Table Of Contents

What Is A CUSIP Number?

The CUSIP number is a unique identification code assigned to most financial instruments, including stocks of all registered US and Canadian companies, commercial paper, and US government and municipal bonds. It is owned and managed by American Bankers Association and Standard and Poor’s respectively.

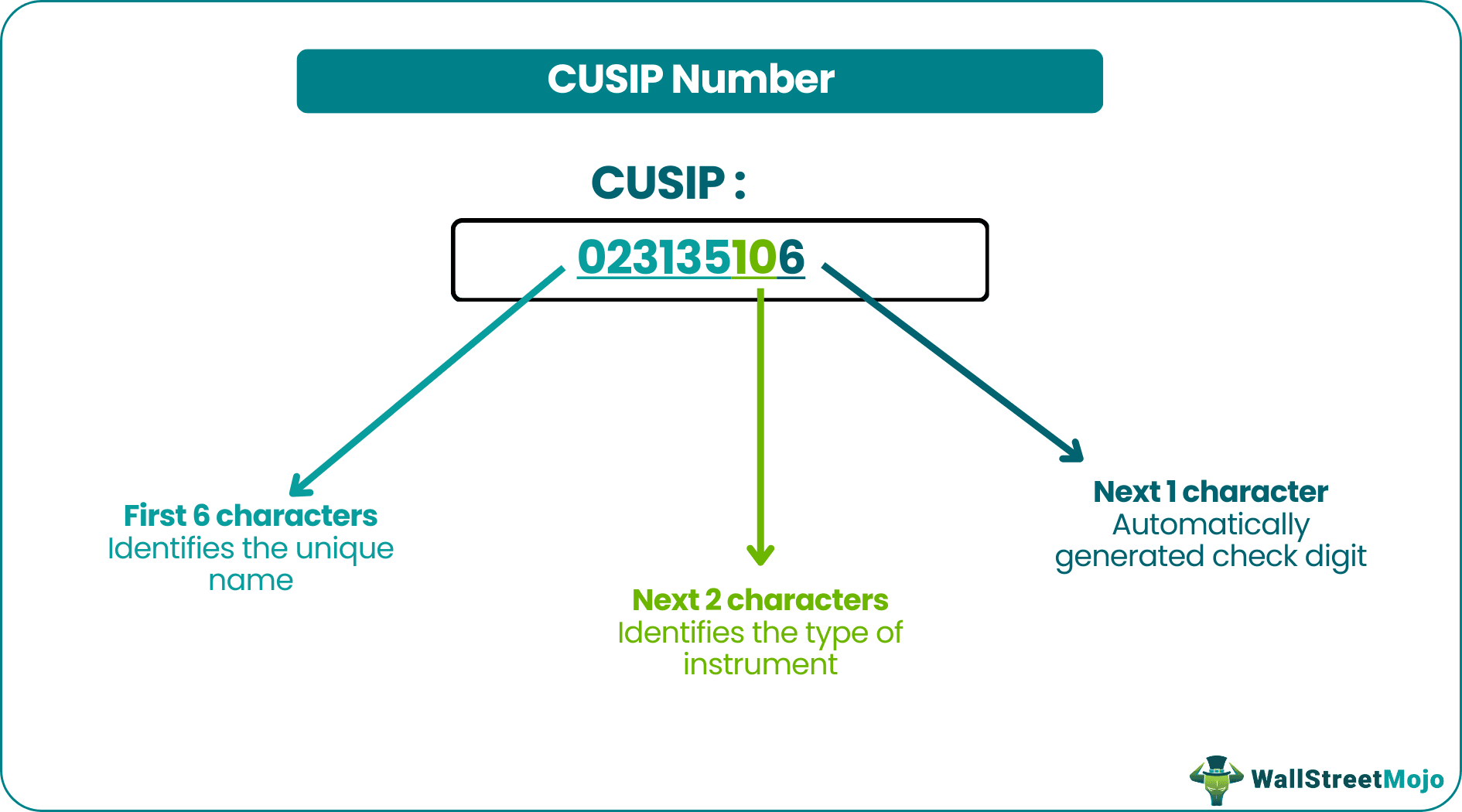

It has nine characters, a combination of numbers and letters, and helps identify the issuer of financial instruments. It has a unique design that is compatible with all types of online record maintenance systems and is used for various purposes like security, clearance, and settlement.

Key Takeaways

- The CUSIP Number is a unique identification number allotted to securities, stocks, and financial instruments in the USA and Canada companies, commercial paper, and bonds.

- The CUSIP Number provides easy operation for such securities and financial instruments as it provides trackability.

- The complete form of CUSIP is Committee on Uniform Securities Identification Procedures. Moreover, this number enables investors to quickly locate individual securities, making it quick to track interest and dividend payouts.

- All analyses related to a financial instrument, such as trends, movements, and transactions, are recorded and identified through the CUSIP number.

CUSIP Number Explained

The CUSIP number for stock and bond is a unique identification code for all financial securities registered with the US and Canadian entities. Under the CUSIP system, securities are provided a unique identification code that enables clear tracking of the issue and security-related details, facilitating ease of execution of trades, settlements, and payouts for both the investor and the issuer.

The full form of CUSIP is Committee on Uniform Securities Identification Procedures.

The system was born out of a need to develop a standard method of identifying securities to improve operating efficiencies across the industry. The American Bankers Association (ABA) was tasked to find a suitable system for the same in 1964 by the New York Clearing House Association. As a result, the Committee on Uniform Security Identification Procedures was created, and the CUSIP system was instituted. The CUSIP. The Service Bureau was formed to administer the system in 1968.

CUSIP Global Services (CGS), the overarching entity for all offerings, is managed on behalf of the ABA by S&P Global Market Intelligence. CGS has a Board of Trustees representing various leading financial institutions.

CGS is the numbering systems or agency for

- The United States and Canada.

- The Cayman Islands, British Virgin Islands, and Bermuda.

- 35 Other markets throughout the Caribbean and Central/South America.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Format

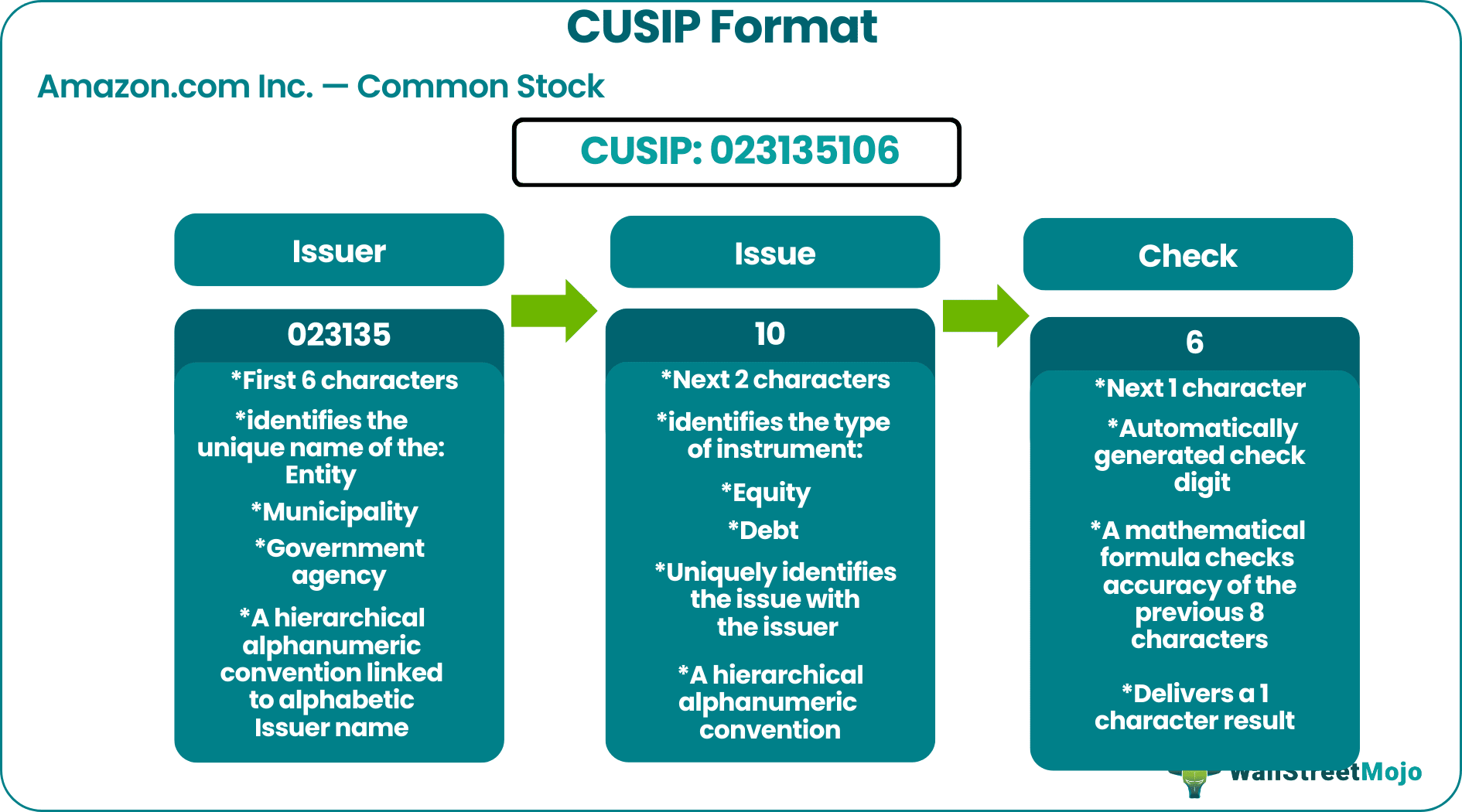

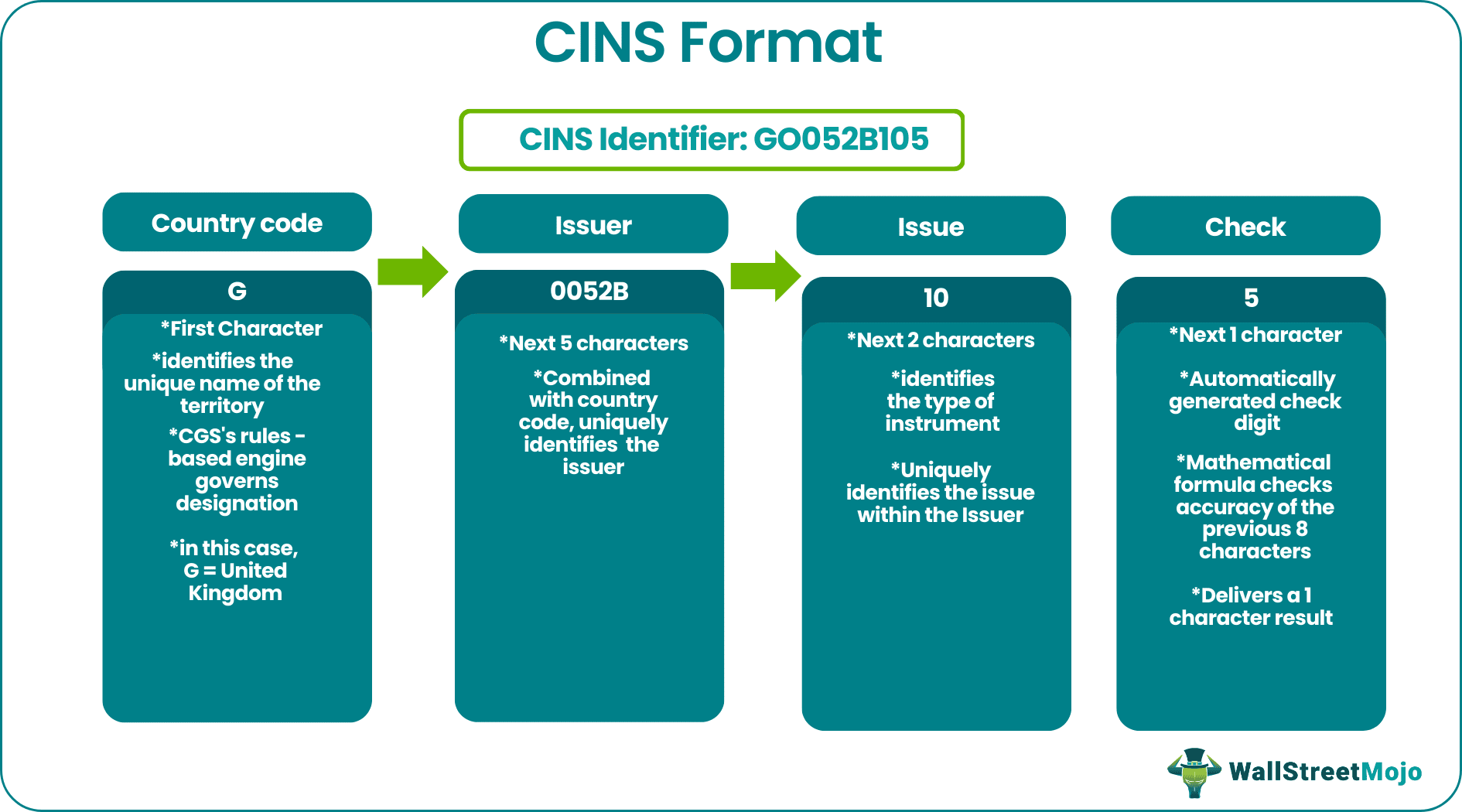

These numbers capture an issue's significant differentiating characteristics based on a 9-character identifier with a common structure. Given is the format of both CUSIP and CINS numbers.

CUSIP Format

Amazon.com Inc. – Common Stock

The CINS identification system uses a nine-character structure similar to the CUSIP but contains a letter in the first position to denote the issuer's country/geographic region.

CINS Format

Abingdon Capital PLC – Shares

Example

Some examples of CUSIP numbers are given below which provides a CUSIP number list.

| CUSIP of Common Stock | CUSIP of a Bond Issue | |

|---|---|---|

| Microsoft | 594918104 | 594918AD6 |

| Procter & Gamble | 742718109 | 742718EV7 |

| Johnson & Johnson | 478160104 | 478160AF1 |

The above CUSIP number list is useful in identifying such financial instruments.

Uses

It is necessary to check CUSIP number because this identification system provides descriptive information about various securities, making it easier to track securities across all processing and analysis phases. The system covers a wide range of global financial instruments and currently covers over 14 million financial instruments.

CINS is used to codify and identify foreign securities, similar to the CUSIP number for stock and bonds.

The criteria for assigning these to equity or debt instruments of issuers are as follows:

| System | Equity | Debt |

|---|---|---|

| CUSIP | Public (unrestricted) offering by US or Canadian Issuer Private (restricted) offering in US by any issuer - In accordance with Rule 144A or Regulation D | Public or Private debt offering in US by any issuer - SEC registered; as per Rule 144A or Regulation D |

| CINS | Equity offerings Exclusively outside the US and Canada - Regulation S stock offering by US company on UK AIM Exchange or in Germany Public Offering in US by non-US or Canadian issuer (except ADR/GDR) Across Cayman Islands, Bermuda and British Virgin Islands | Debt offered exclusively outside the US and Canada - Eurobonds - Regulation S (any issuer) |

How To Find It?

In case the investors want to know how to get a CUSIP number, they should look at the security documents' faces, as shown in the specimen samples below.

#1 - Specimen Share Certificate

Source: SEC archives

#2 - Specimen Bond Certificate

Source: oldstocks.com

Therefore, in the case of securities owned, the investors should check CUSIP number directly from the security documents, offer documents, from securities brokers, on the issuing companies' websites, or by contacting the investor relations department of the issuing entity. In addition, entities usually mention the number of their common stock on their website.

- Brokerage firms and websites that provide securities research also include the CUSIP number in the profile information of the concerned stock or bond. E.g., CBXmarket.

- In the case of common stock, a general Google search with the stock's trading symbol is likely to yield results on the CUSIP number.

- This unique number of municipal bonds can be found in Electronic Municipal Market Access (EMMA), managed by the Municipal Securities Rulemaking Board.

- CGS's 'CUSIP Access' is a fee-based web service that provides access to the entire universe of identifiers and a standardized securities description.

- These numbers can also be found using other web-based search tools offered by various investment houses and brokers such as Fidelity Investments.

Thus, from the above explanation it is clear how to get a CUSIP number.

Benefits

An investor is required to quote the CUSIP number in forms and documents on the purchase and trade of stocks or bonds.

Additionally, the following benefits also accrue to investors:

- Since these numbers are unique and specific to each security, it allows for easy identification and tracking of stocks, bonds, funds, etc., to ensure accurate execution and documentation of trades, settlement, and clearance.

- Information specific to the trades, yield, performance of a stock, etc., can be obtained through research using the CUSIP number.

- It allows issuers to map individual securities to the investors, making it easier to track interest and dividend, etc.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A CUSIP Number is a unique financial instrument and securities identification number. It creates identification and provides trackability for the said instruments and securities. Hence, this number signifies issuer identification, issue number, and check digit.

private companies can have these numbers, although it is less common than publicly traded companies. Hence, private companies may issue securities that require identification and tracking, such as private placements, debt offerings, or certain structured products. The company or its agent can request a CUSIP number for those categories in such instances.

The CUSIP Numbers are available on the Municipal Securities Rulemaking Board (MSRB) and the Electronic Municipal Market Access (EMMA) systems. Hence, specific methods are to be followed for a prospectus or offering documents, final database, platforms, brokerage, or custodial statements to find these numbers.