Table Of Contents

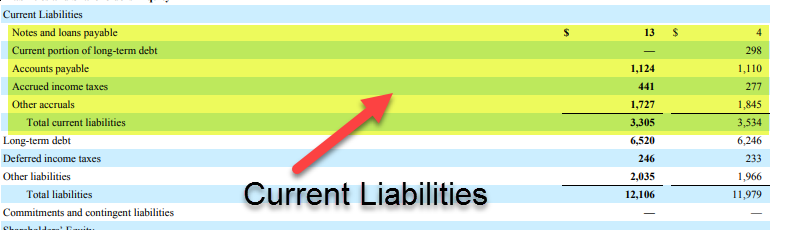

What Are Current Liabilities?

Current liabilities are the obligations of the company which are expected to get paid within one year and include liabilities such as accounts payable, short term loans, Interest payable, Bank overdraft and the other such short term liabilities of the company.

The meaning of current liabilities does not include amounts that are yet to be incurred as per the accrual accounting. For example, the salary to be paid to employees for services in the next fiscal year is not yet due since the services have not yet been incurred.

Current Liabilities Explained

Current Liabilities on the balance sheet refer to the debts or obligations that a company owes and is required to settle within one fiscal year or its normal operating cycle, whichever is longer. These liabilities are recorded on the Balance Sheet in the order of the shortest term to the longest term.

Most Balance sheets separate current liabilities from long-term liabilities. It gives an idea of the short-term dues and is essential information for lenders, financial analysts, owners, and executives of the firm to analyze liquidity, working capital management, and compare across firms in the industry. Being part of the working capital is also significant for calculating free cash flow of a firm.

Although it is more prudent to maintain the current ratio and a quick ratio of at least 1, the current ratio greater than one provides an additional cushion to deal with unforeseen contingencies. Traditional manufacturing facilities maintain current assets at levels double that of current liabilities on the balance sheet. However, the increased usage of just-in-time manufacturing techniques in modern manufacturing companies like the automobile sector has reduced the current requirement.

Current Liabilities in Video

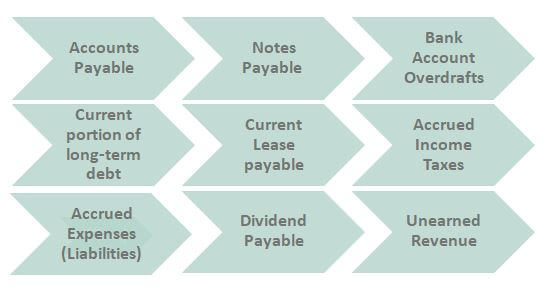

Types

The list of current liabilities below shows the components that play a vital role:

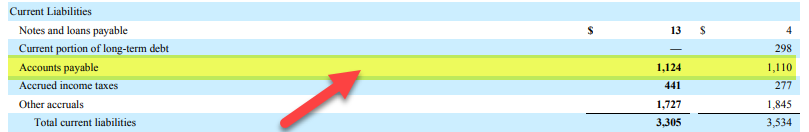

#1 - Accounts Payable

Accounts Payable is usually the major component representing payment due to suppliers within one year for raw materials bought, as evidenced by supply invoices.

Here is the example

We note from above that Accounts Payable of Colgate is $1,124 million in 2016 and $1,110 million in 2015.

#2 - Notes Payable (Short-term)

Notes Payable are short-term financial obligations evidenced by negotiable instruments like bank borrowings or obligations for equipment purchases. Maybe interest bearing or non-interest bearing.

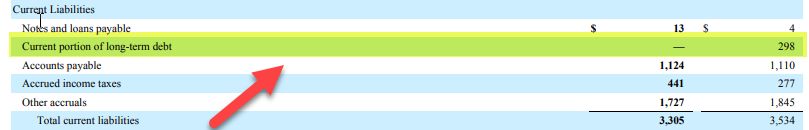

Notes and loans payable for Colgate are $13 million and $4 million in 2016 and 2015, respectively.

#3 - Bank Account Overdrafts

Short term advances made by the banks to offset account overdrafts due to excess funding above the available limit. Also, have a look at the revolving credit facility

#4 - Current portion of long-term debt

Current portion of long-term debt is a part of the long-term debt due within the next year

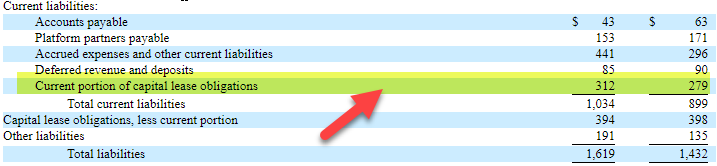

#5 - Current Lease payable

Lease obligations due to the lessor in the short-term

Facebook's current portion of the capital lease was $312 million and $279 in 2012 and 2011, respectively.

#6 - Accrued Income Taxes or Current tax payable

Income Tax owed to the government but not yet paid

We note from above that Colgate’s accrued income tax was $441 million and $277 million, respectively.

#7 - Accrued Expenses (Liabilities)

Expenses not yet payable to the third party but already incurred like interest and salary payable. These accumulate with time. However, they will get paid when they become due. For example, salaries that the employees have earned but not been paid are reported as accrued salaries.

Facebook's accrued liabilities are at $441 million and $296 million, respectively.

#8 - Dividend Payable

Dividends payables are Dividend declared, but yet to be paid to shareholders.

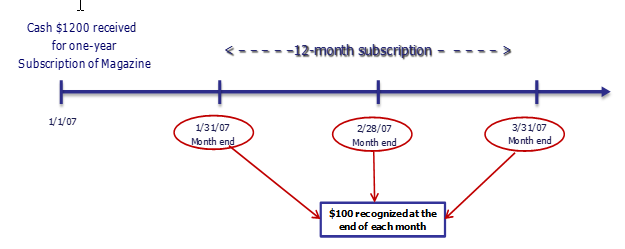

#9 - Unearned Revenue

Unearned revenues are advance payments made by customers for future work to be completed in the short term like an advance magazine subscription.

The below example details of unearned subscription revenues for a Media (magazine company)

How To Calculate?

Current liabilities on the balance sheet impose restrictions on the cash flow of a company and have to be managed prudently to ensure that the company has enough current assets to maintain short-term liquidity. In most cases, companies are required to maintain liabilities for recording payments which are not yet due. Again, companies may want to have liabilities because it lowers their long-term interest obligation.

Some of the essential ways you can analyze them are 1) Working Capital and 2) Current Ratios (& Quick Ratio)

#1 - Working Capital

Working capital is the capital that makes fixed assets work in an organization. Working capital can be calculated as follows:

Working Capital formula = Current Assets – Current Liabilities

- A company’s liquidity position can be gauged by analyzing its working capital. Excessive working capital means that the level of current assets is much higher on the balance sheet. This excess capital blocked up in the assets has an opportunity cost for the firm since it can be invested in other areas for generating higher profits instead of staying idle within working capital.

- On the other extreme, inadequate working capital may pose short-term liquidity issues if the company maintains current assets which are not sufficient enough to meet the liabilities. Consistent liquidity issues may pose problems in the firm's smooth functioning and affect the company's credibility in the market.

#2 - Current Ratio & Quick Ratio

Current Liabilities on the balance sheets are also used to calculate liquidity ratios like the current ratio and quick ratio. These ratios are calculated as follows:

Current Ratio= Current Assets (CA) /Current Liabilities (CL) and

Quick Ratio= (CA- Inventories)/CL

- While working capital is an absolute measure, the current ratio or working capital ratio can be used to compare companies against peers. The ratio varies across industries, and 1.5 is usually an acceptable standard. A ratio above 2 or below 1 indicates inadequate working capital management.

- The Current Ratio is used in the financial analysis along with a quick ratio, which measures a company’s ability to meet its liabilities using its more liquid assets. A company may boast of a high current ratio. However, most of its current assets can be in the form of inventories, which are difficult to convert into cash and hence, are less liquid. In case of immediate funds requirement for meeting liabilities, these less liquid assets would be no help to the company.

- A quick ratio of less than 1 would signify that the company would be unable to pay back its short term liabilities. Thus a quick ratio is also referred to as the acid test ratio, which speaks of a company’s financial strength.

Example

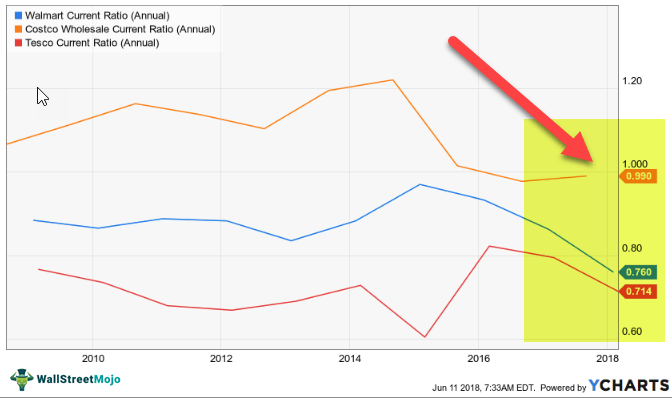

Let us consider a current liabilities example here for a retail industry:

In the retail industry, the current ratio is usually less than 1, meaning that current liabilities on the balance sheet are more than current assets.

As we note from above, Costco’s Current Ratio is 0.99, Walmart’s Current ratio is 0.76, and that of Tesco is 0.714.

- Retailers like Walmart, Costco, and Tesco maintain minimal working capital since they can negotiate longer credit periods with suppliers but can afford to offer little credit to customers.

- Thus they have much higher accounts payable compared to accounts receivable.

- Such retailers also maintain a minimal inventory through efficient supply chain management.

Current Liabilities Vs Non-Current Liabilities

Both current liabilities and non-current liabilities, also known as long-term liabilities, form part of the balance sheet of a company. The difference between the two is as follows:

- Current liabilities are short-term debts, while the latter includes long-term loans and leases.

- The former reduces the working capital funds that the businesses have. On the contrary, non-current liabilities help fund capital expenses through bank loans, etc.

- Examples of the former include utility payments, credits for goods purchased, and other short-term loans. On the other hand, long-term liabilities include bank loans, bonds, debentures, etc.

Recommended Articles

This article is a guide to what are Current Liabilities. Here we explain it with an example and check how to calculate it, vs non-current liabilities & types. You may also have a look at the following recommended articles on accounting basics –