Projecting the Balance Sheet

- Forecasting the financial statements are made in sequence in discounted cash flows. All three statements are interconnected. You may find that while you predict from the income statement, you may have to move to the balance sheet and then to the cash flows, etc.

- Below is a snapshot of Alibaba's balance sheet forecasts.

Projecting the Cash Flow Statements

- You do not have to project each item on the Cash Flow Statements. Sometimes it becomes practically impossible due to a lack of data.

- Here, only the necessary items from the discounted cash flow valuation point of view are forecasted.

Step #2 - Calculating Free Cash Flow to Firm

The second step in discounted cash flow analysis is calculating the firm's free cash flow.

Before we estimate future free cash flow, we must first understand what free cash flow is. Free cash flow is the cash left out after the company pays all operating and required capital expenditures. The company uses this free cash flow to enhance its growth by developing new products, establishing new facilities, paying dividends to its shareholders or initiating share buybacks.

Free cash flow reflects the firm's ability to generate money out of its business, strengthening the financial flexibility it can use to pay its outstanding net debt and increase shareholder value.

Calculate FCFF is as follows -

Free Cash Flow to Firm or FCFF Calculation = EBIT x (1-tax rate) + Non-Cash Charges + Changes in Working capital – Capital Expenditure

| Formula | Comments |

| EBIT x (1-tax rate) | Flow to total capital removes capitalization effects on earnings |

| Add: Non-Cash Charges | Non-cash charges like depreciation, amortization |

| Add: Changes in Working Capital | It can be an outflow or inflow of cash. Watch for large swings year-to-year in forecasted working capital |

| Less: Capital Expenditure | Critical to determining CapEx levels required to support sales and margins in the forecast |

After projecting the financials of Alibaba, you can link the individual items below to find the free cash flow projections for Alibaba.

Having estimated the free cash flows for the next five years, we have to figure out the worth of these cash flows at the present time. However, to get to know the present value of these future cash flows, we would require a discount rate that one can use to determine the net present value or NPV of these future cash flows.

Step 3- Calculating the Discount Rate

The discounted cash flow valuation analysis's third step is calculating the discount rate.

Several methods are being used to calculate the discount rate. But, the most appropriate way to determine the discount rate is to apply the concept of the weighted average cost of capital, known as WACC. First, however, you have to keep in mind that you have taken the right figures of equity and the after-tax cost of debt, as the difference of just one or two percentage points in the cost of capital will make a vast difference in the fair value of the company. So, let us find out how the cost of equity and debt is determined.

Cost of Equity

Unlike the debt portion, which pays a set interest rate, equity does not have an actual price it pays to the investors. However, it does not mean that equity does not bear a cost. We know that the shareholders expect the company to deliver absolute returns on their investment in the company. Thus, from the firm's viewpoint, the required rate of return from the investors is the cost of equity. If the company fails to deliver the necessary rate of return, the shareholders will sell their positions in the company. As a result, it will hurt the share price movement in the stock market.

The most common method to calculate the capital cost is apply the capital asset pricing model or (CAPM). As per this method, the cost of equity would be (Re)= Rf + Beta (Rm-Rf).

Where;

- Re= Cost of equity

- RF= Risk-Free rate

- Β = Beta

- Rm= Market Rate

Cost of Debt

The cost of debt is easy to calculate compared to equity. The rate implied to determine the cost of debt is the current market rate that the company pays on its current debt.

For simplicity in the context of the discussion, I have taken the WACC figures directly as 9%.

IMPORTANT - You can refer to our detailed WACC guide, wherein we have discussed how to calculate this professionally with multiple examples, including that of Starbucks WACC.

Step 4 - Calculating the Terminal Value

The fourth step in discounted cash flow analysis is calculating the terminal value.

We have already calculated the critical components of DCF analysis, except the terminal value. Therefore, we will now calculate the terminal value, followed by the discounted cash flow analysis calculation. There are several ways to calculate the terminal value of cash flows.

However, the most commonly known method is to apply a perpetuity method using the Gordon Growth Model to value the company. The formula to calculate the terminal value for future cash flow is:

Terminal Value = Final Year Projected Cash Flow * (1+ Infinite Growth Rate)/ (Discount Rate-Long Term Cash Flow Growth Rate)

Step 5 - Present Value Calculations

The fifth step in discounted cash flow analysis is to find the present values of free cash flows to the firm and terminal values.

Find the present value of the projected cash flows using NPV formulas and XNPV formulas.

The projected cash flows of the firm are divided into two parts: -

- Explicit Period (the period for which FCFF was calculated – till 2022E)

- Period after the explicit period (post 2022E)

Present Value of Explicit Forecast Period (the year 2022)

Calculate the Present Value of the Explicit Cash Flows using the WACC derived above.

Present Value of Terminal Value (beyond 2022)

Step 6- Adjustments

The sixth step in discounted cash flow analysis is to adjust your enterprise valuation.

Adjustments to the discounted cash flow valuations are made for all the non-core assets and liabilities that have not been accounted for in the free cash flow projections. To find the adjusted fair equity value, one may adjust valuation by adding unusual assets or subtracting liabilities.

Common discounted cash flow valuation adjustments include: -

| Items | Adjustments to DCF (Discounted Cash Flows) |

| Net Debt (Total Debt - Cash) | Market Value |

| Underfunded/overfunded pension liabilities | Market Value |

| Environmental Liabilities | Based on company reports |

| Operating Lease Liabilities | Estimated Value |

| Minority Interest | Market Value or Estimated Value |

| Investments | Market Value or Estimated Value |

| Associates | Market Value or Estimated Value |

Adjust your valuation for all assets and liabilities. For example, cash flow projections do not account for non-core assets and liabilities. As a result, the enterprise value may need to be adjusted by adding other unusual assets or subtracting liabilities to reflect the company's fair value. These adjustments include: -

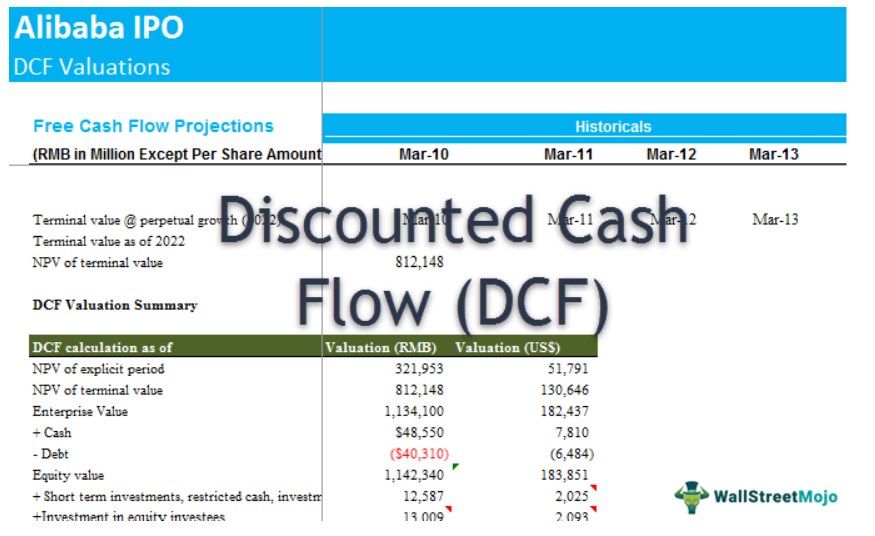

DCF Valuation Summary

Step 7 - Sensitivity Analysis

The seventh step in discounted cash flow analysis is calculating the output's sensitivity analysis.

It is important to test your DCF model with the changes in assumptions. The two of the most important beliefs that have a major impact on valuations are: -

- Changes in the infinite growth rate

- Changes in weighted average cost of capital

We can easily do Sensitivity Analysis in excel using DATA TABLES.

The below chart shows the sensitivity analysis of Alibaba’s DCF valuation model.

- We note that the base case valuation of Alibaba is $78.3 per share.

- When WACC changes from 9% to, say, 11%, then the DCF valuation decreases to $57.7.

- Likewise, if we change the infinite growth rates from 3% to 5%, the fair DCF valuation becomes $106.5.

Conclusion

We know that discounted cash flow analysis helps calculate the company's value today based on the future cash flow. That is because the company's value depends upon the sum of the cash flow that the company produces in the future. However, we must discount these future cash flows to arrive at the present value.