Table Of Contents

What Is Crowd Psychology?

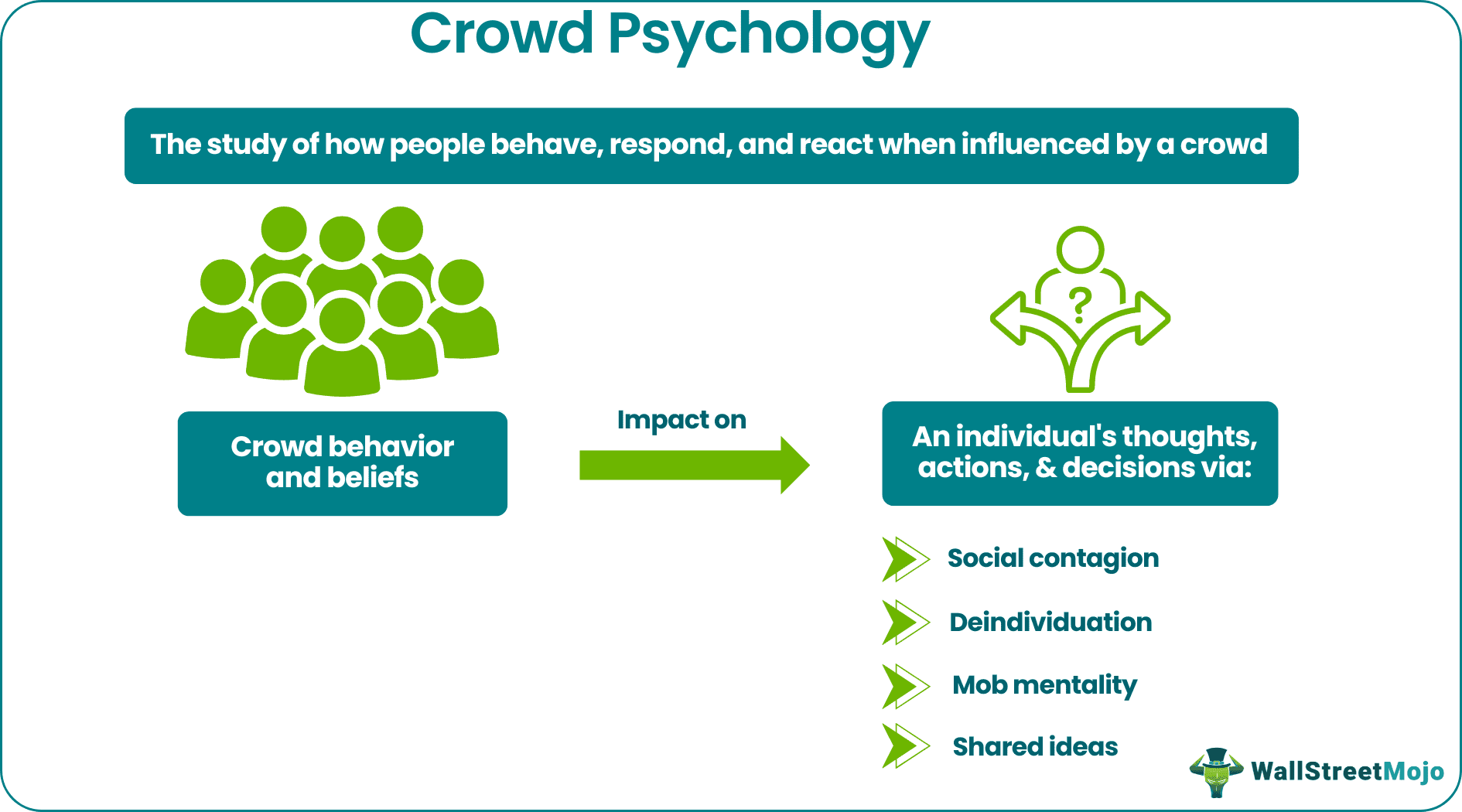

Crowd Psychology, a widely known segment of social psychology, studies how people’s beliefs, thoughts, emotions, actions, and behavior are affected when influenced by a group. Shared ideas, collective opinions, and mob mentality can change an individual's perspective and opinion.

Various theories in crowd science explain mob psychology and crowd dynamics, including convergence, deindividuation, classical, and emergent norm theories. The underlying concept is that an individual's ideas and emotions take the shape of mass opinion and behavior when they are part of a crowd. Thus, knowingly or unknowingly, people's minds tend to follow large groups.

Key Takeaways

- Crowd psychology is a field of social psychology that examines the impact of mob behavior and beliefs on individual actions and decision-making.

- In such situations, people lose their ability to think and are driven by the emotions or sentiments of large groups. Most stock market crashes are a result of such mass influence in financial markets.

- The prominent crowd psychology theories include contagion, convergence, classical, deindividuation, and emergent norm theories.

- To prevent such social impact, individuals should stay rational, take deliberate actions, consider personal opinions, and avoid social pressure.

Crowd Psychology In Financial Markets Explained

Crowd psychology is a critical factor that affects the investment decisions of traders and investors in financial markets. As a general tendency, human beings accept mass opinions, suppressing their thoughts, rationale, and ideas. Hence, this reflex action prompts them to follow groups. While a crowd often gets charged by the collective emotions of fear, panic, excitement, etc., their behavior is usually irrational and baseless.

Historically, we have come across various instances when the collective behavior of investors resulted in a bull or bear market.

Let us now understand different crowd behaviors and their impact on financial markets:

- Fear Of Missing Out (FOMO): When investors are excited about price movements in financial markets, they tend to imitate crowds who have shown interest in such stocks. This stems from the fear that they might miss the opportunity if they do not follow the crowd. The decisions made in such situations are not backed by fundamental analysis or specific trading strategies.

- Greed: Sometimes, traders follow bull market sentiments in the desire for massive profits while ignoring their instincts and time-tested methods of investment analysis. In such cases, they may lose their invested funds if stocks fail to perform.

- Herd Mentality: When mass traders or investors set a pattern in trading, and individuals follow this pattern without research or appropriate logic, risks might arise. As a result of market volatility, investors would be forced to bear significant losses if such overrated stocks fall.

- Other behaviors: Other typical crowd behaviors include panic buying or selling, confirmation bias, loss aversion, etc. They affect how individuals think and respond when faced with dilemmas or problems in financial markets. These behaviors cause distortion via collective thoughts and emotions, resulting in monetary losses more often than not.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Theories

Many expert researchers and scholars have discussed varied ideas and approaches to mob mentality. Some of the best crowd psychology books are How We Know What Isn't So: The Fallibility of Human Reason in Everyday Life by Thomas Gilovich and Thinking, Fast and Slow by Daniel Kahneman.

Given below are some prominent crowd psychology theories to consider:

- Contagion Theory: This approach states that an individual’s actions are influenced by the actions, thoughts, and opinions of crowds. As the name suggests, it is a contagious influence, with ideas being implanted in an individual’s mind through contagion.

- Convergence Theory: This is based on the ideology that crowd behavior is not entirely irrational but attributable to the majority of people's thoughts, values, and beliefs. It means when people have shared beliefs and opinions, convergence develops and impacts each individual in the crowd.

- Deindividuation Theory: It describes how people mentally unite during a crowd situation, irrespective of hurdles like distance and borders. The anonymity that such situations offer appeals to individuals.

- Classical Theories: The classical approach to crowd behavior states that people following a mob mentality often treat individual thinkers differently. Such behavior, when viewed from the classical theory approach, seems illogical, ill-considered, and absurd.

- Emergent Norm Theory: This theory emphasizes that crowds develop their own ideas and beliefs in a given situation, and people tend to follow them. This could be because their interests genuinely align with the crowd or due to the development of shared knowledge about a specific situation. Some may also follow the crowd for fear of being abandoned or shunned by groups.

Examples

Let us now move to some instances where mob psychology significantly impacts an individual's decisions in real life.

Example #1

Suppose FlyHorizon Airlines Ltd. plans to launch its Initial Public Offering (IPO) in a few months. The company is known for the hospitality and safety measures it takes to keep passengers comfortable when they fly FlyHorizon. However, the company's financials do not support its popularity.

Due to competitive pricing in the sector, FlyHorizon Airlines Ltd.'s financial statements for the last quarter indicate losses. Nevertheless, when the IPO was launched, the company received an overwhelming response from potential investors and the public, raising the IPO demand by 125%.

These results were attributed to crowd psychology. Since many considered FlyHorizon Airlines a reputable service provider, people chose to invest in this company.

While optimism dominated people’s decisions due to crowd psychology, a knowledgeable and logical investor would have refrained from participating in the company's IPO, given its poor long-term value.

Example #2

Black Monday, a significant financial crisis after the Great Depression is a perfect example to cite here. In 1987, the stock markets witnessed a considerable rise, with the Dow Jones Industrial Average (DJIA) gaining 44% by late August. Due to this, many wondered if an asset bubble had formed. However, a series of adverse news reports in mid-October, including an unprecedented trade deficit and a falling dollar value, led to extreme market volatility.

The situation worsened on October 16 when multiple activities pertaining to futures and options contracts occurred together, causing people to call this phenomenon triple witching. Later, Treasury Secretary James Baker announced that the US dollar would have to be devalued to contain the trade deficits. This announcement only added fuel to the fire, intensifying the crisis. When Asian markets collapsed on Monday, a cascade effect was seen around the world. The DJIA crashed 22.6%, and markets worldwide suffered.

Crowd psychology played a crucial role in this downfall, with panic selling, concerns about rising interest rates, and computerized trading calls resulting in chaos across global markets, contributing to the market crash. However, the Federal Reserve took timely actions to bring in money and reduce interest rates to prevent a recession, which eventually resulted in a stock market rebound.

Risks

When investors or traders follow market trends, there are various risks involved in employing crowd psychology for decision-making. Some of these are:

- Herding Behavior: Individuals within a crowd may follow others, influenced by collective behavior and without adopting a critical thinking approach. This leads to herd mentality.

- Trading Paradox: Despite certain stocks exhibiting multiple uncertainties and showing adverse numbers or facts, investors sometimes adopt the mob mentality and invest in them. They typically fail to produce the required output, triggering losses.

- Timing: Usually, large groups behave in an irrational manner and cannot time the market well. They also cannot identify trend reversals. Thus, only independent investors with a clear picture can make money without being influenced by such groups.

- Lack of Independence: When market participants depend on crowd mentality for investment or trading decisions, they may encounter poor outcomes or lose genuine investment or money-making opportunities.

- Overreaction: When a crowd drives emotions like greed, fear, excitement, and panic, it can cause significant market volatility, asset bubbles, stock market crashes, etc.

- Heightened Optimism and Pessimism: When mass investors display confidence or panic in the market, it results in market optimism or pessimism. In such cases, the right picture becomes clear only when aftermarket corrections take place.

- Incorrect Predictions: A crowd's sentiments or behavior may not be rooted in facts. This may lead to inaccurate market predictions or misinterpretations.

How To Avoid?

Crowd behavior significantly distorts an individual’s decision-making ability. While it is difficult to identify if an individual got carried away by mob psychology, it becomes even more difficult to avoid such an influence.

However, some effective ways of avoiding crowd behavior are discussed below.

- Value Individual Opinion and Thoughts: Individuals should prioritize their personal opinions, knowledge, thoughts, and instincts over what others think or do.

- Firmly Stand Out: It is essential to have the tenacity and conviction to stand out from the crowd and not accept behaviors for social acceptance. Success in financial markets becomes attainable only when one follows one’s instincts.

- Stop and Take Time: Investors should refrain from immediate decision-making, particularly when they believe they might be under the influence of a crowd. They should wait, research, think, and invest their time before taking action.

- Ignore Social Pressure and Manage Stress: It is better to be called a nonconformist rather than bearing losses by accepting every idea and belief put forth by large groups. Individuals should try not to succumb to social pressure and handle stress with self-confidence.

- Be Rational: Individuals should engage in research and focus on learning to imbibe knowledge of the markets and stay rational to avoid being influenced by crowd mentality.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Crowd psychology aims to understand why and how individuals lose their independent thinking and decision-making abilities when they are in a large group. Hence, it is of immense importance on a macro level, particularly for law enforcement agencies, companies, corporate houses, governments, policymakers, etc. It helps these entities gather insights that prove valuable for decision-making, business planning, policy execution, etc.

The introduction of crowd psychology is attributed to the following incidents:

- In 1891, Scripio Sighele mentioned the phenomenon in his monograph La Folla Delinquente.

- In 1892, Henry Fournial penned down his thoughts in Essai Sur la Psychologie of Foules.

- In 1892, Gabriel Tarde emphasized the crowd's criminal anthropological thinking and behavior in Les Lois de l'imitation.

- In 1895, Gustave Le Bon focused on crowd behavior and presented The Crowd: A Study of the Popular Mind. He explained the various factors that drive peaceful groups to become violent, which transforms them into mobs.

Yes, diversification is one of the ways to prevent oneself from being influenced by crowds. Since diversification allows individuals to understand and acknowledge the benefits of investing in various asset classes and financial instruments, it helps them avoid herd mentality.