Table Of Contents

Dark Pool Meaning

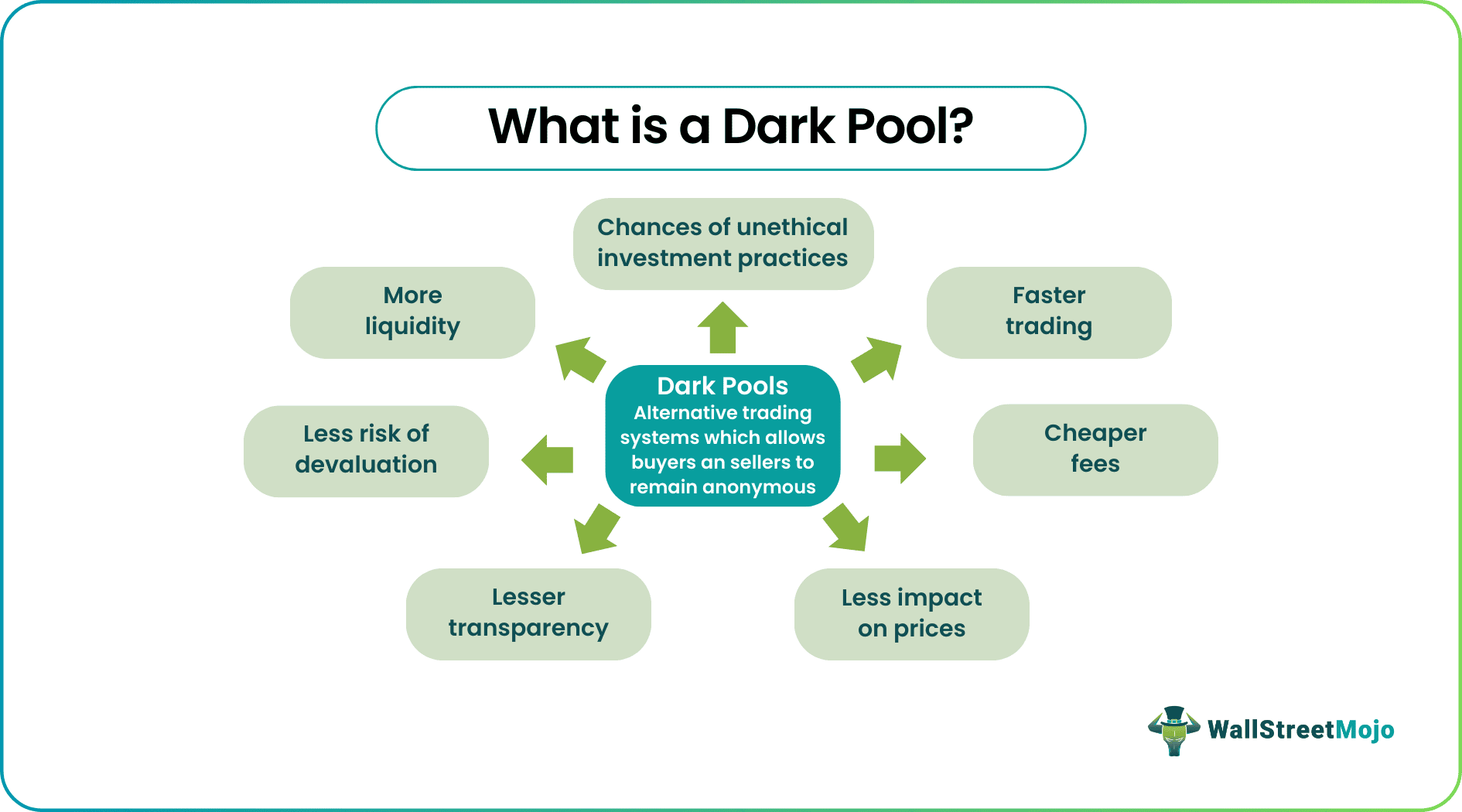

Dark pools are a type of Alternative Trading System (ATS) that allows investors to trade large blocks of shares without public attention. Unlike public exchanges, dark pools allow investors trade without disclosing their identities till the trade is completed. They are fully legal and grant an additional privacy step to the users.

Dark pools are privately organized and highly advantageous to certain institutional investors like hedge funds who want to remain anonymous. Despite its menacing name, these exchanges are closely monitored and regulated by the Securities and Exchanges Commission (SEC) and need to follow the basic trading laws to operate.

- Dark pools are private platforms where small and big investors can trade without disclosing their identity before the transaction.

- The dark pool indexes and indicators are tools used to measure the liquidity and prices in this market. They indicate bearish or bullish movements.

- These platforms offer several advantages, such as less impact on prices, more privacy, and fewer fees.

- There are also cons to these platforms, such as the lack of transparency and predatory behavior from high-frequency traders.

How Dark Pool Trading Works?

Dark pool trading is similar to other platforms, except they are not public. Most of the time, dark pool stocks are owned by mainstream financial companies such as Morgan Stanley or the New York Stock Exchange (NYSE). But the difference is that the identity of the users is hidden during the transactions. That doesn’t happen in the main NYSE platform, for instance.

Public financial exchanges are highly regulated and attract a lot of attention from the media. So, everybody knows who is trading what, and this might affect prices if one waits a long time before the transaction is complete. This may happen because there’s not enough liquidity for large transactions.

Dark pool trading only exposes the identity of traders after the trade. These exchanges match the trades by themselves using algorithms or brokers and often use block trades to exchange a high number of assets simultaneously. They also often offer a reduction in transactional fees for the investors.

Because of this, institutional investors frequently use the dark pool, either because they don’t want the market to know what they’re buying before they do or because they want to use high-frequency trading (HFT). In the second case, they can trade large data blocks in milliseconds ahead of the other investors and get large profits.

This platform emerged in prominence during the 1980s. In 1979, the U.S. Securities and Exchange Commission (SEC) brought a rule that allowed companies to trade assets in over-the-counter spaces. The SEC ruling in 2007 further improved access to trade and led to an increase in the number of dark pools.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

An example of dark pool stock trading can be quoted when an executive of a large company decides to sell 50% of his shares. He knows that this would directly impact the company he’s working for because this is a large number of shares, and his position would attract media attention to the trade.

So, he decides to use a dark pool platform. In this case, he can sell that high number of assets almost as quickly as he would outside the platform. But the price won’t get devaluated so quickly. This happens because people will know that he sold the assets only after completing the transaction.

The inverse of this is also possible. For example, a prominent, well-known investment fund can buy a large share of a public company.

However, if they bought the stocks using a normal platform, people might see it and follow the move, making the price higher before the transaction is complete. In this case, using a dark pool prevents the price from rising instead of going down.

Dark Pool Index (DIX)

The Dark pool index (DIX), is based on the same companies as the Standard & Poor’s 500 index. However, it uses the numbers from dark pools instead of the public stocks from these businesses.

This measure determines whether the sentiment on the dark pools is currently bullish (will buy assets) or bearish (will sell them). The number is represented by a percentage that theoretically goes from 0 to 100%. So the more bullish the sentiment is, the more the numbers will go up on the chart.

Dark Pool Indicators (DIP)

The Dark Pool Indicator (DIP) is an indicator similar to the DIX, but it works differently. For starters, the DIX is based on the Standard & Poor’s 500 indexes, while the DIPs are based on how individual stocks are doing in the dark pool market.

The DIX is basically a specific kind of DIP representing how a basket of assets behaves in the dark pools. The DIP measures the same in different assets. Depending on which program you're using, you can also see the moving average of different tickers. This way, you can see long-term trends in the market.

Not only can these indicators be used to invest using the dark pool, but investors may also use them as a complement to get more in-depth insights on the future of mainstream markets like NASDAQ or the New York Stock Exchange.

Pros And Cons

These platforms may be attractive to investors who want to conceal their identity while they trade. However, they also have a few drawbacks. Here are the major pros and cons of trading in the dark pool:

Pros:

- One can acquire equities without affecting the market too much, even if they trade a high volume of assets.

- Dark pools help protect the trader’s identity, which is very useful if they are a well-known institutional investment firm and do not want to influence the market.

- The use of high-frequency trading mechanisms helps these platforms get more liquidity.

Cons:

- There’s little transparency in how these platforms operate. This could lead to inefficiencies in the system.

- High-frequency traders often profit at the expense of other users in dark pools, especially because one can hide their unethical investment practices in these platforms.

- The prices in the dark pool may be very different from the official public prices of the assets, which can be either good or bad, depending on the situation.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Dark pool trading allows investors to trade without disclosing their details publicly. The trading information is only made public after the successful execution. There are several benefits for trading in such platforms like less transactional fees, more privacy, lesser risk of devaluation, etc. It also enables high-frequency trading where the traders can make a huge profit in very less time.

Dark pool trades are reported only after the trade execution. This way, the identity and trading intentions of the investors are protected. As a result, there is lesser transparency in the market and hence a lesser risk of prices getting affected.

Trading anonymously protects the public's trading information and prevents the prices from being affected. Since dark pool trades are privately organized, there are fewer exchange fees than public platforms.