Table of Contents

What Is A Crummey Trust?

A Crummey trust is an unalterable trust that allows the grantor to contribute annual gifts to beneficiaries while taking advantage of gift tax exemptions. Named after Clifford Crummey, who popularized this strategy, it permits beneficiaries to withdraw funds from the trust within a specified time frame, typically 30 to 60 days. After this period, the assets become inaccessible.

Crummey trust rules offer advantages such as enabling the grantor to leverage gift tax exemptions and providing beneficiaries with access to funds for a limited time. However, it comes with the drawback of requiring careful administration to comply with IRS regulations and may involve complex legal processes, including drafting and maintaining trust documents.

Key Takeaways

- Crummey Trust is an irrevocable trust used for estate planning. It enables donors to make tax-free gifts to beneficiaries.

- The trust includes withdrawal rights called Crummey powers. Beneficiaries have the option to withdraw contributions within a limited timeframe.

- The trust helps minimize gift taxes and transfer assets to beneficiaries efficiently. It requires meticulous planning and following IRS regulations in its totality to maximize tax benefits.

- Crummey trusts are commonly used by individuals looking to relocate their wealth to their heirs while limiting tax liabilities.

How Does A Crummey Trust Work?

A Crummey trust is a type of trust that is irrevocable. It is used for estate planning, allowing donors to make tax-free gifts to beneficiaries. It incorporates withdrawal rights, known as Crummey powers, enabling beneficiaries to withdraw contributions within a specific timeframe. This trust structure minimizes gift taxes and facilitates the seamless passing on of assets to beneficiaries while adhering to IRS regulations.

It operates by allowing the grantor to pass on gifts on a yearly basis to the trust for the benefit of designated beneficiaries, typically family members. These gifts must adhere to the annual gift tax exclusion ceiling set by the IRS. Upon receipt of the gift, each beneficiary is given a limited window of time, usually 30 to 60 days, to withdraw their share of the contribution, known as Crummey power.

The Crummey power serves a crucial function in the trust structure, as it transforms what would otherwise be an irrevocable gift into a present interest gift. It is eligible for the annual gift tax exclusion. By providing beneficiaries with this limited withdrawal right, the trust ensures that each gift qualifies for the exclusion, thereby minimizing or eliminating gift tax implications for the grantor.

After the withdrawal period expires, any remaining funds in the trust become subject to the trust's terms and conditions, which typically include provisions for asset management and distribution. The trust assets and other holdings are taken care of or managed by a trustee, who administers them according to the trust agreement and the grantor's instructions. Beneficiaries may be bestowed with distributions from the trust for purposes such as education, healthcare, or general support, depending on the trust's provisions.

Hence, a Crummey trust letter offers a tax-efficient strategy for transferring wealth to beneficiaries while maintaining some degree of control over the timing and distribution of assets. However, careful planning and adherence to IRS regulations are required to ensure compliance and maximize its benefits for both the grantor and beneficiaries.

Requirements

The introduction makes it clear that a Crummey trust notice is advantageous for family members. However, it is also essential to understand the meticulous requirements for maintenance. These requirements are as established below.

- Legal Documentation: Establishing such a body requires drafting and executing a trust agreement that outlines the terms and conditions of the trust, including the Crummey provisions.

- Gifts to the Trust: The grantor must make annual gifts to the trust. These gifts are liable to the annual gift tax exclusion limit set by the IRS.

- Crummey Powers: Each beneficiary named in the trust must be provided with a Crummey power. It allows them the right to withdraw their share of the gifted amount within a specified timeframe, typically 30 to 60 days.

- Notice Requirement: The grantor or trustee must notify beneficiaries in writing of their withdrawal rights, including the amount available for withdrawal and the timeframe for exercising the Crummey powers.

- Limited Withdrawal Period: Beneficiaries must have a limited window of time to exercise their Crummey powers and withdraw their share of the gifted amount.

- Trust Administration: The trust must have a designated trustee who is in charge of managing the trust assets. They must also ensure compliance with the trust agreement and applicable tax laws.

- Compliance with IRS Regulations: The irrevocable bond must adhere to IRS regulations regarding annual gift tax exclusions, withdrawal rights, and reporting requirements to maintain its tax advantages.

5 by 5 Rule

When the discussion around Crummey trust rules takes place among any group, the 5 by 5 rule is undoubtedly on the agenda. The points below shall explain its importance within this concept in detail.

- The 5 by 5 rule refers to the ability of each beneficiary to withdraw up to the annual gift tax exclusion limit, which was fixed at $18,000 in 2024.

- Under this rule, beneficiaries can exercise their Crummey powers to withdraw up to $18,000 each year without incurring gift tax consequences.

- The 5 by 5 rule applies to each beneficiary named in the Crummey trust, allowing them to withdraw more significant amounts from the trust collectively.

- By utilizing the 5 by 5 rule, the grantor can make tax-efficient gifts to multiple beneficiaries within the annual gift tax exclusion limit.

- Grantors can maximize the benefits of the Crummey trust by leveraging the 5 by 5 rule to distribute assets to beneficiaries while minimizing gift tax implications and preserving the trust's tax advantages.

How To Set Up?

The discussions around requirements and essential rules have been established. Therefore, it is time to understand how to set up such a trust through the points below.

- Selecting a Trustee: The grantor must designate a trustee to take care of the trust assets and oversee distributions according to the trust terms.

- Drafting the Trust Agreement: A legal document specifying the trust's purpose, beneficiaries, withdrawal rights, and other provisions must be prepared by an attorney.

- Funding the Trust: The grantor passes on assets, such as stocks, real estate, or even cash, into the trust, which becomes the property of the trust estate.

- Notifying Beneficiaries: The trustee must notify beneficiaries of their withdrawal rights by providing them with a formal letter, known as a Crummey trust notice, informing them of their ability to withdraw funds from the trust within a specified timeframe.

- Compliance: To ensure compliance with IRS regulations, the trustee must strictly comply with the terms of the trust agreement and document all transactions and communications related to the trust's administration.

- Regular Review: A periodic review of the trust agreement and its provisions is essential to address any changes in the grantor's circumstances or legal requirements and to ensure the trust continues to meet its intended objectives.

Examples

It is always easier to understand any concept with the help of practicality and real-life insights. The examples below are an attempt to explain the concept in an easy-to-understand manner.

Example #1

Mr. Will Jacks has been an entrepreneur for over three decades and has managed to amass exemplary wealth. However, on his 50th birthday, he felt like he must start planning with respect to passing on the fortune to his family.

After consulting with his legal advisor, a Crummey trust was formed, and benefits for his wife, three children, and six grandchildren were mentioned in Crummey trust letters to each of them.

Mr. Jacks' wife, Melinda, was appointed as the member who would look after the trust for the rest of the family. Regular contributions were made, and the trustees made sure that the trust was run as per IRS regulations.

Example #2

The Biden Administration's fiscal 2024 revenue proposal introduced significant changes impacting estate planning. While some may have speculated that these changes won't pass with a Republican-controlled House, the unpredictability of Congressional action suggested otherwise, especially amid looming debt ceiling negotiations.

Many of the proposed estate tax changes have circulated for years, indicating potential future implementation. The IRS aims to limit taxpayers' ability to utilize Crummey powers for annual gifts to trusts, capping such gifts at $50,000 per year per donor. While this may not affect most individuals, wealthy individuals relying on substantial annual gifts may need to reassess their estate plans promptly.

Taxation

While passing on wealth to the family for their future needs is thoughtful, it has to be within a specific framework. The framework is often referred to as taxation. The nitty gritties in this regard are explained through the points below.

- Contributions to a Crummey trust are typically treated as taxable gifts, subject to gift tax rules and exemptions.

- Each beneficiary's withdrawal right is typically limited to the annual gift tax exclusion amount, which allows for tax-free gifts up to a certain threshold.

- Contributions to a Crummey trust may be subject to the generation-skipping transfer tax (GSTT) if the trust benefits skip one or more generations.

- Income earned by the investment of trust assets is typically taxed at the trust level, although beneficiaries may be taxed on any benefits they receive from the trust.

- The trustee is in charge of making sure that the trust is functioning in adherence with all relevant tax laws and regulations, like filing tax returns and reporting income and distributions.

- It's advisable to consult with a qualified tax advisor, legal advisor, or accountant to thoroughly understand the tax implications of establishing and maintaining a Crummey trust and to ensure compliance with tax laws.

Pros and Cons

Each concept or phenomenon has two sides of a coin. Both sides of a Crummey trust notice are mentioned below.

Pros

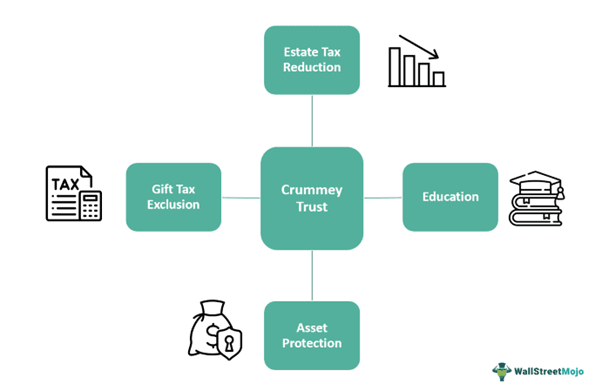

- Crummey trusts can be helpful in reducing the taxable value of an estate by eliminating assets from the grantor's estate.

- Contributions to the trust may qualify for the annual gift tax exclusion, allowing for tax-free gifts up to a specific limit.

- The grantor retains control over when and how much beneficiaries can withdraw from the trust, providing flexibility in managing distributions.

- Assets held within the trust are safeguarded from creditors and lawsuits, providing a layer of asset protection for beneficiaries.

- Crummey trusts can be used to fund education expenses for beneficiaries, providing a tax-efficient way to save for educational needs.

Cons

- Crummey trusts can be complex to establish and maintain, requiring careful drafting and ongoing administration.

- Beneficiaries may have limited withdrawal rights, which could restrict their access to trust funds when needed.

- Proceeds to the trust may be eligible for gift tax, and income earned by the trust assets is generally taxed at the trust level.

- Establishing and administering a Crummey trust may involve fees or charges towards legal and accounting services, as well as ongoing trustee fees.

- Disputes among beneficiaries or with the trustee could arise over distribution decisions or trust management, leading to potential conflicts.