While both the cut-off score and the credit score ranges serve as a decision-making factor for the lending institutions in terms of extending credit to a particular borrower, they hold the following dissimilarities:

Table Of Contents

Cut-Off Score Meaning

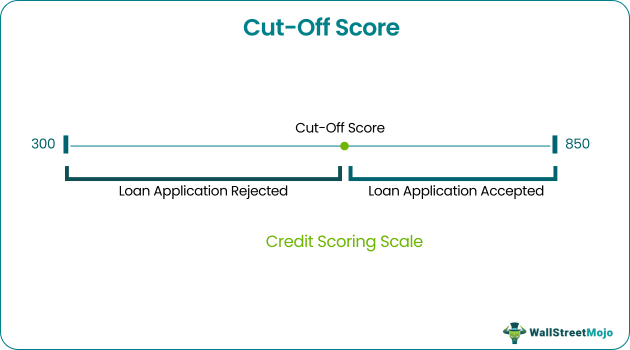

A Cut-Off Score refers to the lowest possible credit score an individual or firm needs to secure to obtain debt from a particular loan provider. The lender decides on such a minimum creditworthiness requirement, which may differ based on credit type or provider.

The lowest acceptable credit score differs from lender to lender and the type of credit offered. Moreover, the lending institution can reject the loan or credit card application if the borrower's credit rating falls below this number. It, thus, sets a risk limit while ascertaining the degree of credit risk a lender is willing to take.

Key Takeaways

- A cut-off score in finance is a minimum credit score requirement or criterion for being qualified for a credit offering such as a loan or credit card from a particular lender.

- The credit provider ascertains it. Different lenders may set varying cut-offs based on the type of credit offerings or products and their risk appetite.

- While long-term loans have high cut-offs, short-term offerings like credit cards have low cut-off score criteria.

- It notably differs from the credit score ranges, which are the different sections of borrowers’ credit scoring that categorize their creditworthiness from exceptional to poor.

How Does Cut-Off Credit Score Work?

A cut-off score is the minimum acceptable credit score by a credit provider, such as a bank, beyond which it cannot proceed with any loan, credit card, or other lending. Moreover, every lender ascertains a different cut-off credit score based on their risk appetite and type of credit offerings. It is one of the credit issuance criteria for lenders, who may also consider the borrower’s financial position, income, assets, bank balance, investments, etc., before issuing credit.

A credit score is a rating generated by credit bureaus like Experian, Equifax, and TransUnion to state a borrower's credibility and the credit risk associated with lending money to the respective individual or business entity. Also, the most commonly used scoring system is the Fair Isaac Corporation (FICO) scores. A credit score lies between 300 and 850, out of which any rating above 700 is ideal.

Talking about FICO scores, it manifests a borrower’s creditworthiness on the following parameters:

- Payment History - 35%

- Credit Utilization Ratio - 30%

- Credit History Length - 15%

- New or Recent Credit - 10%

- Credit Mix or Types - 10%

Based on the credit scoring system, a lender decides the minimum threshold for considering the credit seeker’s application. A lending institution may have a high minimum acceptable credit score for long-term loans like mortgages, personal, or home loans. This is because their lengthy tenure of repayment intensifies default risk. However, credit cards, consumer loans, and other short-term loans have comparatively low cut-off score requirements. Only in exceptional cases may a lender overlook the cut-off score while offering a loan.

Examples

Let us now understand the concept of cut-off scores through some real-life examples:

Example #1

Suppose PQR Leasing and Finance Ltd. uses the FICO credit scoring system to determine the creditworthiness of the potential borrowers. The FICO scores borrowers on a scale of 300 to 850. The company has set its cut-off score as 650 for personal loans it offers to clients. Now, John is applying for a personal loan, and the company follows the standard procedure of checking his credit scores first. He secures 670, which is acceptable to the lender for considering his loan application.

Example #2

In another example, say XYZ Bank has fixed a cut-off score of 580 for credit card applicants. Now, Mary approaches the bank to request a credit card. When the bank checked her credit report, they found that she didn’t meet the cut-off score criteria. She scored only 560 (which is slightly lower than the desired score) by the FICO Scores. However, her other financial indicators showed that she is financially strong.

On an in-depth analysis, the manager discovered that Mary has been rated low since she settled her 7 years of loan in just 3 years. Also, she has currently taken multiple consumer loans. However, due to her high income and huge investments, the bank decided to issue a credit card.

Importance

The cut-off scores serve as a critical parameter for credit-providing institutions like banks, credit unions, payday loan companies, and other lenders to define their risk appetite or limit. It is significant for the following reasons:

- Eligibility Criteria: The cut-off score is decided by the lender and, thus, represents the minimum credit score threshold requirement or criteria for extending a credit.

- Risk Mitigation: Since such a system determines the creditworthiness of an individual or firm while not entertaining the potentially high-risk borrowers, it mitigates the credit and default risk of the lenders.

- Fairness and Objectivity: It ensures that all credit applicants are treated with equality while accepting or rejecting their loan requests based on their credit scores.

- Product-Specific: Every credit offering or product has different minimum credit score requirements based on their tenure and the risk associated with them.

- Efficiency: Setting a minimum limit for loan request acceptance makes the credit issuance system more efficient by standardizing the selection process.

- Regulatory Compliance: As required by credit regulatory agencies, lenders must keep an ideal cut-off score to avoid high credit risk or deprive deserving applicants of loans.

Cut-Off Score vs Credit Score Ranges

| Basis | Cut-Off Score | Credit Score Ranges |

|---|---|---|

| 1. Definition | It is the lowest credit score that a lending institution demands for extending loans or other forms of credit. | It is the categorization of the borrowers based on their creditworthiness as ascertained by the credit scoring systems. |

| 2. Represents | Lowest possible credit score requirement for availing of a loan from a particular lender | A broad division of borrower’s credit health, ranging from poor to excellent |

| 3. Purpose | Serves as a minimum eligibility criteria for accepting a borrower’s loan or credit application | Used for determining interest rates, credit terms, and approval or rejection of loan requests |

| 4. Decided By | Lenders or credit providers like banks | Credit scoring systems like FICO Score. |

| 5. Determinants | Type of credit and policies of lending institution | Five factors - payment history, credit utilization ratio, credit history length, new or recent credit, and credit mix or types |

| 6. Impact | Any loan applicant whose credit score is lower than the cut-off score stated by the lender tends to be refused credit. | Falling in a higher credit score range results in easy availability of loans at favorable terms and lower interest rates, and vice-versa |

| 7. Credit Score | One fixed credit score value say 700 | 800 to 850 - Exceptional; 740 to 799 - Very good; 670 to 739 - Good; 580 to 669 - Fair; and Below 580 - Poor |