Table Of Contents

What Is Dash To Trash?

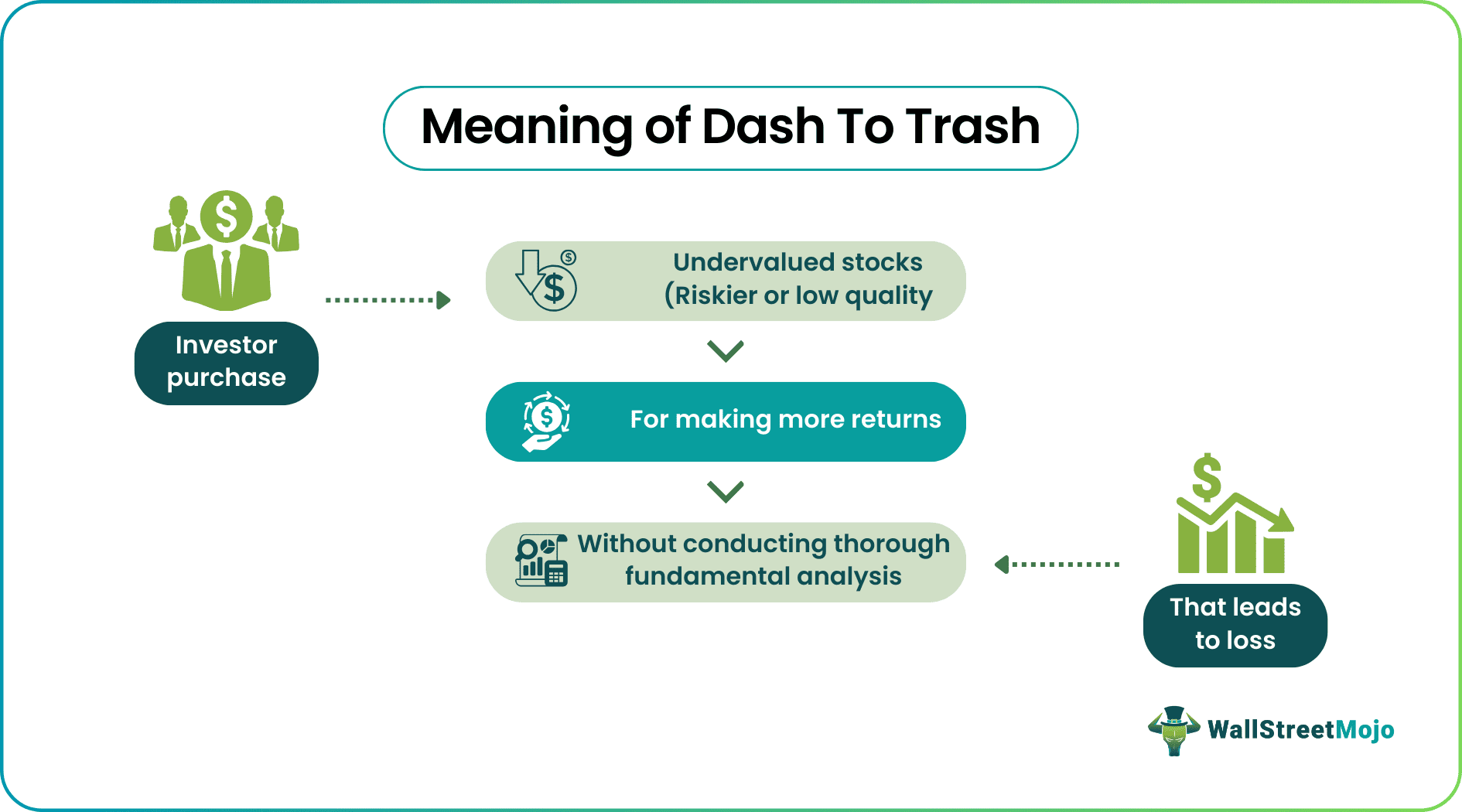

Dash to Trash refers to a phenomenon where investors purchase low-valued securities to generate higher profits in the equity market. Typically, these occurrences occur during a bull market when stock prices seem disconnected from the underlying fundamentals and valuations.

The dash to trash tends to manifest towards the middle or end of a bull market, often obscuring the actual value of the stocks involved. Consequently, investors are drawn to pursuing higher returns while potentially overlooking associated risks. Nonetheless, it is worth noting that these investments can ultimately result in diminished stock values.

Key Takeaways

- Dash to trash refers to traders purchasing undervalued stocks to earn higher profits. However, after price correction, these investments turn into losses.

- They lead to inflation, price bubbles, and chaos among investors in the stock market. Factors like bullish cycles and sudden market sentiments can also lead to this situation.

- Here, investors reject the risk tolerance factor associated with these stocks. As a result, these stocks become trash once the market stabilizes.

- Intraday or short-term traders can profit significantly from this. Also, it leads to portfolio diversification and entry of new investment strategies.

Dash To Trash Explained

The dash to trash phenomenon describes a situation where investors flock toward low-valued stocks. It usually occurs during bull markets where most stocks spike despite their actual value. It pushes the price of lower-valued stocks. So, when the prices reach their maximum, it causes inflation and forms a speculative bubble. However, the situation only stays for a short period. Once the market stabilizes, the prices of the stocks reach their original value. As a result, the investors may regret their purchase decision in the first place.

Investors believe the bull market is a perfect time to buy undervalued stocks. They do not necessarily consider the company's financials as the bullish trend may be for a shorter period. Therefore, they take advantage of this market and buy securities. But these investments can be deceptive in a real scenario. Although they purchase them for long-term gains, there is a hidden risk. This financial risk arises when the market enters into consolidation or a bearish trend. As a result, it leads to price correction that reveals the true worth of investments. Thus, investors are forced to sell their stocks and end up at a loss. However, there can be various factors that can lead to dash and trash trades.

Most of the time, forecasts and predictions of other analysts drive the stock price. As a result, the rest of the market blindly follows the advice with little research. Despite the stock seeming cheap, investors see it as a popular investment with high returns. Therefore, it is essential to consider the fundamentals and the company's worth to decrease losses. Traders can conduct company valuation to determine the enterprise value that depicts the firm's current value.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Factors

Various factors influence the market and can lead to these events. However, with less or no knowledge, it might be hard to detect them. So, let us look at them:

#1 - Bullish cycle

The primary cause for a dash to trash is the bull market itself. It highly influences the market prices of the equities despite their value. So, if an index is about to cross its highest potential, it will drive the constituted stocks, too. These markets reduce the risk tolerance of investors. As a result, they tend to buy stocks that may not fit their investment portfolio.

#2 - Sudden market sentiments

Another influential factor can be a sudden rise in the company's stakeholding or the entry of new investors. Although the stock has a lower value, the investor's stake spikes the current price of the stock. With this rise, other traders and investors invest in it, leading to this phenomenon.

#3 - Undervalued stocks

In a bull market, many investors believe that stocks that suddenly rise might be undervalued. As a result, they invest a considerable amount to make profits over a longer period. They anticipate the bullish trend to continue further. However, in the later stage, these investments may turn into trash for them.

#4 - Analysts perspective

The equity market is usually driven by the market sentiments and perspectives put forth by analysts. If a significant investor or analyst gives positive feedback on a stock, it flocks other investors around. Because of this, they may invest with little research on the company's finances.

Examples

Let us look at some real-time and hypothetical examples to understand the concept in a better way.

Example #1

Suppose Gims is a stock that has operated in the textile industry for the past ten years. However, in the equity market, it has been only five years since their entry. But, in comparison with peers, the stock was valued lower. As a result, many investors and traders saw a moderate increase in the stock price (trading at $12). However, a celebrity and a famous fashion designer announced a 40% stake in the company last week.

Due to this, the price rose from $12 to $50. Likewise, the stock was high enough to touch its upper circuit. As a result, the market turned bullish for a few days. But, after the market correction, the news about the investor's stake turned fake. Therefore, the stock went as low as $10, and traders' investments turned dash to trash.

Example #2

In 2023, there was a situation where people were buying risky stocks, hoping to make quick money. One example was Carvana, a company selling used cars. Its stock price increased by 1,077% because it changed some of its debt. It made many investors excited and buy the stock. But this excitement didn't last long. The stock price quickly dropped by 40%, showing that investing in these kinds of stocks is risky.

Another company, Silvergate Capital, also got involved in this risky trading, but it ended poorly for them. Their stock price fell a lot, causing significant losses for investors.

Some people make a lot of money in these situations, but others lose a lot, too. These stocks are known for being unpredictable. It is essential to be cautious when investing in them because they sometimes follow different stock market rules.

Importance

Investors can find value in this phenomenon, even when stocks surge in the upper circuit. This situation offers opportunities for strategic investing and portfolio diversification. It allows investors to consider new portfolio stocks, expanding beyond their usual focus. For instance, someone primarily interested in chemical industries may discover health stocks during a bull market, contributing to portfolio diversity. Furthermore, traders may become optimistic about specific stocks, fostering positive market sentiment.

Similarly, active intraday traders can benefit from this scenario by purchasing undervalued stocks and conducting cross-trades within the same trading session. They can exit their positions before encountering resistance, even if a pattern is evident. However, it's crucial not to overlook the associated risks. These situations often involve heightened volatility, requiring diligent research and risk management, particularly following price corrections.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Depending on the investor's goals, there can be various reasons to keep up with dash to trash. For instance, some may need to be made aware of this. As a result of overconfidence, they might continue with it to gain more returns. Also, few speculative assets are liquidated; hence, it might be convenient for investors to trade off their positions.

Dash to trash does cause many concerns for the investor. It brings extreme price instability and liquidity issues for them. Although prices reach their highest potential, a panic selling situation may trigger a domino effect in the market. Due to this, it might be challenging to trade off their position.

Although both concepts seem similar, they have a correlation and equal distinction. While dash to trash is a strategy to buy highly speculative stocks, lottery-like stocks are equities that like a jackpot or offer incredibly high returns on purchase.