Table Of Contents

What Is Day Count Convention?

Day count convention is a system used in the finance field wherein number of days are used as a basis to determine the interest component in investments such as bonds, mortgages, swaps and forward rate agreements; and forms a basis for determining the present value of future cash flows involved in any financial transaction.

The 30/360 days convention is most straightforward in its form & allows simple calculations. On the other hand, the actual/actual convention gives value to each day in the period. But as said earlier, the day count conventions are not defined in any statute but are globally understood.

Key Takeaways

- Day count convention is the method used to calculate the interest accrued on fixed-income security, such as bonds or loans, based on the number of days in a specific period.

- Day count conventions provide a standardized approach for calculating interest across various financial instruments and markets.

- Different ways may be used depending on the country, currency, and type of security involved.

- Day count conventions determine how the number of days between two interest payment dates is counted for interest accrual purposes.

- Different day count conventions exist, such as Actual/Actual, 30/360, Actual/365, Actual/360, and others.

- Each way has specific rules regarding the treatment of leap years, month lengths, and the number of days a year.

Day Count Convention Explained

The day count convention is a standard approach that is normally used to calculate the interest amount that is accumulated on any financial instrument which may be bonds, notes, loans, etc. In this process, the number of days in between two payment dates are considered.

There are various types of conventions used globally in the financial market, which vary depending on the economy, the different laws and practices followed in the market and most importantly the financial instrument.

Any financial instrument like a bond day count convention basically means an assumption used to standardize a few processes. We usually say, “there are 31 days in the month of December, 28 days in the month of February”. Day count convention may say “a month means a period of 30 days,” irrespective of the actual number of days in the relevant month when we use the 30/360 day count convention. Similarly, we normally understand that a year consists of 365 days (or 366 days in case of a leap year). It can be assumed that a year usually contains 360 days irrespective of the actual number of days.

So, if you are guessing that they are made for the purpose of ease of calculations, then you are partially right. As I said earlier, conventions are standardized processes. Hence, the dual purpose of this convention is a) ease of calculations b) standardization of calculations/assumptions.

It is essential to select the appropriate day count process because it affects the computation of the interest rate, the yield, or any other calculation in case it is a bond day count convention. The user should understand which method suits which financial instrument so that the analysis and comparison are accurate.

Examples

Let us try to understand the concept with the help of some examples.

Example#1

Let's take an example.

Given:

- Principal Amount / Par Value = $ 1,00,000

- Periodicity of Payment of coupons = Semi-annual

- Rate of Interest = 9%

- Coupon Every 6 months = $ 4,500

Please refer to the above given excel template for detailed calculation of the day count convention.

Where is it Used?

Explanation

- The issuer has issued a bond of the face value of $ 100,000 at a coupon rate of 9% with semi-annual coupon payments on 1st January 2019. The first coupon falls due on 1st July 2019. Since the coupon is payable semi-annually, we can easily compute the annual coupon amount as $100,000*9% = $ 9000. Hence, for six months, the coupon amount is $ 4,500.

- We need to calculate the accrued interest till 31st March 2019. Hence, we find the number of days from the start of the coupon period till 31st March 2019, i.e., 89 days in case (I). We also compute the number of days between the coupon date and start date, i.e., 181 days in case (I). We then compute the ratio of the number of days accrued to the total number of days. We get 89/181 = 49.17%. We apply this to $ 4500, and we get the amount of accrued interest = $ 2,212.71. Thus, the investor is entitled to receive this amount had the bond issuer paid it on 31st March 2019.

- But is the amount calculated correctly? Yes. Is any alternative answer possible? Yes. It’s all about which day count convention is applied. In the case of the case (ii), the accrued interest is $ 2,250, and in case (iii), the said amount is $ 2,225.

Example#2

Let’s say a US-based company issued bonds of $ 10,000 each on the 1st of January, 2019 at a coupon rate of 12% with semi-annual payouts. It means the investor would get the coupon amount of $ 10,000 * 12% * 6/12 = $ 600 every six months. But the question arises, “what is the date of payment of coupons?"

There can be various possibilities:

- Six months from exactly 1st January 2019, we get 1st June 2019.

- On an actual basis, a year contains 365 days (non-leap year). Then half of 365 gives us 182.5 days. In this case, we get 2nd July as the date of payment of the coupon.

- Another convention says that a month contains 30 days. In this case, we get 31st May 2019 as the date of payment of the coupon.

Which date of coupon should an investor rely on? Here, the money market day count convention comes into play. The issuer of the bond chooses one of either convention and communicates the relevant dates to investors.

Types

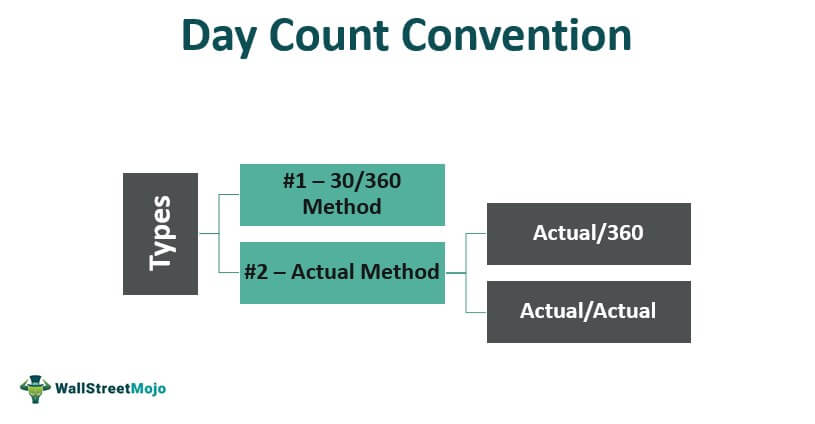

Basically, there are two methods which govern these money market day count convention:

#1 - 30/360 Method

- This method of 30/360 day count convention ignores the actual number of days during the period. It assumes that a month means a period of 30 days and a year means a period of 360 days.

- It is used for ease of calculations.

#2 - Actual Method

- This method considers the actual number of days during the period.

- This merits the actual facts rather than assumptions.

- Actual/360: Here, the actual number of days is used and this method is common for currency day count convention. However, the base assumes that the year contains 360 days. It should be noted that for most currencies the interest rate at LIBOR(London Inter Bank Offered Rate) is also calculated using this particular method of currency day count convention, with the only exception being British Pounds.

- Actual/Actual: Here, the actual number of days is used. Also, the actual number of days in the year are considered.