Table Of Contents

What Are Cyclical Stocks?

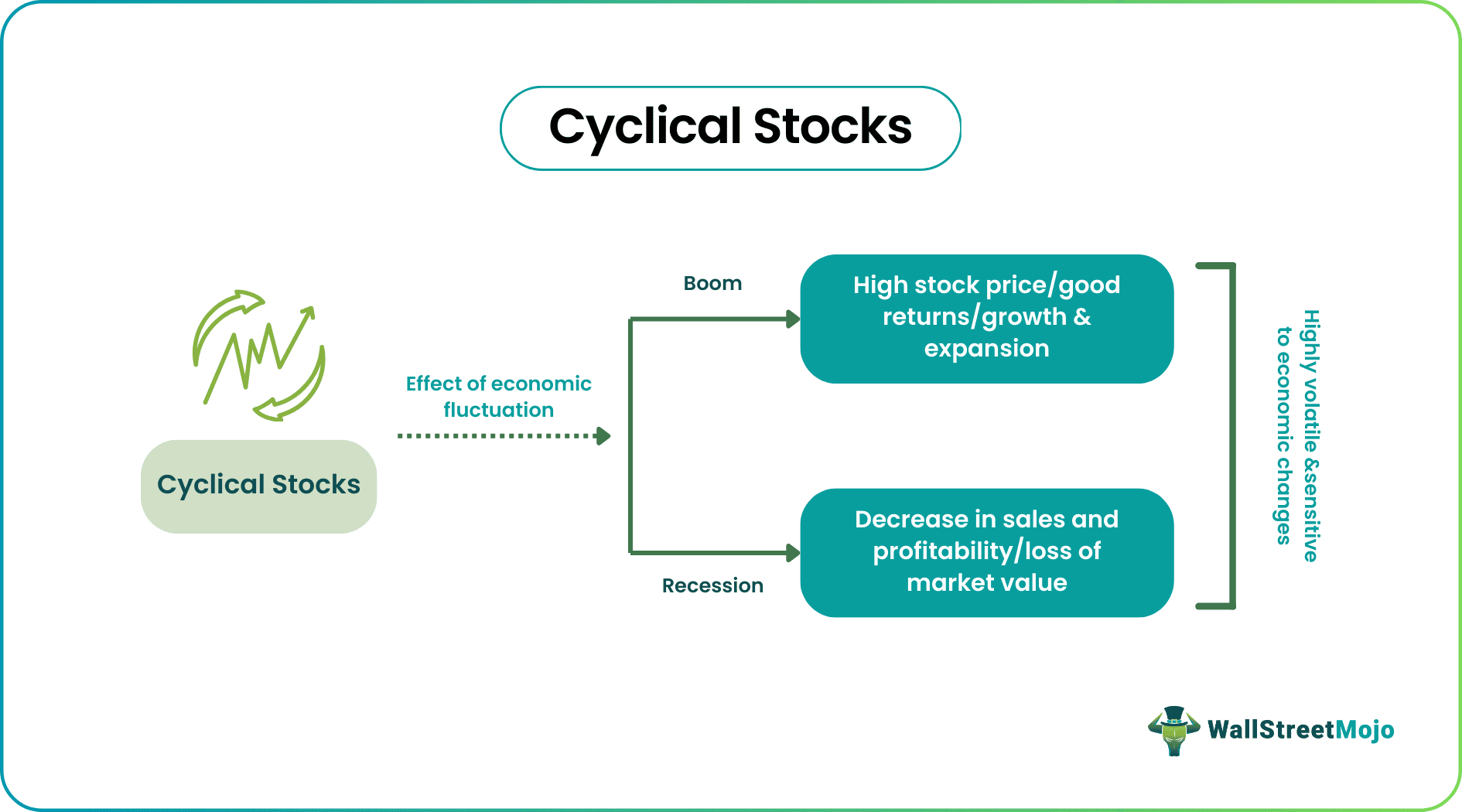

Cyclical Stocks refer to a stock or company security that mimics the country's macroeconomic environment and provides greater returns when the economy is booming and results in losses when the economy is in bad shape. Examples of cyclical stocks include auto manufacturers, airlines, hotels, casinos, restaurants, etc.

Any significant change in economic conditions like recession, peak, expansion, etc., immediately influences these stock values because their product consumption increase during peak, and consumers tend to cut down their consumption during the recession. Thus, they usually experience heavy trading during booming economic conditions, making them highly sensitive to change in business cycles.

Key Takeaways

- Cyclical stocks companies are those that reflect the situation in the economy by their prices. Such as, when the economy is booming, these stocks give high returns, whereas when the economy is not in good shape, they disappoint their investors.

- Such industries include auto manufacturers, airlines, hotels, casinos, restaurants, etc.

- The advantages of such stocks are they bring massive growth, provide more dynamics than the benchmark, stimulate interest rates, and reflect business sentiment.

- The pitfalls of such stocks are that they are risky and vulnerable, with huge losses, need careful analysis, and are inappropriate for passive investors.

Cyclical Stocks Explained

Cyclical stocks are those whose value wildly fluctuates according to the country’s economic performance. Therefore, cyclical stocks sectors, due to their fluctuating nature, tend to be very volatile and will reflect the business sentiment prevalent in the country. Hence because of the mirror reflection that they tend to adopt the economy, they tend to be wealth creators when the country is going upward. Hence, they tend to increase in value, reflecting the country’s positive business and investment sentiment.

However, at times of recession, they tend to lose enormous value due to the fall in prices and panic that would exist in the market. Therefore, while investing in cyclical stocks, timing matters a lot when buying such securities, and thus careful analysis is required before making any trade decisions. It is not suitable for passive investors. It would only suit such investors who would carefully follow the market and undertake the required research and analysis.

Generally, long-term investors tend to be passive and do not involve regular active buying and selling. They do not bother to follow the markets frequently. They believe in the tenet of having to ‘Buy right and sit tight.’ Hence, when the economy is in a recession and if the long-term investor holds on to cyclical stocks companies, they cause significant erosion to his holdings’ value due to the fluctuating nature of the cyclical securities.

Hence it is not advised for the long-term and passive investors as they may have to wait for 7-10 years before the economy begins to pick up from the downfall. However, if they are reasonably well-diversified, that need not be the case.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How To Identify?

Here are some ways to identity stock of cyclical nature.

- Massive Growth – Cyclical stocks tend to provide massive growth to investors when the economy is booming. The value and prices of such stocks skyrocket as they reflect the increased confidence the consumers have placed in such companies when the economy is growing.

- Right buy before the beginning of the boom generates great returns. If an investor can identify the period just before the economy starts to boom, he can tend to amass enormous gains. Timing matters while picking cyclical stocks, and if one manages to make the right move just before the economy begins to make the uptick and thus manage to buy such stocks at the bottom of the cycle, which would go on to witness an upturn, they are sure in for a significant gain.

- Stimulus During Falling Interest Rates – When interest rates in the economy fall, these stocks tend to have better valuations. Interest costs will be low, and earnings thus tend to increase to that extent. It is further reflected in the stock price. Therefore in environments where such interest rates are falling, good cyclical stocks do get a massive boost, and hence investors tend to make a lot of money under such circumstances.

- More Volatile than Benchmark – At times, these cyclical stocks will be more volatile than the benchmark indexes. It will suggest that an investor who can time his purchase and investment in an industry that is heavily dependent on the country's economic strength, such as the technology sector, would at times be able to generate returns above the benchmark index of the particular country.

- Reflective of Business Sentiment - One can consider good cyclical stocks to reflect business sentiment in the economy. Thus, one may gauge where the economy is headed by very well understanding the movement of such cyclical stocks. They tend to rise during times of expansion and gradually decline during phases of recession. Thus, they mirror the business cycle and sentiments that prevail in the economy.

- Requires Careful Analysis – For cyclical stocks, careful analysis and understanding are required due to their volatile nature. It becomes imperative that one always follows the markets and is very well aware of the upcoming signs. Only when one can dedicate sufficient time to follow the market would they know and understand the current trends and thereby decide when to enter and when to exit the market to take advantage of market movement and business cycles.

Examples

Let us look at some examples to understand the concept.

Example #1

Perfect Cuisine Inc. is a chain of restaurants and hotels spread out in various parts of the world, and is listed with Nasdaq Composite. Its stocks have been performing very well. But due to Covid 19, a sudden fall in the economic condition worldwide resulted in the people spending very less on outside food. This in turn reduced sales of hotels and restaurants like Perfect Cuisine Inc. Thus, these stocks are cyclical in nature, since they are very easily affected by adverse economic conditions.

Example #2

A sudden turnaround in the main indices of Wall Street, that is, Dow Jones Industrial Average, Nasdaq Composite and S&P 500, is led by gains in cyclical stocks along with a rise in the financials and consumer price index beyond expectation. Thus, stocks that were hugely affected by macroeconomic disturbances, started showing some gains.

Disadvantages

Some disadvantages of these kind of stocks are as follows:

- Timing Matters – As for cyclical stocks, the timing during which you buy them does matter, and should one make the mistake of having to enter into the purchase just when the economy starts to slide down from the top and thereby later sell at rock bottom at bad prices, it indeed is a recipe for disaster. Careful analysis is required before having to buy such stocks.

- High Volatility – Another major disadvantage of having to do with cyclical stocks is that they are volatile. They tend to fluctuate greatly with the current scenario and conditions prevalent in the economy. They may, at times, go too far from the current levels and the benchmarks, even heading down south way more than the levels that the current benchmark would tend to be at.

- Major Fall during Times of Recession – Since cyclical stocks tend to reflect the country’s business cycles, during times of recession, they do witness a significant fall in value. Investors who do not manage to sell off their stocks before the onset of economic decline will have to bear such enormous losses owing to a fall in the stock prices of such stocks.

Cyclical Stocks Vs Defensive Stocks

Cyclical stocks are those that easily change its value due change in economic cycle whereas defensive stocks are those that do not change with economic cycle easily. However, some differences between them are as follows:

| Cyclical Stocks | Defensive Stocks |

|---|---|

| Change in economic conditions easily affect them. | Change in economic conditions do not affect them easily. |

| There is very high sale during boom and less sale during recession. | They remain stable during a boom or recession. |

| They involve a high risk but high return. | They give a steady return throughout the year. |

| They are very volatile in nature. | Volatility is very less. |

| Good market analysis is important to determine the right time to invest. | It is a hedge against adverse condition and a safe investment. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

These stocks are best during reduced interest rates since such situations stimulate the economy. On the other hand, when interest rates are high, such stocks give poor returns. On the other hand, they provide very high returns during economic boosts.

Mainly, these stocks are judged by their beta values or systematic risk analysis. They tend to have a higher beta value, usually more than 1. It implies that they will underperform during index price reductions.

A defensive stock is a stock that offers stable returns and decent dividends, unbothered by market conditions. They are less vulnerable, growth-oriented, and reliable than stocks that are cyclical. Therefore, they are mostly chosen by active investors wanting regular income.