Table Of Contents

What Is A Day Order?

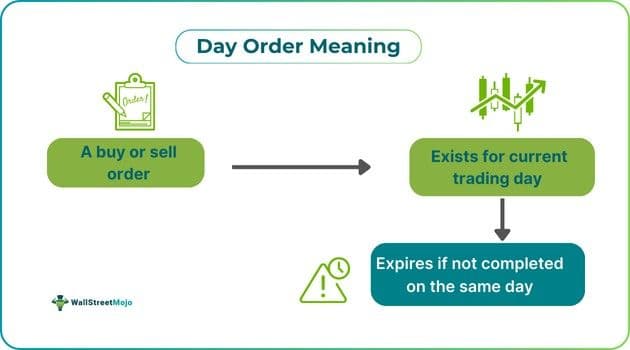

A day order in the share market is a trade execution order that expires by the end of the trading day. It can be either a buy or sell order to a broker at a specific price but will expire if not completed. This allows a trader or investor to limit the execution duration of a trade order and set it only for a particular day.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

Day orders are very common with trading platforms and other brokers, so much so that they are often the default trading method applied. Many types of day orders can be placed, but only using the right trading orders makes sense to a trader or investor. If a trader wants the trade order to remain active beyond the day, they must choose a different type of trade order.

Key Takeaways

- A day order is a buy or sell order given by a trader or investor to a stock broker or trading platform for execution. If not completed, it expires with the current trading day.

- There are many different types of day orders such as immediate or cancel orders, limit orders, market orders, or good till canceled orders.

- It has become the default trade setting for most online trading platforms. It allows traders and investors to strategically set trade orders without having to monitor the market constantly.

- If not triggered, the trades will get canceled by the end of the day. For big traders or investors planning a bigger trade strategy, they have the option to set different durations.

Day Order Explained

Day orders are clear trade instructions to stock brokers to execute the trade when the price hits a particular point and remain active till it does. At the same time, ensure that the trade order expires if not completed on the current trading day. It is so common that day orders have become the default trading method for most online trading platforms. These trade orders can be both buy and sell orders. Day orders are most beneficial when used to trade securities at a specific price point; this single facility allows traders to do other market activities or run their day as per their plan without having to worry about closely monitoring the securities prices and patiently waiting for the price to fall under their range and then execute orders.

Most day traders commonly use day orders to make a profit by buying or selling the securities at the right price before the trading day ends. This whole activity begins even before the trading session commences; the traders perform full market research along with all the discussions, market news, and different industry updates and create their investing strategies.

Today, any stock market in the world receives and processes millions of day orders, and since it is limited to only current trading days, the investor enjoys the luxury of not worrying about it in the future coming days, and it automatically reduces the risk exposure to market news, announcements, rumors or systematic risks.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Below are two examples to understand the concept better:

Example #1

Peter is new to the stock market. He is planning to buy 900 shares of a hotel company stock, which is currently trading at $9.45. However, Peter is expecting the price to fall, and he does not have time to monitor the market closely.

In such a scenario, Peter puts a limit day order to buy 900 shares of stock if its market price reaches $8.91. Now, if this happens, Peter’s order will be executed automatically without him actually monitoring the market or coming back at the right time to do it. In contrast, if the price of the hotel stock does not drop, the order remains active but is not executed, and by the end of the day’s trading session, it will get canceled. This is a simple day-order example.

Example #2

In June 2024, the National Stock Exchange of India (NSE) achieved a major milestone: a new world record for the highest number of single-day orders: a whopping 19.71 billion orders and 280.55 million trades within the whole day.

The NSE handled the highest number of transactions in a single day within 6 hours and 15 minutes. The NSE CEO announced the news through X, formerly known as Twitter. The NSE also reported robust financial performance for the first quarter of 2024, with a 20% year-on-year increase in consolidated net profit.

Pros And Cons

The pros are as follows:

- Allow traders the luxury of not monitoring the market for the right trade execution.

- Investors who are involved in multiple asset levels can take advantage of it to make trade orders throughout the day.

- Multiple types of orders assist traders in executing orders according to their needs.

- Since it needs the execution duration just for the current day session, it eliminates the degree of risk and exposure to market volatility.

The cons are as follows:

- When the equity markets are volatile, the price changes can be rapid and affect your day orders.

- Abrupt market news and sudden new events can negatively affect the market for day orders.

- No trader expects to get into an unwanted scenario by not canceling their order before execution.

Day Order vs Good Till Canceled Order vs IOC

The main differences between day order, good till canceled order, and Immediate or Cancel (IOC) are:

- Day order Good till canceled (GTC) orders remain valid until completed or canceled by the broker. Still, immediate or canceled orders are valid for a brief duration to get executed and get canceled beyond that.

- Both GTC and IOC are types of day orders, including limit and market orders, but not the other way around.

- Compared to GTC and IOC, day orders are common among traders and are a default trading method adopted by online trading platforms.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.